OpenAI slams Robinhood for unauthorized stock tokenization—whose interests are being affected?

TechFlow Selected TechFlow Selected

OpenAI slams Robinhood for unauthorized stock tokenization—whose interests are being affected?

The real game is a battle for IPO pricing power.

Author: Azuma, Odaily Planet Daily

Thanks to a series of aggressive moves into the "stock tokenization" market, Robinhood has dominated headlines across major financial media outlets over the past few days, with its stock price breaking through $100 to reach an all-time high.

Beyond bringing already-listed stocks onto blockchain markets via tokenization, Robinhood has extended the scope of stock tokenization to private, pre-IPO companies. It plans to gift EU users tokenized shares of OpenAI and SpaceX—both not yet publicly listed—a move widely interpreted by the market as Robinhood’s attempt to seize pricing power in the Pre-IPO market.

OpenAI Condemns Robinhood for Unauthorized Action

However, in the early hours of July 3, OpenAI issued a clarification on X stating: "These so-called OpenAI tokens are not equity in OpenAI. We do not have a partnership with Robinhood, are not involved in this initiative, and do not endorse it. Any transfer of OpenAI equity requires our approval — and we have not approved any such transfers. Please be cautious."

In response to OpenAI's criticism, Vlad Tenev, co-founder and CEO of Robinhood, posted on X: "In our recent cryptocurrency campaign, we announced that we would offer limited tokenized shares of OpenAI and SpaceX to eligible European customers. While strictly speaking, these tokens are not 'equity' (those interested can review our terms for specifics), they effectively provide retail investors access to these private assets. Our giveaway is just the beginning of a broader vision. Since our announcement, we’ve received numerous letters from private companies eager to join us in this tokenization revolution."

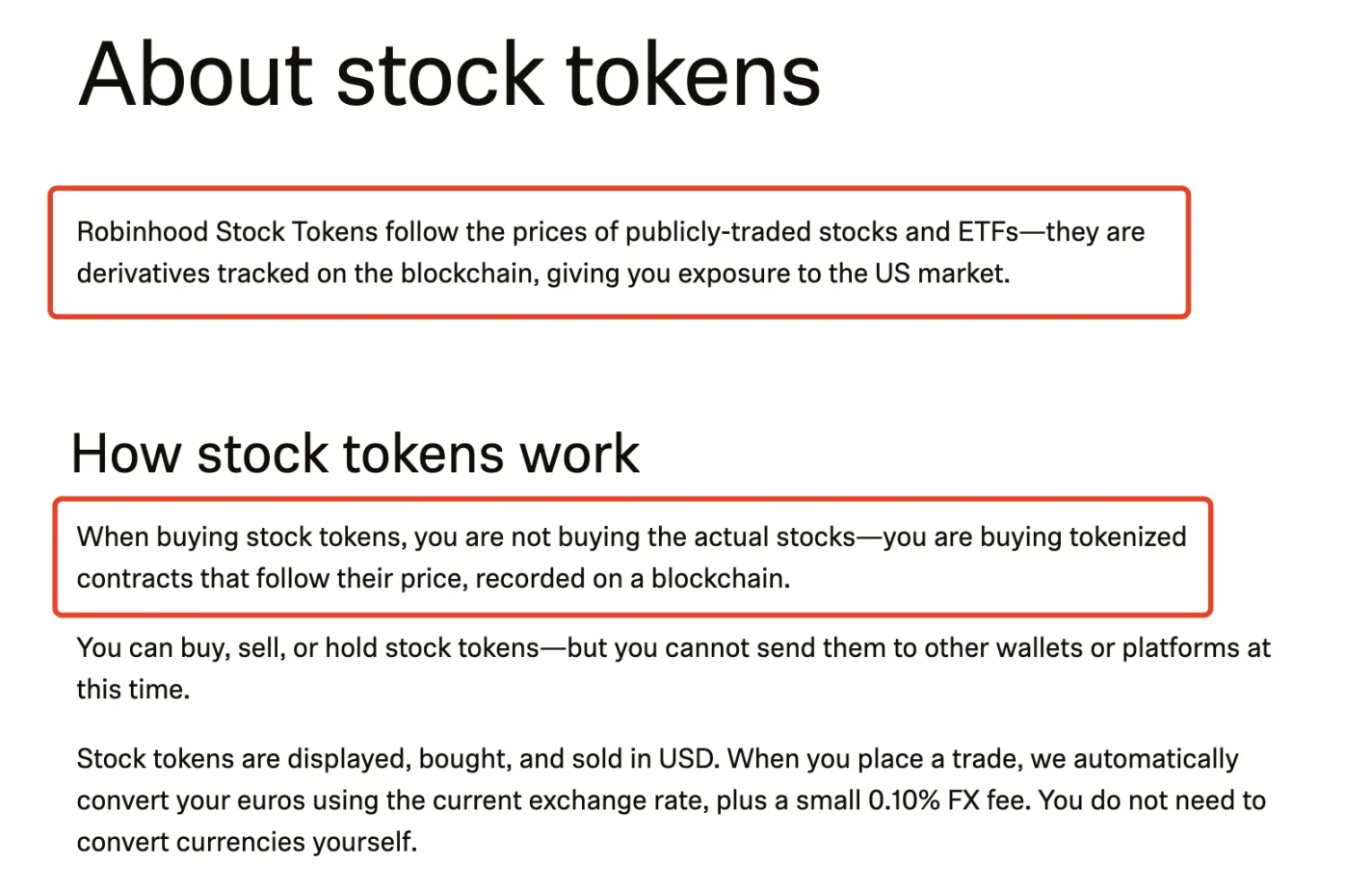

Regarding Vlad Tenev’s statement that the tokens “are not equity,” Robinhood’s product documentation provides further detail: "Robinhood stock tokens track the prices of publicly traded stocks and ETFs. They are derivatives on blockchain that mirror price movements... When you purchase a stock token, you are not buying actual shares, but rather a tokenized contract that follows the share price and is recorded on the blockchain."

Core Controversy: Can Private Company Shares Be Tokenized?

As two of today’s most prominent players in the financial world, OpenAI’s public rebuke of Robinhood quickly ignited widespread debate across the market. The central question: Can shares of private companies like OpenAI and SpaceX be tokenized? Do platforms like Robinhood—or derivative issuers—require authorization from the underlying company? And can private firms restrict the circulation of such tokenized shares?

Odaily Note: Notably, Elon Musk, long embroiled in disputes with OpenAI, took the opportunity to mock OpenAI for having only “fake stocks.” Musk’s conflict with OpenAI stems from its shift from a nonprofit to a for-profit entity—an ongoing saga closely watched across the tech industry. Interested readers may search for more details independently.

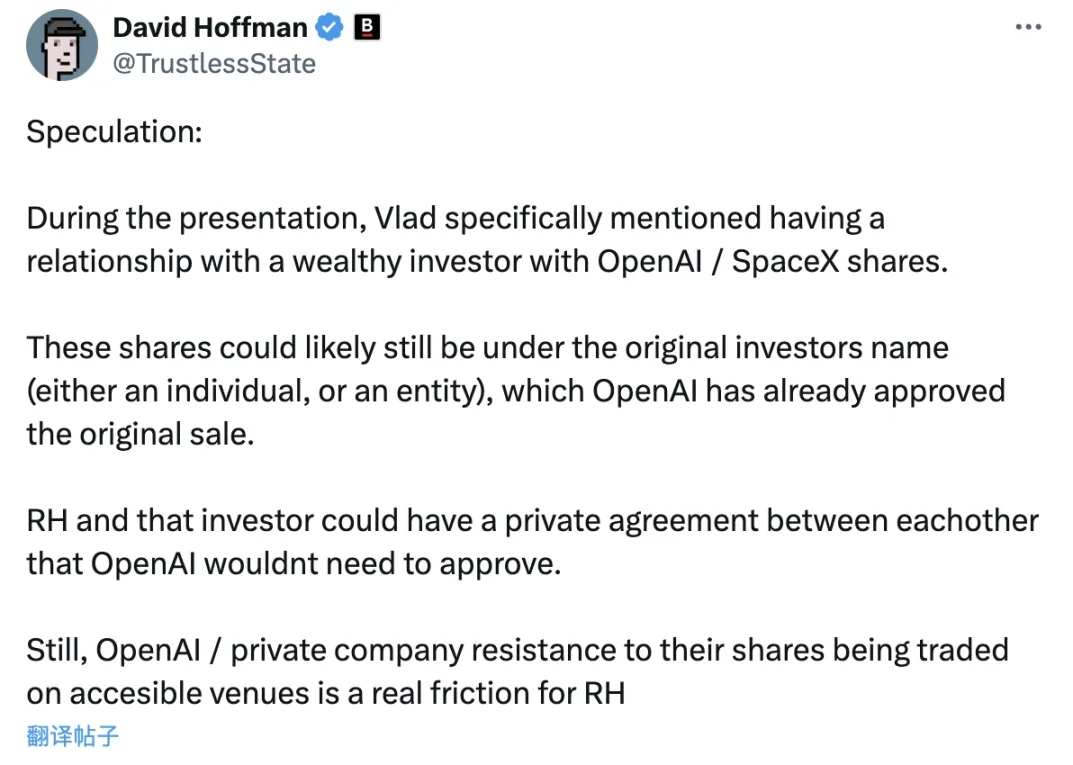

David Hoffman, founder of Bankless, speculated that Robinhood might have reached an agreement with an individual holding OpenAI/SpaceX shares: "Vlad Tenev specifically mentioned during a presentation his connection with a wealthy investor who owns OpenAI/SpaceX shares. These shares likely remain legally owned by the original investor (an individual or entity), and OpenAI may have already approved that investor’s sale of equity. In this case, Robinhood and the investor could enter into a private agreement without needing OpenAI’s direct approval. Nevertheless, private companies like OpenAI can still refuse to recognize trading of their shares on accessible platforms, creating real friction for Robinhood."

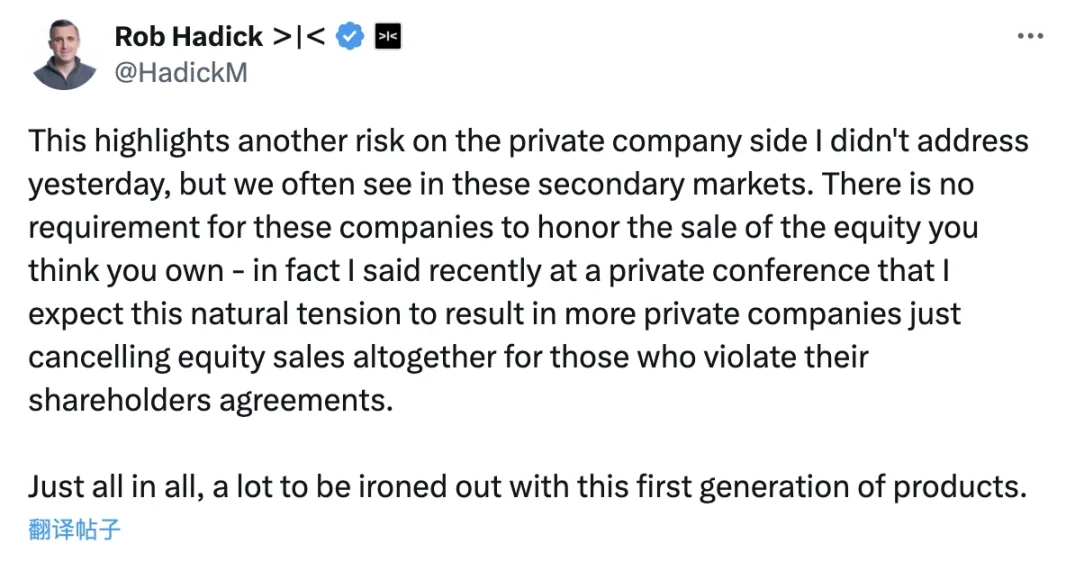

However, Dragonfly partner Rob Hadick pointed out another potential risk: private companies like OpenAI might later invalidate completed equity sale agreements on grounds of breach: "OpenAI’s clarification highlights another risk I didn’t mention yesterday—the risk from the private company side—but these issues frequently arise in secondary markets. Private companies aren't obligated to recognize your claimed right to transferred equity. In fact, I recently said at a closed-door meeting that I expect such inherent contradictions will lead more private companies to outright cancel equity sales that violate shareholder agreements. Overall, many issues with this generation of products remain unresolved."

VC lawyer Collins Belton offered a more detailed legal explanation. He noted that many non-VC lawyers believe securities laws and other regulations primarily govern the trading of private and public stocks—which is partly true. However, additional contractual obligations between shareholders and the company also apply. For example, a company can include provisions in its charter, memorandum, or terms stipulating that certain or all shares cannot be 'transferred' without the company’s consent. The term 'transfer' is often broadly defined, encompassing not just direct sales but also pledging and creating derivatives.

Collins added that popular late-stage Silicon Valley startups typically impose secondary market restrictions via contracts. In earlier-stage companies, these may only apply to common stockholders, especially when VCs hold influence. But as companies grow hotter and more mature, such restrictions usually extend to all shareholders—including prominent venture capitalists.

Collins also commented: "I was initially curious whether emerging stock tokenization platforms like Robinhood or xStocks had solved this issue. I assumed that given Robinhood’s scale, they might have addressed this potential problem. But based on OpenAI’s statement, I suspect they haven’t. Either they’re pretending not to know, or they genuinely don’t understand the restriction."

According to Collins’ legal analysis, if OpenAI indeed signed additional agreements with investors restricting the 'transfer' of shares, then Robinhood’s tokenization of OpenAI stock—even if structured as derivatives—should be subject to those limitations. Given OpenAI’s statement that “any transfer of equity requires our approval,” it’s highly likely such restrictive agreements exist. However, since Robinhood hasn’t disclosed the source of these shares, the market currently cannot verify the exact terms between OpenAI and the unnamed investor.

The Underlying Battle: A Fight for Pricing Power

OpenAI and Robinhood are now in open confrontation, with neither side showing signs of backing down. This isn’t merely about whether stocks can be tokenized—it’s fundamentally about the battle for IPO pricing authority.

Chen Yuetian, founder of Fengfeng Capital, analyzed the situation on social media: "After purchasing shares of OpenAI and SpaceX in the primary market, Robinhood issued tokenized STOs on its own platform. Remember, OpenAI hasn’t gone public and currently has no IPO plans. These are private equities that ordinary people couldn’t access before due to high entry barriers. Now, Robinhood buys them and tokenizes the rights, enabling secondary-market pricing. This means a tradable valuation emerges even before any official IPO. Moreover, because Robinhood holds only a small number of shares while facing massive demand, the price will inevitably be inflated—effectively seizing IPO pricing power."

In traditional finance, IPO pricing is led by lead underwriters working closely with the issuing company, setting prices based on funding needs and growth expectations. But with Robinhood entering as a disruptive force, previously untradable private equity now gains a secondary market where anyone, regardless of wealth, can freely trade on-chain. This enables robust price discovery for private shares well before IPO, shifting pricing power away from the company and its underwriters—a scenario OpenAI clearly wants to avoid.

From the Retail Investor’s Perspective: Should You Jump In?

Given the current situation, when tokenizing already-listed stocks with clear public pricing, platforms like Robinhood have some historical precedent and a relatively straightforward implementation path. But tokenizing shares of private firms like OpenAI and SpaceX is largely uncharted territory, and Robinhood’s current approach remains highly uncertain.

Dragonfly partner Rob Hadick emphasized: "Robinhood deliberately maintains extreme opacity regarding the precise nature of these derivatives, how they're hedged, who the counterparty is (where the equity comes from), and what legal recourse investors actually have. Most importantly, private company equity is being used to create derivatives of an asset without a public price, involving various securities/profit-sharing schemes traded at different valuations. Furthermore, how these derivatives settle under different corporate actions is completely opaque."

From a retail investor’s standpoint, uncertainty sometimes represents opportunity—but more often, it signals risk.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News