Ripple raised another $500 million—Are investors getting discounted $XRP?

TechFlow Selected TechFlow Selected

Ripple raised another $500 million—Are investors getting discounted $XRP?

The company raised funds at a $40 billion valuation, but it already owns $80 billion worth of $XRP.

Author: Steven Ehrlich

Translation: TechFlow

Ripple has raised $500 million at a $40 billion valuation, despite already holding $80 billion worth of XRP.

Ripple Labs recently announced the completion of a $500 million funding round, with investors including prominent firms such as Brevan Howard, an affiliate of Citadel Securities, and Marshall Wace. Additionally, well-known crypto investment firms Galaxy and Pantera also participated in this round.

But what exactly did investors get for their $500 million?

Recently, Ripple itself has been actively acquiring companies. Over the past few months, Ripple acquired custody platform Palisade, $1.25 billion prime broker Hidden Road, and stablecoin infrastructure platform Rail. Furthermore, Ripple launched its own stablecoin RLUSD, which has already surpassed $1 billion in market capitalization. At the same time, Ripple's XRP token is expected to see the launch of the first U.S. spot ETF (exchange-traded fund) next week, and the company plans to apply for a national bank charter from the Office of the Comptroller of the Currency (OCC).

Despite Ripple’s rapid recent growth, justifying its $40 billion valuation appears difficult—especially considering that the XRP Ledger generates less than $200,000 per month in transaction fees. So what logic lies behind this?

According to several investors and venture capitalists who spoke to Unchained on condition of anonymity, this funding round was largely about gaining exposure to Ripple’s XRP holdings, possibly at a significant discount to the spot price.

"[This company] has nothing going for it except its XRP holdings. No one is using their technology, and there's no usage volume on their network or blockchain." said a prominent venture capitalist bluntly.

Another investor added: "Ripple’s equity itself may not be worth much, let alone justify a $40 billion valuation."

XRP Wealth

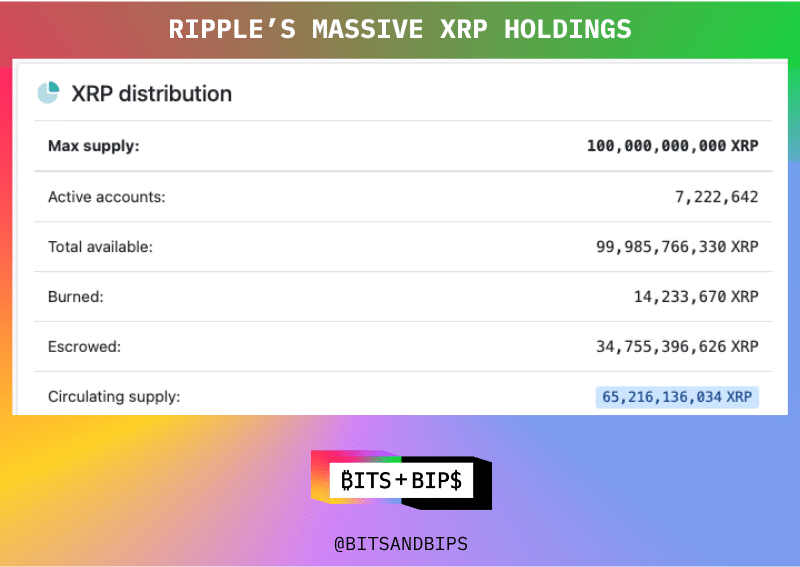

While Ripple Labs may not be the highest-valued company in the crypto industry, it could be among the richest. At the company’s and blockchain’s inception, as part of an early allocation strategy, Ripple Labs was assigned 80 billion of the total 100 billion XRP supply, released quarterly through escrow accounts.

To date, Ripple Labs still holds 3.476 billion XRP tokens, with 1 billion released monthly. Typically, 60%-70% of these tokens are re-escrowed, while the remainder is used to cover operating expenses. At the current XRP price of $2.32, these tokens have a nominal value of $8.063 billion.

A Private XRP Digital Asset Treasury (DAT)?

If this investment is viewed as a stake in Ripple’s Digital Asset Treasury (DAT), the deal appears highly attractive to investors. After all, investing at a $40 billion valuation in a company sitting on $80 billion in assets equates to buying in at a 50% discount, with an mNAV (market-to-net asset value multiple) of just 0.5. In comparison, typical DAT investment proposals usually come in at mNAV levels closer to 0.7 or 0.8.

But things aren’t that simple. Even if Ripple were willing and able to sell all its XRP on the open market today, it would almost certainly not realize anywhere near the $80 billion valuation. However, even applying a 50% discount to these holdings—one investor not involved in the round called this estimate reasonable—would still mean investors are entering at an mNAV of 1, while also gaining exposure to the potential upside from Ripple’s recent moves and acquisitions.

All investors participating in the round declined to respond to Unchained’s inquiries about the investment, particularly regarding the role of Ripple’s XRP holdings in the decision-making and pricing process. Ripple also did not respond prior to publication.

However, a source familiar with one of the participating firms revealed that these companies have had long-standing business relationships over the years. Especially in the payments space—which has heated up following the passage of the GENIUS Act in July and growing market interest in stablecoins—investors feel compelled to back multiple players in this race.

The source also alluded to Ripple’s massive treasury, candidly stating: "Even if they can't build a successful business themselves, they can just buy one outright."

Ripple’s Calculations: What’s Behind the Fundraising?

Although Ripple did not respond to requests for comment, a former employee noted that this fundraising round brings multiple benefits to the company. First, it solidifies the $4 billion valuation of the company’s shares traded on platforms like Carta. The individual mentioned that the company may have already spent over $1 billion repurchasing shares from early investors and employees.

In addition, the funding provides additional capital for further acquisitions without having to raise money by selling XRP—avoiding potential market panic.

Ironically, the most capitalized company in crypto may actually be facing a cash crunch.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News