Bitcoin hits new highs, but you haven't realized your assets are naturally trending toward zero

TechFlow Selected TechFlow Selected

Bitcoin hits new highs, but you haven't realized your assets are naturally trending toward zero

This article explores the shift in risk preferences toward gambling with positive expected returns and its broad social implications.

By thiccy

Translation: AididiaoJP, Foresight News

The Era of High-Risk Speculation

(Contains minimal math, but logic is clear and accessible.)

Imagine you're playing this coin-flip game. How many times would you flip? The rules are simple: if it lands heads, your assets increase by 100%; if tails, you lose 60% of your assets.

At first glance, this seems like a money-printing machine. Each flip has a positive expected value of +20%, meaning on average, each flip grows your wealth by 20%. In theory, with enough flips, you could accumulate all the world’s wealth.

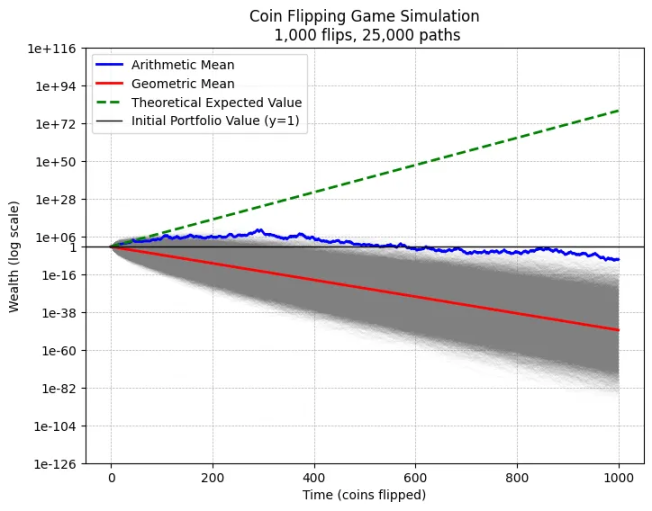

In reality, however, if we simulate 25,000 people each flipping 1,000 times, nearly everyone ends up with zero.

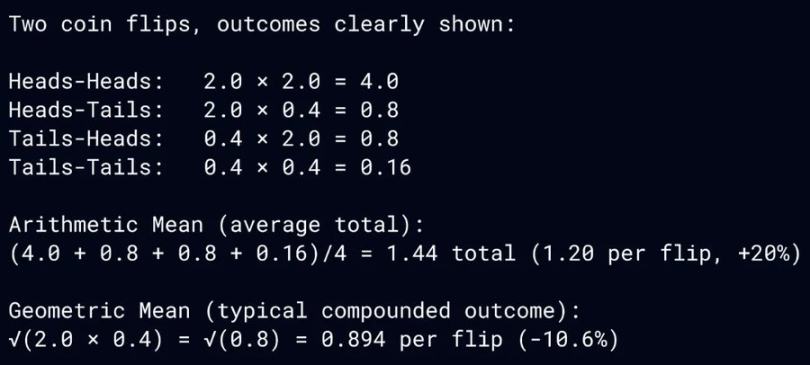

This outcome stems from the multiplicative effect of repeated flips. While the arithmetic average (expected value) suggests a 20% gain per flip, the geometric average is negative—meaning long-term compounding actually erodes wealth.

How do we understand this? Here's an intuitive explanation:

The arithmetic average measures the mean wealth across all possible outcomes. In this coin-flip game, wealth becomes highly concentrated in scenarios requiring near-impossible streaks of consecutive heads. The geometric average, by contrast, reflects median outcome wealth.

The simulation above highlights this divergence. Nearly all paths converge to zero. To merely break even after 1,000 flips, you’d need exactly 570 heads and 430 tails. After that many trials, all positive expectation is locked into just the top 0.0001% of runs—the extremely rare sequences of relentless heads.

The gap between arithmetic and geometric averages creates what’s known as the “jackpot paradox.” Physicists call it an ergodicity problem; traders refer to it as volatility drag. When expected gains depend on vanishingly improbable events, they’re effectively unattainable. Chasing such extremes turns positive expectations into a path toward ruin.

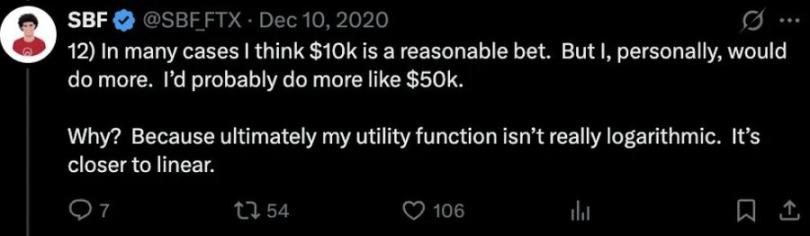

The early 2020s crypto culture was a vivid illustration of the jackpot paradox. SBF sparked this conversation with a now-infamous tweet about wealth preferences:

-

Logarithmic wealth preference: Each additional dollar is worth less than the last. As capital grows, risk tolerance decreases.

-

Linear wealth preference: Every dollar has equal value regardless of existing wealth. Risk appetite remains constant.

SBF proudly declared himself a linear wealth preferer. Since he planned to donate all his wealth, growing from $10 billion to $20 billion felt just as meaningful as going from $0 to $10 billion—making high-risk strategies rational in his view.

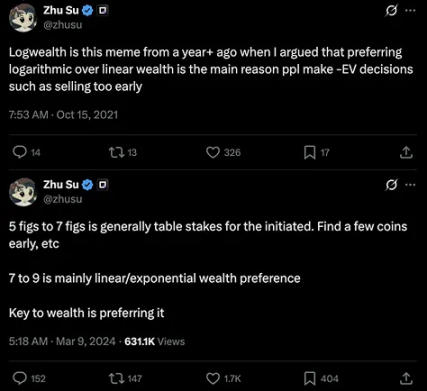

Su Zhu, co-founder of Three Arrows Capital, agreed with linear preference and went further, proposing exponential wealth preference:

Exponential wealth preference: Each dollar is worth more than the previous one. As capital increases, so does risk appetite—and one willingly pays a premium for vanishingly small probabilities.

How do these three wealth preferences play out in our coin-flip game? Given the jackpot paradox, clearly SBF and Three Arrows were betting on infinite flips. This mindset fueled their initial rise—and unsurprisingly, led to both collapsing from tens of billions to nothing. Perhaps in some parallel universe, they’re trillionaires, validating their gambles.

These blowups aren’t just cautionary tales about risk management math—they reflect a deeper cultural shift toward linear and exponential wealth preferences.

Founders are expected to think linearly, acting as cogs in the venture capital machine, placing oversized bets to maximize expected value. Stories of Elon Musk, Jeff Bezos, and Mark Zuckerberg risking everything and becoming the world’s richest reinforce the mythos driving the entire VC ecosystem, while survivorship bias easily hides millions of failed founders who ended up with nothing.

This appetite for extreme risk has seeped into everyday culture. Wage growth lags far behind capital compounding, pushing ordinary people to pin real upward mobility hopes on negative-expectation jackpots. Online gambling, zero-day-to-expiry options, retail meme stocks, sports betting, and crypto memecoins are all manifestations of exponential wealth preference. Technology makes speculation ubiquitous; social media amplifies every rags-to-riches story, luring the masses like moths into a massive, unwinnable game.

We’re becoming a culture that worships jackpots and prices survival at zero.

Artificial intelligence exacerbates this trend by further devaluing labor and intensifying winner-take-all outcomes. Techno-optimists dream of an AGI-driven age of abundance where humanity devotes itself to art and leisure. But the reality may be closer to billions using UBI stipends to chase zero-sum capital games and lottery-like bets. Perhaps "to the moon" should be redesigned to reflect the blizzard endured along the paths to zero—that’s the true silhouette of the jackpot era.

In its most extreme form, capitalism resembles a collectivist hive. The mathematics of the jackpot paradox suggest it’s rational for civilization to treat humans as interchangeable labor units, sacrificing millions of worker bees to maximize the group’s linear expected value. This may be optimal for aggregate growth—but it’s brutal for the individual bee.

Marc Andreessen’s techno-optimist manifesto warns: “Humans shouldn’t be farmed; humans should be useful, productive, and dignified.”

Yet rapid technological advancement and increasingly aggressive risk appetites are steering us precisely toward the outcome he warned against. In the jackpot era, growth is fueled by farming our peers. Usefulness, productivity, and dignity are increasingly reserved for the privileged few who win the competition. We elevate the average at the expense of the median, widening gaps in liquidity, status, and dignity—giving rise to entire economies built around negative-sum cultural phenomena. These externalities manifest as social unrest, beginning with elected demagogues and ending in violent revolution—costly disruptions to civilizational compounding.

As someone who earns a living trading crypto markets, I’ve witnessed firsthand the decay and despair this cultural shift breeds. My victories are built atop the wreckage of thousands of other traders—a monument to wasted human potential.

When insiders ask me for trading advice, I almost always spot the same pattern: they take too much risk and suffer deep drawdowns. The root cause is usually scarcity mindset—an anxiety of “falling behind” and an urge to quickly reverse losses.

My answer is always the same: build more edge, not more risk. Don’t commit suicide chasing jackpots. Logarithmic wealth preference is key. Maximize median outcomes. Create your own opportunities, avoid drawdowns, and eventually, you will succeed.

But most people never develop sustainable edges. “Win more” isn’t scalable advice. In this technological feudalism, meaning and purpose have become winner-take-all. That brings us back to meaning itself. Perhaps we need a revival of religion—one that reconciles ancient spiritual teachings with modern technological realities.

Christianity spread by promising universal salvation. Buddhism flourished by declaring enlightenment accessible to all.

A modern version must similarly offer dignity, purpose, and alternative paths to everyone—lest they destroy themselves chasing jackpots.

The Psychological Foundations of the High-Risk Speculation Era

This obsession with jackpots has deep psychological roots. The human brain evolved a strong preference for immediate rewards—a mechanism beneficial for survival in hunter-gatherer times, but a trap in today’s financial environment. The dopamine system reacts intensely to potential high payoffs, even when actual probabilities are negligible. Neuroscience shows that when people imagine winning big, their brain activation patterns resemble those seen when receiving small, guaranteed, consistent rewards.

Social media and fintech products expertly exploit these neural mechanisms. Infinite scroll, instant trade execution, and flashy profit displays create a perfect addiction loop. Every success story is algorithmically amplified, while countless failures are quietly filtered out. This distorted information environment reinforces the illusion: “It could be me next.”

The Failure of Education Systems

Modern education systems, to some extent, reinforce this jackpot mentality. Standardized testing and elite selection mechanisms are inherently winner-take-all competitions. From childhood, students are conditioned into an “all-or-nothing” mindset. The star power in arts and sports further entrenches this worldview. By the time young people enter society, they already define success as extreme outcomes rather than gradual accumulation.

Higher education is increasingly seen as a lottery ticket—only a few reap massive returns via elite university branding, while most graduate burdened with heavy debt and limited prospects. This structure naturally pushes people toward other forms of “lotteries”—be it cryptocurrency, influencer economy, or startup mania.

Financial System Amplification

The modern financial system is technically the perfect engine for jackpot culture. Zero-commission trading, leveraged products, and derivatives allow ordinary individuals to engage in speculative behaviors once reserved for professional institutions. Algorithmic market makers and dark pools create illusions of liquidity, masking the underlying zero-sum or negative-sum nature of the games.

The venture capital industry has institutionalized jackpot logic. Successful funds often rely on a handful of 100x return projects to offset numerous failed investments. This model is treated as gospel, yet rarely questioned for its long-term impact on the innovation ecosystem. When all resources chase potential unicorns, businesses generating steady, moderate returns get starved of support.

The Erosion of Social Mobility

The rise of jackpot culture closely correlates with declining social mobility. As middle-class pathways to upward mobility—through education or career progression—shrink, extreme speculation becomes a natural substitute. The financialization of housing markets turns shelter from a basic need into a speculative instrument, further accelerating this trend.

Widening intergenerational wealth gaps create a vicious cycle: young people without family wealth are more inclined toward high-risk behavior, which in turn leads to greater wealth polarization. When social safety nets are weak, people exhibit abnormally high tolerance for “all-or-nothing” gambles.

The Dilemma of Technological Accelerationism

Today’s accelerationist tech narratives dangerously resonate with jackpot culture. Blind worship of exponential growth ignores fundamental physical and social constraints. When every startup claims to “change the world,” the actual output is often zero-sum or negative-sum financial engineering.

This is especially evident in blockchain and AI. Most projects fail to create real value, instead attracting capital through complex tokenomics and arbitrage opportunities. The result of this technofinance fusion is a bloated, bubble-filled ecosystem where genuine innovation struggles to access resources or attention.

Possible Ways Out

Reversing jackpot culture requires reforms across multiple levels:

-

Financial regulation: Limit access to leverage and speculative products; strengthen behavioral oversight of fintech platforms.

-

Educational reform: Cultivate probabilistic thinking and long-term planning skills; reduce overemphasis on rankings and competition.

-

Tax policy: Impose higher taxes on short-term capital gains to incentivize long-term investment.

-

Media responsibility: Require social media platforms to balance portrayals of speculative rewards with clear depictions of risks.

-

Social safety nets: Build stronger welfare systems to reduce economic desperation that drives reckless risk-taking.

Ultimately, we need to redefine what success means. A healthy society should reward sustained value creation, not accidental breakthroughs. This demands a comprehensive transformation—from individual mindsets to institutional design—and represents a difficult, long march against deep-seated psychological biases.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News