Where will XRP's price go now that Ripple's legal dispute has ended?

TechFlow Selected TechFlow Selected

Where will XRP's price go now that Ripple's legal dispute has ended?

The company has finally ended its battle with the U.S. SEC. But its blockchain still sees little adoption, and its stablecoin faces an uphill struggle.

Author: Steven Ehrlich

Translation: TechFlow

After successfully resolving its regulatory dispute with the U.S. Securities and Exchange Commission (SEC), Ripple Labs CEO Brad Garlinghouse appears to have a renewed sense of momentum.

On July 2, Ripple announced it had applied to the Office of the Comptroller of the Currency (OCC) for a federal banking charter, aiming to become the second company after Anchorage Digital to achieve this distinction. Additionally, its New York-regulated custodian, Standard Custody and Trust Company, is working toward becoming the first cryptocurrency firm to obtain a Federal Reserve Master Account, enabling it to hold reserve deposits directly at the Fed backing its $469 million stablecoin, RLUSD.

"In line with our long-standing commitment to compliance, @Ripple has applied to the OCC for a national bank charter," Garlinghouse tweeted on July 2. "If approved, we would be regulated at both the state level (via NYDFS) and the federal level—setting a new (and unique) benchmark for trust in the stablecoin market."

Meanwhile, Ripple continues to expand RLUSD's infrastructure. The company announced a partnership with Switzerland-based AMINA Bank, and collaboration with London’s OpenPayd, using stablecoins to build payment networks.

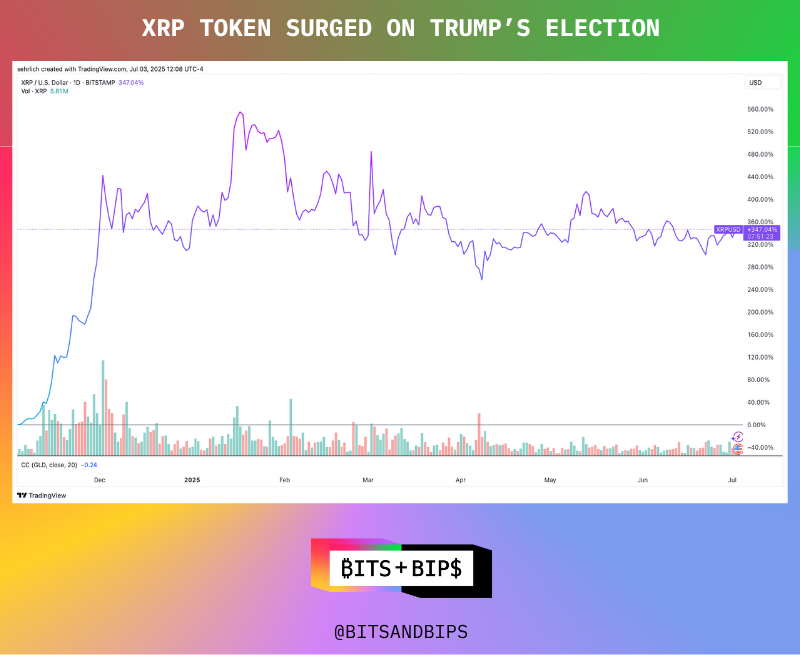

And that’s not all—since November 1 of last year, XRP, the native token primarily held by Ripple Labs, has surged 347%. Moreover, XRP could see the launch of the U.S.’s first spot exchange-traded fund (ETF) later this year. Despite this, XRP’s price has largely stagnated over the past six months.

While the future of Ripple Labs, the XRP Ledger (XRPL), and its stablecoin remains uncertain, the biggest question still centers on its original token, XRP.

As Ripple appears to shift more focus toward the stablecoin market, some argue that if RLUSD truly scales, it could erode the potential demand Ripple has long sought to create for XRP.

For Ripple, this indeed marks a fresh start—but for this blockchain company, old challenges remain. To push XRP into its next phase of price growth, certain key factors may need to change. Here are two major hurdles to watch.

Real-World Use of XRP Remains Limited

Back in March 2024, I published an article titled “The Rise of Crypto’s Billion Dollar Zombies” in Forbes. When researching that piece, I chose the XRP Ledger (XRPL) as a central case study.

I wrote: “From the perspective of global capital flows, Ripple Labs’ current impact is negligible—few believe it can disrupt SWIFT, the Belgian banking consortium processing up to $5 trillion daily in interbank transfers. Despite failing to achieve its core mission, Ripple’s blockchain—a ledger recording XRP transactions—continues to operate. But it’s essentially useless, while the XRP token maintains a market cap of $36 billion, making it the sixth-largest cryptocurrency.”

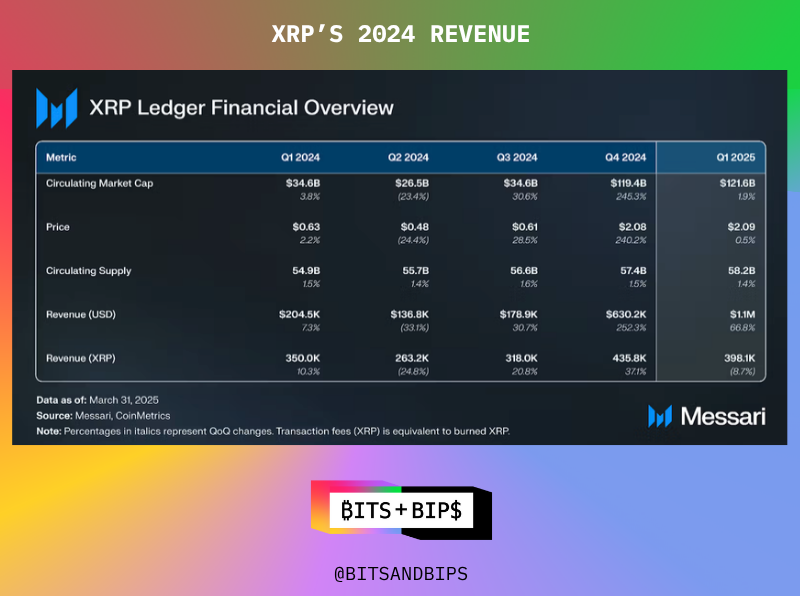

This assessment was admittedly harsh, but I highlighted that despite XRPL’s $36 billion valuation at the time, its transaction fee revenue in 2023 totaled only $583,000—an astonishing price-to-sales (P/S) ratio of 61,690x. More strikingly, Ripple was already 12 years old by then—not a startup. To me, these figures suggested XRP was more of a “memecoin” than a utility-driven asset.

So what’s changed since then? In 2024, XRPL’s fee revenue rose to $1.15 million, an increase of just $567,000 from the prior year. Meanwhile, its market cap grew from $33.32 billion at the start of 2024 by over $8 billion, resulting in a staggering P/S ratio of 103,826x.

These numbers underscore XRP’s core issue: despite rising valuations, real-world usage and economic output remain minimal, failing to justify its lofty market price.

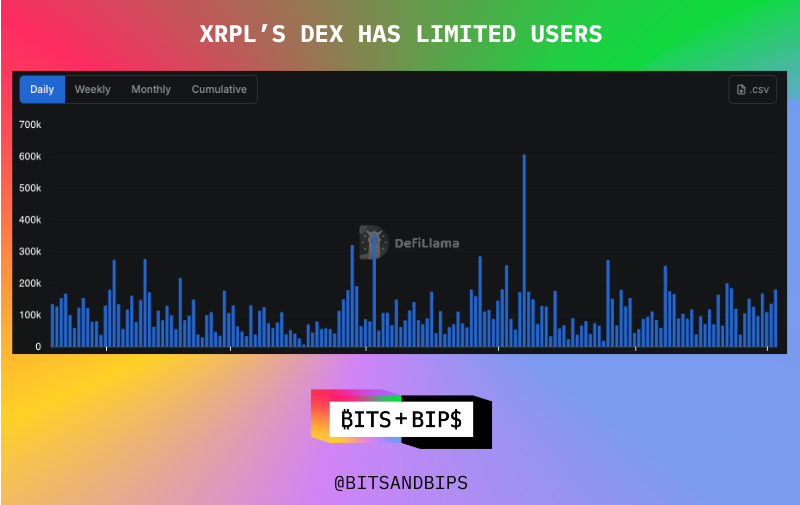

Data from Messari shows that activity on XRPL is insufficient to support price appreciation. Its flagship decentralized exchange (DEX) typically sees less than $100,000 in daily trading volume. By contrast, market leader PancakeSwap exceeds $1 billion in daily spot volume, not to mention the rapidly growing derivatives DEX sector, where Binance and Hyperliquid process trillions in monthly volume.

In the non-fungible token (NFT) space, XRPL also lags significantly. According to Messari, XRPL averaged only about 550 daily NFT traders in 2024. Even amid today’s broader NFT market downturn, Ethereum still sees around 5,000 active daily traders.

Furthermore, XRPL has struggled to introduce native smart contract functionality. As blockchains evolve beyond single-use cases like payments, smart contracts have become a baseline feature. However, on June 30, Ripple Labs launched an EVM-compatible sidechain in partnership with Axelar to address this gap. XRP will serve as the gas token and native asset on this new chain, creating potential new sources of demand beyond payments.

Still, Ripple faces an uphill battle in generating genuine, non-speculative user demand for XRP through this new initiative.

What About RLUSD?

XRP holders must also consider how Ripple Labs’ stablecoin, RLUSD, might affect demand for XRP. After all, XRP was originally designed as a bridge currency to help banks convert currencies more efficiently and cheaply. Yet some argue that launching a stablecoin could directly contradict this goal—especially if RLUSD further entrenches dollar dominance. This aligns with U.S. interests in preserving dollar hegemony and could extend to regions underserved by traditional dollar access.

According to CoinGecko, the stablecoin market is growing at rocket speed. Total stablecoin supply now stands at $254.79 billion, with the sector still digesting Circle’s highly successful IPO last month. Meanwhile, the U.S. government is nearing passage of the GENIUS Act—the country’s first crypto-specific legislation—which will establish rules for stablecoin development. With massive capital inflows and favorable regulation, many now believe stablecoins—not XRP—are the future of payments.

That said, I can envision a world where both coexist. Unless emerging markets follow El Salvador’s lead in adopting the dollar officially, foreign exchange conversion needs will persist. Still, others argue stablecoins, being far less volatile, are better suited than XRP as bridge currencies.

This dual-demand perspective is shared by Ripple Labs CTO David Schwartz. During an interview last spring around RLUSD’s launch, he said: “Offering customers multiple pathways improves experience and brings in more users. If we relied solely on XRP, we’d have to say ‘no’ in places where XRP isn’t available.” Yet compared to Ripple’s founding in 2012, XRP’s potential market size may have shrunk.

Beyond the general rise of stablecoins, another reason Ripple may have launched RLUSD is the regulatory shadow cast by the SEC’s enforcement action against Ripple Labs. Owen Lau, executive director at Oppenheimer & Co., told Forbes in April 2024: “Ripple may have felt it had no choice but to issue a stablecoin to convince banks and financial institutions to work with it—many of which may be reluctant to hold or use XRP due to its price volatility and associated SEC litigation risks.”

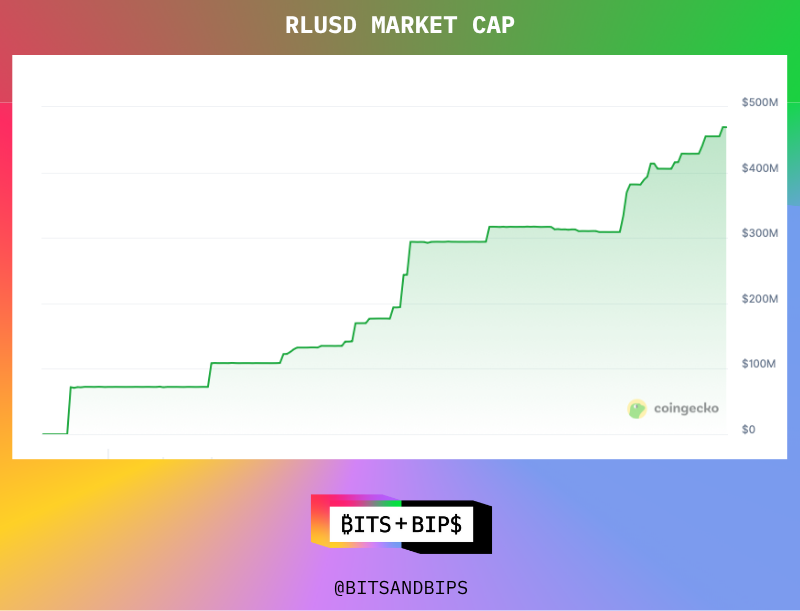

However, for RLUSD to achieve breakout growth—and potentially return value to XRP—Ripple must act quickly. The stablecoin market is currently dominated by two giants: Tether (market cap $158.3 billion) and Circle (market cap $62 billion). Ripple’s best bet may be leveraging its new sidechain to drive RLUSD adoption—for example, through incentives that boost RLUSD usage, thereby increasing demand for XRP as gas fees. But this remains a speculative hypothesis.

Circle and Tether have already achieved widespread distribution and are aggressively expanding their ecosystems. Tether dominates trading and recently announced its tokens can be used to pay gas fees on a new blockchain called Stable. Circle, meanwhile, has high-profile partnerships with Coinbase to promote USDC on the Base blockchain, and with Shopify to enable merchant payments in USDC.

Despite the hype around stablecoins, RLUSD is entering anything but a “blue ocean market.”

Circle and Tether have achieved mass distribution and are aggressively expanding their ecosystems. Tether dominates in trading and recently announced its tokens can be used to pay gas fees on a new blockchain called Stable. Circle, through its high-profile partnership with Coinbase, is pushing USDC adoption on the Base blockchain, and has partnered with Shopify to allow merchants to accept USDC payments.

Despite intense interest in stablecoins, for Ripple’s RLUSD, this is far from a “blue ocean market.”

Ripple’s Ace Card

If Ripple Labs holds one ace, it’s likely being among the most financially robust crypto companies globally. According to its Q1 2025 financial report, the company holds 4.56 million XRP—worth approximately $1.027 billion—in its corporate wallet. Additionally, it holds 371 million XRP in escrow, valued at around $83.5 billion, set to unlock gradually over the coming years.

While the company couldn’t possibly liquidate all XRP at once without severe market impact, Ripple is almost certainly insulated from any risk of running out of funds.

For XRP holders, this means Ripple has virtually unlimited resources to stimulate demand for its new EVM sidechain, and to fund partnerships and use cases for both RLUSD and XRP.

Yet, perhaps none of this truly matters to XRP holders. After all, despite minimal user growth on the XRPL ledger in recent years, XRP’s price has continued to rise—defying fundamentals.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News