Deep Dive into BlackRock's BUIDL Fund: How Will It Impact the RWA Landscape?

TechFlow Selected TechFlow Selected

Deep Dive into BlackRock's BUIDL Fund: How Will It Impact the RWA Landscape?

This report will provide a comprehensive and in-depth analysis of the BUIDL Fund, covering its operational mechanisms, business logic, workflows, and technical pathways.

Author: DePINone Labs

Executive Summary

The BlackRock USD Institutional Digital Liquidity Fund (BUIDL) is the first tokenized fund issued by BlackRock—the world's largest asset manager—on a public blockchain, launched in March 2024.

In collaboration with the real-world asset (RWA) tokenization platform Securitize, BUIDL aims to combine the stable returns of traditional finance (TradFi) with the efficiency and accessibility of blockchain technology, offering qualified investors a new investment paradigm.

This report provides a comprehensive and in-depth analysis of the BUIDL fund, covering its operational mechanics, business logic, workflow, and technical architecture.

-

Product Essence: At its core, BUIDL is a regulated traditional money market fund (MMF), with underlying assets consisting of highly liquid, low-risk instruments such as cash, U.S. Treasury bills, and repurchase agreements. Its innovation lies in tokenizing fund shares into BUIDL tokens that circulate on public blockchains, enabling on-chain ownership records, transfers, and yield distribution.

-

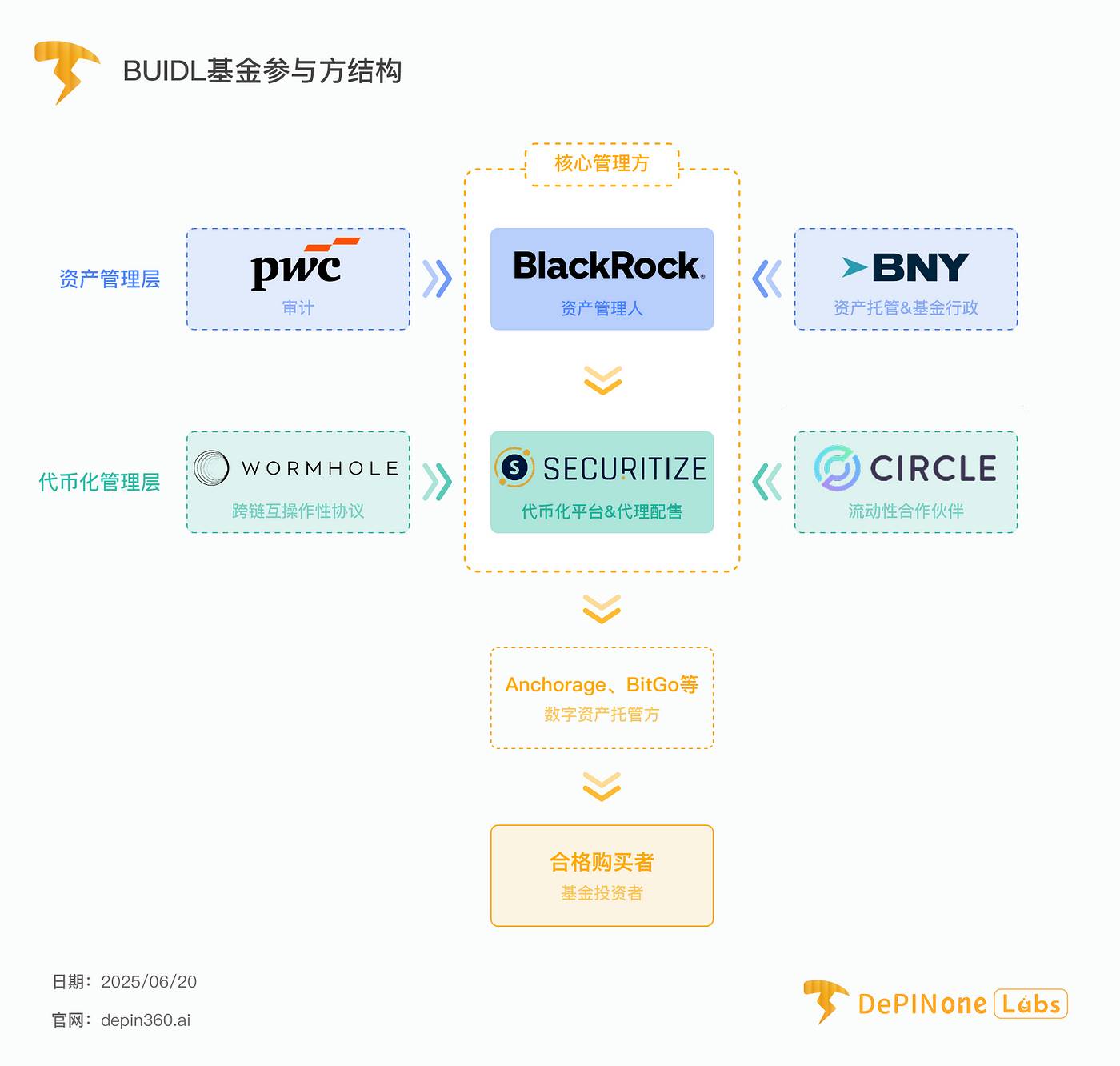

Operating Mechanism & Ecosystem: BUIDL’s success relies on a carefully constructed ecosystem combining strengths from both TradFi and crypto. BlackRock acts as the asset manager responsible for investment strategy; Securitize serves as the core technology and compliance partner, providing tokenization, transfer agency, and investor onboarding services; while BNY Mellon plays a foundational role in traditional finance as custodian and administrator of fund assets. This "iron triangle" structure ensures robustness in compliance, security, and scalability.

-

Business Workflow: The investment process embodies the concept of "permissioned finance." Investors must qualify as “Qualified Purchasers” under U.S. securities law and pass KYC/AML checks via Securitize, after which their wallet addresses are added to a whitelist within the smart contract. Subscription (minting tokens) and redemption (burning tokens) bridge off-chain fiat flows with on-chain token operations. A key innovation is Circle’s instant USDC redemption channel, which uses a smart contract to resolve the fundamental mismatch between traditional financial settlement cycles and the crypto world’s demand for 24/7 immediate liquidity.

-

Technical Architecture: Initially launched on Ethereum as a customized ERC-20 token, BUIDL’s core technical feature is an embedded whitelisted transfer control mechanism. To expand reach, the fund has rapidly expanded to multiple major blockchains including Solana, Avalanche, and Polygon, leveraging Wormhole for cross-chain interoperability. This multi-chain deployment strategy maximizes accessibility and utility across different ecosystems.

-

Market Impact & Strategic Significance: The launch of BUIDL marks not only a critical step in BlackRock’s digital asset strategy but also serves as a powerful catalyst and validator for the entire RWA tokenization space. It quickly surpassed early competitors to become the world’s largest tokenized treasury fund. Its asset under management (AUM) growth is primarily driven by B2B demand from crypto-native protocols like Ondo Finance and Ethena, who use it as reserve and collateral. This indicates that BUIDL’s success stems not from traditional investors, but from precisely meeting the urgent need within the DeFi ecosystem for compliant, stable, yield-bearing on-chain dollar assets—positioning itself as foundational infrastructure for institutional-grade DeFi.

BUIDL is more than just a product—it is a strategic industry benchmark. It offers a replicable compliance blueprint for bringing traditional financial assets on-chain and pioneers a new track of “permissioned DeFi,” parallel to open DeFi.

This report will elaborate on all the above points, providing a detailed breakdown of BUIDL’s operational intricacies and impact.

Disclaimer: All articles by DePINone Labs are for informational and educational purposes only and do not constitute any investment advice.

This report is produced by DePINone Labs. Reproduction requires prior permission.

1. Deconstructing BUIDL: A New Paradigm in Asset Management

This chapter clarifies the fundamental nature of BUIDL, defining it as a regulated financial instrument bringing assets on-chain rather than a crypto-native asset. We explain the actual rights held by investors, and how returns are generated and delivered.

1.1 Fund Mission: A Regulated Money Market Fund on Blockchain

The BlackRock USD Institutional Digital Liquidity Fund (“BUIDL”) is BlackRock’s first tokenized fund issued on a public blockchain. Its core structure is a money market fund (MMF). This classification is crucial, as it determines the fund’s investment strategy, risk profile, and regulatory framework.

From a regulatory standpoint, the fund issues shares under Rule 506(c) of the Securities Act of 1933 and Section 3(c) of the Investment Company Act of 1940. This means offerings are strictly limited to “Qualified Purchasers,” excluding retail investors. This “compliance-first” design is foundational to attracting and serving institutional clients.

The fund’s primary objective is “to seek current income consistent with liquidity and stability of principal.” This aligns with standard MMF goals, but BUIDL’s revolutionary aspect lies in using blockchain technology as the delivery vehicle.

1.2 Investment Strategy: Generating Stable Returns Through Traditional Instruments

To achieve its objectives, BUIDL invests 100% of its total assets in a portfolio composed of cash, U.S. Treasury bills, and repurchase agreements. These are widely recognized as low-risk, high-liquidity instruments in traditional finance and represent standard allocations for institutional MMFs.

By investing in these high-quality short-term debt instruments, the fund aims to offer investors a low-risk way to earn U.S. dollar yields—essentially delivering safe assets like U.S. Treasuries to on-chain investors via tokenization. As disclosed in prospectuses of similar BlackRock funds, although market risks such as interest rate exposure exist, the primary goal remains capital preservation.

1.3 The BUIDL Token: A Digital Representation of Fund Shares

The BUIDL token is not an independent cryptocurrency, but a digital representation of fund shares. Each share of the fund is represented by one BUIDL token. Therefore, holding BUIDL tokens equates to owning a proportional stake in the fund.

The fund strives to maintain the value of each BUIDL token at $1.00, consistent with the $1.00 net asset value (NAV) target common to traditional MMFs. This price stability is not achieved through complex algorithms or over-collateralization, but entirely through full backing by traditionally managed, high-quality underlying assets.

Legally, the fund entity is incorporated as a company in the British Virgin Islands (BVI), a commonly used offshore structure for international funds.

1.4 Yield Mechanism: Daily Accrual, Monthly On-Chain Distribution

BUIDL’s yield mechanism is a core manifestation of its on-chain characteristics. The fund generates daily interest from its underlying holdings, resulting in “daily accrued dividends.”

However, the method of yield distribution is ingeniously designed. Instead of distributing dividends in fiat currency or increasing the price per BUIDL token, accumulated dividends are distributed monthly as newly minted BUIDL tokens directly airdropped to investors’ wallets.

This design choice carries profound strategic implications. By distributing returns through “re-basing” or token issuance, the face value of each BUIDL token remains steadily pegged at $1.00. An asset with a constant price is ideal as collateral and store of value within DeFi protocols. If yield were reflected through price appreciation, BUIDL’s value would fluctuate continuously, significantly increasing liquidation risks and integration complexity when used as collateral.

Thus, this yield distribution model reflects a deliberate design decision by BlackRock and Securitize to position BUIDL as a stable, composable “Lego brick” within the DeFi ecosystem.

At its essence, BUIDL is a traditional financial product wrapped in Web3 technology. Its stability and yield are entirely derived from BlackRock’s conventional, off-chain asset management expertise, while blockchain and tokenization provide an unprecedentedly efficient delivery mechanism.

2. Strategic Imperatives: BlackRock’s Vision for On-Chain Finance

This chapter explores the commercial motivations and strategic partnerships behind BUIDL’s creation, explaining why BlackRock took this step and analyzing the collaborative relationships enabling its operation.

BlackRock’s stated goal in launching BUIDL is to develop solutions that address “real client problems.”

Compared to traditional money market funds, BUIDL leverages blockchain technology to deliver significant advantages: instantaneous and transparent settlement, 24/7/365 peer-to-peer transfer capabilities, and broader access to on-chain products. These features address long-standing pain points in traditional finance related to operating hours, settlement inefficiency, and counterparty risk.

More deeply, BUIDL represents the latest advancement in BlackRock’s broader digital strategy. Senior executives, including CEO Larry Fink, have clearly stated that “the future of securities is tokenization.” BUIDL is the first major practical implementation of this vision, aiming to enhance liquidity, transparency, and overall efficiency in capital markets through tokenization.

2.1 BlackRock and Securitize: A Symbiotic Partnership

The partnership between BlackRock and Securitize is pivotal to BUIDL’s success—a deeply integrated symbiosis rather than a simple vendor relationship.

Securitize plays a central technological and service role in the ecosystem, with responsibilities including:

-

Tokenization Platform & Transfer Agent: Securitize digitizes fund shares, manages on-chain token issuance, redemptions, and dividend distributions, and maintains ownership records.

-

Placement Agent: Its subsidiary, Securitize Markets, LLC, acts as the fund’s placement agent, marketing and selling the fund to qualified investors.

-

Compliance Gateway: Securitize manages the critical investor onboarding process, including KYC/AML verification, and maintains the on-chain whitelist of approved wallet addresses.

In terms of business model, Securitize Markets receives compensation from BlackRock as the placement agent. This includes an upfront fee and ongoing quarterly fees, typically calculated as a percentage of the net asset value of investors it brings in. This creates strong financial incentives for Securitize to grow the fund’s AUM.

More importantly, BlackRock has made a strategic investment in Securitize, and Joseph Chalom, Global Head of Strategic Ecosystem Partnerships at BlackRock, has joined Securitize’s board of directors. This signifies a deep, long-term strategic alliance. Through this move, BlackRock secures its dependency on a key technology layer in tokenization and positions itself to influence the future development of RWA tokenization standards.

2.2 Ecosystem: BNY Mellon, Custodians, and Infrastructure Providers

A successful tokenized fund requires a complete ecosystem integrating both traditional financial institutions and crypto-native service providers. BUIDL’s ecosystem exemplifies this fusion.

-

BNY Mellon: As a pillar of traditional finance, BNY Mellon’s role is indispensable. It serves as the custodian and administrator for the fund’s off-chain assets (cash and securities), acting as a critical bridge between the digital world and traditional markets.

-

Digital Asset Custodians: Investors have flexible custody options for holding BUIDL tokens. Key digital custodians in the ecosystem include Anchorage Digital, BitGo, Copper, and Fireblocks.

-

Auditor: PricewaterhouseCoopers LLP (PwC) has been appointed as the fund’s auditor, providing credibility and trust at the level expected in traditional finance.

The “iron triangle” formed by BlackRock (asset management), Securitize (technology and compliance), and BNY Mellon (custody and administration) constitutes the core of the entire operation.

Each party plays a distinct and essential role: BlackRock brings unparalleled asset management capability and distribution networks; Securitize provides the specialized technology and licenses needed to compliantly bridge assets onto blockchains; BNY Mellon delivers the institutional-grade custody and administrative services required for fund operations.

2.3 Strategic Precedent: Setting Standards for RWA Tokenization

As the world’s largest asset manager, BlackRock’s entry alone brings immense legitimacy and validation to the entire RWA sector.

It sends a clear signal to other traditional financial institutions: asset tokenization is not just a feasible concept, but a strategically important direction worth serious investment. BUIDL’s entire architecture—from its Rule 506(c) compliance framework, to the appointment of a transfer agent, to the implementation of on-chain whitelisting—provides a clear, compliant blueprint for other TradFi institutions seeking to bring assets onto blockchains.

3. Investor Journey: From Subscription to Redemption

This chapter details the complete lifecycle of a BUIDL investor, from initial qualification and onboarding to final redemption. We break down the process step-by-step, focusing on key control points and liquidity mechanisms.

3.1 Entry Barrier: Qualified Purchasers and Onboarding Process

BUIDL is not a retail product available to the general public; its entry barrier is extremely high, reflecting its strict compliance orientation.

-

Investor Qualification: Only “Qualified Purchasers” as defined by the U.S. Securities and Exchange Commission (SEC) are eligible to invest. This definition typically requires individuals or family offices to possess at least $5 million in investable assets—significantly higher than the threshold for “Accredited Investors.”

-

Minimum Investment: The initial minimum investment amount is $5 million.

-

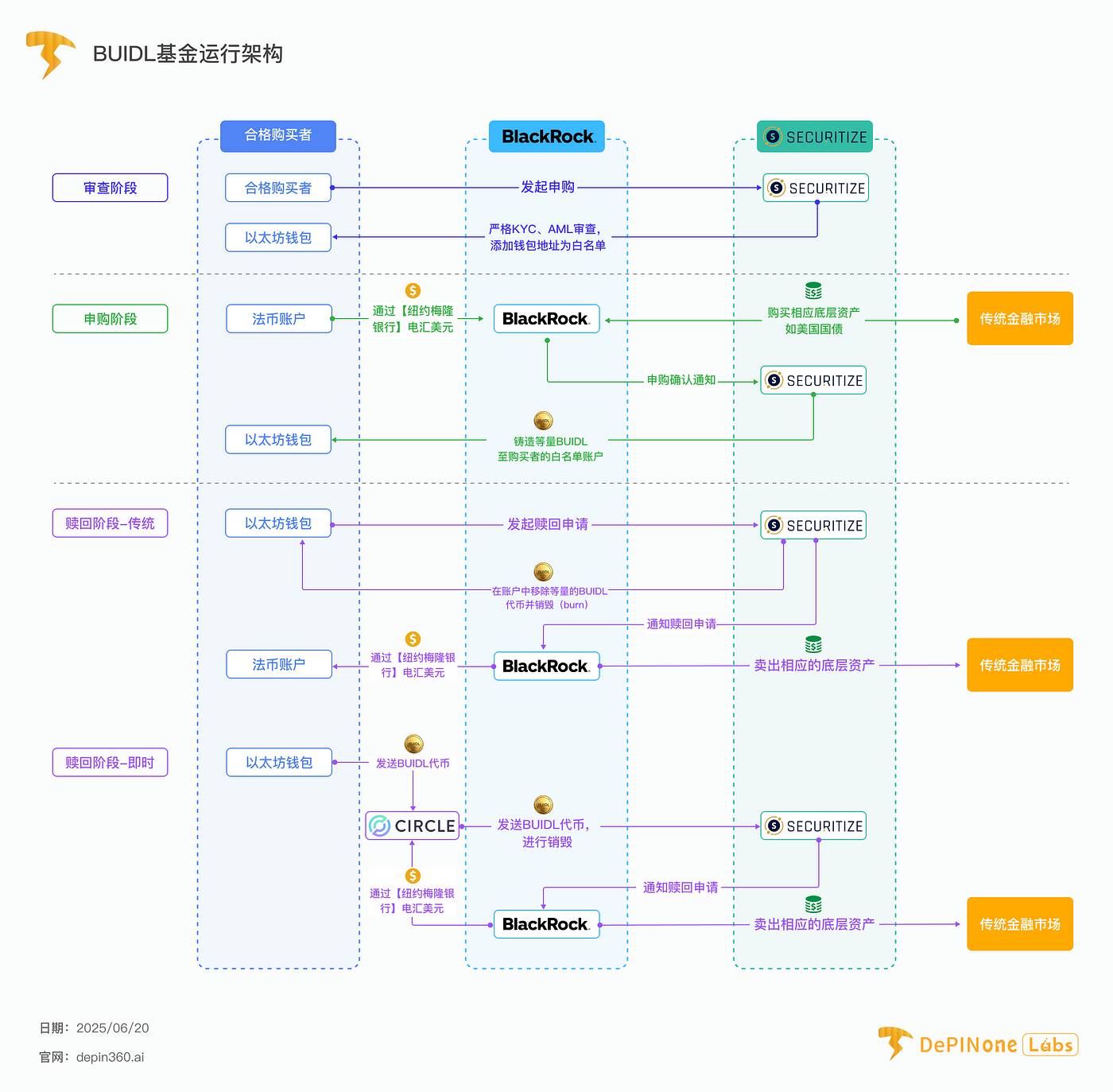

Onboarding Process: Prospective investors must apply through the fund’s placement agent, Securitize Markets, LLC. This involves rigorous Know Your Customer (KYC) and Anti-Money Laundering (AML) reviews. Once cleared, the investor’s Ethereum wallet address is added to the “whitelist” in the BUIDL smart contract—a prerequisite for all subsequent on-chain activities.

3.2 Subscription (Minting): Converting Fiat into On-Chain BUIDL Tokens

When a whitelisted investor is ready to invest, the subscription process connects the off-chain fiat world with the on-chain token economy:

-

The investor wires U.S. dollars (USD) to the fund’s administrator, BNY Mellon.

-

Upon receipt, BlackRock, as fund manager, purchases corresponding underlying assets (e.g., U.S. Treasuries) in traditional markets.

-

Securitize, acting as transfer agent, receives confirmation of the subscription.

-

Securitize then invokes the mint function of the BUIDL smart contract, creating a corresponding number of BUIDL tokens at a 1:1 ratio and sending them to the investor’s whitelisted wallet address.

This process leaves verifiable records on the blockchain. Every successful subscription increases the total supply of BUIDL tokens, data that is publicly viewable on blockchain explorers.

3.3 Whitelist Mechanism: Permissioned Peer-to-Peer Transfers

The whitelist is the core technical mechanism enabling BUIDL’s compliant operation.

The BUIDL smart contract contains a list of all approved investor wallet addresses. Any attempt to transfer BUIDL tokens to an address not on the whitelist is automatically rejected and fails.

This mechanism ensures that fund shares (i.e., BUIDL tokens) are always held only by investors who have passed KYC/AML checks, thereby meeting regulatory requirements for ownership tracking.

Yet, within this compliant framework, BUIDL offers significant flexibility. It allows approved investors to conduct 24/7/365 peer-to-peer (P2P) transfers. Compared to traditional funds, which can only transfer through intermediaries during market hours, this represents a major leap in efficiency.

3.4 Redemption (Burning): Dual Pathways via Securitize and Circle USDC

When investors wish to exit, BUIDL offers two distinct redemption pathways.

🌟 Path One: Traditional Redemption (via Securitize)

-

The investor initiates a redemption request through the Securitize platform.

-

Securitize calls the burn function of the smart contract, removing the specified number of BUIDL tokens from the investor’s wallet.

-

BlackRock sells the corresponding underlying assets in traditional markets to obtain cash.

-

BNY Mellon wires the U.S. dollar proceeds back to the investor.

This path is subject to traditional financial settlement cycles, such as T+1 or T+2.

🌟 Path Two: Instant Redemption (via Circle’s USDC Smart Contract)

-

Key Innovation: To address the timeliness issue of traditional redemptions, Circle partnered with BlackRock to launch a dedicated smart contract, providing BUIDL holders with an almost instantaneous, 24/7 on-chain redemption channel.

-

Process: Whitelisted BUIDL holders can send their BUIDL tokens to Circle’s smart contract, which atomically (in a single transaction) returns an equivalent amount of USDC stablecoins to the user’s wallet.

-

Liquidity Provider Role: After receiving BUIDL tokens, Circle can redeem them for dollars through the traditional pathway described above. Effectively, Circle acts as a liquidity provider, using its own USDC reserves to offer instant liquidity, thus bridging the gap between crypto’s immediacy and traditional finance’s settlement delays.

-

On-Chain Evidence: Etherscan data shows a specific contract address named “Circle: BUIDL Off-Ramp” (0x31d3f59ad4aac0eee2247c65ebe8bf6e9e470a53), whose Redeem function is frequently invoked, confirming active usage as a liquidity exit point.

This USDC redemption channel is the most critical feature enabling BUIDL’s widespread adoption in the crypto-native world. It resolves the fundamental liquidity mismatch between traditional finance’s settlement delays and DeFi’s demand for instant composability. Without this channel, BUIDL might have remained a niche product with limited liquidity; with it, BUIDL becomes fully functional DeFi infrastructure.

However, while the whitelist mechanism is necessary for compliance, it creates a dilemma of “permissioned composability.” The magic of DeFi lies in permissionless interoperability—any protocol can interact with any other. But BUIDL’s contract only interacts with whitelisted addresses, meaning it cannot be directly deposited into permissionless protocols like Aave or Uniswap. Any integration must go through trusted intermediaries like Ondo Finance, which themselves are on the whitelist, building “wrapped” products. This creates a “walled garden”—a new, compliant, institution-centric DeFi ecosystem—but one isolated from the existing open DeFi world. This is the inevitable trade-off made for compliance over openness.

4. Technology Stack: Bridging TradFi and DeFi

This chapter provides a technical analysis of BUIDL’s on-chain components, from its core smart contract architecture to its multi-chain deployment strategy and the key interoperability and liquidity protocols underpinning its functionality.

4.1 Core Architecture: A Permissioned ERC-20 Smart Contract on Ethereum

-

Launch Network: BUIDL debuted on Ethereum, signaling BlackRock’s recognition of Ethereum as a secure and stable platform for institutional applications.

-

Token Standard: The BUIDL token follows the ERC-20 standard, ensuring basic compatibility with the Ethereum ecosystem (wallets, explorers). However, it is not a standard ERC-20; it has been customized for compliance, most notably with the whitelist-based transfer restriction logic discussed earlier.

-

Smart Contract Addresses: Etherscan reveals multiple Ethereum contracts associated with BUIDL. The primary token contract appears to be 0x7712c34205737192402172409a8f7ccef8aa2aec. Additionally, there is a contract labeled BUIDL-I (0x6a9DA2D710BB9B700acde7Cb81F10F1fF8C89041) and Circle’s redemption contract (0x31d3f59ad4aac0eee2247c65ebe8bf6e9e470a53). These contracts likely employ a proxy pattern, a standard practice allowing contract logic upgrades without changing the contract address—critical for institutional products requiring iteration and bug fixes.

-

Security & Audits: Institutional-grade products demand high security. While public research materials do not provide publicly available audit reports for BUIDL’s core contracts—a notable information gap—security is ensured through multiple layers. First, Securitize, as a compliance tech provider, emphasizes in its SEC filings that permissioned token features (such as freeze, burn, and re-mint capabilities) make them safer than bearer assets and capable of responding to errors or malicious transactions. Second, audits of deeply integrated protocols like Ondo Finance indirectly assess the safety of interactions with the BUIDL contract. Nonetheless, investors largely rely on trust in brands like BlackRock and Securitize rather than independently verifiable code audits. This represents a hybrid model blending TradFi’s “trust me” approach with Web3’s “verify me” technology.

4.2 Multi-Chain Expansion: Principles and Implementation

Following a successful launch on Ethereum, BUIDL adopted an aggressive multi-chain expansion strategy, aiming to become a universal institutional RWA across ecosystems.

-

Deployed Networks: BUIDL has expanded to multiple major blockchains, including Solana, Avalanche, Polygon, Arbitrum, Optimism, and Aptos.

-

Strategic Rationale: This expansion aims to give investors, DAOs, and crypto-native companies greater choice and easier access, allowing them to use BUIDL within their preferred ecosystems. This strategy ensures BUIDL maintains dominance regardless of which blockchain captures the largest market share in the future.

-

Network-Specific Advantages: For example, deploying on Solana explicitly targets its network’s speed, low cost, and vibrant developer ecosystem—features well-suited for high-frequency trading and mass adoption.

4.3 Interoperability Engine: The Critical Role of Wormhole

To ensure BUIDL remains unified and liquid across a multi-chain environment, the fund uses Wormhole as its cross-chain interoperability solution. Wormhole is a cross-chain messaging protocol that enables seamless “teleportation” or transfer of BUIDL tokens across all supported blockchains. This is crucial, ensuring BUIDL is a fungible asset with equal value across all networks, rather than fragmented siloed assets.

4.4 Liquidity Engine: Technical Breakdown of the Circle BUIDL-to-USDC Smart Contract

Circle’s redemption contract is the crowning jewel of BUIDL’s technology stack.

-

Functionality: The contract offers a one-way, 1:1 instant exchange from BUIDL to USDC. It functions as an automated, permissioned redemption pool.

-

Technical Implementation: This is a dedicated smart contract deployed on Ethereum (address 0x31d…a53). A BUIDL holder must first approve the Circle contract to spend their BUIDL tokens. Then, the user calls the redeem function on Circle’s contract. Internally, the contract executes the necessary actions (e.g., burning or locking the user’s BUIDL) and transfers an equivalent amount of USDC from its own pool to the user.

-

On-Chain Footprint: Transaction history on Etherscan shows frequent invocations of the Redeem function, confirming active use as a liquidity outlet.

BUIDL’s technical architecture demonstrates elegant design: it employs a “hub-and-spoke” model to manage compliance while using a “mesh” model to build liquidity.

The whitelist managed by Securitize serves as the central hub for all compliance checks—regardless of which chain a transaction occurs on, it must pass through this central validator. Meanwhile, multi-chain deployment via Wormhole creates a mesh network, enabling BUIDL to flow freely among all supported chains.

Finally, Circle’s redemption channel provides a universal exit from the main hub (Ethereum) back to a highly liquid dollar-native asset (USDC). This architecture cleverly centralizes non-negotiable compliance functions while decentralizing asset presence and liquidity paths to maximize utility.

5. Market Catalyst: BUIDL’s Impact on the RWA Ecosystem

This chapter quantifies BUIDL’s market performance and analyzes its role as a catalyst for the broader RWA space, focusing on DeFi protocol adoption and its competitive positioning.

5.1 From Launch to Leadership: BUIDL’s AUM Growth Trajectory

Since its launch, BUIDL’s assets under management (AUM) have experienced explosive growth, demonstrating strong market demand.

-

Rapid AUM Growth: Launched in March 2024, the fund attracted $245 million in its first week. By July 2024, AUM neared $500 million; by March 2025, it surpassed $1 billion; and by mid-2025, it approached $2.9 billion.

-

Market Dominance: Within months, BUIDL overtook Franklin Templeton’s comparable fund to become the world’s largest tokenized treasury fund. By March 2025, it captured nearly 34% of the segment’s market share, solidifying its leadership.

5.2 A New Collateral Class: How DeFi Protocols Leverage BUIDL

A core driver of BUIDL’s growth is its adoption by numerous crypto-native protocols as reserve and collateral assets.

This reveals BUIDL’s true product-market fit—not serving traditional high-net-worth individuals, but becoming B2B infrastructure for the DeFi industry.

-

Primary Use Case: For DeFi protocols needing large dollar reserves, switching from non-yielding stablecoins (like USDC, USDT) to BUIDL—which offers U.S. Treasury yields backed by BlackRock—is a financially sound decision.

-

Ondo Finance: The protocol shifted a significant portion of the assets backing its OUSG token (initially $95 million) into BUIDL to leverage its instant settlement advantage. Ondo’s adoption constituted a major component of BUIDL’s early AUM.

-

Ethena Labs: As issuer of the USDe stablecoin, Ethena allocated a substantial portion of its new stablecoin USDtb’s reserves to BUIDL. This single allocation of hundreds of millions of dollars was a key factor driving BUIDL’s AUM past the $1 billion mark.

-

Frax Finance: Launched a stablecoin called frxUSD, structurally designed to be backed by assets held in BUIDL, further validating BUIDL’s utility as foundational collateral in the DeFi world.

5.3 Competitive Landscape: BUIDL vs. Franklin Templeton’s BENJI and Others

BUIDL’s entry completely reshaped the competitive landscape of tokenized treasury funds.

-

The Flippening: BUIDL rapidly overtook the early market leader—Franklin Templeton’s on-chain U.S. Government Money Fund (FOBXX, aka BENJI)—to become the new market champion.

-

Main Competitors: Other key players in the tokenized treasury market include Hashnote (USYC) and Ondo Finance (USDY).

BUIDL’s ability to surpass Franklin Templeton’s fund stems not just from BlackRock’s brand power, but more importantly from superior product design.

BUIDL’s multi-chain strategy (powered by Wormhole) and the critical Circle USDC instant redemption channel were specifically engineered to meet the liquidity and interoperability demands of its core customers—DeFi protocols. In contrast, Franklin’s fund initially launched on Stellar, a chain less connected to the mainstream Ethereum DeFi ecosystem.

This shows that even in the RWA space, features and integrations tailored for the crypto-native market are decisive factors in adoption.

BUIDL’s rapid rise and market dominance strongly validate the existence of massive demand among institutions and crypto-native markets for RWA products that are highly compliant, deeply liquid, yield-generating, and issued by top-tier providers.

Driven by BUIDL, the total size of the tokenized U.S. Treasury market has exceeded $4.4 billion, while the broader RWA market (excluding stablecoins) has grown to nearly $8 billion. BUIDL is undoubtedly the primary engine behind this growth trend.

6. Strategic Analysis and Future Outlook

This chapter synthesizes the preceding analysis, evaluating BUIDL’s risks, core strategic trade-offs, and future trajectory, along with the outlook for the institutional RWA movement it represents.

6.1 Risk Assessment

Despite its remarkable success, BUIDL’s operations face multidimensional risks.

Technology Risks

-

Smart Contract Vulnerabilities: Undiscovered bugs in BUIDL’s core contracts or third-party dependencies (e.g., Wormhole, Circle redemption contract) could lead to catastrophic consequences. Although relevant protocols have undergone audits, risks remain.

-

Underlying Blockchain Risks: The fund depends on the various public blockchains it deploys on. Major events such as 51% attacks, contentious hard forks, or prolonged network outages could threaten normal operations.

Regulatory Risks

-

Uncertainty: The global regulatory framework for tokenized securities is still evolving. Future regulations from the SEC or other authorities could impact BUIDL’s current structure or legality.

-

Cross-Border Complexity: The global, 24/7 nature of blockchains introduces jurisdictional complexities absent in traditional funds, especially concerning cross-border transactions.

Market Risks

-

Liquidity Risk: Although Circle’s USDC channel greatly alleviates redemption liquidity concerns, this instant liquidity heavily relies on a single partner. Secondary P2P market liquidity among whitelisted investors may be very limited.

-

Counterparty Risk: BUIDL relies on a complex chain of counterparties—BlackRock, Securitize, BNY Mellon, Circle, Wormhole, etc. Failure at any link could disrupt the entire system.

-

Underlying Asset Risk: Despite minimal exposure, the fund remains subject to market risks of its U.S. Treasuries and repo agreements, and the fund does not guarantee that NAV will always remain at $1.00.

6.2 Trade-Off Between Compliance and DeFi Composability

BUIDL’s core design embodies a profound strategic trade-off.

The whitelist managed by Securitize is both the cornerstone of BUIDL’s compliance and the moat—and wall—of the entire model. It ensures only approved entities can hold tokens, satisfying securities regulations.

This centralized control mechanism prevents BUIDL from directly interacting with permissionless DeFi protocols (like Aave, Uniswap), creating a “walled garden” or “permissioned DeFi” ecosystem. It sacrifices DeFi’s core principle of open composability for regulatory compliance.

Securitize argues this permissioned nature is a strength, not a flaw. It allows remediation in cases of error or fraud (e.g., freezing, burning, re-minting tokens) and enables compliance with legal obligations such as OFAC sanctions, making it safer for institutions than anonymous, bearer crypto assets.

Fundamentally, BUIDL’s operating model is one of “trusted third parties,” diverging from crypto’s original “trustless” ethos but perfectly aligning with institutional investor needs. Investors must trust BlackRock to manage assets properly, BNY Mellon to safeguard custody, Securitize to correctly administer the on-chain ledger and whitelist, and Circle to fulfill redemption obligations. It is a chain of trusted intermediaries. Institutional operations depend on trust, regulation, and legal recourse—exactly what the BUIDL model delivers.

Therefore, BUIDL is not an evolution of open DeFi, but the beginning of a parallel, permissioned, institutional-grade DeFi. In this new ecosystem, trust in reputable brands is the primary security model, while blockchain technology provides efficiency gains.

6.3 BUIDL and the Evolution of Institutional RWA Products

BUIDL is merely the first step in BlackRock’s grand vision.

-

Expanding Asset Classes: BlackRock’s ambition extends far beyond money markets—to the tokenization of all securities, including stocks and bonds. BUIDL serves as a successful proof-of-concept for this broader strategy.

-

Deepening DeFi Integration: Future developments may involve more sophisticated, regulated “wrapped” solutions that allow BUIDL’s yield and collateral value to be more broadly utilized within the DeFi ecosystem without compromising the core whitelist mechanism.

-

Setting Industry Standards: BUIDL’s success will drive standardization in RWA tokenization technology and legal frameworks, positioning BlackRock to influence this process at a pivotal moment.

The Foundation Layer of Next-Generation Finance

BUIDL is more than a successful fund—it is a strategic masterpiece in product-market fit.

It precisely identified a core need in the DeFi ecosystem (stable, compliant, yield-bearing collateral) and built a perfect product to fulfill it, fully leveraging the dual advantages of traditional finance (trust, scale, asset management) and Web3 (efficiency, speed, programmability).

BUIDL represents a pivotal moment in the convergence of TradFi and DeFi. It establishes a viable, scalable, compliant blueprint for bringing real-world assets on-chain. By becoming the foundational collateral layer for the crypto-native economy, BlackRock is not just entering this market—it is embedding itself deeply into its financial core, positioning itself as a cornerstone of next-generation finance.

However, BUIDL’s deepest long-term risk may not stem from technology or markets, but from philosophical tensions within the crypto ecosystem itself.

BUIDL’s success hinges on adoption by crypto-native protocols that value decentralization and censorship resistance. Yet these protocols are building atop a centralized, permissioned, censorable foundation (Securitize can freeze tokens per legal requirements). This dependency contradicts core values cherished by many in the crypto community. As the ecosystem matures, a “flight to decentralization” may emerge—protocols actively seeking more censorship-resistant collateral, even if it means sacrificing some yield or perceived “safety.”

Thus, despite its current dominance, BUIDL’s long-term viability depends on whether the crypto ecosystem continues to prioritize compliance and yield over ideological pursuit of pure decentralization.

This philosophical tension represents its most profound and unquantifiable risk.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News