Why Is "The Fed Not Cutting Rates" Actually Better for U.S. Stocks and Crypto Markets in the Long Run?

TechFlow Selected TechFlow Selected

Why Is "The Fed Not Cutting Rates" Actually Better for U.S. Stocks and Crypto Markets in the Long Run?

This is a revaluation of asset logic, not a cycle of macroeconomic easing.

Author: Dr.PR

The market is currently fixated on "when will rates be cut," but what truly matters is this: the Fed maintaining high interest rates unchanged may actually be the macro environment most favorable for long-term performance in both U.S. equities and crypto markets. While counterintuitive, historical experience, fundamental structures, and fiscally driven implicit easing all point in this direction.

1. High Rates ≠ Bear Market: History Shows Structural Bull Markets Often Emerge Under High Interest Rates

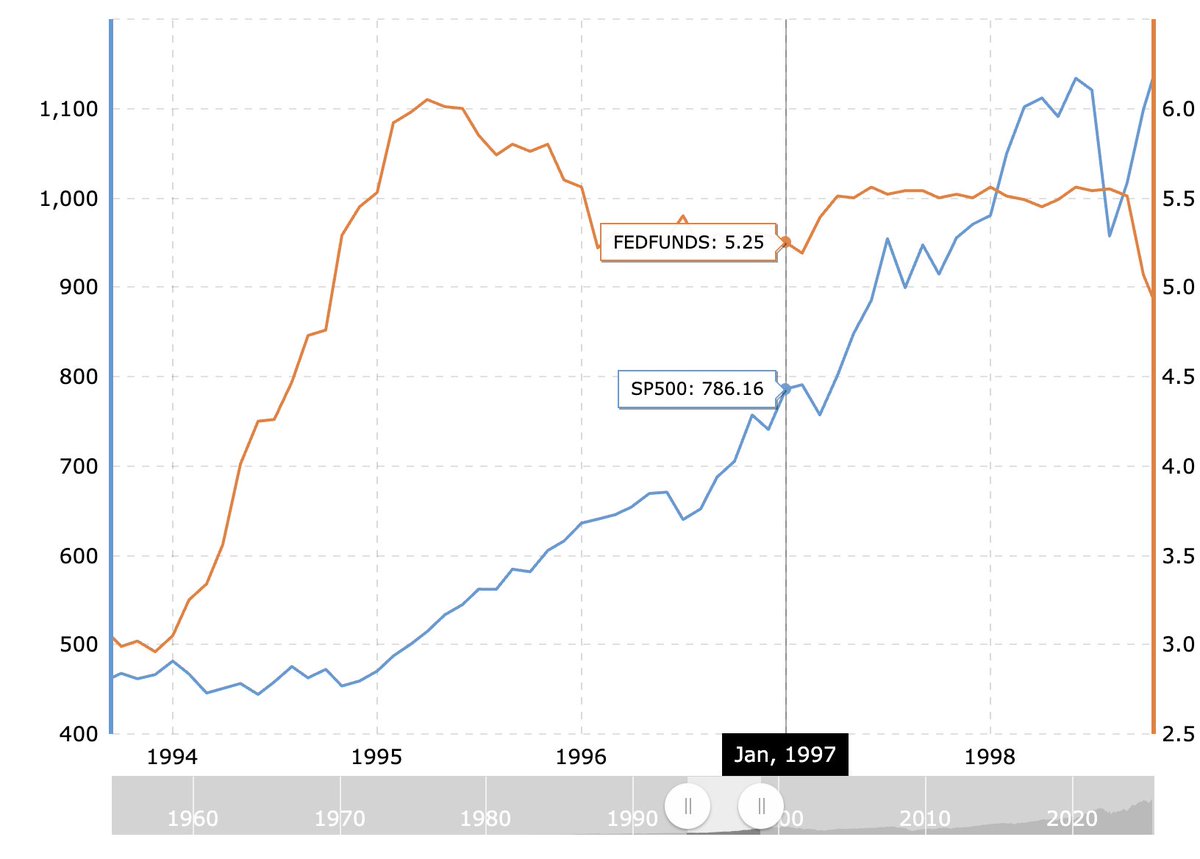

Federal Funds Rate vs. S&P 500 (approx. 1994–2000)

Take the period from 1994 to 2000: in 1994, the Federal Reserve raised the federal funds rate from around 3% to 6%. Following that tightening cycle, U.S. equities entered one of the strongest tech bull markets in history:

-

The S&P 500 rose from approximately 470 points to a peak of 1,500 in 2000;

-

The Nasdaq delivered over 25% annualized returns between 1995 and 2000, driving a real earnings cycle before the "dot-com bubble";

-

Corporate earnings, technological innovation, and return on investment became the main drivers—not monetary easing itself.

This means that as long as the economy avoids a hard landing, high interest rates are not the root cause of stock market suppression.

2. The Current "No Rate Cuts" Reflects Confidence in the Economy

As of July 2025, the Federal Reserve's target range for the federal funds rate stands at 4.25%-4.50%. Although there has been no significant easing, the key point is—there have been no further hikes either.

This reflects an underlying reality: a soft landing is materializing:

-

Core PCE inflation has declined from a 2022 peak of 5.4% to a mid-2025 range of 2.6%-2.7%;

-

GDP growth remains steady at an annualized rate between 1.5% and 3%;

-

Unemployment holds at 4.1%, demonstrating strong labor market resilience;

-

S&P 500 EPS expectations for 2025 are in the 250-265 range, indicating recovering profitability.

In other words, the decision not to cut rates signifies the Fed sees no need to intervene—the market is healing itself.

3. Real "Easing" Is Being Driven by Fiscal, Not Monetary Policy

Despite unchanged nominal interest rates, the overall U.S. macro liquidity structure has already shifted toward "fiscal dominance."

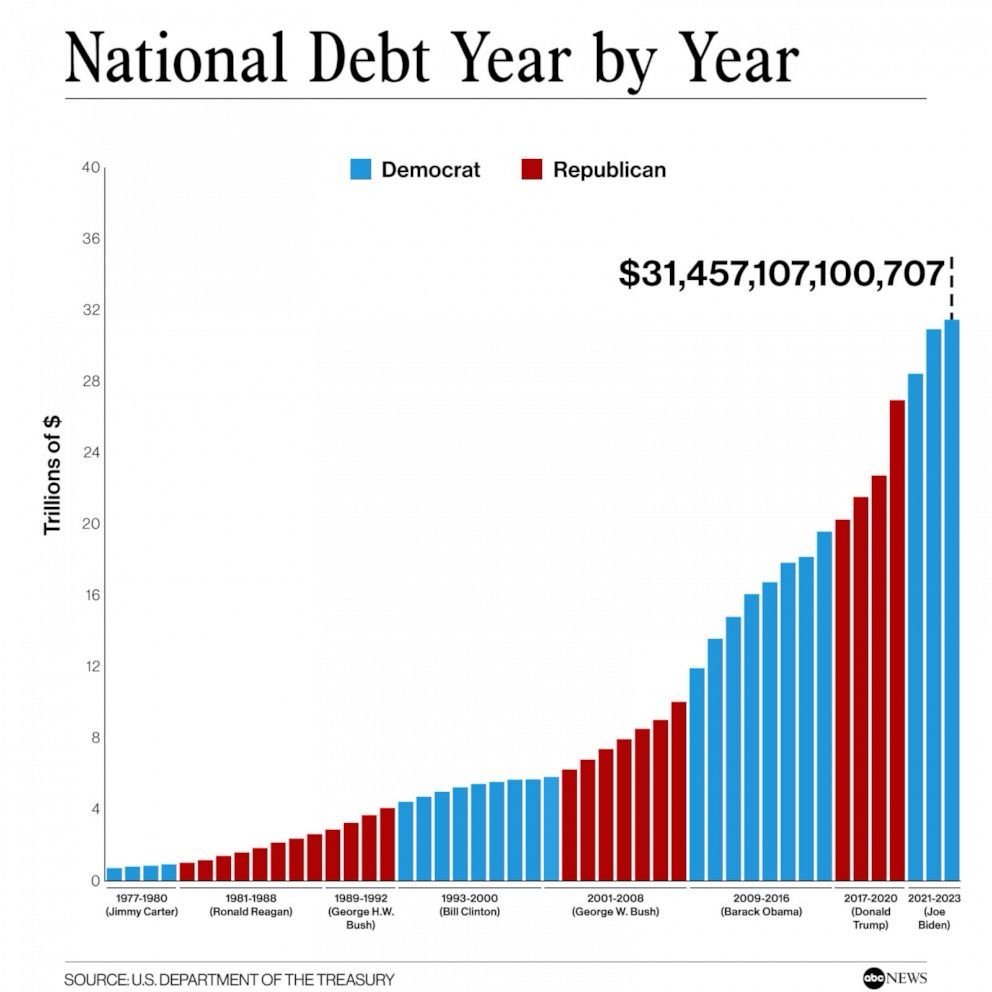

U.S. Federal Debt Annual Growth Trend

-

The U.S. fiscal deficit in 2024 exceeded 6.4% of GDP—one of the highest post-war levels;

-

By July 2025, total U.S. federal debt surpassed $36.7 trillion;

-

Net U.S. Treasury issuance in Q3 2025 is expected to exceed $1 trillion;

-

The "Big Beautiful Bill," championed by the Trump faction, includes massive tax cuts and industrial subsidies, projected to add about $3 trillion in deficits over ten years.

Even with the Fed standing pat, such fiscal spending constitutes de facto "implicit easing."

4. High Rates Cleanse Market Structure, Reinforcing the Winner-Takes-All Dynamic

While high interest rates increase financing difficulty, they paradoxically benefit large corporations:

-

Apple holds over $130 billion in cash, Alphabet over $90 billion, Meta nearly $70 billion;

-

At 4%-5% interest rates, this cash alone generates billions in interest income annually;

-

Small and medium enterprises face higher funding costs, accelerating market share concentration among giants;

-

Strong cash flows fuel buybacks, boosting EPS and creating more resilient valuation structures.

This explains why the "Magnificent Seven" continue to dominate market capitalization rankings and why index assets keep reaching new highs despite elevated rates.

5. Crypto Markets: Transitioning From Speculation to Structural Asset Allocation

Crypto assets were once seen as "speculative products fueled by zero rates," but over the past two years under high interest rates, their market structure has undergone profound changes:

1) ETH/BTC Have Become Portfolio Holdings for "Digital Cash Flow" and "Digital Gold"

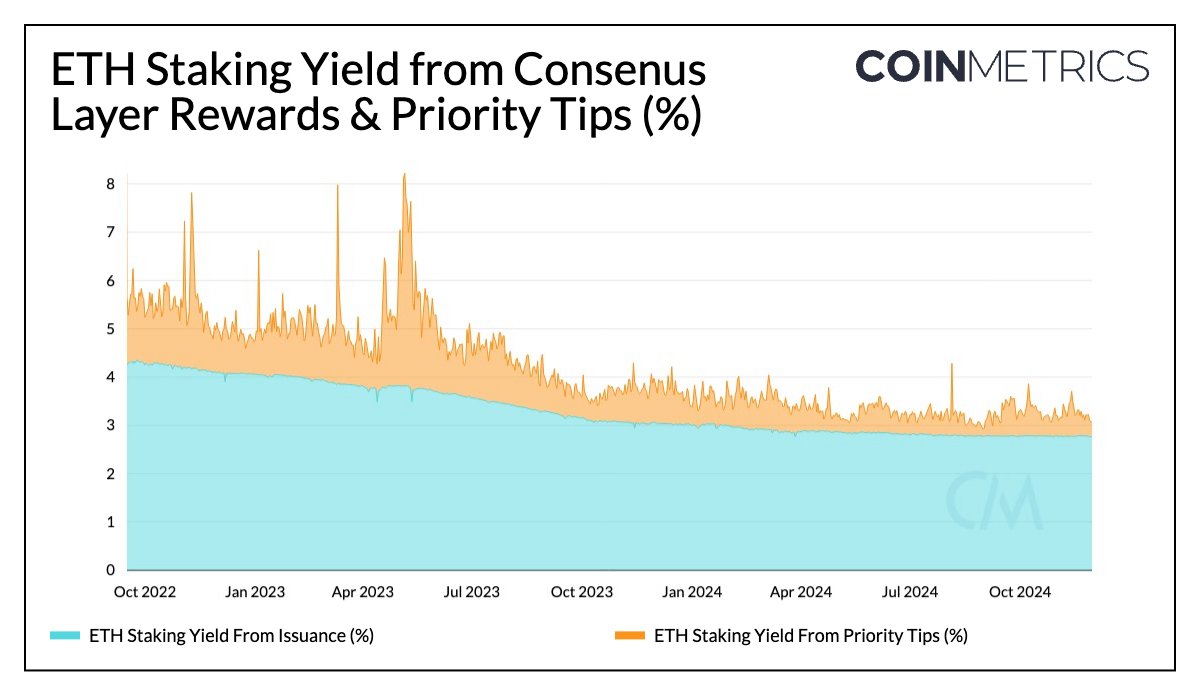

Ethereum ETH Staking Yield Trend (Annualized)

-

Ethereum staking yields remain between 3.5% and 4.5%, exhibiting bond-like characteristics;

-

BTC has become a core reserve asset for multiple U.S. public companies (e.g., MicroStrategy);

-

ETF launches, restaking mechanisms, and on-chain treasury yields have given ETH a combination of "stable yield + asset scarcity."

2) Stablecoins’ "Interest Rate Spread Dividend" Has Become a Hidden Profit Pool

-

Circle earned over $1.7 billion in profit in 2024 from U.S. Treasury interest;

-

Tether generated over $4 billion in investment income from its reserves over the past year;

-

The stablecoin ecosystem becomes more profitable under high rates, strengthening DeFi infrastructure stability.

3) Crypto Market Survival Logic Shifts Toward "Cash Flow" and "Systematic Returns"

-

Speculative altcoins and meme coins fade;

-

Projects with clear revenue models—such as Uniswap, EigenLayer, and Lido—gain investor favor;

-

Markets begin evaluating on-chain assets based on "ROE, cash flow, inflation resistance."

The crypto market is transitioning from "story-chasing" to "structure-chasing."

6. Conclusion: This Is a Reassessment of Asset Logic, Not a Cycle of Macro Easing

Rate cuts can certainly boost asset prices, but without being grounded in real earnings and structural improvements, they merely repeat the post-2021 bubble burst.

This time, however, U.S. equities and crypto markets are taking a healthier path:

-

High rates coexist with controlled inflation;

-

Ongoing fiscal stimulus supports corporate earnings recovery;

-

Stronger firms gain cash flow advantages;

-

Crypto assets return to competing on economic models.

Real, sustainable bull markets aren't driven by printing presses, but by structural reallocation powered by pricing mechanisms and cash flows.

The Fed’s current "inaction" is precisely the critical backdrop enabling this structural reassessment to unfold.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News