Ripple's Trillion-Yuan Market Cap: The Key to Its Success—Living Off Token Sales, Riding the Waves of Payments, ETFs, and Political Winds

TechFlow Selected TechFlow Selected

Ripple's Trillion-Yuan Market Cap: The Key to Its Success—Living Off Token Sales, Riding the Waves of Payments, ETFs, and Political Winds

XRP ETF global rollout accelerating, CEO says could launch in second half of year.

Author: Nancy, PANews

Decentralization is regarded as a core tenet of the crypto world, yet the story of legacy blockchain Ripple has been full of drama and irony. Since its inception, Ripple has faced criticism for its highly centralized token distribution model, accused of betraying the spirit of cryptocurrency. Even its own founders have admitted the company "lives off selling tokens." At the same time, this multibillion-dollar crypto project has been criticized for lacking technological innovation and underwhelming revenue performance, with Forbes bluntly labeling Ripple a "zombie company."

Nonetheless, market dynamics and reality tell a different story. Ripple has won favor among financial institutions, and its market cap frequently surges dramatically—sometimes rivaling that of traditional giants. Recently, multiple factors—including growing ETF expectations, U.S. political support, progress in payment services, and aggressive stablecoin expansion—have once again thrust Ripple into the spotlight.

Payment-Centric Strategy Drives Ripple’s Multi-Pronged Expansion

Ripple has continued advancing its business expansion this year. Cross-border payments remain its core focus, and it continues to extend its global reach—for example, by partnering with Chipper Cash to expand into Africa, collaborating with Portugal’s oldest currency exchange firm Unicâmbio to enable instant payments between Brazil and Portugal, and supporting SBI Shinsei Bank's use of Ripple’s DLT for international remittances.

To ensure ongoing legal and regulatory compliance, Ripple has aggressively pursued licensing globally. As of April 2025, Ripple has secured over 55 money transmitter licenses (MTLs), covering 33 U.S. states and regions such as Dubai. In recent months alone, it obtained money transmission licenses in New York and Texas, and became the first blockchain payment provider licensed by the Dubai Financial Services Authority (DFSA), enabling regulated cryptocurrency payment services across the UAE.

Beyond payments, Ripple is expanding its influence through its stablecoin RLUSD. Since launching in December last year, RLUSD’s market cap has climbed above $290 million. This year, Ripple accelerated efforts to broaden RLUSD’s use cases—partnering with Chainlink to enhance its utility in DeFi; teaming up with Revolut and Zero Hash to increase market coverage; and recently listing on Kraken while integrating RLUSD into Ripple Payments, its payment solution used in cross-border transactions for clients like BKK Forex and iSend. Going forward, Ripple plans to open RLUSD access to more payment platforms.

Recently, Ripple announced a $1.25 billion acquisition of crypto-friendly prime broker Hidden Road—one of the largest deals ever in the crypto industry. As a major brokerage and credit network, Hidden Road serves over 300 institutional clients, clears over $10 billion via traditional channels annually, and processes more than 50 million transactions. Following the acquisition, Hidden Road will integrate RLUSD as collateral within its prime brokerage offerings and migrate post-trade activities onto the XRPLedger blockchain. This move not only brings greater liquidity and real-world utility to RLUSD but also strengthens Ripple’s position in the real-world asset (RWA) space.

In addition, Ripple is expanding into crypto custody and wallet services. In mid-March, Ripple Labs filed a trademark application for “Ripple Custody.” According to the filing, the trademark covers financial services including storage and management of digital assets to meet financial management needs. This follows Ripple’s launch of a custodial service in October 2024, suggesting the company is seeking new revenue streams beyond payment settlements. The application also references “downloadable software for custody, transfer, and storage of cryptocurrencies, fiat, virtual currencies, and digital currencies,” hinting at potential development of an official crypto wallet. If launched, such a product could generate new income through transaction fees.

Notably, Ripple CEO Brad Garlinghouse recently revealed that the company plans to enter financial sectors including payments, real estate, and securities trading.

SEC Drops Lawsuit After Four-Year Battle; Close Ties With Trump

With Donald Trump back in power, the U.S. crypto regulatory environment has shifted significantly toward leniency, bringing a “major victory” for Ripple after years of turmoil. In March, Ripple announced that the U.S. SEC formally dropped its four-year lawsuit against the company, reaching a preliminary settlement. The SEC agreed to refund $75 million of the $125 million penalty previously ordered by the court, retaining only $50 million to close the case. In return, Ripple withdrew its cross-appeal.

"This moment has finally arrived—the one we've been waiting for. The SEC will drop its appeal. This is a complete win for Ripple, and by any measure, a win for the entire crypto industry. The future is bright. Let’s build," Garlinghouse posted at the time.

Prior to this, Ripple’s expansion in the U.S. market had been severely hampered by the protracted “security classification” dispute with the SEC. Garlinghouse previously disclosed in a Fox Business interview that the litigation forced Ripple to shift 95% of its customer base overseas. To counter this, Ripple actively engaged in U.S. political lobbying and poured substantial funds into the super PAC Fairshake during the 2024 U.S. election cycle, becoming one of the most generous corporate donors in the crypto sector.

Ripple’s apparent closeness with Trump has further fueled speculation about its U.S. growth prospects. In early January, Garlinghouse shared a photo on X showing dinner at Mar-a-Lago with Trump and others, drawing widespread attention. Shortly afterward, during the initial launch phase of the Trump-themed meme coin TRUMP, Ripple and Galaxy Digital provided MoonPay—an encrypted payments firm—with an emergency $160 million loan to handle high transaction volumes. This support was seen as crucial to TRUMP’s early explosive growth.

In mid-February, Trump shared an article about XRP on Truth Social, citing Garlinghouse’s statement that since Trump’s November 2024 election victory, Ripple had seen significant increases in U.S. business transactions and hiring. The post quickly ignited market sentiment, sending XRP trading volume soaring. Last month, Trump went further, announcing plans to include XRP and other cryptocurrencies in the U.S. Strategic Reserve—a policy declaration that sparked strong market enthusiasm.

XRP ETF Momentum Builds Globally; CEO Hints at Launch in Second Half

As the U.S. crypto regulatory landscape rapidly evolves, the surge in ETF applications is providing strong momentum for Ripple.

This year has seen frequent developments around XRP ETFs. For instance, asset manager Purpose Investments submitted a preliminary prospectus for the first Ripple ETF to Canadian securities regulators; in February, Brazil approved the world’s first spot XRP ETF, which began trading on the B3 exchange; in March, Hashdex filed an amendment with the U.S. Securities and Exchange Commission (SEC) to expand its ETF to include XRP and other cryptos; and recently, Teucrium Investment Advisors launched the first U.S.-based leveraged ETF linked to XRP, aiming to deliver double the daily return of the XRP token.

Meanwhile, prominent firms including Bitwise, Grayscale, WisdomTree, and Franklin Templeton have all submitted applications for spot XRP ETFs, though none have yet received SEC approval. However, Nate Geraci, president of The ETF Store, believes the conclusion of Ripple’s legal battle with the SEC means approval of a spot XRP ETF is “clearly just a matter of time.” Bloomberg analyst James Seyffart shares a similar view, predicting an XRP ETF could launch within months—possibly starting with futures-based products.

Garlinghouse, in an interview with Bloomberg TV, indicated that an XRP ETF could arrive in the second half of 2025, with approximately 11 different XRP ETF filings currently awaiting SEC review. He also suggested that an IPO for Ripple Labs is not out of the question.

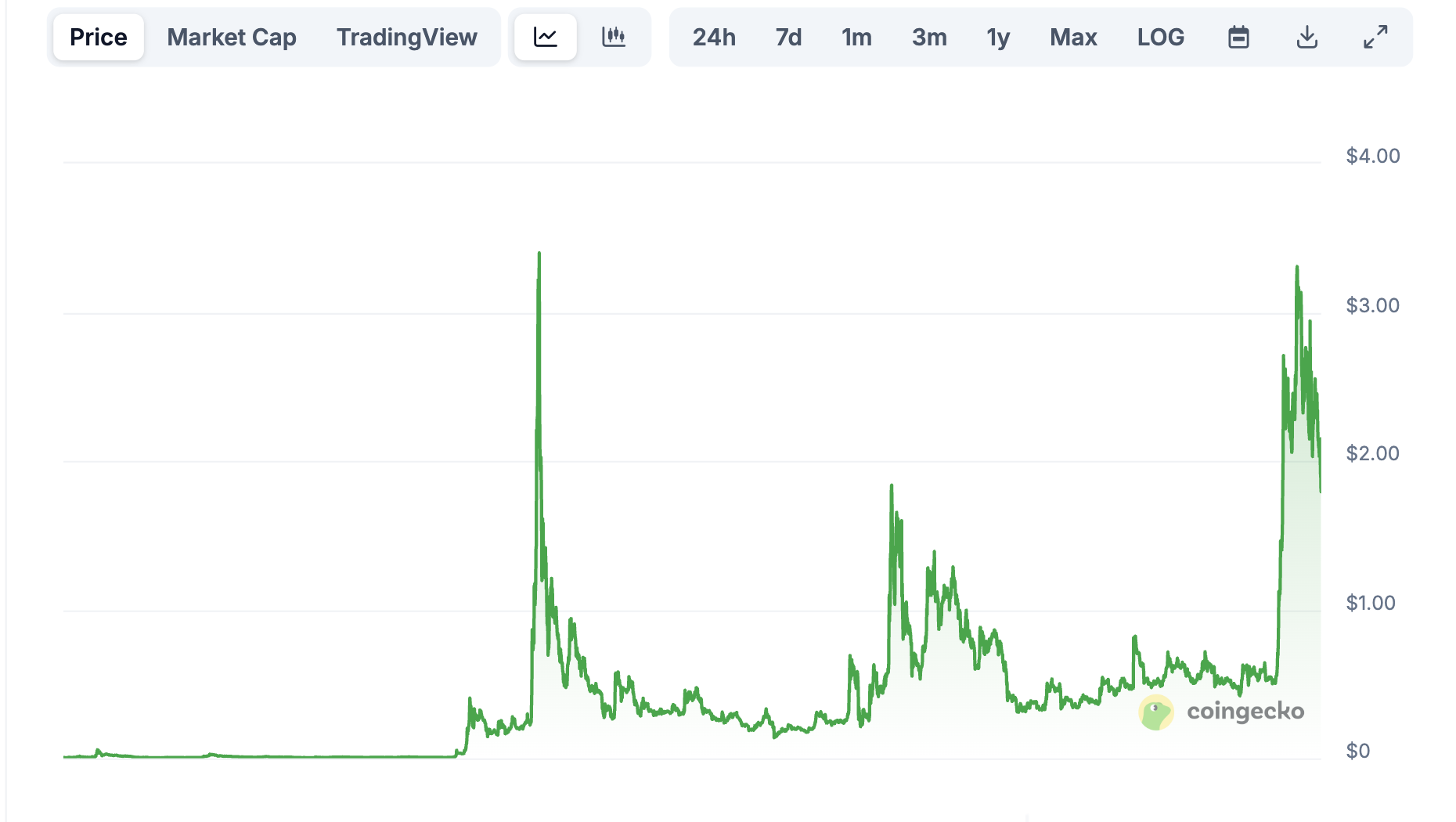

Token Hits Multi-Year High Amid Ongoing Debate Over Token Model

Driven by multiple positive catalysts, XRP’s price has seen significant gains. According to CoinGecko data, XRP rose as much as 70.62% from the start of the year to $3.30, marking its highest level since January 2018.

Garlinghouse stated outright that with rising XRP prices and increasing demand for Ripple’s blockchain solutions, the company’s previous $11 billion valuation is now “severely outdated.”

Standard Chartered recently released a report stating that XRP surged sixfold in the six months following Trump’s election. This rally is sustainable, partly due to changes in SEC leadership and because XRP uniquely occupies a central role in one of digital assets’ most promising application areas—cross-border and cross-currency payments. Additionally, the XRP Ledger (XRPL) aligns closely with key use cases for stablecoins like Tether, particularly facilitating financial transactions for traditional finance (TradFi) institutions via blockchain. Stablecoin transaction volume is projected to grow tenfold over the next four years. Ripple also plans to expand XRPL into tokenization, suggesting XRP could keep pace with its biggest competitor, Bitcoin. The bank forecasts XRP could reach $12.50 before Trump leaves office. However, Standard Chartered also notes two drawbacks facing XRPL: limited developer activity and weak value capture mechanisms.

Still, Ripple’s token model remains controversial. Pierre Rochard, Vice President of Research at Riot Platforms, warned investors: “You are not investing in Ripple the company—you’re simply getting tokens created out of thin air. XRP isn’t a security because Ripple doesn’t actually owe you any ‘utility’ or anything else.” In response, Ripple CTO David Schwartz said, “Ripple can, will, and should act in its own interest. Investors shouldn’t expect Ripple to benefit them at the expense of the company and its shareholders.” This implies Ripple retains the right to sell XRP tokens for operational funding, raising investor concerns. Indeed, Garlinghouse once admitted, “If we didn’t sell our XRP holdings, we wouldn’t be profitable or generate positive cash flow.”

Public records show that XRP has a total supply of 100 billion tokens. Of these, 20 billion are held by three co-founders—Chris Larsen, Jed McCaleb, and Arthur Britto—with the remaining 80 billion allocated to Ripple Labs.

To ease market concerns over XRP supply, Ripple has since 2017 placed 55 billion XRP (55% of total supply) into escrow accounts on the XRP Ledger. These smart contract-controlled accounts release 1 billion XRP per month automatically, later adjusted to 450 million monthly after 2020. However, not all unlocked tokens enter circulation immediately. Ripple typically uses only a portion (e.g., 20%-25%) for market sales, re-escrowing the remainder for future release.

It’s important to note that Ripple’s founders still hold large amounts of XRP. According to crypto investigator ZachXBT’s disclosure in March, addresses associated with co-founder Chris Larsen continue to hold over 2.7 billion XRP (worth approximately $7.18 billion). In January 2025, these Larsen-linked addresses transferred over $109 million worth of XRP to exchanges.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News