Crypto market macro outlook for the second half of 2025: "coin-stock strategy" ignites market enthusiasm, sustainability remains to be seen

TechFlow Selected TechFlow Selected

Crypto market macro outlook for the second half of 2025: "coin-stock strategy" ignites market enthusiasm, sustainability remains to be seen

The market is like a vast ocean—we cannot predict storms, only adjust our sails amidst them.

Author: IOBC Capital

In the first half of 2025, the crypto market was significantly influenced by several macro factors, three of which were most critical: Trump administration's tariff policies, the Federal Reserve's interest rate policy, and geopolitical conflicts in Ukraine-Russia and the Middle East.

Looking ahead to the second half, the crypto market will continue navigating a complex and volatile macro environment. The following major macro factors will remain influential:

1. Inflation expectations stemming from Trump’s tariff policy

Tariffs are a key policy tool for Trump. The Trump administration aims to achieve several economic goals through tariff negotiations: first, expand U.S. exports and reduce foreign trade barriers; second, maintain a base tariff rate above 10% to increase government revenue; third, enhance domestic competitiveness in specific industries and stimulate the return of high-end manufacturing.

As of July 25, the U.S. has made varying progress in tariff negotiations with major global economies:

Japan: An agreement has been reached. U.S. tariffs on Japanese goods have been reduced from 25% to 15% (including automobiles), while Japan has committed to investing $550 billion in the U.S. across semiconductors and AI sectors, opening its automotive and agricultural markets, and increasing import quotas for U.S. rice.

European Union: The deadline is August 1. EU negotiators arrived in the U.S. on July 23 for final talks, but results have not yet been publicly disclosed.

China: The third round of trade talks will be held in Sweden from July 27 to 30. After the first two rounds, U.S. tariffs on Chinese goods dropped from 145% to 30%, and China’s tariffs on U.S. goods fell from 125% to 10%. Reports suggest the deadline for Sino-U.S. tariff negotiations may be extended another 90 days. If no new agreement is reached during the third round, suspended tariffs could revert.

In addition, the U.S. has already reached tariff agreements with the Philippines and Indonesia. Currently, the most watched negotiation is the third round between the U.S. and China. Although tariff policy uncertainty is gradually decreasing, it remains possible that talks with key economies may fail to make substantive progress, potentially causing greater shocks to financial markets.

From an economic theory perspective, tariffs represent a negative supply shock and carry “stagflationary” effects. In international trade, although businesses are the nominal taxpayers, they often pass this tax burden onto American consumers via price transmission mechanisms. As a result, the U.S. may experience a rise in inflation during the second half, which could significantly affect the Fed’s pace of rate cuts.

In summary, the impact of Trump’s tariff policy on the U.S. economy in the second half may manifest as a temporary rise in inflation. Unless data shows inflation pressure is mild, this would likely slow down the pace of rate cuts.

2. The dollar tide cycle entering a weak-dollar phase benefits the crypto market

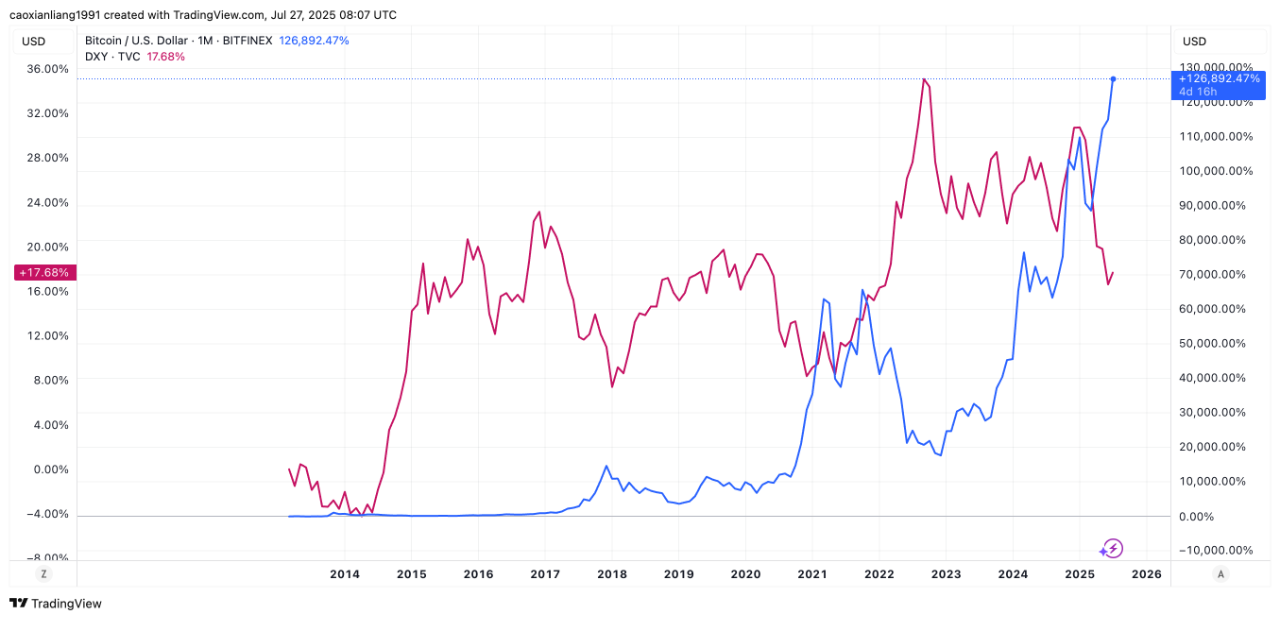

The dollar tide cycle refers to the systemic outflow and inflow of the U.S. dollar across the globe. Despite no rate cuts in the first half, the dollar index has weakened—falling steadily from a year-start high of 110 to 96.37, reflecting a clear "weak-dollar" state.

Several factors may explain the dollar’s weakness: First, Trump’s tariff policies have suppressed trade deficits, disrupted the dollar’s circulation mechanism, and reduced the attractiveness of dollar-denominated assets, raising concerns about the stability of the dollar system; Second, fiscal deficits are undermining confidence, as rising U.S. debt levels and climbing Treasury yields deepen market concerns over fiscal sustainability; Third, the oil-dollar agreement has expired without renewal. Global central banks’ dollar reserves have declined from 71% in 2000 to 57.7%, while gold holdings have increased, signaling ongoing "de-dollarization" efforts. Additionally, rumored policy direction implied by the "Mar-a-Lago Accord" may also play a contributing role.

Historically, the strength or weakness of the dollar index has almost entirely dictated global liquidity trends. Global liquidity tends to follow a 4-5 year complete dollar tide cycle, exhibiting cyclical fluctuations. A weak-dollar phase typically lasts 2–2.5 years. If this cycle began in June 2024, it could extend until mid-2026.

Chart: IOBC Capital

As shown above, Bitcoin prices often move inversely to the dollar index. When the dollar weakens, Bitcoin typically performs strongly. If the "weak-dollar" phase continues in the second half, global liquidity will shift from tight to loose, further benefiting the crypto market.

3. The Federal Reserve’s monetary policy is likely to remain cautious

There are four FOMC meetings scheduled in the second half of 2025. According to CME's "Fed Watch" tool, there is a high probability of 1–2 rate cuts during this period. The likelihood of holding rates steady in July is as high as 95.7%; the probability of a 25-basis-point cut in September stands at 60.3%.

Since taking office, Trump has repeatedly criticized the Federal Reserve on X for moving too slowly on rate cuts, even directly attacking Fed Chair Powell and threatening to fire him. This has placed political pressure on the Fed’s independence. Nevertheless, the Fed resisted pressure in the first half and refrained from cutting rates.

Under normal succession plans, Fed Chair Powell is set to officially step down in May 2026. The Trump administration plans to announce a nominee for the new chair in December 2025 or January 2026. Under these circumstances, dovish voices within the Fed are gaining market attention, seen as reflecting the influence of a potential "shadow chair." Nonetheless, the market widely expects the July 30 meeting to maintain current interest rates.

Three core reasons explain the anticipated delay in rate cuts:

1️⃣ Persistent inflation pressure—impacted by Trump’s tariff policies, U.S. CPI rose 0.3% month-on-month in June, and core PCE inflation climbed to 2.8% year-on-year. Tariff pass-through effects are expected to further push up prices over the coming months. The Fed believes progress toward its 2% inflation target is obstructed and requires more data to confirm a downward trend;

2️⃣ Slowing economic growth—the U.S. economy is projected to grow just 1.5% in 2025, but better-than-expected short-term data such as retail sales and consumer confidence have eased the urgency for immediate rate cuts;

3️⃣ Resilient labor market—unemployment remains low at 4.1%, though hiring has slowed. The market forecasts a gradual rise in unemployment in the second half, with Q3 and Q4 estimates at 4.3% and 4.4%, respectively.

In sum, the likelihood of a rate cut on July 30, 2025, is extremely low.

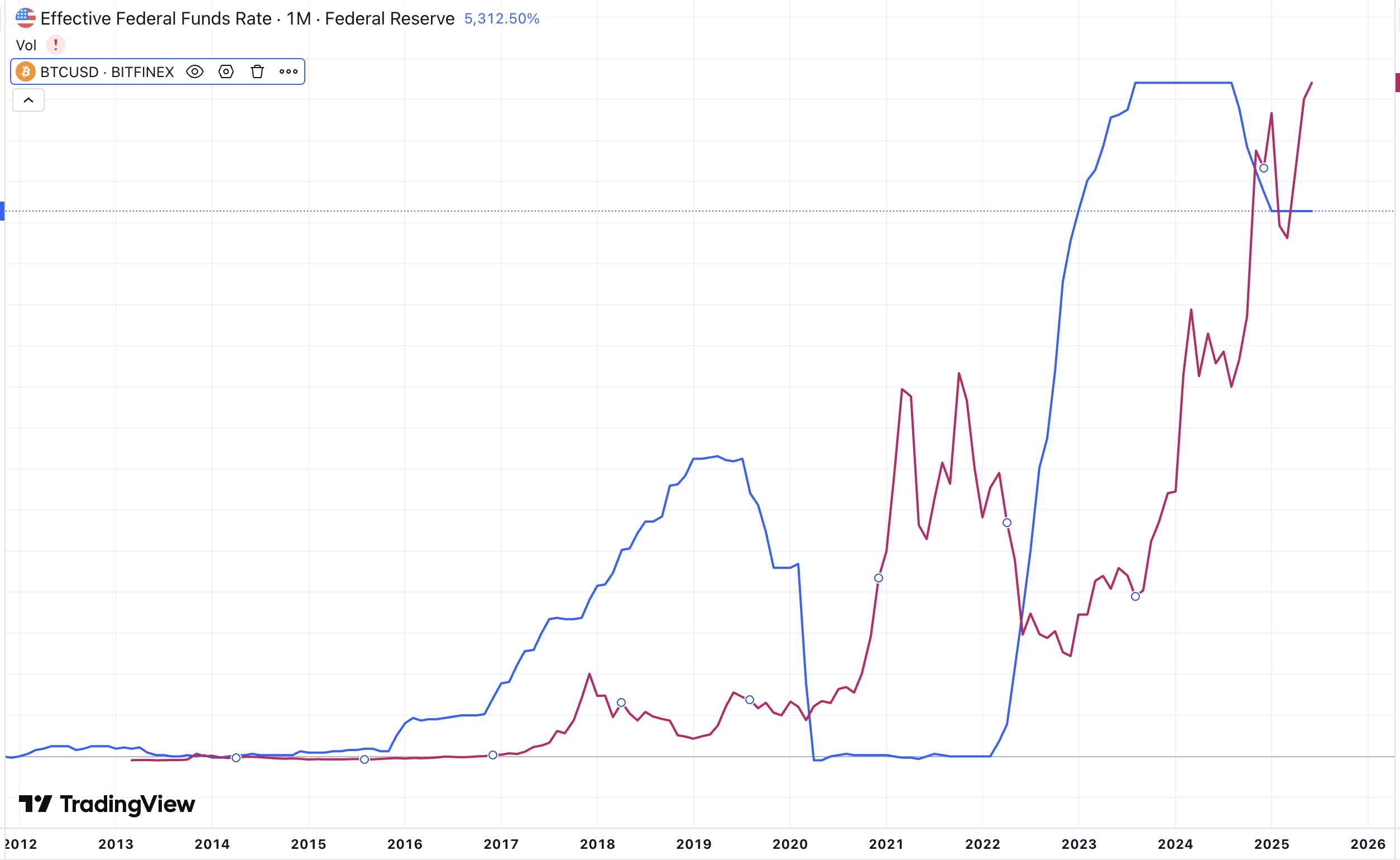

Chart: IOBC Capital

Overall, the Fed’s monetary policy is expected to remain cautious, with likely only 1–2 rate cuts for the entire year. However, when we examine historical charts of Bitcoin prices versus Fed interest rates, there is no significant correlation. Compared to changes in interest rates, Bitcoin appears to be more affected by global liquidity conditions under a weak-dollar regime.

4. Geopolitical conflicts may have short-term impacts on the crypto market

The Russia-Ukraine war remains in a stalemate, with little prospect of diplomatic resolution. On July 14, Trump proposed a "50-day ceasefire ultimatum": if Russia fails to reach a peace deal with Ukraine within 50 days, the U.S. will impose 100% tariffs and secondary sanctions, and NATO will provide military aid to Ukraine, including "Patriot" missile defense systems. However, Russia has assembled 160,000 elite troops, planning to focus on key strongholds along the Donbas front. Meanwhile, Ukraine has not remained idle—on July 21, it launched a large-scale drone attack on Moscow airports. Additionally, Russia has announced its withdrawal from a thirty-year military cooperation agreement with Germany, marking a complete breakdown in Russia-EU relations.

Given the current situation, achieving a ceasefire by September 2 seems unlikely. If no truce occurs, Trump’s threatened sanctions could trigger market turmoil.

5. Crypto regulatory framework takes shape, ushering in a policy honeymoon period

The U.S. GENIUS Act took effect in July 2025, stipulating that "interest payments to token holders are prohibited, but reserve interest belongs to the issuer and must be disclosed." However, it does not ban issuers from sharing interest earnings with users—for example, Coinbase’s USDC offering a 12% annual yield. The ban on paying interest to holders restricts the development of "yield-bearing stablecoins," a measure designed to protect U.S. banks by preventing trillions of dollars from flowing out of traditional bank deposits, which support lending to businesses and consumers.

The U.S. CLARITY Act clearly assigns SEC oversight to security tokens and CFTC oversight to commodity tokens (such as BTC and ETH). It introduces the concept of a "mature blockchain system"—decentralized, open-source, and operating automatically based on predefined rules. Projects that meet certification criteria (e.g., submitting proof of no centralized control) can transition from being regulated as "securities" to being recognized as "commodities," thereby transferring full regulatory authority to the CFTC, with the SEC relinquishing securities jurisdiction. Additionally, DeFi activities receive partial exemptions—coding, running nodes, providing frontends, and non-custodial wallets are generally not considered financial services and are exempt from SEC regulation, provided basic anti-fraud and anti-manipulation rules are followed.

Overall, the accelerated advancement of the GENIUS Act, CLARITY Act, and Anti-CBDC Surveillance State Act marks America’s shift from a period of "regulatory ambiguity" to one of "transparent regulation." It also reflects the policy intent to "safeguard the U.S. dollar’s status as the world’s primary trade currency." As the regulatory framework matures, the stablecoin market is poised for further expansion, benefiting compliant stablecoin projects and DeFi protocols.

6. "Coin-stock strategies" ignite market enthusiasm, but sustainability remains to be seen

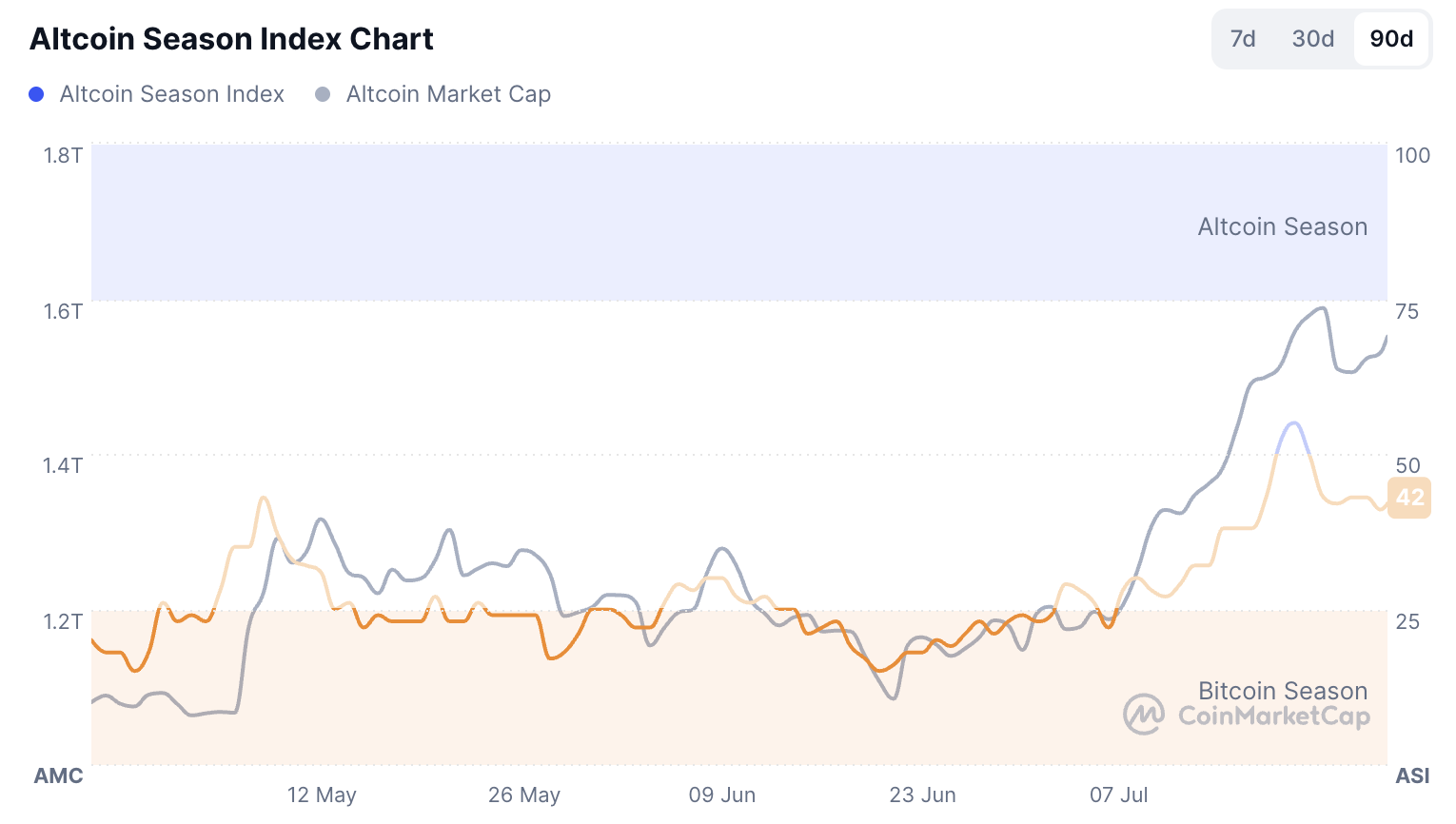

As MicroStrategy completes its epic transformation through its "Bitcoin strategy," a revolution in corporate crypto asset reserves led by public companies is sweeping capital markets. From ETH to BNB, SOL, XRP, DOGE, HPYE, TRX, LTC, TAO, FET, and more than ten other major altcoins are becoming new anchors for corporate treasuries. This "coin-stock strategy" has become a market trend this year.

Take MicroStrategy’s "triple flywheel" model as an example of this capital alchemy:

Flywheel of stock-coin synergy: Stock price trades at a long-term premium to net asset value per share (currently 1.61x), creating a low-cost funding channel; fundraising → buying more BTC → driving up coin price → increasing per-share crypto value → boosting valuation, forming a self-reinforcing upward spiral.

Flywheel of stock-debt coordination: Zero-coupon convertible bonds effectively transform debt pressure—no principal repayment required, and conversion rights rest with the company. This attracts hedge fund arbitrage capital and injects low-cost liquidity.

Flywheel of coin-debt arbitrage: Using depreciating fiat-denominated debt to acquire appreciating crypto assets enables long-term arbitrage positioning.

Moreover, tiered financing strategies precisely attract three types of capital: preferred shares lock in fixed-income investors, convertible bonds draw arbitrage funds, and common stock carries risk speculation. For detailed logic, see "Understanding MicroStrategy’s Bitcoin Strategy in One Article".

Since the beginning of the year, more and more public companies have adopted the "coin-stock strategy"—allocating crypto assets on their balance sheets as reserve assets. The scale of corporate crypto holdings continues to expand, with asset allocation showing diversification. According to incomplete statistics: 35 listed companies collectively hold over 920,000 BTC; 13 hold over 1.48 million ETH; 5 hold over 2.91 million SOL. Others are not listed here—we will detail each project’s holdings in a future article.

The convergence of traditional finance and the crypto world is a unique market variable in this cycle. As public companies turn their balance sheets into crypto warfare platforms, we must also remain vigilant against risks when the tide recedes.

Summary

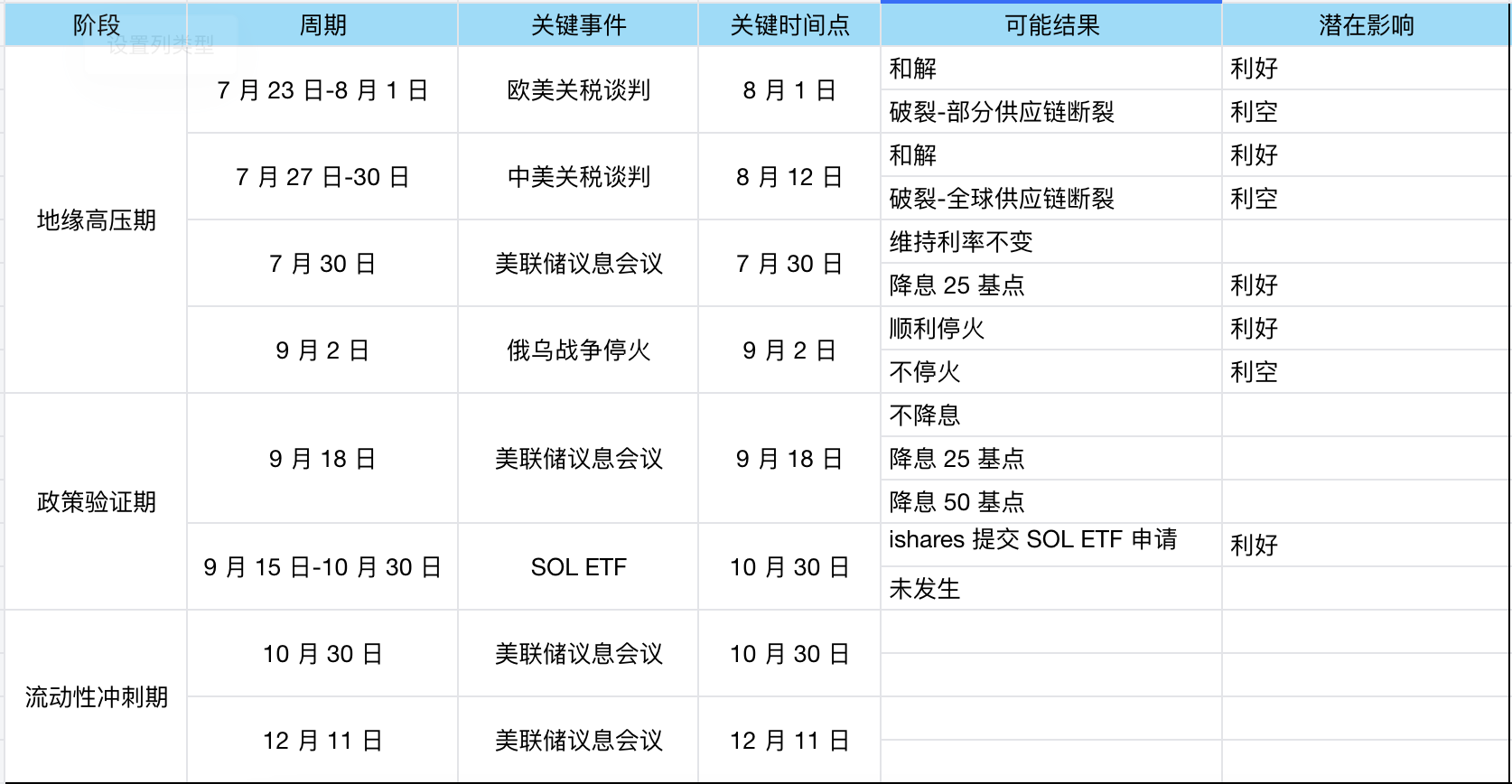

If we project the foreseeable macro events in chronological order, the second half can be divided into the following phases:

Chart: IOBC Capital

The market is like a vast ocean—we cannot predict storms, but we can adjust our sails amidst them.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News