Stablecoin regulations set to take effect, Hong Kong market sees undercurrents

TechFlow Selected TechFlow Selected

Stablecoin regulations set to take effect, Hong Kong market sees undercurrents

On the upcoming August 1, Hong Kong's Stablecoin Ordinance will officially take effect.

Article by: Tuoluo Finance

The stablecoin wave continues to blow.

On one front, the U.S. Stablecoin TRUST Act has been signed into law by Trump; on the other, Hong Kong's stablecoin launch is entering its final countdown. On August 1, Hong Kong’s “Stablecoin Ordinance” will officially take effect. Compared to the massive waves stirred by U.S. stablecoin legislation in the crypto world, Hong Kong’s ripples are modest within cryptocurrency circles—yet remarkably, they have shown extraordinary impact in the stock market.

Since the draft stablecoin bill passed, enthusiasm for stablecoins in Hong Kong's stock market has surged unprecedentedly. The Hong Kong stablecoin sector has skyrocketed, with numerous stocks doubling and even some achieving tenfold gains. Investors are thrilled, and listed companies welcome new investments. While this appears to be a universally positive scenario, Hong Kong regulators now harbor fresh concerns. Recently, HKMA Chief Executive Eddie Yue published an article titled "Stablecoins: Steady Progress for Long-Term Success" on the official website, aiming to cool down the rapidly overheating stablecoin market.

However, cooling down this boiling kettle will undoubtedly prove difficult.

On May 21, Hong Kong’s Stablecoin Ordinance draft passed its third reading in the Legislative Council. At that time, as the U.S. stablecoin bill was still under Senate review, Hong Kong’s move to “race ahead” sparked widespread market discussion. In substance, elements such as licensing requirements, 100% full reserve backing, HK$25 million paid-in capital, and anti-money laundering provisions align closely with regulations in other major jurisdictions. Yet public sentiment has been polarized—representing the true state of Hong Kong’s stablecoin narrative.

On one hand, due to Hong Kong’s waning influence in the crypto space and repeated instances where early initiatives generated more hype than results, the crypto market generally holds a relatively pessimistic view. Many believe that despite Hong Kong’s ongoing efforts to strengthen regulatory foundations and refine rules, limited market demand would ultimately relegate its stablecoins to mere extensions of dollar-denominated stablecoins, serving only as supplementary gateways.

Despite lukewarm reception from the crypto market, the news has proven highly beneficial elsewhere. Following the ordinance’s passage, major forward-looking enterprises swiftly moved in. Traditional media outlets and securities firms have competed to report on it, enabling stablecoins to truly break out beyond niche circles. Discussions about stablecoin definitions, use cases, and significance have intensified, gradually expanding into debates on the necessity of a renminbi-denominated stablecoin. The trillion-dollar stablecoin market seems poised on the brink of explosion.

This Friday, the Hong Kong Stablecoin Ordinance will officially take effect, simultaneously opening applications for licenses. Yet just one week prior, HKMA head Eddie Yue poured cold water on the momentum. In his article “Stablecoins: Steady Progress for Long-Term Success,” he explicitly stated that stablecoins are becoming excessively conceptualized and showing signs of bubble formation. Yue emphasized that only a handful of stablecoin licenses would likely be issued initially, urging investors to remain calm and exercise independent judgment when processing favorable market news. Additionally, the HKMA will consult the public on two guidance documents—one covering regulation and the other anti-money laundering measures—with stricter AML requirements to be established to minimize risks of stablecoins being used for money laundering.

These statements reflect HKMA’s concern over current market conditions and its extremely cautious stance toward issuing stablecoin licenses. The reason behind an official authority writing to temper market expectations is simple: stablecoins in Hong Kong have become overly heated.

This overheating is most evident in the stock market. A bright future juxtaposed against very early-stage development makes stablecoins an appealing capital story. Under this narrative, nearly every stock associated with stablecoins has surged rapidly, with growth effects almost immediate.

After Guotai Junan International obtained a securities trading license in June, becoming the first Chinese-funded brokerage offering end-to-end virtual asset services, its shares soared 198% on June 25, with year-to-date gains reaching 4.58 times.

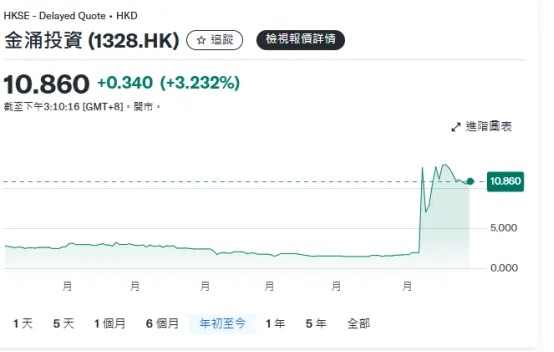

On July 7, Jinrong Investment announced it had signed a strategic cooperation MOU with AnchorX to explore potential collaboration in four areas including cross-border payments, trade, and stablecoin application expansion. The next day, Jinrong Investment surged 533.17% on high volume.

On July 15, China Sanyan Media announced preparations for applying for a stablecoin license. On July 16, the company closed up 72.73%, with cumulative gains this year reaching 14.95 times.

A single announcement can trigger a direct spike—evidence enough of the powerful narrative effect surrounding stablecoins. Beyond these newly added players, established概念股 also rose collectively. OKX Blockchain, Yunfeng Financial, Yixin Group, Neofound Tech Holdings, and OSL Group have all seen year-to-date gains exceeding 100%. Even mainland A-shares were affected, with digital RMB概念股 such as Hengbao, Sunline, and Chutian Dragon seeing multi-fold increases.

Under these circumstances, whether chameleon-like firms merely chasing trends, financial institutions seeking a share of the pie, or strategic giants aiming to reduce settlement costs and build corporate moats—all have rushed in. To date, according to Caixin, around fifty to sixty companies intend to apply for Hong Kong stablecoin licenses, including central SOEs, financial institutions, and internet giants from mainland China.

Yet, application frenzy does not equate to approval enthusiasm. The HKMA noted that most applicants remain at the conceptual stage, lacking real-world application scenarios. Those with practical use cases often lack technical capabilities and experience managing various financial risks required for issuing stablecoins. Issuance for issuance’s sake is clearly not what Hong Kong wants to see—and it is precisely against this backdrop that the HKMA stated only single-digit licenses will be granted initially.

Meanwhile, facing excessive application interest, the HKMA intends to implement a preliminary screening mechanism. Citing sources, Caixin reported that stablecoin issuer licenses will not follow the standard process of self-downloading forms and submitting written applications. Instead, an invitation-based model will be adopted. In practice, the HKMA, responsible for licensing oversight, will pre-communicate with prospective applicants to assess basic eligibility. Only those receiving preliminary approval will be issued formal application forms by the HKMA.

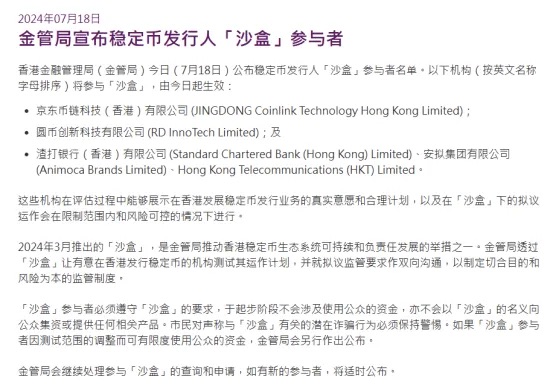

Who will ultimately receive licenses? Market sentiment suggests stronger odds for those already participating in the stablecoin sandbox pilot program. As early as July last year, the HKMA launched a stablecoin sandbox test, selecting institutions including JD Blockchain, Orbix Innovations, and the Standard Chartered Consortium (comprising Standard Chartered, Anni Group, and Hong Kong Telecom). Now entering its second phase, although the HKMA stresses sandbox inclusion doesn’t guarantee licensing—and all participants must formally apply—the先行 testing of use cases and risk controls gives sandbox members greater insight into meeting regulatory expectations.

Overall, the HKMA primarily evaluates three key aspects in license applications: first, technical capability to meet issuance requirements; second, practical demand and viable use cases requiring concrete plans and implementation scenarios; third, risk management capacity, particularly in preventing money laundering via stablecoins. Objectively speaking, large enterprises with existing cross-border finance and payment operations and comprehensive risk control systems hold clear advantages. For small and medium-sized enterprises, the chance of success is slim—they are mostly along for the ride.

At present, despite the HKMA’s call for cooling, market FOMO is unlikely to subside anytime soon.

First, there is a certain level of linkage between U.S. and Hong Kong stablecoin developments. After the TRUST Act passed, enthusiasm for U.S. stablecoins remains strong, with Circle hitting new highs and major institutions expressing significant interest. Combined with positive crypto market sentiment and anticipated rate cuts, the U.S. stablecoin narrative will continue evolving—and carry spillover effects.

Second, discussions around Hong Kong stablecoins continue to expand. Initially focused solely on Hong Kong dollar stablecoins, attention has increasingly shifted toward the necessity of offshore renminbi stablecoins. National think tanks like the National Institute of Financial Development, local government bodies such as Shanghai SASAC, major brokerages, consulting firms, and social organizations are all beginning to engage. Current opinions suggest piloting offshore RMB stablecoins in Hong Kong first, then exploring domestic offshore markets represented by free trade zones once conditions mature. Previously, Hong Kong’s slow Web3 development stemmed from blocked channels. If offshore RMB stablecoins become feasible, not only would this unlock greater possibilities for the sector and accelerate industry growth, but it could also profoundly impact the broader financial system in the long term.

More importantly, from a participant perspective, stablecoins represent a profitable and promising market, gradually forming a complete industrial chain. From an issuer standpoint, retail-focused issuers benefit from significantly reduced transaction and settlement costs, enhancing competitiveness. Payment-focused issuers aim to penetrate deeper into digital assets through platforms, advancing toward global financial infrastructure. Even for entities motivated purely by boosting stock valuations and capital narratives, participation offers incentives. Amid the current concept-driven climate, over five groups—including ZhongAn Online, Fourth Paradigm, Jiami Technology, and Easou Technology—have announced major placement financing plans. OSL Group placed over 101 million shares at HK$14.9 per share, raising nearly HK$2.4 billion. Beyond issuance, virtual asset exchanges serving as primary traffic monetization vehicles and custodians led by banks are actively positioning themselves to capture industry benefits.

Given all this, speculation around stablecoins will persist in the short term. Licenses, as the entry ticket in this compliance race, will make competition increasingly fierce. However, it’s important to note that for an industry still in its infancy, the actual scope and strength of license spillover effects, as well as business feasibility, remain unproven. Considering the hard threshold of HK$25 million and potentially millions in annual compliance costs, rushing into applications without solid business models may backfire. As the HKMA article suggests, few will ultimately achieve sustainable, long-term success. Many companies merely chasing headlines will inevitably return to their original state after the license vetting process.

For investors closely watching stocks, extra caution is warranted.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News