Old coins lead the rally—has a mini "altseason" begun?

TechFlow Selected TechFlow Selected

Old coins lead the rally—has a mini "altseason" begun?

Investors are re-embracing risk, injecting long-absent vitality into the market.

Written by: BitpushNews

Recently, Bitcoin (BTC) has repeatedly set new all-time highs, briefly surpassing $123,000 per coin. Against this strong upward trend in Bitcoin, significant capital rotation is emerging within the crypto market, with a group of previously underperforming legacy large-cap altcoins gradually gaining momentum—some even outperforming Bitcoin’s recent gains.

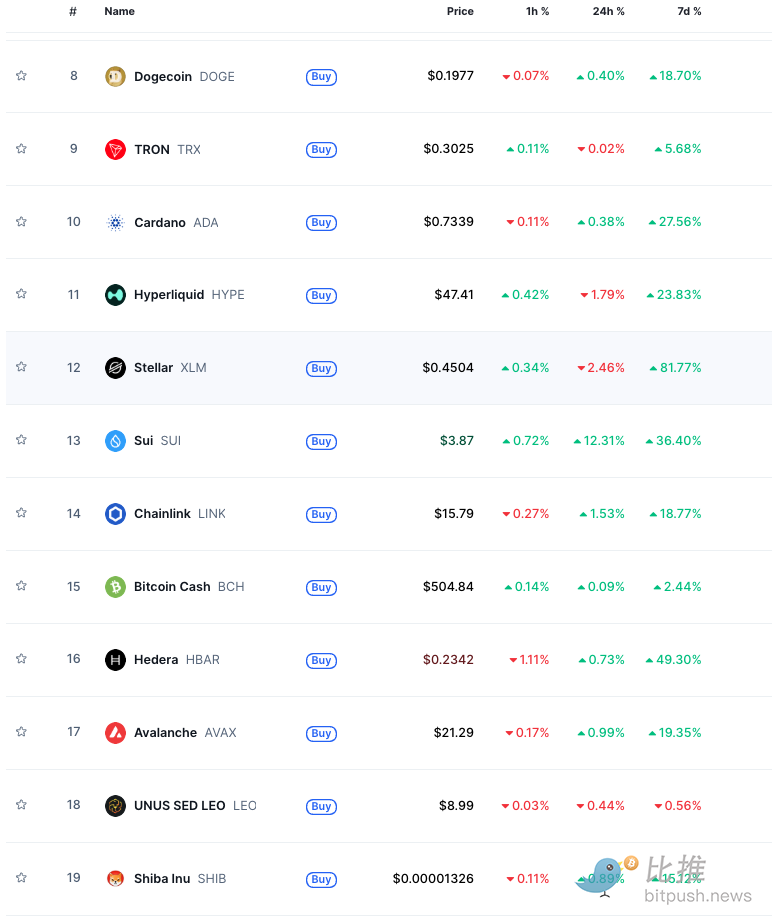

Market data from CMC shows that among the top 20 cryptocurrencies by market capitalization, several veteran first-layer (L1) altcoins have stood out, posting double-digit gains over the past seven days. Leading the pack is Stellar (XLM): ranked 12th by market cap, it surged 82% weekly—topping its peers. Cardano (ADA), ranked 10th, gained nearly 30%; Ripple (XRP) rose 29%; Dogecoin (DOGE) climbed 18%.

Some relatively newer altcoins also delivered strong performance, including Sei (SEI), an L1 project focused on decentralized exchanges (DEX), and Ethena (ENA), a synthetic dollar protocol, both posting over 30% gains in the past week.

A recent research report by Delphi Digital noted that long-standing tokens that have weathered multiple bull and bear cycles have, since January this year, collectively outperformed AI and DePIN (Decentralized Physical Infrastructure Networks)—two highly discussed narrative-driven sectors at the time.

Analysts suggest the broad strength in legacy altcoins may signal early signs of retail capital returning. These tokens represent long-established, high-market-cap cryptocurrencies whose activity often reflects retail investor participation and capital preferences. At the same time, traders remain attentive to innovative narratives and emerging projects with high growth potential.

The "BANANA ZONE 2.0" for Altcoins

Market observer @MerlijnTrader analyzed the TOTAL3 chart, which tracks the combined market capitalization of all cryptocurrencies excluding Bitcoin (BTC) and Ethereum (ETH), serving as an effective indicator of overall altcoin momentum. He pointed out that the TOTAL3 chart is now entering the “Banana Zone 2.0,” typically signaling an explosive breakout phase following a consolidation period.

The trader believes that compared to the 2020 altcoin wave, the upcoming rally will be “bigger, faster, and backed by real-world use cases and massive capital inflows.” This suggests that altcoin market growth may no longer be driven purely by speculation but by fundamentals and institutional capital, leading to more sustainable expansion.

Signals of an "Altcoin Season"

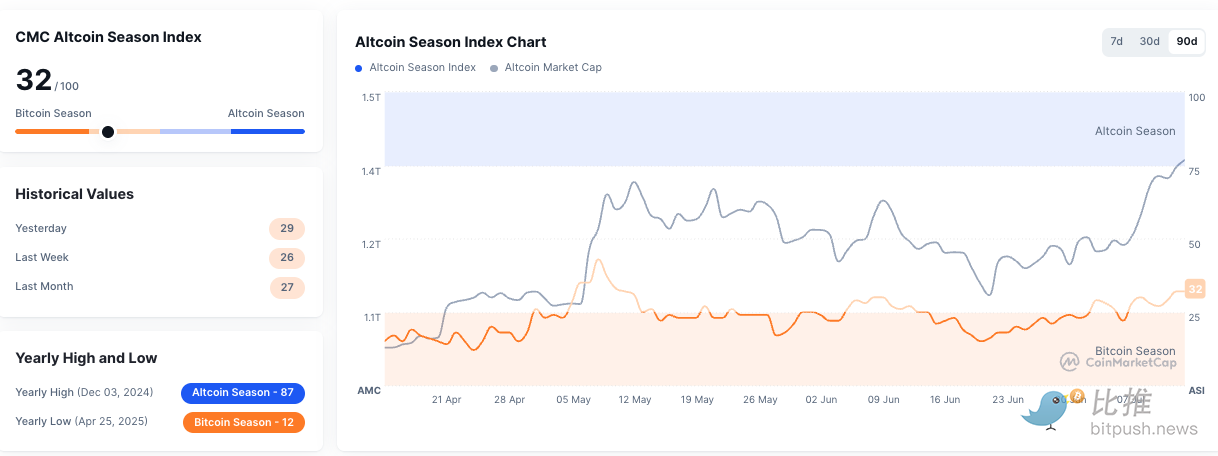

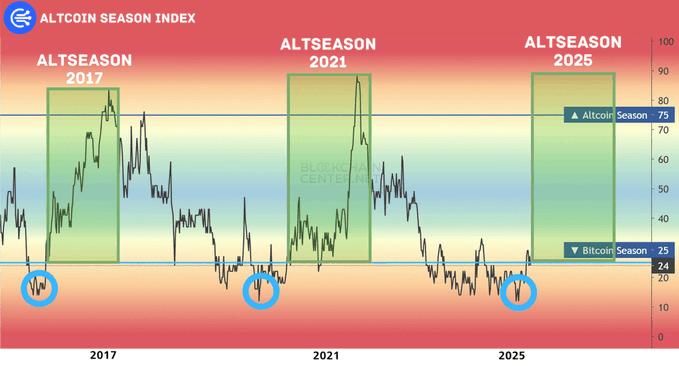

According to the CMC Altcoin Season Index definition, an official “Altcoin Season” begins when 75% of the top 100 altcoins (excluding stablecoins and wrapped tokens) outperform Bitcoin over the past 90 days. This threshold reflects a broad market shift where capital rotates from Bitcoin dominance into diversified altcoin growth.

Currently, the Altcoin Season Index stands at 32/100—still far from the 75-point threshold—indicating the market remains in a Bitcoin-dominated phase. However, the index has shown a positive upward trend recently (rising from 26 last week to 32 today), suggesting early signs of rotation are emerging.

Key signals indicating the arrival of Altcoin Season include:

-

Increased altcoin dominance: During previous altcoin seasons (e.g., May 2021), the total market cap of the top 100 altcoins exceeded Bitcoin's market cap by over 130%. Such expansion marks increased capital inflow into altcoins.

-

Rapid price appreciation: Altcoins often experience sharp rallies within short periods. In early 2021, major altcoins achieved average returns of 174%, vastly outpacing Bitcoin’s modest 2% gain during the same period.

-

FOMO sentiment and retail frenzy: Altcoin seasons are typically accompanied by high 24-hour trading volumes and intense bullish sentiment. Market optimism increases buying pressure, further driving prices upward and attracting new participants.

A key feature of the current market is the decline in Bitcoin Dominance. Crypto analyst Satori observed that historically, when Bitcoin’s price remains stable or experiences mild gains while its share of the total crypto market cap declines, it often signals capital rotating from Bitcoin into altcoins—heralding a possible “Altcoin Season.”

Satori noted this pattern was evident during past cycles such as 2017 and 2021. Currently, altcoins are beginning to show broad-based strength, with trading volumes steadily rising—suggesting institutional and retail investors may be reallocating capital into alternative digital assets. This shift is driven by multiple catalysts working in tandem:

-

Spot ETF launches: The approval of spot Bitcoin and Ethereum ETFs in the U.S. has provided institutional investors with compliant entry points, unlocking substantial institutional liquidity. After flowing into Bitcoin and Ethereum, some of these funds may spill over into altcoins with higher growth potential.

-

Advancements in Layer 2 (L2) solutions: Progress in L2 technologies has enhanced scalability and efficiency for L1 blockchains like Ethereum, reducing transaction costs and enabling broader application deployment—benefiting ecosystem altcoins.

-

The convergence of artificial intelligence (AI) with blockchain, the tokenization of real-world assets (RWA), and improvements in blockchain gaming infrastructure are creating new value propositions and use cases for altcoins, providing fundamental support.

Therefore, while the longevity of this “mini altcoin season” remains to be seen, the positive signals released by the market indicate that investors are once again embracing risk—injecting much-needed vitality back into the crypto ecosystem.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News