Analyst: 40% of Bitcoin supply controlled by the U.S.

TechFlow Selected TechFlow Selected

Analyst: 40% of Bitcoin supply controlled by the U.S.

According to Fred Krueger's analysis, of the nearly 20 million bitcoins in circulation worldwide, the United States holds nearly 8 million, accounting for 40% of the existing total.

Source: bitcoinist

Translation: Blockchain Knight

Latest on-chain research shows the United States far ahead in Bitcoin holdings. Countries and companies are increasingly accumulating Bitcoin, drawing close attention from investors and analysts. The sheer scale of U.S. Bitcoin holdings is reshaping discussions in the cryptocurrency space around scarcity and value.

According to analysis by Fred Krueger, the U.S. holds nearly 8 million of the nearly 20 million Bitcoins in circulation, accounting for 40% of the total supply.

The report indicates that if each Bitcoin is valued at $120,000, the total value of Bitcoin held by the U.S. amounts to approximately $936 billion. Meanwhile, U.S. Bitcoin ETFs recorded $6 billion in net inflows in July, marking the third strongest month in the product's history, behind only February and November 2024.

Bitcoin holdings outside the U.S. are significantly lower. India ranks second with 1 million Bitcoins, or 5% of the total, worth about $120 billion at the same price. Europe follows closely with 900,000 Bitcoins (4.6%), valued at $108 billion.

China holds approximately 194,000 Bitcoins (1%), mostly seized assets, worth about $23.3 billion. Latin America and other parts of Asia each hold around 400,000 Bitcoins (2%), each valued at $48 billion. Africa and other regions combined hold 300,000 Bitcoins (1.5%).

Reports reveal that U.S. publicly traded companies are key players in the Bitcoin market. Strategy leads by a wide margin with 628,791 Bitcoins on its balance sheet. Marathon Digital Holdings (MARA) follows with 50,000; XXI Capital holds 43,514.

Bitcoin Standard Treasury Company holds 30,021 Bitcoins, Riot Platforms holds 19,225. Donald Trump Media & Technology Group Corp., led by former U.S. President Donald Trump, also appears on the list with 18,430 Bitcoins. These firms span mining operations, financial services, and other sectors, highlighting the diversified corporate interest in cryptocurrencies.

Data shows that despite an uncertain regulatory environment, cryptocurrency holdings in India continue to surge. Most holders in the country are small retail investors, but the massive user base has allowed India to surpass Europe.

In Europe, both retail and institutional investors are driving cryptocurrency adoption. However, growth in Europe remains steady, while India's compound annual growth rate (CAGR) from 2018 to 2023 approached 100%, far exceeding the traditional payments sector's roughly 8%. This contrast highlights the unique appeal of cryptocurrencies to Indian users.

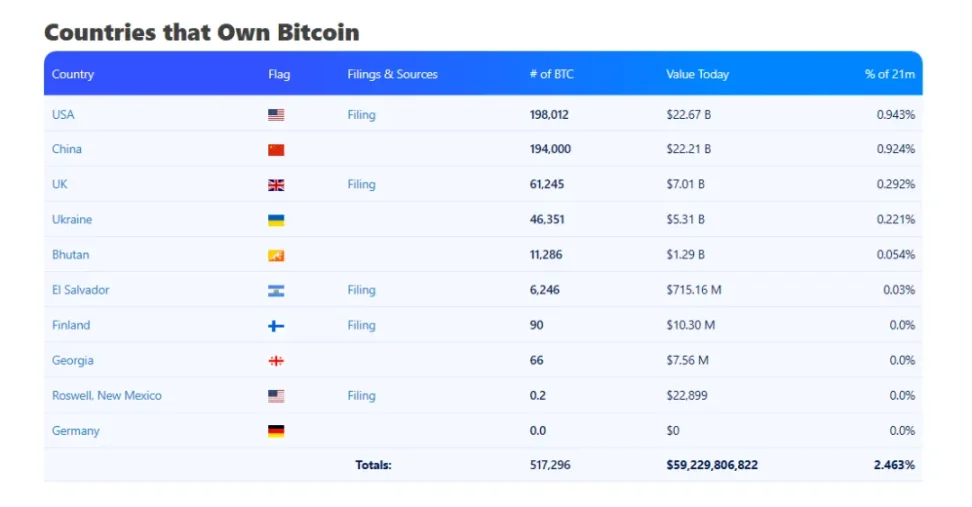

Additionally, recent charts from Bitbo reveal national reserve positions. The chart shows Bitcoin reserves linked to the United States exceeding 200,000, with China holding a similar amount.

The UK ranks third with 61,000 Bitcoins, Ukraine fourth with 46,000. Smaller economies such as Bhutan, El Salvador, and Finland hold between 5,000 and 10,000 Bitcoins.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News