Native yield plus high volatility: Why is ETH a better solution for public companies?

TechFlow Selected TechFlow Selected

Native yield plus high volatility: Why is ETH a better solution for public companies?

From the current $8 billion to $240 billion, the next cryptocurrency wealth myth is rising.

Author: kevin

Translation: TechFlow

While the crypto community has long championed tokenization and on-chain assets as tools for enhanced accessibility, the most significant progress has actually come from integrating cryptocurrency with traditional securities. The recent surge in public market interest in digital asset treasury strategies perfectly illustrates this trend.

Michael Saylor pioneered this strategy through MicroStrategy (TechFlow note: now renamed "Strategy"), transforming his company into a $100+ billion market cap entity surpassing even NVIDIA. We provided an in-depth analysis of this blueprint in our article on MicroStrategy—an excellent reference for those new to treasury management. The core financial argument behind these strategies is that publicly traded equity offers cheaper, unsecured leverage—a tool entirely inaccessible to ordinary traders.

Recently, attention has expanded beyond Bitcoin to Ethereum-based treasury platforms such as Sharplink Gaming ($SBET, led by Joseph Lubin) and BitMine ($BMNR, led by Thomas Lee). But do ETH treasury platforms make sense? As outlined in our MicroStrategy analysis, treasury companies are essentially attempting to arbitrage the long-term compound annual growth rate (CAGR) of the underlying asset against their cost of capital. In a previous article, we laid out the following argument: ETH’s long-term CAGR. It is a scarce, programmable reserve asset playing a foundational role in securing the on-chain economy as more assets migrate onto blockchain networks. This article will explain why ETH treasuries exhibit a structurally bullish bias and offer operational guidance for enterprises adopting this treasury strategy.

Accessing Liquidity: The Foundation of Treasury Companies

One major reason tokens and protocols seek to create these treasury companies is to provide access to traditional finance (TradFi) liquidity, especially amid declining altcoin liquidity within crypto. Typically, these treasury companies access liquidity to acquire more assets through three primary methods. Importantly, this liquidity/debt is unsecured, meaning it is non-recallable:

-

Convertible Bonds: Raising funds by issuing debt that lenders can convert into equity, using proceeds to purchase more Bitcoin.

-

Preferred Shares: Raising capital by issuing preferred shares that pay investors a fixed annual dividend.

-

At-the-Market (ATM) Issuance: Selling new shares directly on public markets to raise flexible, real-time funds for purchasing Bitcoin.

Why ETH Convertible Bonds Outperform BTC Convertible Bonds

In our earlier MicroStrategy article, we noted that convertible bonds offer institutional investors two key advantages:

-

Downside Protection with Upside Exposure: Convertible bonds allow institutions exposure to the underlying asset (e.g., BTC or ETH), while protecting principal investment through inherent bond-like safeguards.

-

Volatility-Driven Arbitrage Opportunities: Hedge funds often buy convertible bonds not just for exposure, but to execute gamma trading strategies (TechFlow note: an options trading strategy primarily based on the "gamma" value among the Greek letters in options pricing, where gamma measures the sensitivity of an option's delta to changes in the price of the underlying asset), profiting from volatility in both the underlying asset and its securities.

Among these, gamma traders (hedge funds) currently dominate the convertible bond market.

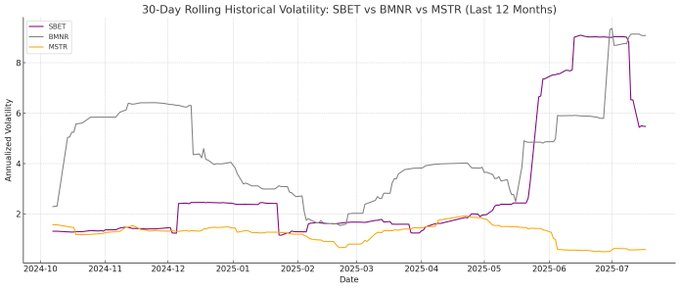

With this in mind, Ethereum’s higher historical and implied volatility compared to Bitcoin becomes a critical differentiator. ETH treasury companies reflect this elevated volatility in their capital structure by issuing ETH convertible bonds (CBs). This dynamic makes ETH-backed CBs particularly attractive to arbitrageurs and hedge funds. Crucially, this volatility also enables ETH treasury companies to secure more favorable financing terms by selling CBs at higher valuations.

Figure 1: Historical Volatility Comparison – ETH vs BTC

Source: Artemis

For convertible bond holders, increased volatility enhances profit opportunities via gamma trading strategies. Simply put, the greater the underlying asset’s volatility, the higher the potential gamma trading profits, giving ETH asset CBs a clear edge over BTC asset CBs.

Figure 2: Historical Volatility Comparison – SBET, BMNR vs MSTR

Source: Artemis

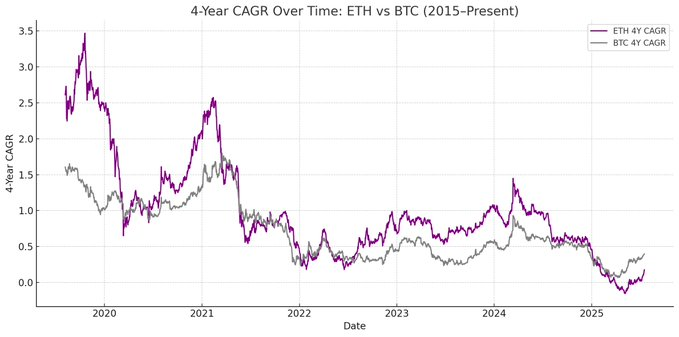

However, there is an important caveat: if ETH fails to maintain its long-term compound annual growth rate (CAGR), appreciation in the underlying asset may be insufficient to justify conversion before maturity. In such cases, ETH treasury companies face the risk of having to repay the full bond amount. By contrast, BTC convertible bonds—backed by Bitcoin’s more established long-term performance record—are less prone to this downside risk, as historically most such bonds under this strategy have converted into equity.

Figure 3: Four-Year Compound Annual Growth Rate (CAGR) Over Time – ETH vs BTC

Source: Artemis

Why ETH Preferred Shares Offer Differentiated Value?

Unlike convertible bonds, preferred share offerings are structured for fixed-income asset classes. While certain convertible preferred shares offer hybrid upside participation, yield remains the primary concern for many institutional investors. These instruments are priced based on underwritten credit risk—i.e., whether the treasury company can reliably make dividend payments.

A key advantage of the MicroStrategy model lies in using ATM issuance to fund these payments. Since this typically represents only 1–3% of total market cap, dilution and risk are minimal. However, the model still depends on market liquidity and volatility of both BTC and MicroStrategy’s underlying securities.

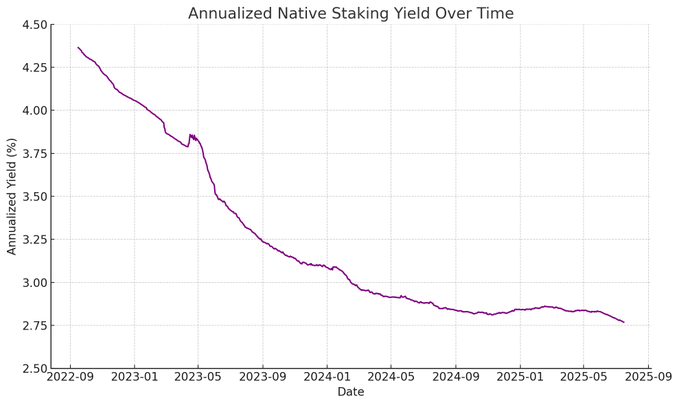

Ethereum adds another layer of value: native yield generation through staking, restaking, and lending. This built-in yield provides greater certainty for servicing preferred distributions, theoretically enabling higher credit ratings. Unlike Bitcoin, which relies solely on price appreciation, Ethereum’s return profile combines CAGR with protocol-layer native yield.

Figure 4: Annualized Native Staking Yield of ETH

Source: Artemis

I believe a compelling innovation of ETH preferred shares lies in their potential to become non-directional investment vehicles, allowing institutional investors to support network security without taking directional ETH price exposure. As emphasized in our ETH report, maintaining at least 67% honest validators is crucial for Ethereum’s security. As more assets move on-chain, it becomes increasingly important for institutions to actively support Ethereum’s decentralization and security.

Yet, many institutions may not want direct long exposure to ETH. ETH treasury companies can act as intermediaries, absorbing directional risk while offering institutions fixed-income-like returns. The preferred shares issued by $SBET and $BMNR are designed specifically as on-chain fixed-income staking products for this purpose. They can be enhanced with bundled advantages such as priority inclusion, protocol-level incentives, and more, making them more attractive to investors seeking stable returns without full market risk exposure.

Why ATM Issuance Favors ETH Assets

One of the most commonly used valuation metrics for financial firms is mNAV (market multiple relative to net asset value). Conceptually, mNAV functions similarly to the P/E ratio: it reflects how the market prices future per-share asset growth.

Due to Ethereum’s native yield mechanism, ETH assets inherently command a higher net asset value premium. These activities generate recurring “earnings” or increases in per-share ETH value without incremental capital. In contrast, BTC treasury companies (BTC assets) must rely on synthetic yield strategies such as issuing convertible bonds or preferred shares. Without these institutional products, when BTC asset market premiums approach net asset value (NAV), yields become difficult to justify.

More importantly, mNAV is reflexive: higher mNAV enables treasury companies to raise capital more efficiently through ATM issuance. They issue shares at a premium and use proceeds to purchase more underlying assets, increasing per-share assets and reinforcing the cycle. The higher the mNAV, the greater the value captured, making ATM issuance particularly effective for ETH treasury companies.

Access to capital is another key factor. Companies with stronger liquidity and broader fundraising capabilities naturally command higher mNAV, while those with limited market access tend to trade at a discount. Thus, mNAV often reflects a liquidity premium—the market’s confidence in a company’s ability to effectively access additional liquidity.

How to Screen Treasury Companies from First Principles

A useful mental model is viewing ATM issuance as a way to raise capital from retail investors, while convertible bonds and preferred shares are typically designed for institutional investors. Therefore, the success of an ATM strategy hinges on building strong retail influence, which usually depends on having a trusted and charismatic leader and maintaining consistent transparency so retail investors believe in the long-term vision. In contrast, successfully executing convertible bond and preferred share offerings requires strong institutional distribution channels and relationships with capital markets desks. Based on this logic, I believe $SBET, as a stronger retail-driven company, benefits largely from Joe Lubin’s leadership and the team’s consistent transparency regarding per-share ETH accumulation. Meanwhile, $BMNR, under Tom Lee’s leadership and with close ties to traditional finance, appears better positioned to tap into institutional liquidity.

Why ETH Assets Matter for the Ecosystem and Competitive Landscape?

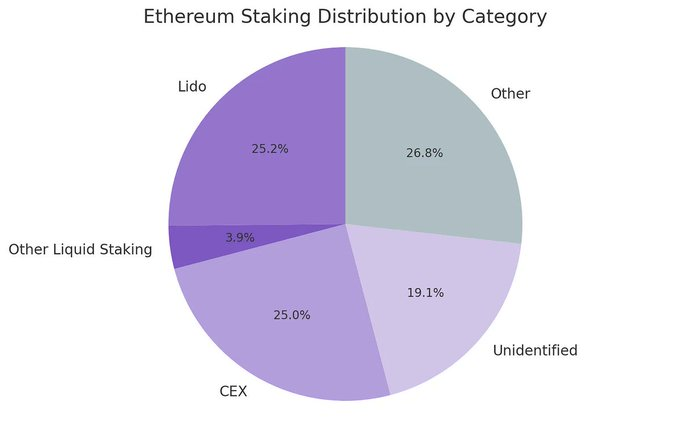

One of Ethereum’s biggest challenges is the increasing centralization of validators and staked ETH, particularly within liquid staking protocols like Lido and centralized exchanges like Coinbase. ETH treasury companies can help balance this trend and promote validator decentralization. To support Ethereum’s long-term resilience, these companies should distribute their ETH across multiple staking providers and, where possible, operate their own validators.

Figure 5: Staking Distribution by Category

Source: Artemis

Against this backdrop, I believe the competitive landscape for ETH treasury companies will differ significantly from that of BTC treasury companies. In the Bitcoin ecosystem, the market has evolved into a winner-takes-all structure, with MicroStrategy holding over ten times more BTC than the second-largest holder. Leveraging first-mover advantage and strong narrative control, MicroStrategy dominates the convertible bond and preferred share markets.

In contrast, ETH treasuries are starting from scratch. No single entity currently dominates, with multiple ETH treasuries launching simultaneously. This lack of first-mover advantage is not only healthier for the network but also fosters a more competitive and rapidly evolving market environment. Given that major players’ ETH holdings are relatively close in size, I expect we will likely see a duopoly emerge between two leading contenders: $SBET and $BMNR.

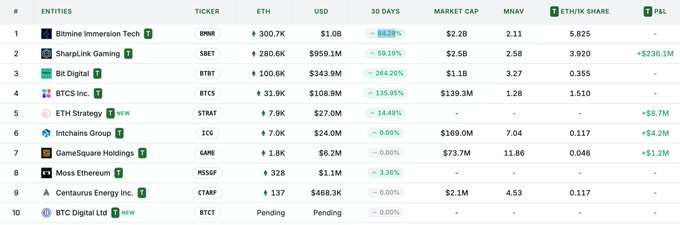

Figure 6: ETH Asset Holdings

Source: strategicethreserve.xyz

Valuation: MSTR + Lido Comp

Broadly speaking, the ETH treasury model can be viewed as a fusion of MicroStrategy and Lido, tailored for TradFi. Unlike Lido, ETH treasury companies, by owning the underlying assets directly, have the potential to capture a larger share of asset appreciation, making the model more advantageous in value accumulation.

A rough valuation perspective: Lido currently manages around 30% of total ETH staked, with an implied valuation exceeding $30 billion. We believe that within one market cycle (4 years), $SBET and $BMNR could, following MicroStrategy’s growth trajectory and driven by the speed, depth, and reflexivity of TradFi capital flows, potentially surpass Lido in total company valuation.

Context: Bitcoin’s market cap stands at $2.47 trillion, while Ethereum’s is $428 billion (17–20% of BTC’s). If $SBET and $BMNR each reach about 20% of MicroStrategy’s $120 billion valuation, that implies a long-term value of approximately $24 billion each. Currently, the combined valuation of both companies is slightly below $8 billion, indicating massive growth potential as ETH treasuries mature.

Conclusion

The convergence of cryptocurrency and traditional finance through digital asset treasury strategies represents a major shift, with ETH treasuries now emerging as a powerful force. Ethereum’s unique advantages—including higher volatility for convertible bonds and native yield for preferred issuances—enable ETH treasury companies to achieve distinctive growth. Their potential to promote validator decentralization and foster competition further sets them apart from the BTC treasury space. Combining MicroStrategy’s capital efficiency with Ethereum’s embedded yield unlocks tremendous value and drives deeper integration of the on-chain economy into TradFi. Rapid expansion and growing institutional interest signal transformative impacts on both crypto and capital markets in the years ahead.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News