Machi Big Brother and Yīnén Jìng return—will the NFT market truly recover this time?

TechFlow Selected TechFlow Selected

Machi Big Brother and Yīnén Jìng return—will the NFT market truly recover this time?

NFT market trading volume warms up, buyers surge—behind the apparent recovery, is the real spring arriving, or is it just an illusion in the midst of winter?

Author: Zz, ChainCatcher

"First came the麻吉, now comes Yo Yang. Many big NFT players from the last cycle are returning."

In 2021, celebrity influence fueled the NFT craze. Today, they're making a comeback, bringing new stories and new bets.

At the same time, NFT market trading volume is rebounding and buyers are surging. But behind this apparent recovery, is it the arrival of a true spring—or merely an illusion in the midst of winter?

Is the NFT Market Entering a Deep Transition Phase?

The macro data presents a confusing contradiction.

On one hand, long-term outlooks remain optimistic. Authoritative institutions like Vancelian predict this year's market size will surpass the tens of billions of dollars. On the other hand, short-term reality is unusually cold: DappRadar reports that NFT transaction volume in Q2 this year dropped nearly 29% quarter-on-quarter.

Yet this apparent retreat hasn't triggered market panic. Instead, it reveals a structural transformation.

According to DappRadar, in Q2 2025, although total NFT trading volume declined due to fewer high-value collectibles, the number of transactions surged 78% from approximately 7.02 million to 12.5 million, while unique buyer count rose sharply by 44% from 651,000 to 936,000.

This abnormal "price down, volume up" data reveals deep changes underway. NFTs are quietly shifting from a high-priced speculative game for a few into a broader "democratization process."

As Coindoo noted: despite declining trading volume, the rise in sales numbers and falling average transaction values indicate wider market participation. The driving force behind transactions is shifting from pure speculation to utility and community consensus.

And at this delicate moment, a group of once-departed "celebrity players" are returning. What does their comeback really mean?

Celebrities Return—Are the Scythes Still Sharp?

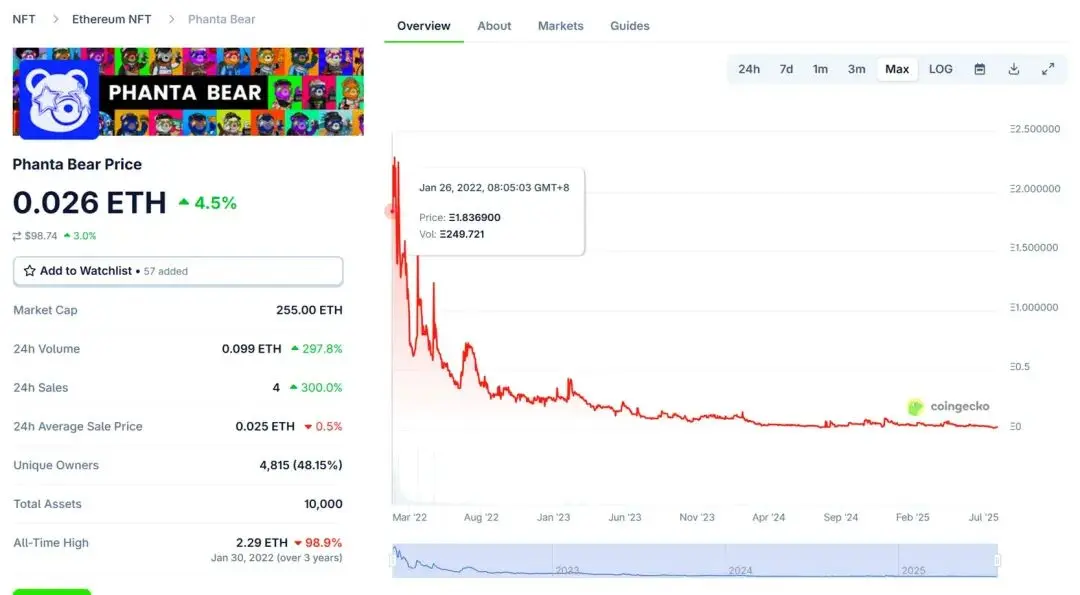

From Jay Chou's PhantaBear to Shawn Yue's ZombieClub, and even Yo Yang's own Theirsverse—these once-frenzied projects now have floor prices down over 98% from their peaks, nearly zeroed out. Behind these cold numbers lie countless investors still silently nursing their wounds.

Source: CoinGecko, Cryptorank

To understand today's market, we must look back at those years filled with both frenzy and awakening.

2021: Peak of the Party

This was a golden age where dreamers danced with speculators.

Bitcoin soared to its all-time high of $69,000, and NFTs leapt from niche novelty to global phenomenon. In October 2021, 麻吉 spent 425 ETH on a Cyborg Bored Ape, instantly igniting FOMO across the market.

By year-end, Jay Chou's PhantaBear sold out within 40 minutes, generating over $10 million in daily sales.

2022: Winter Arrives

But prosperity was fleeting. Hit by black swan events, high inflation, rising interest rates, and war, Bitcoin plunged below $20,000 and crypto market cap halved to $1 trillion.

Edison Chen, Shawn Yue, and Yo Yang launched NFT projects, but all eventually collapsed amid the bear market. Theirsverse fell from 0.219 ETH to just 0.02 ETH—a drop exceeding 96%—earning Yo Yang the label of "Queen of Bagholders."

2025: Old Faces Return, New Forces Enter

Today, 麻吉 has transformed his identity—from NFT whale to high-leverage meme coin trader. He's placing real-money bets on BLAST and PUMP tokens, openly sharing profits and losses, becoming a "number one gambler" intertwined with the market. Meanwhile, Yo Yang has quietly returned.

Additionally, legendary entrepreneur Qian Fenglei, boasting a "ten-billion RMB fortune," entered Web3 early this year, vowing to invest $100 million into building the "Peach Blossom Garden NFT." Galaxy Digital's Mike Novogratz has also quietly switched to a Pudgy Penguin profile picture.

Everything seems to be returning to 2021—celebrities back in place, markets stirring. But this time, beneath the heat lies less blind faith and more restraint.

Community Evolution: From Followers to Value "Judges"

In 2025, the NFT community is no longer just a participant—it has evolved into a true "judge."

On the surface, data looks strong: NFT trading volume steadily rebounds, blue-chip projects like CryptoPunks, BAYC, and Pudgy Penguins continue climbing. Yet this time, community reactions are unprecedentedly calm.

"The 2021 NFT boom won't repeat," @RicecakeNFT bluntly stated on X. "Entry barriers have risen sharply; investors now prioritize utility and community value." This captures the truth of the 2025 NFT market—after speculative bubbles burst, value reclamation becomes the main theme.

Community member @waleswoosh predicted: "In 2025, a single top-tier NFT project might no longer dominate. Instead, we’ll see several projects with floor prices above 50 ETH. This year will be about repricing and real value."

The 2025 NFT world appears lively on the surface—but remains calm underneath.

From hype to consensus, from frenzy to rationality—this deep gear shift in the NFT market marks a reshaping of value.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News