Ripple aims to unlock XRP's tens of billions market cap through XRPFi, filling the gap in its DeFi ecosystem

TechFlow Selected TechFlow Selected

Ripple aims to unlock XRP's tens of billions market cap through XRPFi, filling the gap in its DeFi ecosystem

XRPFi is increasingly being seen by practitioners as a new pathway to activate XRP, the veteran cryptocurrency asset, and drive growth across the XRPL and Ripple ecosystems.

Author: Weilin, PANews

On June 10, the XRP Ledger Apex 2025 conference opened in Singapore. At the event, a concept called "XRPFi" became a hot topic on social media. XRPFi—combining XRP with decentralized finance (DeFi)—is increasingly seen by industry participants as a new pathway to unlock the potential of XRP, the veteran crypto asset, and drive growth across the XRPL and Ripple ecosystems.

XRP is one of the most representative assets in the cryptocurrency market, with a current market cap approaching $134.4 billion, making it the highest-market-cap non-smart-contract cryptocurrency after Bitcoin. Thanks to its fast and low-cost cross-border payment capabilities, XRP has stable applications in traditional financial scenarios. However, in the on-chain domain, XRP has long lacked smart contract support, hindering its integration into mainstream DeFi ecosystems—a structural contradiction that has gradually drawn attention.

With the SEC pausing its lawsuit against Ripple, Ripple’s stablecoin RLUSD nearing a $390 million market cap, and ongoing speculation about an XRP ETF, investor expectations for XRP’s future are rising. Institutional and retail investors alike are beginning to explore how XRP can generate yield and improve capital efficiency through DeFi, fueling the emergence and development of the "XRPFi" concept.

Leveraging Flare to Empower XRPFi and Build a Multichain Interoperable DeFi Ecosystem

In the current evolution of XRPFi, Flare Network is regarded as a key infrastructure provider. While the XRP Ledger (XRPL) excels in speed and stability, it faces inherent limitations in composability and contract functionality required for DeFi. To bridge this gap, Flare provides technical empowerment to XRP, serving as the core engine connecting traditional XRPL with multichain DeFi ecosystems.

Flare is an EVM-compatible Layer 1 blockchain designed specifically for multichain interoperability. Its FAssets protocol maps non-smart-contract assets like XRP into FXRP, enabling them to interact with smart contracts and seamlessly integrate into decentralized lending, trading, and derivatives protocols. Through this mechanism, XRP holders can participate in mainstream on-chain yield activities such as staking and liquidity mining.

In addition, Flare has introduced USD₮0, a native stablecoin issued under the OFT (Omnichain Fungible Token) standard based on LayerZero, featuring native cross-chain interoperability. Paired with XRP, USD₮0 can serve not only as liquidity pool depth and collateral in lending markets but also connect to the USDT ecosystem valued at over $155 billion, injecting a highly liquid "capital foundation" into the XRPFi ecosystem.

According to official data, Flare’s ecosystem has seen significant recent growth: as of June 10, total value locked (TVL) surpassed $157 million, driven largely by the launch of USD₮0, which now has a circulating supply of approximately $92.1 million. Over a longer timeframe, from February 2024 to February 2025, Flare’s TVL grew more than 400%. Additionally, Flare has integrated wallet tools compatible with XRPL such as Bifrost and Oxenflow, further lowering the barrier to entry for users.

Flare describes its XRPFi framework as a “flywheel model”: USD₮0 provides capital, FXRP enables composability, their pairing generates liquidity, which in turn attracts more DeFi applications and real-world use cases, ultimately reinforcing the long-term ecological value of XRP.

In the future, Flare plans to bring other non-smart-contract assets such as Bitcoin and Dogecoin onto its network, expanding their utility within the DeFi space.

Building an XRPFi Yield Matrix: Dual-Track Approach Combining CeDeFi and On-Chain Strategies

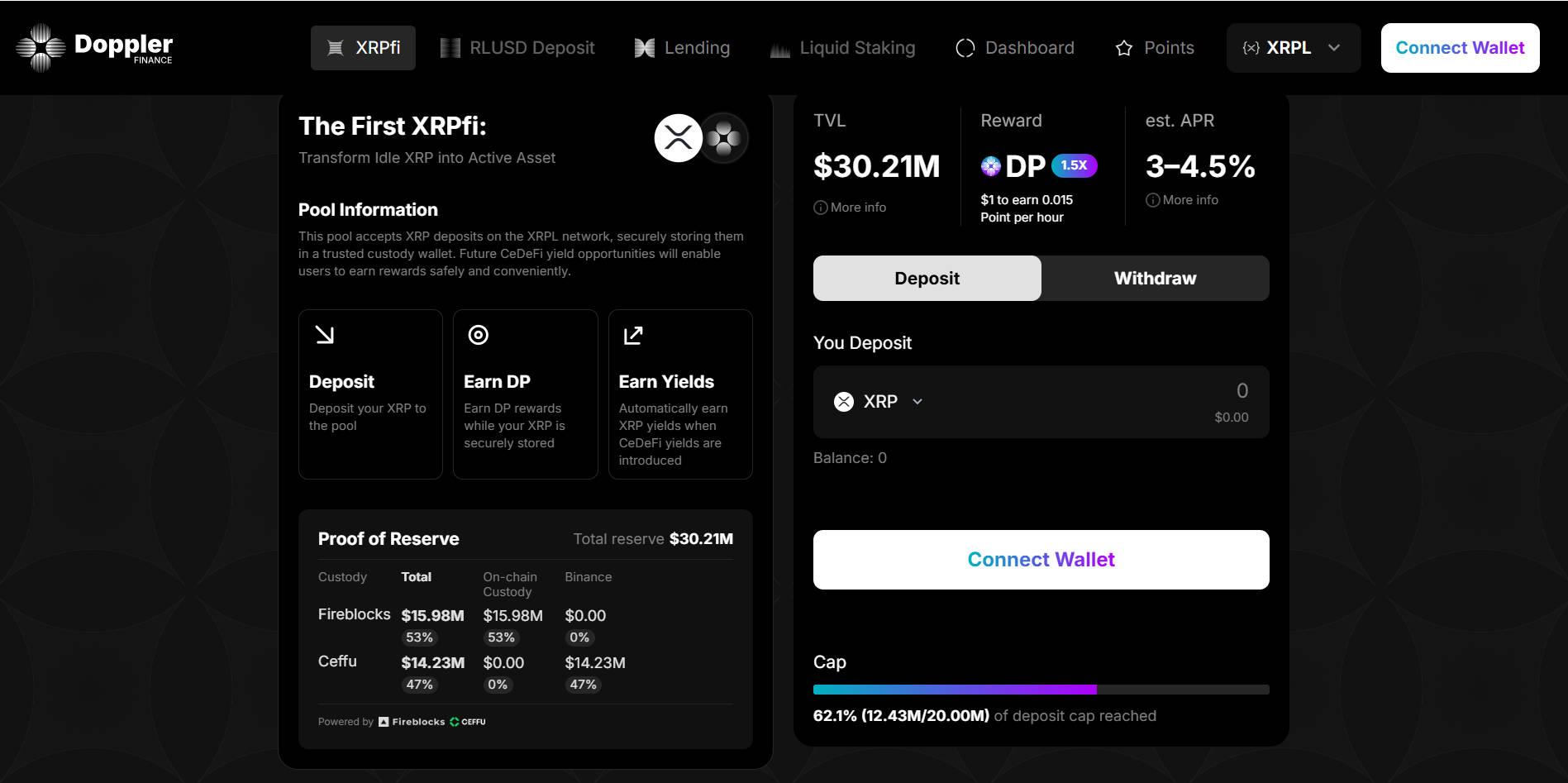

While Flare builds on-chain compatibility, Doppler Finance is designing a comprehensive suite of yield mechanisms around XRP, aiming to fill the historical gaps in interest-bearing products and financial instruments for XRP. As of June 8, the platform has attracted over $30 million in TVL, positioning itself as a major player in the XRPFi space.

Doppler Finance offers two primary types of yield products: CeDeFi yields and on-chain DeFi strategies. The former relies on institutional-grade custody and quantitative operations for asset management, while the latter explores on-chain yield opportunities including lending, stablecoin strategies, and staking.

Under the CeDeFi model, users deposit XRP into dedicated addresses, where assets are held by custodians such as Fireblocks and Ceffu and then systematically transferred to centralized exchanges to execute quantitative strategies such as arbitrage and basis trading. Profits are settled off-chain and returned to user accounts.

For on-chain yield generation, Doppler is actively integrating with the XRPL sidechain ecosystem, including EVM-compatible networks and emerging protocols. Its strategies include:

-

XRP Lending: Depositing XRP into audited and compliant lending protocols to earn interest or native rewards. Borrowers provide other assets as collateral, and the platform automatically manages liquidations to ensure security.

-

Stablecoin Yield Strategies: Using XRP as collateral to borrow stablecoins (e.g., USDC), then deploying those funds into stablecoin yield protocols. Doppler employs conservative loan-to-value (LTV) ratios and dynamically adjusts positions to achieve low-risk returns.

-

Liquid Staking and Leverage Strategies: Users can perform one-click leveraged staking in specific LST pools, particularly involving sidechain tokens like ROOT. This mechanism simplifies complex operations via automated contracts, enhancing user experience.

To further mitigate risks, Doppler Finance is building risk-isolated lending markets, allowing different asset pools to operate independently and preventing high-volatility assets from undermining overall system stability. In addition to core pools containing mainstream assets such as XRP, USDC, and ROOT, Doppler plans to launch multiple isolated markets—including an LST pool tailored for leveraged yield farming and another isolated market for gaming tokens from the Futureverse ecosystem.

Given that XRPFi involves cross-chain transfers, custody, and advanced strategy execution, security mechanisms are a critical component of project design. Currently, Doppler Finance employs a multi-layered risk control framework.

For asset custody, the platform uses leading industry providers such as Fireblocks and Ceffu, ensuring security through cold wallet management, on-chain verification, and bankruptcy remoteness. For quantitative trading, the platform adopts a multi-strategy, multi-team collaboration model, structuring most operations as "loan contract frameworks" to ensure principal recovery under non-extreme conditions.

Additionally, according to official statements, all partnered trading entities must undergo rigorous due diligence, assessed across dimensions such as historical performance, strategy stability, AUM scale, and financial risk, ensuring only qualified institutions participate.

Filling a DeFi Market Gap, XRPFi Remains in Early Stages

As Ethereum’s DeFi ecosystem becomes increasingly saturated, the market is turning toward high-market-cap assets that have yet to be fully activated. XRPFi fills the longstanding void of XRP being a “high-market-cap, low-on-chain-usage” asset. Through technologies such as Flare’s FAssets protocol, XRP—previously lacking smart contract capabilities—is now able to enter the DeFi ecosystem. Doppler Finance is building a comprehensive set of sustainable yield mechanisms, including CeDeFi returns and liquid staking, offering not just viable pathways but also investing resources into improving security and user experience.

Logically, the development of XRPFi responds to the urgent need to activate both XRP and the broader Ripple ecosystem. However, it must be noted that the XRPFi ecosystem is still in its early stages. Although Flare and Doppler have relatively clear product roadmaps, overall user adoption, liquidity depth, and protocol maturity remain to be proven. Can legacy assets succeed under new narratives? PANews will continue to monitor developments closely.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News