Ripple: A Sophisticated Experiment in High-End Financial Populism

TechFlow Selected TechFlow Selected

Ripple: A Sophisticated Experiment in High-End Financial Populism

Ripple: Creating Value or Manufacturing Belief?

Author: YettaS

Yesterday, a single statement from the president sent $XRP soaring, briefly surpassing $ETH in FDV to become second-ranked. While XRP has long been famous, few people actually understand what it does. Is Ripple a massive scam? If not, why do we almost never see real end-users in daily life? How significant is Ripple's business scale, and can it justify its current valuation? If not, then what exactly is supporting its value?

This article will break down Ripple’s business logic, confront its challenges and controversies, and explore how it turns "populism" into a feast of capital and technology—from its innovations in cross-border payments to the central role of XRP as a bridge currency.

What Kind of Business Is Ripple?

Ripple operates in the cross-border payments space. Traditional cross-border payment processes consist of two flows: information flow and fund flow. The information flow uses SWIFT to standardize messaging across sending and receiving countries. The fund flow involves clearing and settlement between the initiating bank and the recipient bank. If these banks lack a direct relationship, intermediary banks—often multiple—are required to transfer funds. This leads to three main problems: 1. Long processing times, 2. High costs, 3. Low transparency.

Crypto is well-suited to solve issues related to fund transfer and settlement.

Let’s first look at stablecoin-based solutions: A local OTC or payment company receives foreign currency, converts it into USD via a bank, then exchanges that USD for USDT through an OTC provider like Cumberland. USDT is then transferred on-chain, and upon receipt, another OTC process converts USDT back to USD before final conversion into local currency via banking channels. In this model, transferring and settling with USDT becomes simple—but the complexity and moat lie in the OTC network itself. Using USDC makes the process slightly easier, since users can directly deposit and withdraw via regulated platforms working with Circle.

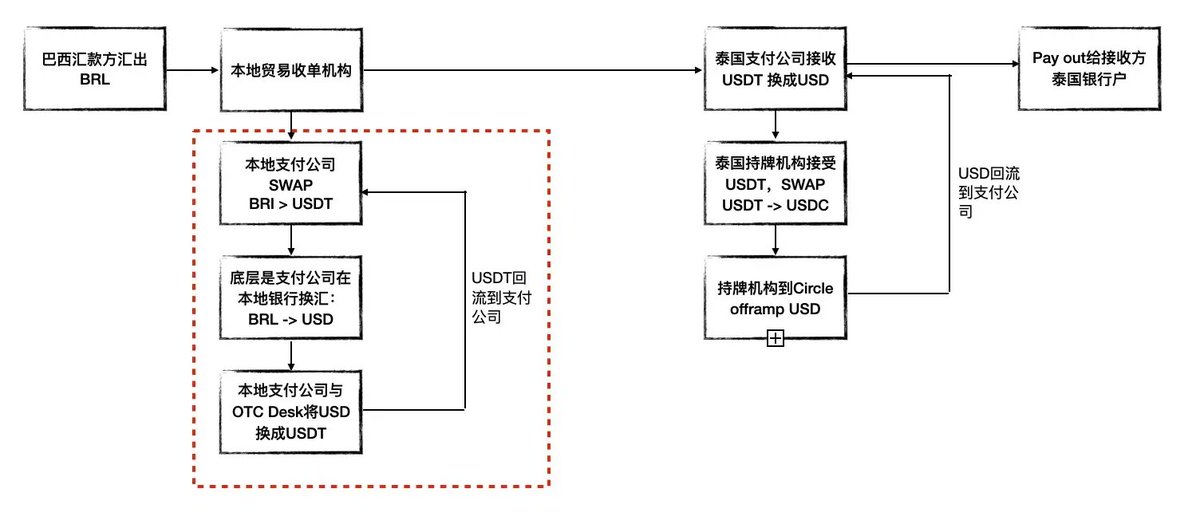

The diagram below illustrates a transaction path starting with USDT and ending with USDC. In reality, the red-boxed section in the diagram represents the crux of stablecoin-based cross-border payments: having OTC providers constantly available to support USDT deposits and withdrawals. These intermediaries tie up substantial capital, making this the most expensive part of the cross-border pipeline—and thus Tether’s key competitive advantage. As I discussed in “Consensus in the Crack: Tether and the New Global Financial Order,” various channels and exchange platforms have effectively become Tether’s workforce, helping expand its network globally.

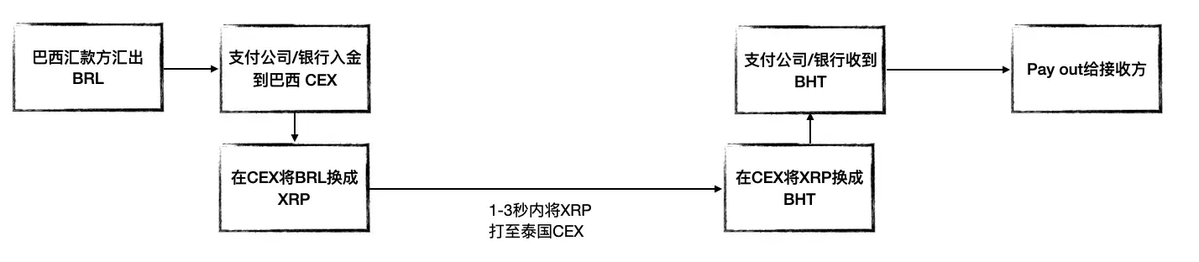

Ripple offers an even simpler alternative than stablecoins. Its process involves converting foreign currency into XRP via local banks or payment institutions on a CEX, transferring XRP to a CEX in the destination country, and then exchanging XRP for local currency. The diagram below shows an example from Brazil to Thailand, following the currency path BRL → XRP → THB. In essence, Ripple uses XRP as a bridge currency to rebuild the foreign exchange market.

Ripple provides an elegant and efficient solution for cross-border payments. In traditional SWIFT or stablecoin-based models, capital immobilization has always been a pain point. Banks or OTC providers typically need to pre-fund accounts to ensure smooth transactions—for instance, holding sufficient USD for exchange or stocking large amounts of USDT. This pre-funding (pre-funding) is cumbersome and severely reduces capital efficiency. Ripple’s innovation lies in leveraging CEX liquidity mechanisms to avoid this requirement entirely—enabling asset swaps directly on exchanges. This is precisely the concept behind their On-Demand Liquidity (ODL) offering.

What Makes Rebuilding This FX Market Possible?

Ripple isn't just running a conventional business—it's attempting to drive an entirely new model for international remittances. From a regulatory perspective, policies and viable transaction models vary significantly by region. Ripple has taken on the challenge alone, striving to push forward this transformative shift.

Two key elements underpin Ripple’s development strategy:

-

Bank BD (Business Development): Convincing banks to adopt the XRP-based cross-border payment solution.

-

CEX Market Depth: Ensuring sufficient liquidity in XRP trading markets across regions to support global currency conversions.

Ripple hasn’t skimped on execution.

First, regarding bank partnerships: Prior to 2017, Ripple wasn’t deeply involved in monetary operations. Its initial goal was to replace SWIFT by leveraging advantages in the information layer, forming strategic collaborations with major banks worldwide and educating the market. For example, in September 2016, SBI (Strategic Business Innovator) acquired a 10.5% stake in Ripple for $55 million. That same year, SCB (Siam Commercial Bank) also invested in Ripple. It wasn’t until 2017 that Cuallix became the first financial institution to pilot XRP as a bridge currency. The use of XRP as a bridge only scaled widely during the pandemic.

This also explains why genuine usage cases of Ripple are rarely visible online. Ripple’s cross-border payment solution doesn’t expose itself directly to end users or merchants. Instead, it operates behind the scenes through banking channels—meaning recipients and senders don’t need to know which system processed the transfer. In fact, even if banks route just a small fraction of their transactions through Ripple, it would be enough to sustain the entire business model.

Second, concerning CEX market depth: Ripple must build a global CEX network ensuring deep XRP trading liquidity—available 24/7, with low slippage and seamless deposit/withdrawal functions. On this front, Ripple has made significant investments. In 2019, Ripple invested in Bitso, Mexico’s first major CEX, later expanding its influence into Brazil and Argentina. Meanwhile, Coins.ph, a leading Philippine exchange, became an authorized Ripple partner and preferred CEX for XRP payments, further enhancing Ripple’s market penetration.

Ripple is fundamentally a highly BD-driven operation. A quick look at LinkedIn reveals a large team dedicated to business development and marketing, staffed predominantly with professionals from top consulting firms and investment banks—a level of sophistication most players cannot match.

How Well Is Ripple Doing in This Business?

In 2023, the global cross-border payments market reached approximately $190 trillion. By contrast, Ripple has facilitated around 35 million transactions totaling about $70 billion—minuscule relative to the overall market size.

I interviewed a Latin American OTC trader whose annual cross-border volume reaches $100–150 million—this from just one ordinary OTC desk. Compared to such figures, Ripple’s transaction volume pales in significance even against stablecoin-based payment systems.

Industry norms set cross-border fees between 1% and 2%. Based on this, Ripple generating profits purely from payment fees would yield negligible returns.

Moreover, in its early days, Ripple heavily subsidized partners to encourage adoption. For instance, in Q2 2020 alone, Ripple paid $15 million in incentives to MoneyGram, once the world’s second-largest money transfer company, to use its network.

Ripple’s Next Move—Expanding Into Custody and Stablecoins

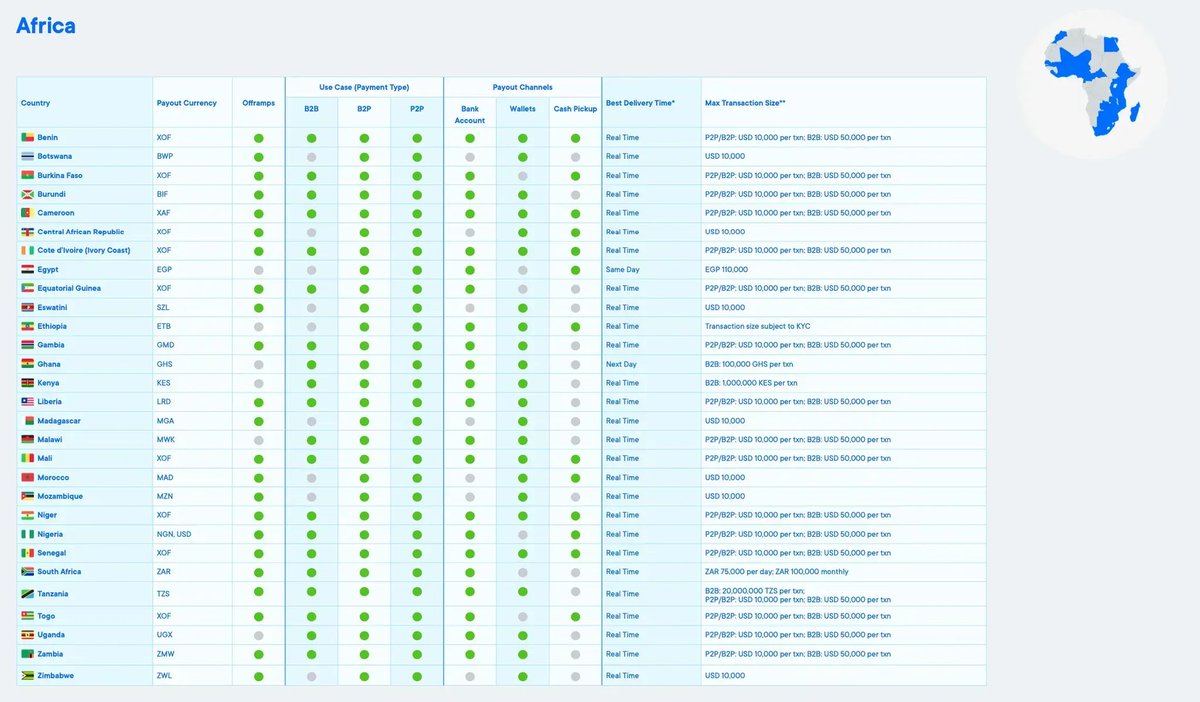

Unlike Tether, which leverages the dollar’s inherent global liquidity and reinforces U.S. monetary dominance, Ripple’s ecosystem relies entirely on self-built infrastructure and alliance-building. Given this constraint, its growth ceiling is evident. To overcome this, Ripple has expanded strategically along three enterprise-focused business lines: Payments, Custody, and Stablecoins.

In May 2023, Ripple acquired Swiss custody firm Metaco for $250 million.

In June 2024, Ripple completed the acquisition of Standard Custody, which holds nearly 40 U.S. money transmission licenses, a Major Payment Institution (MPI) license from Singapore’s Monetary Authority (MAS), and VASP registration with Ireland’s Central Bank. Jack McDonald, CEO of Standard Custody, now serves as Senior Vice President of Stablecoins at Ripple—an indication that Ripple is laying the groundwork for stablecoin issuance.

In December 2024, Ripple officially launched its stablecoin RLUSD, receiving approval from the New York State Department of Financial Services (NYDFS).

At this point, Ripple can be viewed clearly as a full-fledged fintech company, with three distinct and well-defined business pillars.

How Has Crypto Helped Ripple?

If Ripple’s core business isn’t highly profitable, how does it generate revenue? The answer is simple: Selling tokens.

The prolonged legal battle between Ripple and the SEC originated precisely from token sales. The SEC alleged that Ripple sold over $1.3 billion worth of XRP to 1,278 institutional investors as unregistered securities, violating federal securities laws, and sought a $2 billion fine. Ultimately, in August 2023, the court ruled Ripple must pay approximately $125 million, though the judge noted that its On-Demand Liquidity (ODL) service might still cross legal boundaries.

Why could Ripple sell so many tokens?

As previously mentioned, On-Demand Liquidity (ODL) is central to Ripple’s cross-border solution. As long as XRP maintains strong liquidity, participants can avoid pre-funding and instead use XRP for instant exchange during transfers. Crucially, ODL enables Ripple to monetize continuously—especially since Ripple itself remains the largest holder of XRP. Moreover, positioning XRP as a bridge currency rather than a security strengthens its argument against classification as a security.

On-Demand Liquidity is a brilliant triple-win mechanism within Ripple’s business model.

Ripple tightly links operational demand with XRP circulation. The utility-driven liquidity of XRP forms the foundation of its narrative and gives Ripple greater flexibility in capital markets.

A High-End Financial Populism Experiment

Ripple’s business model has gradually shifted from product-centric to capital-centric, evolving into a “market consensus-driven” profit engine. This is why some jokingly refer to Ripple as a blue-chip meme coin—its price moves primarily on policy-related news and sentiment.

In my view, Ripple’s business logic represents a sophisticated “financial populism experiment.” By packaging real cross-border payment pain points, it attracts participation from mainstream financial institutions while exploiting cognitive biases among crypto retail investors to amplify the perceived strategic importance of its business. As a result, Ripple has moved beyond the traditional fintech model of “product growth → revenue generation” into a high-risk, high-reward domain driven more by “market narratives” and “capital dynamics.”

We cannot know Ripple’s original intent—whether it aimed to raise capital to advance technological progress or used a marginally useful product as a vehicle for financial arbitrage. But there’s no denying Ripple’s masterful grasp of financial populism.

In financial markets, value creation and value perception are often misaligned—especially in the highly speculative crypto environment, where “market consensus” itself can become a business model. Ripple exemplifies this phenomenon perfectly. It neither relies solely on product growth like traditional fintechs nor depends purely on liquidity bubbles like speculative crypto projects. Instead, it skillfully navigates between regulated finance and decentralized ecosystems—using institutional credibility to build trust while amplifying its narrative through policy shifts and market sentiment.

Is Ripple creating value—or manufacturing belief? At the heart of high-end financial populism lies precisely this ambiguity.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News