Opinion: XRP is being undervalued by the market

TechFlow Selected TechFlow Selected

Opinion: XRP is being undervalued by the market

Few people truly understand the real functionality of XRP.

Author: Bayberry Capital

Translation: TechFlow

The market continues to misjudge XRP because it does not truly understand what it is evaluating. It sees only a token, overlooking the system behind the token.

For years, the market has measured XRP using the wrong metrics. Traders focus on volatility, analysts chase headlines, but neither delves into its infrastructure. XRP is not a speculative toy; it is a financial instrument designed to transfer value across global systems with precision, finality, and neutrality. Its price has not yet reflected its functionality because the world has not yet assigned the right value to that functionality itself.

The market hasn't mastered how to evaluate infrastructure

Infrastructure is always prone to misunderstanding in its early stages. Investors often chase visible growth while ignoring the foundations supporting that growth. The same dynamic played out during the early days of the internet. Back then, companies building routers, networks, and data centers saw flat stock performance, while speculative capital flooded into internet startups with no real output.

Only when this infrastructure became indispensable did capital return to the actual builders. Today, XRP is in a similar position. It is the underlying pipeline of the next financial era. The market sees a calm price chart and assumes irrelevance. But in reality, it is witnessing the slow formation of an invisible network that will become a critical pillar of global liquidity.

Few truly understand XRP's core function

XRP was never designed to be a speculative asset. Its mission is to serve as a bridge asset connecting isolated financial systems. XRP enables liquidity to flow freely between different currencies, payment networks, and tokenized values. Achieving this requires widespread institutional adoption, clear regulatory frameworks, and deep technical integration—processes that unfold over years, not weeks.

The market cannot price what it does not understand. It still compares XRP to narrative-driven speculative assets, when in fact XRP’s entire architecture is monetary, not promotional. The longer this misunderstanding persists, the greater the revaluation will be once utility becomes the focus.

Liquidity utility follows a path entirely different from market sentiment

The path of utility adoption is fundamentally different from market sentiment. Growth in liquidity infrastructure is quiet and continuous until it reaches a systemic tipping point. At that stage, existing supply will fail to meet demand, and prices will adjust rapidly to reflect the new utility value.

Most traders have never witnessed this, as it runs counter to retail market drivers. Real adoption is slow, silent, and ultimately final. When financial institutions settle real transaction volumes through distributed systems, that liquidity does not disappear—it deepens over time. XRP’s stability is not a weakness, but an accurate reflection of its current phase.

Debates about supply miss the key issue

Critics often treat XRP’s total supply as the sole factor for assessing potential, but this is incorrect. What truly matters is the effectively circulating supply relative to utility demand. A large portion of XRP is locked in escrow or long-term custody, meaning the actual circulating supply used for global settlement is far below surface-level figures.

As transaction volume grows and velocity increases, available liquidity tightens. This compression of circulating supply, combined with rising demand, is what drives genuine price discovery. This is not speculation—it is mechanism-driven.

Regulation establishes the framework for utility

Traditional financial markets typically price in regulatory developments ahead of time, whereas in digital assets, regulation is often seen as an afterthought. However, with XRP’s legal status now clarified, this regulatory clarity is a milestone. It transforms XRP from a legal risk into a compliant bridge mechanism that banks and institutions can actually use.

The market has not yet adjusted to this shift, still trading XRP as if it were a marginal tool rather than a recognized financial conduit. This misalignment is one of the most significant asymmetries in the digital asset space today.

The coming wave of tokenized value

The world stands at the edge of a new financial structure where real-world assets will be recorded on ledgers. Bonds, treasuries, currencies, and commodities will all be tokenized and exchanged digitally. For these systems to be interoperable, they will require a neutral bridge asset capable of cross-network settlement. XRP was built precisely for this purpose.

As tokenized transaction volumes expand, bridge liquidity will become the new "oil" of global finance. Every movement of on-chain assets will drive demand for a neutral settlement medium. This demand is structural—not driven by speculation, but by real necessity.

The quiet nature of institutional integration

Real adoption often happens in silence. Ripple and its partners operate within regulated environments, prioritizing reliability over publicity. Pilot channels, enterprise solutions, and liquidity partnerships are typically developed privately, tested quietly, and only scaled when fully functional.

Retail markets crave public excitement; institutions prioritize certainty. The infrastructure being laid today will only reflect in price once it becomes essential to operations. By then, the market will realize that years of apparent silence were actually years of construction.

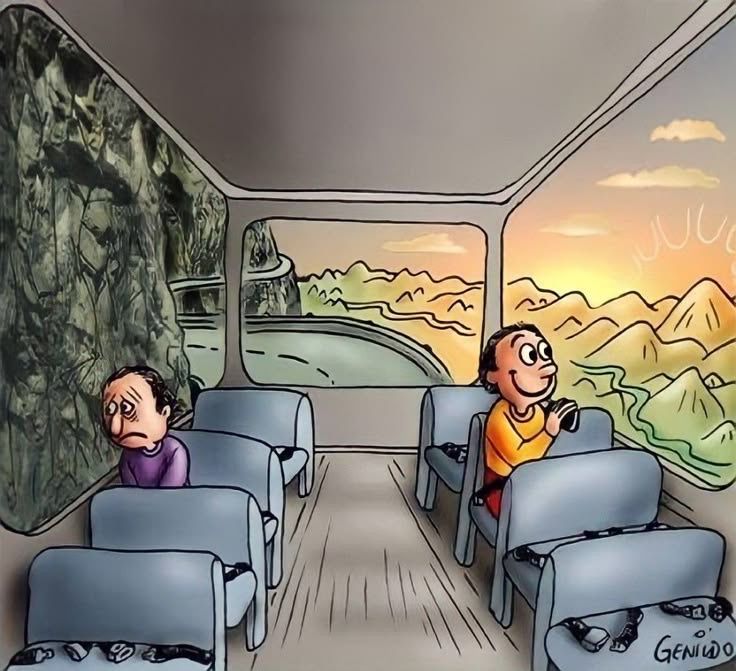

Perspective shapes perception

The difference between speculators and investors lies in their ability to see beyond the present into the future. XRP’s current market cap may seem large compared to other digital assets, but when measured against global settlement volumes, foreign exchange flows, and projected scales of tokenized assets, it appears negligible.

This mispricing stems from the market still viewing XRP as a trade, not a transformation. It is valued like other cryptocurrencies, not as monetary infrastructure capable of enabling trillions in global value movement. When the perspective shifts from price charts to liquidity mechanisms, valuation models will completely change.

XRP is undervalued because the market still sees it as an event, not a system. It has not yet realized that value accumulation within financial architecture is slow—but once mature, it explodes rapidly.

When settlement via distributed systems becomes standard rather than experimental, XRP will no longer need promotion or defense—its utility will speak for itself.

At that point, the market won’t be discovering a new asset, but recognizing one that has long existed—quietly building the foundation for the next generation of value transfer.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News