What is Aspecta (ASP) launching on Binance Alpha?

TechFlow Selected TechFlow Selected

What is Aspecta (ASP) launching on Binance Alpha?

Aspecta aims to build on-chain standards and trust mechanisms for "illiquid assets."

By: Alex Liu, Foresight News

Originally published on July 11

Binance Alpha will list Aspecta (ASP) on July 24. Eligible users can claim an airdrop using Binance Alpha points on the Alpha event page after trading opens. Previously, on the evening of July 10, Yzi Labs announced a strategic investment in Aspecta. This article aims to briefly interpret Aspecta—its effort to build on-chain standards and trust mechanisms for illiquid assets in traditional capital markets—including its design logic, product ecosystem, application progress, and industry potential.

Team Background

Aspecta did not start from scratch. The project was incubated in 2022 at Yale University’s Tsai CITY (Tsai Center for Innovative Thinking at Yale). Core team members come from top academic and research institutions including Yale, Tsinghua, Berkeley, and McGill, with multiple patents and research publications in AI and graph learning. The co-founding team includes Steve Liu, former Chief Scientist at Tinder and Fellow of the Canadian Academy of Engineering, serving as Chief Scientist, and Jack He as Co-founder. The team also brings together several senior engineers and growth leads such as Jane Yang.

Co-founder Jack He speaking at TreeHacks

Why It Exists: What Problems Does It Solve?

In traditional markets, a large number of assets—such as early-stage equity, locked tokens, private equity, and real-world assets (RWA)—cannot be traded on public markets due to lack of transparent pricing, severely limiting liquidity and pricing efficiency. Aspecta proposes giving these "closed assets" a life on-chain, enabling not only price discovery but also tradability, thereby reducing information asymmetry and improving asset utilization.

To understand this logic, imagine a project holding a portion of tokens locked post-Series A, hesitant to exit immediately upon vesting due to market illiquidity and absence of pricing mechanisms. Aspecta uses a standardized "wrapping + reputation mechanism" to enable pricing, trading, and tracking of such assets—unlocking new value.

Two Core Products: BuildKey and Aspecta ID

Aspecta's architecture is clear, centered around two mutually reinforcing pathways:

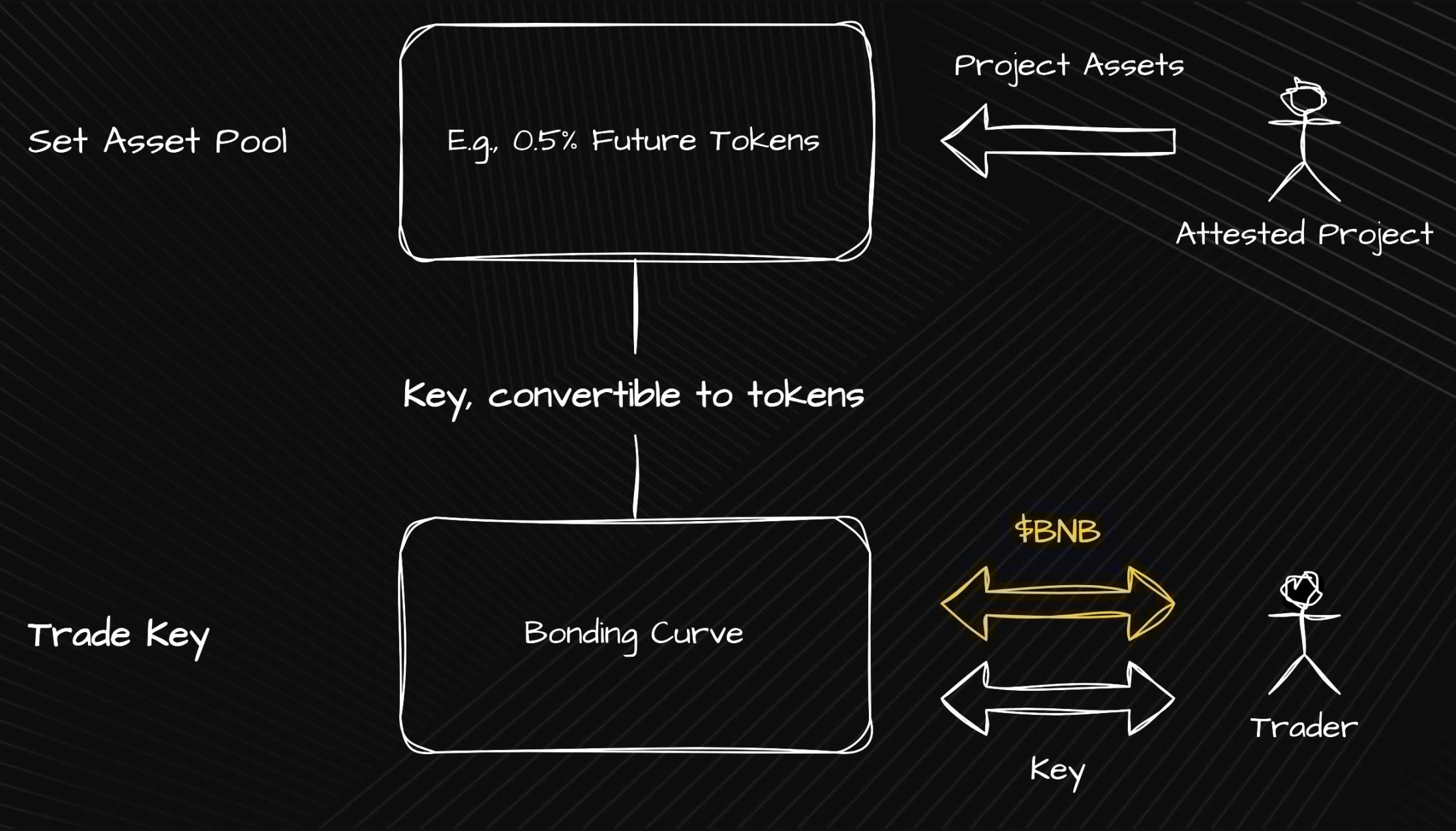

BuildKey: Asset Standardization and Lifecycle Pricing

BuildKey represents illiquid assets as tradable ERC-20-style tokens. For example, pre-TGE equity, locked tokens, or private allocation rights can all be issued and traded on-chain via BuildKey. This mechanism supports multiple pricing models—including AMM, order book, and auction—and allows assets to transition across lifecycle stages, enabling an "on-chain relay" from venture capital to public markets.

Notably, since its launch, BuildKey has enabled pricing for over 25 types of digital assets and facilitated more than 50 million transactions, demonstrating strong demand from closed capital for on-chain liquidity mechanisms. It is not merely token minting, but a "lifecycle asset variant" system: users can freely enter and exit at various stages such as TGE, vesting, and secondary markets, resulting in more continuous asset pricing.

Aspecta ID: AI-Powered Trusted Identity Protocol

If BuildKey is a tool for asset tokenization, Aspecta ID is the trust mechanism that backs issuers. By integrating data such as GitHub commits, on-chain behavior, and project contributions, it uses AI algorithms to generate credit profiles and assign reputation scores for developers, projects, and asset issuers.

This mechanism eliminates "trust vacuums" in asset packaging. During early or closed stages of a project, the trust signal provided by Aspecta ID reduces concerns among investors and traders. To date, over 54,000 GitHub developers have completed verification, and the system is evolving from a trust protocol toward community governance.

Product Integration: How Is the Loop Closed?

In Aspecta’s architecture, BuildKey and Aspecta ID are not isolated—they work together seamlessly to form a complete ecosystem loop from asset creation and trust establishment to trading and circulation. For instance, when a developer submits code on GitHub linked to a project, their technical contributions and on-chain activities are recognized and assessed by the Aspecta ID system to form a reputation profile. Based on this identity verification, the project gains credible backing when issuing illiquid assets such as pre-TGE equity. These assets are then tokenized via BuildKey, publicly offered, undergo initial price discovery, and establish transaction records.

As community participation deepens, AMM, order book, and auction mechanisms supported by BuildKey gradually enhance price transparency and trading depth. Throughout this process, users make informed decisions on whether to participate in subscriptions or exit investments based on issuer reputation ratings and market pricing, allowing assets to follow a full lifecycle trajectory and accumulate verifiable trading history and value feedback. This mechanism not only promotes pricing transparency for early-stage assets but also creates a positive feedback loop between trust and liquidity: on one hand, Aspecta ID provides foundational credit anchoring; on the other, on-chain trading data continuously enriches the trust evaluation system, making future asset issuance more efficient and credible.

Community, Users, and Ecosystem

As of mid-2025, Aspecta has attracted over 650,000 users, including more than 54,000 GitHub-verified developers who play a vital role in ecosystem development, further enhancing the utility and appeal of the identity system. Meanwhile, BuildKey has enabled on-chain issuance and trading for over 25 types of illiquid assets, demonstrating broad market adaptability. Active community involvement has accelerated the rollout of features such as multi-chain compatibility and hybrid AMM/order book models, driving the overall ecosystem toward greater openness and flexibility.

From a practical standpoint, Aspecta is building a triangular structure of "AI + Assets + Community," aiming to close the loop from identity recognition and asset packaging to on-chain governance and incentives, beginning to generate infrastructure-level network effects.

Conclusion

Aspecta is using its own approach—combining "trusted identity + lifecycle asset packaging + on-chain liquidity mechanisms"—to bridge the gap between traditional capital and Web3. From GitHub commits to tokenized instruments, from closed issuance to secondary market trading, its product suite continues to evolve in a self-consistent manner. Though still in early stages, with over $50 million in BuildKey transaction volume and a user base exceeding 650,000, it has established a solid foundation.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News