Base to be "restructured"—which assets are worth positioning for?

TechFlow Selected TechFlow Selected

Base to be "restructured"—which assets are worth positioning for?

List of promising Base ecosystem projects worth positioning for.

Author: kkk, TechFlow

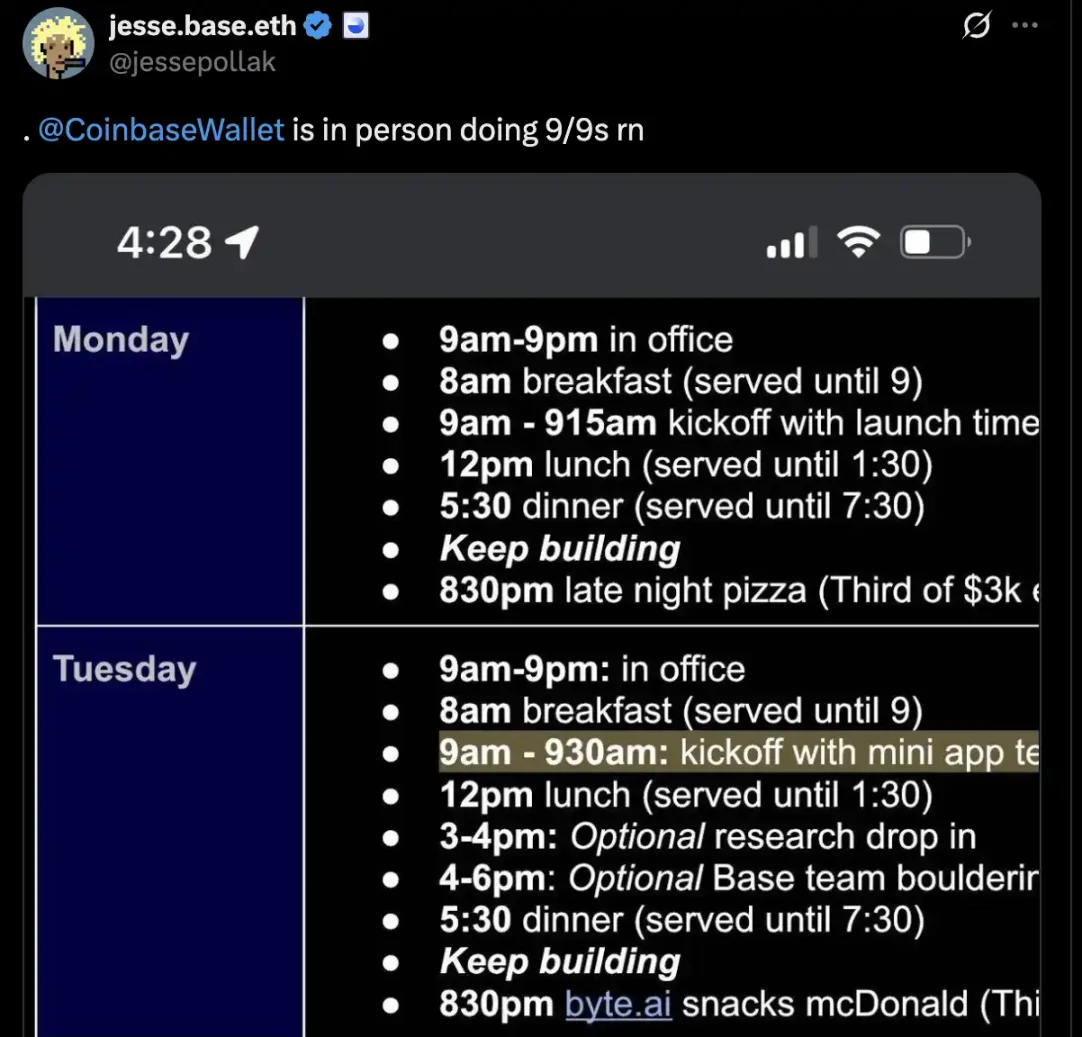

On July 15, Coinbase Wallet officially previewed a "major update" to be released the following day. Previously, Jesse Pollak, co-founder of Base chain, also announced on X that an important announcement would come on July 16, potentially marking a significant upgrade for Coinbase Wallet products.

Recently, Coinbase has been undergoing a deep strategic restructuring centered around the Base chain, no longer content with being just a "crypto asset management tool." Instead, it is actively transforming into an "on-chain super gateway" integrating social relationships, transaction execution, content distribution, and offline consumption. The wallet's embedded MiniApp system and app recommendation mechanism are gradually evolving into a cold-start engine and traffic hub for the Base ecosystem, making the wallet users' first stop for discovering new projects, while enabling Coinbase to build a closed-loop ecosystem of "payment, social, trading, and consumption."

In addition, Coinbase’s acquisition of several traditional tech companies earlier this year was precisely aimed at laying the groundwork for this ecosystem. This Wallet update is likely a concentrated release of traffic and functionality, potentially bringing a new wave of user growth and capital inflow to the Base chain. Against this backdrop, this article outlines promising investment opportunities within the Base ecosystem.

Aero: Revolutionizing MetaDEX

Aerodrome combines the best features of previous-generation DEXs: it adopts a tokenomic model inspired by Curve and Convex to optimize governance and token emissions, along with a Uni v3-style concentrated liquidity AMM for efficient capital utilization. These features align incentives across stakeholders, making Aerodrome the preferred trading venue for users.

Coinbase Ventures is an active participant in Aerodrome’s governance, voting to direct AERO token emissions toward the cbBTC pool, further solidifying Aerodrome’s market dominance. This reaffirms the close ties between Aerodrome, Base, and Coinbase, positioning the protocol as foundational financial infrastructure on the Base L2.

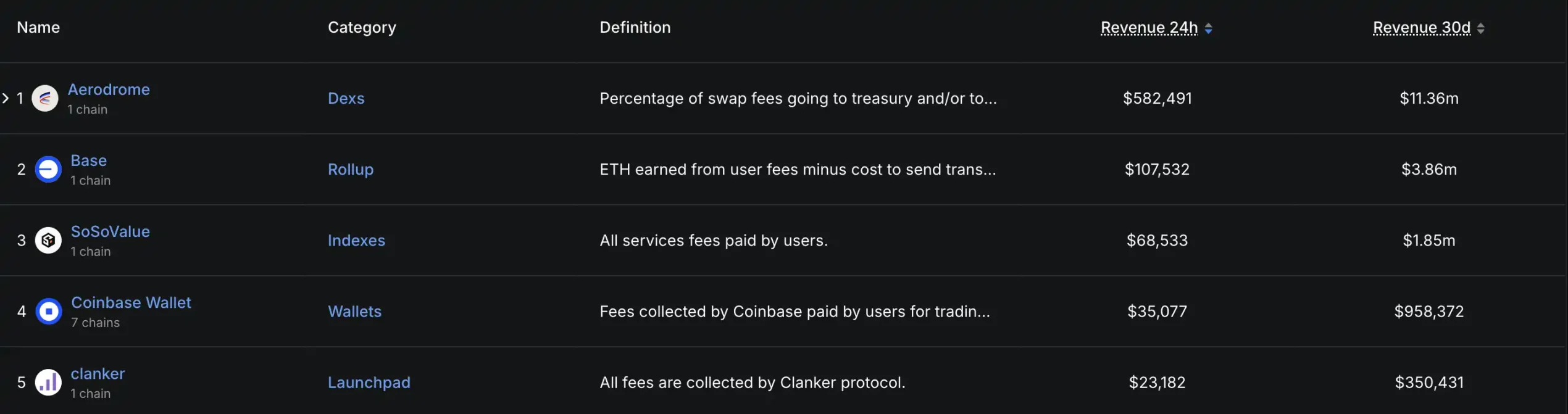

Benefiting from Base chain’s user growth, Aerodrome’s popularity continues to rise. Data shows platform TVL rebounded from $300 million in April to $530 million today, with protocol revenue consistently leading—reaching $580,000 in 24-hour revenue—topping Base chain rankings long-term. The upcoming update will boost Base ecosystem activity, driving new growth for Aero.

Clanker: A Launchpad for Everyone to Issue Tokens

Clanker is an autonomous agent built on the Base blockchain whose core function is helping users deploy ERC-20 standard tokens. Users simply tag @clanker on the social platform Farcaster and provide basic token details (such as name, symbol, and image), after which Clanker automatically handles token creation, liquidity pool setup, and liquidity locking. The entire process requires no technical expertise, truly enabling "anyone to issue a token."

Recently, Clanker upgraded to version V4, fully integrating Uniswap v4 and exclusive extended features, becoming the most flexible meme issuance infrastructure available. The new version delivers a highly customizable deployment experience—including dynamic/static fees, configurable fee-collecting token mechanisms, and a creator-first "snipe auction" MEV module—greatly enhancing deployment flexibility, user experience, and creator revenue pathways.

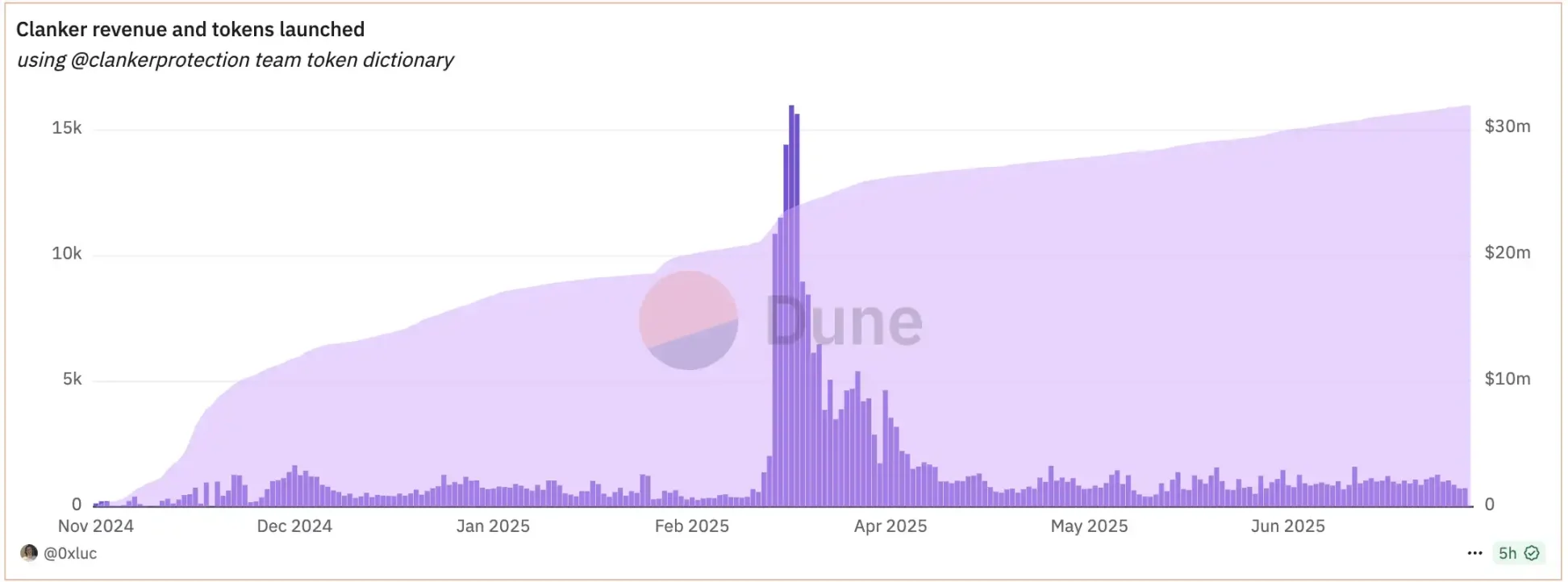

Clanker currently generates over $350,000 in monthly revenue, with cumulative profits surpassing $30 million—far outpacing most competitors—while its market valuation remains relatively low. With the V4 protocol rollout and upcoming rollouts of revenue-sharing, staking, and governance mechanisms, Clanker is poised to become the "launchpad king" for meme tokens on Base chain.

Mamo: Coinbase Wallet’s “On-Chain Spare Change”

In the past two weeks, $MAMO surged fourfold, with FDV exceeding $100 million, making it one of the most notable rising stars on Base chain. Mamo is hailed as Coinbase Wallet’s "Spare Change" service, featuring "auto-compounding yield farming." Users simply deposit assets into their wallet, and the system intelligently allocates funds into high-yield strategies, achieving up to 7% APY. No manual actions required—earnings compound daily, delivering true "passive income" on-chain.

The project is backed by Moonwell, a Coinbase-invested team, making $MAMO’s surge a transparent and strategic move.

Byte: AI-Powered Self-Service Wallet

Byte is redefining the boundary between crypto payments and real-world consumption. With just one sentence, AI automatically selects a restaurant, places the order, and completes payment—no clicks required. It not only bridges cryptocurrency with real merchants but also represents the world’s first POS-integrated solution enabling "AI-powered automatic checkout."

Jesse Pollak, co-founder of Base, even publicly endorsed Byte by tweeting about ordering food through it, validating its real-world applicability. As more restaurants join and AI agent transactions become widespread, Byte could become the foundational payment layer in the AI commerce era, expanding into e-commerce, subscriptions, and offline services—staking early claim to the "AI wallet" gateway of the next decade.

Conclusion

Today, Coinbase Wallet is rapidly evolving into an on-chain super app: integrating social (Farcaster), payments (Byte ordering), short video and other content consumption, and embedding automated wealth management (Mamo), it serves as a one-stop platform for users’ daily on-chain activities. This transformation—from "trading tool" to "lifestyle gateway"—marks Coinbase’s full-stack ecosystem rebuild around Base chain, betting on the next paradigm of Web3 growth.

With the major update on July 16 approaching, this product-level upgrade has the potential to break the narrow boundaries of traditional exchanges, drive stronger user acquisition and liquidity growth for Base, further cementing its leading position in the on-chain application ecosystem.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News