You shouldn't be asking whether the Bitcoin bull market has ended, but rather: which season are we in now?

TechFlow Selected TechFlow Selected

You shouldn't be asking whether the Bitcoin bull market has ended, but rather: which season are we in now?

If your mind only has the two buttons of "bull market" and "bear market," then every decision you make is like flipping a coin.

By: Daii

Lately, the question friends ask me most often is:

"Is the Bitcoin bull market about to end? Should I sell now?"

After all, Bitcoin has already climbed to around $120,000 and has been stuck there for weeks without breaking higher. People are getting nervous:

"Has it peaked? Is a bear market waiting just behind the door?"

This is a good question. But let’s flip it around:

Suppose a bear market really is lurking behind that $120,000 door—what will you do?

Sell everything and lock in profits?

But what if this is just another "fake top," and the next stop is straight to $200,000? Will you end up like those in 2013, 2017, or 2021 who exited too early, only to chase back in at much higher prices?

This kind of thing has happened more than once:

-

In April 2013, Bitcoin dropped from $260 to $70, with media screaming bear market—but seven months later it surged to $1,100;

-

In June 2019, it pulled back from $14,000 to $7,000, again mistaken as “bull exhausted, bear incoming,” yet no one expected it would rocket to $64,000 by 2021;

-

At the end of 2022, after FTX collapsed and Bitcoin crashed to $16,000, many cashed out and left—three months later it jumped straight to $25,000;

-

In summer 2023, some finally exited at $31,000, only to watch helplessly as it soared to $73,000 over the next nine months.

What truly brings regret isn’t “missing the bear market,” but mistaking an ongoing rally for the finish line and getting off too early.

If your mind only has two buttons—“bull market” and “bear market”—then every decision feels like flipping a coin: call it right and you’re praised for taking profits at the top; call it wrong and you’ve missed the entire cycle.

But markets aren’t black-and-white photos—they’re more like palettes: beyond the bright sun of bull markets and the storms of bear markets, there are long stretches of闷热横盘 (stifling sideways movement), and near-vertical surges with almost no pullback.

Only when you recognize all four seasons can you stop gambling on fate at every crossroads, and instead let your asset allocation change clothes with the weather and adjust sails with the wind.

To put it plainly, the traditional “bull-bear dichotomy” is simply too crude.

I’m not the first to say this. Years ago, investment researcher Jesse B. Mackey offered a clearer map—expanding from the black-and-white binary world of bulls and bears into a colorful four-season market: Bull, Bear, Wolf, and Eagle.

—This “seasonal revolution” in investing has only just begun.

1. From Bulls and Bears to Wolves and Eagles: Returning the Market Palette to Investors

Until now, most of us have been used to dividing the market into two colors—rising is a bull market, falling is a bear market.

Up means “flush with gains,” down means “icy winter.”

But Jesse B. Mackey proposed a more realistic depiction of the market. It was as if he pulled out a finer palette and said:

“What you’re seeing is just a corner of a black-and-white world. The real market is a full-color map.”

Beyond the classic roles of bull and bear, he added two other players long ignored yet extremely common—Wolf Market (Wolf) and Eagle Market (Eagle). This wasn’t conceptual play—it came from his statistical analysis of every single daily chart of the S&P 500 from 1950 to 2017.

Let’s meet these four “market weathers” one by one:

🐻 1.1 Bear Market (Bear)

Standard definition: cumulative decline exceeding 20% from recent peak.

Climate traits: sudden cold wave, market like a power outage, volume spikes, fear index (VIX) soars.

Psychological feel: each green candle is like foam in a tsunami, heartbeat plunging with portfolio value into the abyss.

🐂 1.2 Bull Market (Bull)

Standard definition: any rising phase that doesn’t meet bear market criteria.

Historical traits: averages 2.7 years duration, median gain ~112%.

Climate traits: gentle spring breeze, market steadily climbing along 200-day moving average, confidence quietly returns.

Investment rhythm: dollar-cost averaging, long holding—doing nothing often earns the most.

🐺 1.3 Wolf Market (Wolf)

Standard definition: price pulls back >10% from high, then recovers; or experiences two ≥10% drops without making new highs in between.

Historical occurrence: occupies ~22% of market calendar days.

Visual image: candles move like sawteeth, direction unclear, technical traders repeatedly “stopped out.”

Investor experience: you don’t feel like the market is falling, yet your account bleeds slowly. Trend systems often fail here, repeatedly “cut to pieces.”

🦅 1.4 Eagle Market (Eagle)

Standard definition: ≥30% gain over past year, with no ≥10% drawdown.

Historical occurrence: as high as 34%, even more common than bull markets.

Climate traits: like being lifted by a balloon, prices rise steadily with unusually low volatility.

Typical scene: you wait for a pullback that never comes; the market keeps rising, leaving hesitation behind.

When Mackey reclassified 70 years of market data, he uncovered a stunning truth:

Wolf + Eagle together occupy 56% of the time, while the familiar “bull market” accounts for only 24%; bear market is 17%, and the rest 3% unclassified.

What does this mean?

It means most of the time, we’re actually living in markets outside “bull” and “bear,” unaware of it.

We wait for pullbacks in eagle markets, chase trends in wolf markets, frequently swap positions under false bull illusions—and end up either missing big moves or having our confidence ground down.

The real problem isn’t “you guessed bull/bear wrong,” but that your map never drew the paths of wolves and eagles.

So what’s the logic behind this? Why does the market behave this way?

2. Why Do We Need “Wolf” and “Eagle”?

In one sentence:

The black-and-white glasses of bull and bear can no longer see this colorful, abnormal market clearly.

2.1 Correlation: Everything Moves in Reverse

The biggest assumption of the bull-bear model is “up and down take turns”: when stocks fall, bonds rise, and vice versa. This “negative asset correlation” is the cornerstone of traditional asset allocation.

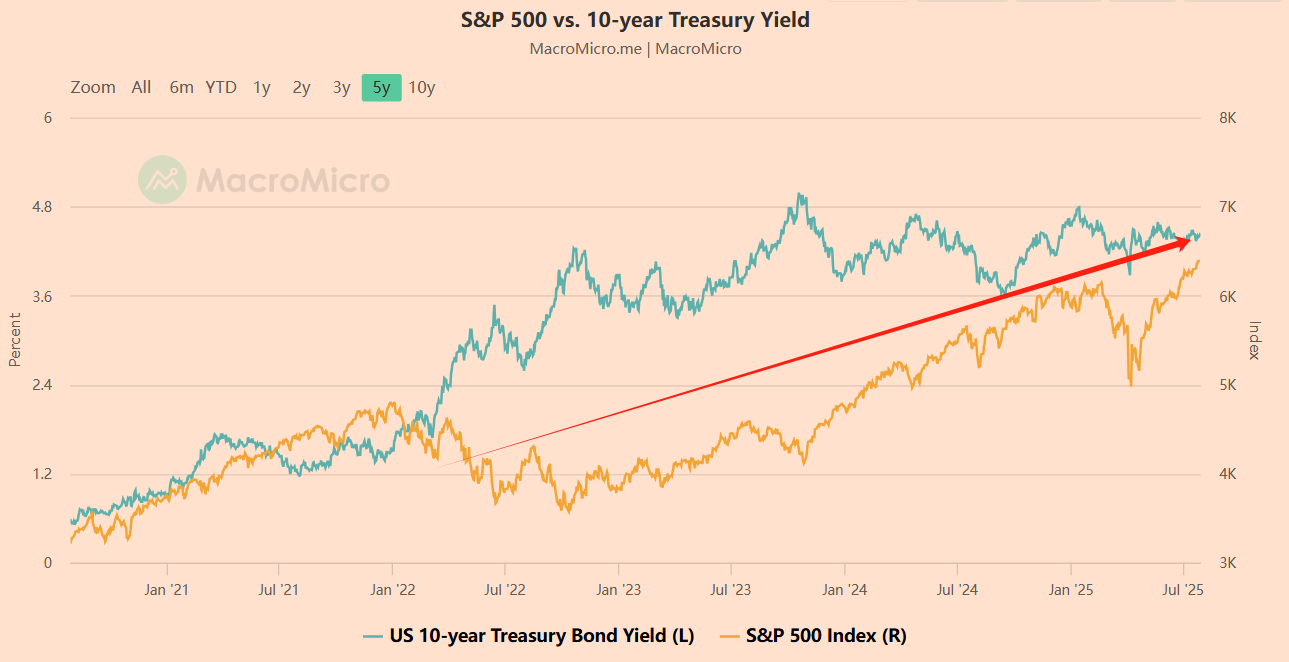

But since 2022, this “law of physics” suddenly failed, as if gravity vanished. According to Bank of America’s global research report, from 2022 to 2023, the 60-day rolling correlation between U.S. 10-year Treasuries and the S&P 500 turned positive multiple times, peaking near 0.6.

What does this mean? You think buying bonds during a bear market is safe, but find stocks and bonds both in “free fall.” By late 2023, they start rising together.

The bull-bear model works only for clear “one up, one down” scenarios, but today you face chaotic “both up, both down” turbulence—where the model fails completely.

2.2 Macro Policy: Now an Eight-Track Subway

The last super bull market (2009–2020) had a “big backdrop”:

Global central banks coordinated easing, cutting rates together, pushing markets up in sync.

Now, that highway has split into multiple lanes—while the Fed paused rate hikes in 2023, the ECB cautiously cut rates in 2024, and China, India, and Australia kept flooding the system. The BIS 2025 Annual Report stated bluntly: “monetary policy divergence has become the largest source of shock for cross-border capital flows.” [Source: BIS Annual Report 2025, Chapter III].

You’re still using the old logic of “global easing = bull, tightening = bear,” like holding a two-line subway ticket but entering an 18-line transfer station. You get dizzy and board the wrong train.

2.3 Bears Not Fierce, Bulls With Fangs

The traditional bull-bear model assumes:

Bear market = high volatility; bull market = low volatility.

But liquidity bubbles have broken this rhythm.

From 2021 to 2022, U.S. stocks had 46 trading days with intraday swings over 2%—more than double the level of previous bull markets. Then in Q1 2024, Bitcoin rose 70% consecutively after ETF approval, yet its 30-day volatility stayed below 25%—a textbook “low-volatility rapid rise” eagle market scenario.

2.4 Four Blunt Strikes Against the Bull-Bear Model

The old bull-bear model was built on assumptions of clear trends, orderly volatility, and predictable mean reversion. Today’s market has derailed.

Sideways ranges become “wolf valleys”: in 2023, both S&P 500 and Bitcoin oscillated within ±10% narrow bands, repeatedly triggering false breakouts. J.P. Morgan data shows 17 fake breakouts of 1.5% just between March and July—trend traders were ground into “metal shavings.”

Rebalancing strategies turn self-harming: BlackRock reports passive funds now hold 54% of free-float U.S. equity market cap. These funds mechanically rebalance quarterly, but due to liquidity crunches, cause massive slippage. At the end of 2023, one Nasdaq weight adjustment erased $18 billion in a single day.

Era of event-driven markets breaks mean reversion: a single tweet or regulatory signal can shake the market. In June 2024, SEC revisiting Ethereum’s security status caused ETH to plunge 12% in one day, then recover half within two days.

Professional money votes with feet: according to HFR, AUM of global trend-following funds has shrunk by one-third since its 2015 peak, while multi-strategy and market-neutral funds grow逆势 (against the tide), signaling the exit of old-school “bull-bear believers” and arrival of the “wolf-eagle hunters” era.

2.5 Summary

The bull-bear model isn’t wrong—it was born in a simpler era of single correlations, regular volatility, and synchronized policies.

Today’s market is like a spilled paintbox:

Divergent central bank paths, distorted liquidity, fragmented news flow, algorithmic trading causing nonlinear feedback—all paint the candlestick charts in a full spectrum of red, orange, yellow, green, blue, indigo, violet.

If you still view this market through black-and-white filters, you’ll inevitably misread signals and miss rhythms at critical moments.

Embracing “wolf” and “eagle” isn’t novelty—it’s returning to reality.

Next time someone asks: “Is the bull market ending?” perhaps you should first ask: “Is it wolf wind, eagle flow, or bear tide?”

Because only when you know the answer can your strategy find direction.

3. New Model × Crypto Pockets: MMI’s On-Chain Practice

We’ve seen that the bull-bear model is insufficient—the market needs a finer “climatology.” But with a more accurate map, the next question is: how to dress properly and stay in rhythm across these shifting on-chain seasons?

This is where MMI strategy (Multi-Modal Investing) comes in.

MMI is an asset allocation model that matches strategy combinations to market regimes, originally designed for traditional assets in a four-quadrant environment. Now it’s brought on-chain, keeping the core idea intact, but swapping stocks, bonds, and volatility funds for stablecoins, perpetuals, liquidity mining, and high-beta tokens.

We break it into four “pockets”—when a market phase arrives, you know which weapon to draw.

3.1 Prepare Four On-Chain Pockets

3.1.1 Bear Pocket: Stablecoins + On-Chain Short-Term Debt

Scenario traits: BTC/ETH down >20% from peak, frequent on-chain liquidations, liquidity drying up.

Stablecoins are your cash vault. Recall the week FTX collapsed in 2022—USDT/USDC trading volume accounted for 81% of total network volume, 15 percentage points above normal (source: Kaiko Research). That week, whoever held “stable coins” could pick up gold off the floor.

On-chain Treasuries let you sleep soundly in the storm. Tokenized short-term debt products like OUSG from Ondo Finance bring 5% U.S. Treasury yields on-chain—remarkably calm even when BTC annualized volatility exceeds 60%.

Hedging “gold” tokens that truly withstand panic. For example, PAXG: during three major sell-offs from 2020–2024, its correlation with BTC remained stably between -0.3 and -0.4—genuine counter-cyclical on-chain assets.

3.1.2 Bull Pocket: Long Holding + Staking Reinvestment

Scenario traits: BTC, ETH steadily rising, on-chain active addresses, TVL, stablecoin inflows all expanding.

BTC and ETH are the most reliable “dual beta kings” in bull markets. CoinShares data shows that in 2025 alone, Bitcoin absorbed $6.2 billion in net inflows into crypto funds—54% of total inflows. The fruits of long bull runs still hang on these two trees.

Staking is the “dividend reinvestment” of on-chain bull markets. LBTC (Lombard), weETH, stETH not only capture upside but compound returns continuously. You earn “sleeping gains” without frequent rebalancing.

3.1.3 Wolf Pocket: Opportunistic Arbitrage + Market-Neutral Strategies + Selling Volatility as King

Scenario traits: price oscillating within ±10% range, frequent false breakouts, “no clear direction.”

Capture basis/funding rate arbitrage—collect shells as volatility “ebbs.” In Q2 2023, annualized basis between BTC spot and perpetuals reached 8–12%. Just go long spot, short perp, and earn steady 2–3% monthly non-directional returns.

Provide liquidity on Uniswap v3. Deposit BTC-ETH into a 10% narrow range, hedge Delta with perps—annualized fee yield can reach 25–35% (data: DeFiLlama).

Wolf markets aren’t about betting direction, but collecting “coins from dust” repeatedly.

3.1.4 Eagle Pocket: Concentrated Exposure + Leveraged Perpetuals + High-Beta Layer 1s

Scenario traits: volatility drops sharply, price rises along 30-day MA, flying upward with almost no pullback.

Leverage is the “rocket cockpit” to catch eagle markets. In Q1 2025, 2x leveraged BTC gained 142% in three months, while spot BTC rose only 70%.

High-beta L1s are the “on-chain NVIDIA” of new cycles. Solana is the most promising candidate after ETH.

Note: eagle markets aren’t about casting wide nets—they’re about choosing the right rocket and holding tight.

3.2 Personal Execution: Three Steps to Install MMI in Your On-Chain Wallet

Step One: Allocate funds into four “crypto pockets”

-

Bear pocket: USDC/DAI + TBILL tokens + PAXG

-

Bull pocket: BTC + ETH (long hold + staking)

-

Wolf pocket: perp basis arbitrage + AMM delta-neutral LP

-

Eagle pocket: BTC/ETH/SOL leveraged perpetuals or 2x ETFs

Each pocket holds 25%.

Step Two: Set “autopilot logic”

Bear and bull pockets: keep mostly unchanged after setup, buy contrarian during panic.

Wolf pocket: semi-automate execution—e.g., choose BTC-ETH for liquidity mining on Base chain; for perp arbitrage, stick to BTC and ETH, low-risk varieties only.

Eagle pocket: control two things—leverage no more than 3x, only select core assets with strong long-term narratives, e.g., BTC, ETH, SOL.

Step Three: Use “scissors” to rebalance, not a “sledgehammer”

Allow pocket weights to float between 15% and 35%;

Adjust only 5–10% at a time to reduce misjudgment and execution costs.

This setup is like your on-chain investment “wardrobe”:

Whether wolf winds blow, eagle streams soar, or bear tides strike, you always have four sets of weather-appropriate “protective gear.”

Markets shift unpredictably, but rhythm can be stable. MMI doesn’t predict the market—it walks with you through it.

The above is just a rough operational framework. I’ll break it down in detail inside my Alpha Daii knowledge community.

Conclusion|Investing Isn’t Predicting the Future—It’s Preparing for Every Future

Let me close with a personal story.

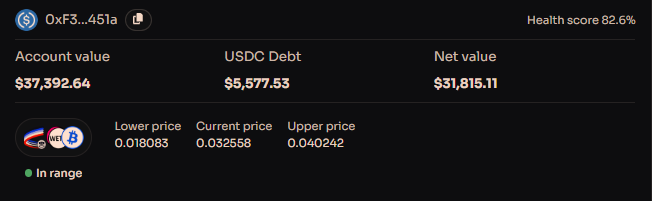

In April this year, when Bitcoin dropped below $80,000, panic swept the market. I didn’t predict where the bottom was, nor did I claim it would rebound immediately. But I deployed $10,000 from my “bear pocket” stablecoins to open a 3x leveraged BTC-ETH liquidity mining position. Today, it’s grown to $31,000—a return over 300%.

I wrote a detailed breakdown of this trade in my Alpha Daii knowledge community—feel free to check it out. But my key point isn’t “I made money,” but this:

I didn’t win by prediction—I won by preparation.

The market isn’t a one-way street, but a city with rotating seasons.

If your mind only knows “bull” and “bear,” then at every turn, you can only guess:

Guess right and you’re “locking in gains at the top”; guess wrong and you’re “regretting forever.”

But if you’ve long prepared your seasonal wardrobe—winter coat for bears, windbreaker for wolves, running shoes for eagles, shorts for bulls—then no matter how fierce the volatility, it’s just another season change.

The MMI “four-pocket mindset” isn’t mysticism or flashy strategy stacking—it’s a lifestyle.

Its essence:

Transforming high-pressure decisions like “should I sell now?” into the daily rhythm of “what should I wear today?”

True investment masters aren’t market prophets, but stewards of their own emotions and positions.

In crypto, your “pockets” might hold stablecoins, staking yields, arbitrage bots, and leveraged perps; in traditional markets, they might be cash, short-term bonds, low-vol strategies, or momentum ETFs.

What you need to do is never predict the market, but:

Define your four pockets, write your own rulebook, and periodically use “scissors” to fine-tune allocations.

Because seasons change, the sun rises, but you must ensure:

An umbrella when it rains, clothing when the wind blows, arrows when launching upward, shields when flatlining.

—The rest, leave to the market, leave to time.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News