Crypto Market Welcomes New Asset: Will Stock Tokens Be the Next Breakout?

TechFlow Selected TechFlow Selected

Crypto Market Welcomes New Asset: Will Stock Tokens Be the Next Breakout?

Robinhood is taking a route somewhat akin to USDC, while Kraken is targeting something more like USDT; one represents the establishment, the other the grassroots.

Author: XinGPT

Recently, U.S.-listed fintech company Robinhood and cryptocurrency exchange Kraken have launched stock token services. Let’s dive into what stock tokens are and why they’re capturing market attention, with insights from XinGPT Research.

Robinhood Leads the Innovation Wave in Stock Tokens

Fintech giant Robinhood has recently launched its highly anticipated Stock Tokens in the European Union (EU), aiming to offer European users a new way to trade equities. This innovative service allows users to buy and sell dollar-denominated derivatives that track underlying stock prices. Robinhood automatically handles EUR/USD conversions on the back end, charging a 0.1% foreign exchange fee.

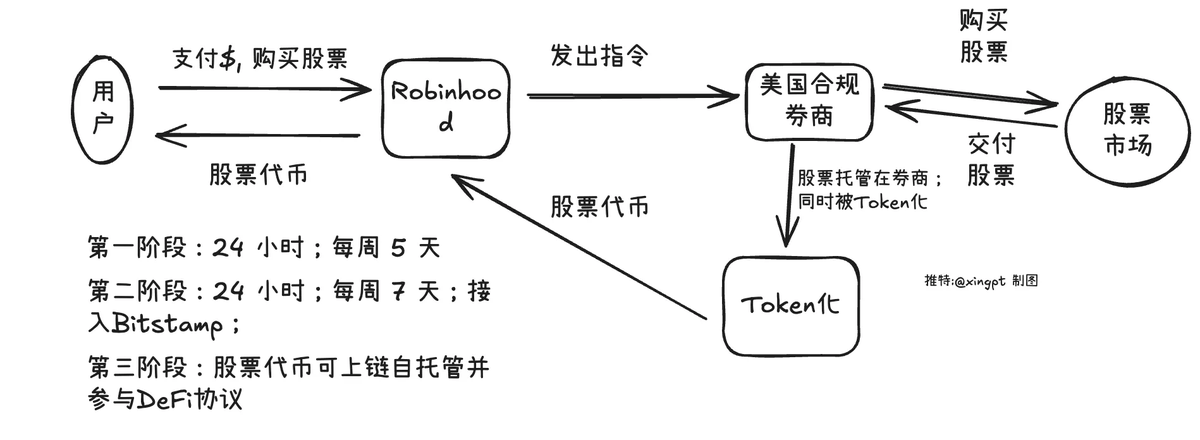

The stock tokenization process is illustrated below:

1. Custody and Mapping Mechanism

The core of Robinhood's stock tokens lies in its unique custody and mapping structure. These tokens are price-tracking derivatives—not direct representations of securities—backed by assets securely held by a U.S.-licensed institution within Robinhood’s European accounts. Robinhood Europe issues these contracts and records them on a blockchain. Importantly, due to their derivative nature, the underlying securities remain locked in Robinhood’s custody, and users cannot directly redeem them.

2. Regulatory Compliance Under EU’s MiFID II Framework

Robinhood offers its stock tokens as derivative contracts under the EU’s MiFID II (Markets in Financial Instruments Directive II) regulatory framework. The company leveraged its acquisition of Bitstamp, which holds an MTF (Multilateral Trading Facility) license—a requirement for firms offering derivative trading services in the EU. This ensures Robinhood’s operations are regulated within the region, providing users with compliance safeguards. However, it should be noted that Robinhood stock tokens are currently only available in the EU and are not tradable in the United States.

3. Trading Hours and Corporate Action Handling

During the initial phase, Robinhood stock tokens are available for trading five days a week, from Monday 02:00 to Saturday 02:00 Central European Time (CET)/Summer Time.

For corporate actions (e.g., dividends, splits, mergers), Robinhood manages them on behalf of users:

-

Position Adjustments: In cases such as stock splits, reverse splits, ticker changes, or spin-offs, your stock token holdings may be automatically adjusted to reflect changes in the underlying shares.

-

Cash Distributions: For events like mergers, acquisitions, delistings, or liquidations, you may receive cash distributions denominated in euros.

-

Dividends: Cash dividends are processed automatically. You will receive dividend payments in euros, recorded in your transaction history as cash distributions. No FX fees apply to dividend payouts, though withholding taxes may apply depending on your jurisdiction.

-

Funds from selling stock tokens can be used immediately for trading and become withdrawable on T+1.

4. Stock Tokens on Blockchain

Robinhood utilizes blockchain technology to issue its stock tokens, initially built on Arbitrum, with plans to migrate to Robinhood’s own Layer 2 blockchain in the future. This reflects Robinhood’s commitment to leveraging blockchain for greater efficiency and transparency.

Robinhood’s launch of stock tokens undoubtedly broadens investment options for European users. However, as a novel derivative product, investors should fully understand its mechanics, risks, and regulatory context before participating.

5. Expansion into Private Equity: Tokenized OpenAI and SpaceX Shares

As part of a broader cryptocurrency expansion strategy, Robinhood has made a landmark move by enabling retail access to private equity via blockchain—launching tokenized shares of OpenAI and SpaceX for European users. This breakthrough was made possible by the EU’s more flexible regulatory environment, allowing everyday investors to gain exposure to pre-IPO companies typically reserved for insiders and high-net-worth individuals.

Kraken’s Approach Is More Crypto-Native and Open

1. Custody and Mapping Mechanism

-

Custody: xStocks are backed by real stocks or ETFs purchased and custodied by Backed Finance through regulated third-party custodians such as Alpaca Securities (U.S.), InCore Bank, and Maerki Baumann (Switzerland). Each xStock token is 1:1 pegged to its underlying asset. The custody process is strictly regulated to ensure security and transparency. The platform emphasizes that Backed Finance’s Proof of Reserves, verified regularly via Chainlink, ensures token-to-asset parity.

-

Mapping: xStocks are SPL tokens on the Solana blockchain, representing fractional ownership of real-world stocks or ETFs. Tokenization is executed via smart contracts, with prices synchronized in real time to traditional markets using Chainlink oracles. Users can transfer xStocks to Solana-compatible wallets (e.g., Phantom) and use them across DeFi protocols (e.g., Raydium, Jupiter, Kamino) for trading, liquidity provision, or collateral. Notably, xStocks can be redeemed at any time for the cash value of the underlying asset, with fast and efficient settlement.

-

Additional Details: xStocks support fractional ownership with minimum investments as low as $1, making them accessible to retail investors. Tokenization eliminates traditional brokerage bottlenecks, reducing cross-border investment costs and latency.

2. Regulatory Compliance and Licensing

-

Compliance Framework: Kraken and Backed Finance actively engage with global regulators to ensure xStocks comply with local laws. Kraken enforces strict KYC and AML procedures, requiring all users to complete identity verification. The issuance and trading of xStocks fall under Backed Finance’s regulatory framework, with full terms available in the Base Prospectus on backed.fi.

-

Regional Restrictions: xStocks are currently unavailable to users in the U.S., Canada, the UK, EU, and Australia. Target markets include parts of Europe, Latin America, Africa, and Asia. While mainland China is not explicitly mentioned on the website, a post on X indicates Chinese users are not restricted from registration—though this requires further verification.

-

Regulatory Challenges and Outlook: The platform acknowledges the complex international regulatory landscape for tokenized securities. Kraken is in dialogue with regulators and plans to gradually expand into additional jurisdictions, emphasizing a compliance-first approach to mitigate legal risk.

-

Additional Details: Kraken holds a MiCA (Markets in Crypto-Assets Regulation) license in the EU, supporting compliant operations in Europe and potentially laying the groundwork for future expansion of xStocks in select EU regions.

3. Trading Hours and Corporate Action Handling

-

Trading Hours: xStocks enable 24/5 trading (Monday to Friday), breaking free from traditional U.S. market hours (9:30–16:00 ET). Trading is supported both on Kraken and directly on-chain via compatible wallets (e.g., Phantom). During market closures (weekends and U.S. holidays), on-chain trading continues based on the last closing price from Chainlink oracles and market supply-demand dynamics, potentially leading to “prediction market”-like price movements. Kraken aims to eventually offer 24/7 trading.

-

Corporate Actions: xStock holders do not have voting rights or participation in shareholder meetings. Dividends are indirectly distributed through price adjustment mechanisms—effectively airdropping equivalent-value tokens based on holdings—to preserve economic benefits. Other corporate actions (e.g., splits, mergers) are managed by Backed Finance, with token quantities or values adjusted accordingly.

-

Additional Details: On-chain settlement for xStocks is instant (T+0), a significant improvement over traditional T+2 clearing. Integration with DeFi (e.g., using xStocks as collateral on Kamino Lend) enhances flexibility, though liquidity depth during off-hours may be limited, increasing slippage risk.

4. Supported Blockchains and Issuance Status

-

Supported Blockchains: xStocks are currently issued on the Solana blockchain using the SPL token standard. Solana was chosen for its high throughput (thousands of transactions per second), low fees (~$0.01 per transaction), and mature DeFi ecosystem (e.g., Raydium, Jupiter). Kraken and Backed Finance plan to expand xStocks to other high-performance blockchains like Ethereum or Arbitrum in the future to improve interoperability and reach.

-

Issuance Status: xStocks are issued by Backed Finance, with an initial batch of 60 U.S. stocks and ETFs including Apple (AAPL), Tesla (TSLA), NVIDIA (NVDA), Microsoft (MSFT), Google (GOOG), and SPDR S&P 500 ETF (SPY). Kraken began listing xStocks on June 30, 2025, with plans to continuously add new assets. xStocks are also tradable on Bybit and Solana-based DeFi platforms like Raydium and Kamino Swap, significantly expanding market access.

-

Issuance Background and Ecosystem: Backed Finance was founded by the core team behind DAOStack and has received backing from institutions like Coinbase, focusing on tokenizing financial assets. The xStocks launch is supported by key partners including Chainlink (price oracle), Raydium, Jupiter, and Kamino, forming the “xStocks Alliance” to provide liquidity, technical infrastructure, and ecosystem integration. The platform highlights that xStocks represent not just a Kraken product extension but a milestone in bridging traditional finance with blockchain.

-

Additional Details: xStocks issuance is dynamically adjusted based on purchases and redemptions of the underlying assets. Users can trade xStocks on Kraken using fiat, cryptocurrencies, or stablecoins (e.g., USDT), with a minimum investment of just $1—ideal for global retail participation.

In comparison, Robinhood excels in regulatory compliance and mainstream user reach, especially with its inclusion of private company shares. Kraken, on the other hand, offers broader geographic access and deeper integration with native crypto ecosystems, supporting on-chain trading and DeFi usage—making it more crypto-native. To draw a rough analogy: Robinhood resembles USDC in its institutional alignment, while Kraken mirrors USDT’s grassroots, decentralized ethos—one represents the establishment, the other the frontier.

For startup teams, competing directly with these giants in issuing new stock tokens may be challenging. However, two promising opportunities stand out:

-

Targeting underserved demographics or regions—akin to replacing Tiger Brokers—by reaching areas and populations overlooked by traditional brokers but accessible via crypto;

-

Driving financial product innovation—once stock tokens are integrated into asset pools, startups can differentiate themselves by launching new derivative products and trading strategies, such as high-leverage contracts, leveraged ETFs, and more.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News