XRP hits new highs, the crypto parallel world behind the fierce resurgence of老牌 coins

TechFlow Selected TechFlow Selected

XRP hits new highs, the crypto parallel world behind the fierce resurgence of老牌 coins

Old coins never die, they are destined for greatness.

By TechFlow

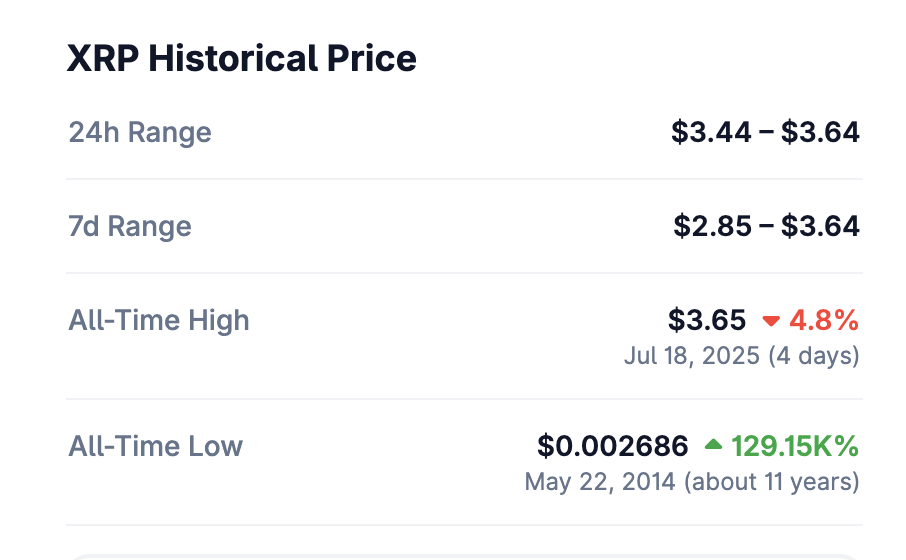

Between every rise and fall of the crypto market, some familiar names consistently reappear at the top of gainers' lists.

XRP, XLM, ADA... projects widely regarded in mainstream crypto circles as "having no future," continue to assert their presence in this new bull cycle.

They are neither innovative new layer-1 blockchains nor trending darlings riding hot narratives, nor do they boast strong ecosystems or technological breakthroughs. Yet, at a certain stage of each bull cycle,

they always manage, in ways difficult to explain, to rise against the trend, return to the spotlight, and even break new highs like XRP.

This is not merely "speculative inertia" in financial markets, but rather suggests the existence of a hidden parallel world within the crypto industry.

In this parallel world, XRP represents the future of cross-border payments, XLM embodies hope for global microtransactions, and ADA signifies a new order of smart contract governance.

Old coins never die—they carry extraordinary resilience.

The Crypto Parallel World

If the crypto market is a stage filled with rotating trends and technological innovation, then the survival ground for old coins lies behind this stage—a world almost parallel to the mainstream crypto community.

We are accustomed to discussing new narratives and projects on Twitter, Discord, Telegram, and WeChat groups, switching focus between Ethereum, Solana ecosystems, or meme coins.

Rarely do we realize that these so-called "old coins" also have vast and stable communities—except their active spaces lie outside our usual circles.

XRP, XLM, ADA, HBAR... users of these legacy assets are never active participants on crypto Twitter, nor are they speculators blindly following KOLs.

They possess their own information channels, community networks, and decision-making logic—or more directly, they simply don't care what's currently popular in the industry.

The XRP community thrives in WhatsApp, Line, and Facebook groups across Japan, the U.S., and even Latin America.

Most of these users care little about cryptographic mechanics or industry trends, yet they are well-versed in XRP’s cross-border payment narrative, support Ripple’s banking partnership model, and may even regard XRP as a "long-term asset for financial innovation."

Whether it's the SEC lawsuit against XRP or various bearish voices in the market, these users’ conviction remains largely unaffected.

The Stellar (XLM) community is similar.

In some developing countries, Stellar’s partnerships with local financial service providers have given it genuine user adoption. These users may know nothing about staking, DeFi, or on-chain innovations, yet Stellar has already become a recognized cutting-edge brand and asset in their minds.

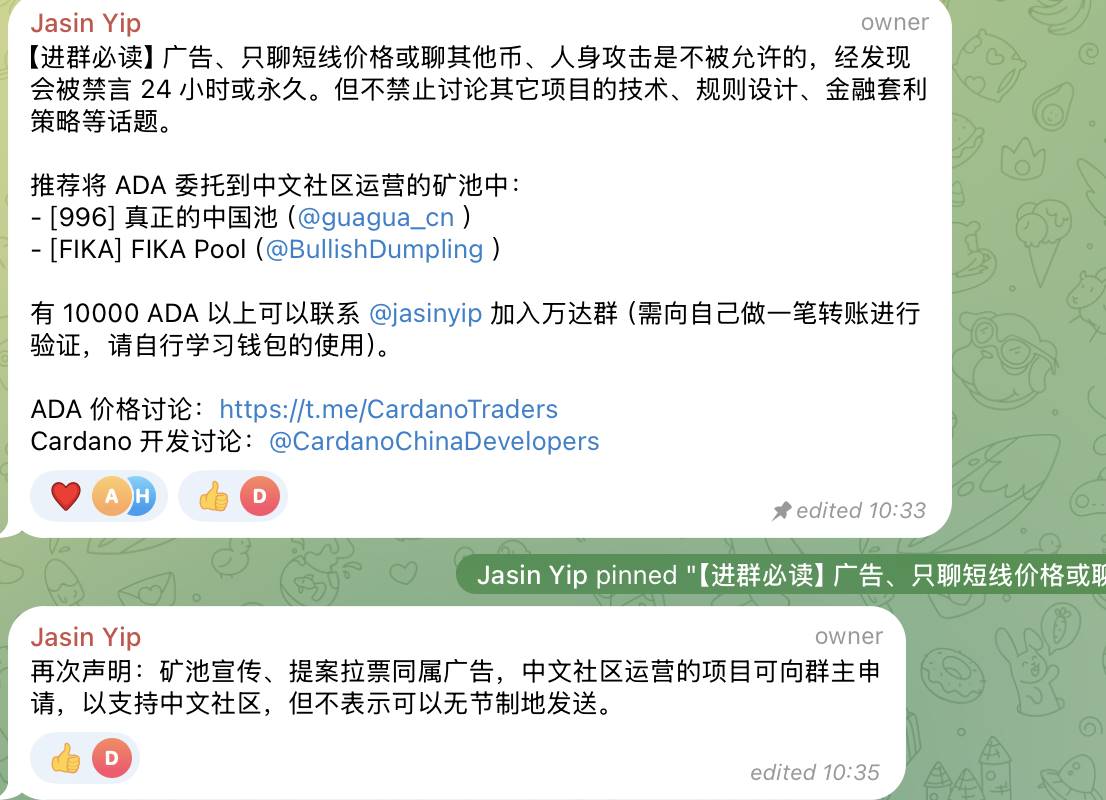

Cardano (ADA) exhibits an even more typical case of fanatical loyalty.

In Japan, Africa, Eastern Europe, and certain English-speaking countries, Cardano’s education initiatives, governance models, and community programs have cultivated a large base of devoted followers. Even in China, there exists an ADA community primarily led by programmers from major internet companies.

These individuals remain active for years on Reddit, Telegram, and regional forums, deeply familiar with Cardano’s technical roadmap and founder Charles Hoskinson’s speeches. Despite slow ecosystem growth and persistent industry skepticism, they continue to hold firmly.

To outsiders, such beliefs might seem long disconnected from reality, yet they form deeply rooted reasons for holding.

All this constitutes an ecosystem running parallel to the mainstream crypto world.

Messari analyst Sam noted on X: "Crypto Twitter constantly dismisses these 'legacy coins' because compared to the new tech they use on-chain, these tokens are outdated. They're right—but ordinary retail investors don’t understand modern on-chain technology; they just buy the coins they recognize (like XRP, ADA, XLM, DOGE)."

This world doesn't survive on hype, nor does it rise and fall with market narratives. The operating logic of these legacy coin communities resembles Web2-era user culture more closely: brand recognition, habits, emotional attachment, and even psychological inertia from long familiarity.

The survival of old coins has never relied on the mainstream crypto stage. Their vitality lies hidden in those "forgotten corners" overlooked by the mainstream.

And precisely for this reason, no exchange would easily delist XRP, XLM, or ADA.

The trading volume, active users, market depth, and hedging demand they bring are crucial components for trading platforms.

Even if project teams show no technical breakthroughs, these legacy coins maintain undeniable positions on spot, leveraged, and perpetual futures trading leaderboards.

They've become part of the market—passive investment allocations, even "old friends" in speculators’ hearts—whenever the market turns, capital will inevitably flow back.

It’s Not Just Capital—It’s Politics Too

Beyond users and communities, the economic and political power of these projects far exceeds public perception.

These so-called "outdated" crypto projects continue to shine not only due to loyal users, but also because they have already secured solid footholds in traditional finance and political capital.

Take XRP: Ripple is not an isolated tech or business entity, but a long-standing "establishment player" deeply involved in traditional finance and policy-making.

Ripple’s founding team and executives frequently appear on panels at international payment forums, U.S. Congressional hearings, and fintech summits, maintaining close ties with the Trump administration.

In January 2025, Ripple CEO Brad Garlinghouse attended a Trump dinner at Mar-a-Lago in Florida and posted a photo on X with the caption “Strong start to 2025!”

On July 19, Trump officially signed the “Genius Act” at the White House, with Ripple’s Chief Legal Officer Stuart Alderoty invited to attend—one of the few representatives from the cryptocurrency industry present.

Throughout the SEC’s prolonged lawsuit against Ripple, Ripple not only survived but achieved favorable outcomes, further cementing its political standing in discussions around "compliant crypto assets."

Beyond that, Ripple has partnered over the years with hundreds of financial institutions globally, including giants like Santander, PNC, Standard Chartered, and SBI Holdings—an extensive commercial network that serves as critical support for market confidence in XRP.

Cardano has driven blockchain education and digital identity projects with governments in Ethiopia, Rwanda, and other nations, aligning directly with national policies and governance frameworks.

Hedera’s governing council includes global corporate leaders such as Boeing, Google, IBM, and Deloitte, and has participated multiple times in U.S. domestic discussions on digital assets and distributed ledger policies. Brian Brooks, a member of Hedera’s board, is former Acting Comptroller of the Currency of the United States and a close associate of current SEC Chair Paul Atkins.

These projects operate beyond internal crypto circles, building solid foundations across political systems, regulatory consulting, and commercial collaborations. They can influence policy, negotiate regulatory compromises, and achieve "chosen" status through political and capital networks.

Therefore, when people question these old coins purely from technical or narrative perspectives, they often overlook the moats these projects have already built at the policy and capital levels.

Within this framework, what these legacy coins demonstrate isn't technological backwardness, but rather another kind of strategy—"surviving long and staying steady"—where real advantages lie in capital, commercial resources, and political shielding.

So next time you see XRP, XLM, ADA, HBAR, or others rising again on price charts, don’t be surprised, nor rush to explain them through tech or narratives.

They don’t need validation—just staying alive is enough.

Sometimes, merely "lasting long enough" is itself an underestimated competitive edge.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News