Analysis of the Current State and Prospects of the Tokenized U.S. Stock Market

TechFlow Selected TechFlow Selected

Analysis of the Current State and Prospects of the Tokenized U.S. Stock Market

Although the market potential for tokenization in U.S. equities is vast, there are currently few investment options available to investors.

Author: Lawrence Lee, Mint Ventures

Recently, there have been significant developments in the field of tokenized U.S. equities:

-

Centralized exchange Kraken announced the launch of xStocks, a tokenized stock trading platform

-

Centralized exchange Coinbase announced it is seeking regulatory approval for its tokenized stock trading services

-

Solana submitted a blockchain-based framework for tokenized U.S. equity products

U.S.-based blockchains and exchanges are accelerating their progress in tokenizing U.S. stocks. Combined with the recent market enthusiasm following Circle’s public listing, the future of tokenized U.S. equities appears increasingly promising.

In fact, the value proposition of tokenized U.S. equities is very clear:

1. Expanded market scale: It provides a 7×24, borderless, permissionless trading venue for U.S. equities—something currently impossible on Nasdaq or NYSE (although Nasdaq has applied for 24-hour trading, implementation is not expected until late 2026).

2. Superior composability: By integrating with existing DeFi infrastructure, U.S. equity assets can be used as collateral, margin, or to build indices and fund products, enabling innovative financial applications previously unimaginable.

The demand from both supply and demand sides is also clear:

-

Suppliers (U.S. listed companies): Gain access to a global pool of potential investors through borderless blockchain platforms, expanding their investor base

-

Buyers (investors): Many investors who previously couldn't directly trade U.S. stocks due to various restrictions can now directly allocate capital or speculate on U.S. equity assets via blockchain

Quoted from "Tokenizing U.S. Stocks and STO: A Narrative Yet to Unfold"

During this current cycle of relatively lenient crypto regulation, progress is highly likely. According to data from RWA.xyz, the current market cap of tokenized stocks stands at just $321 million, held by only 2,444 addresses.

This highlights a stark contrast between the vast market potential and the currently limited asset scale.

This article will analyze the current players in the tokenized U.S. equities market, examine product proposals from other emerging participants, and identify potential investment opportunities within this space.

The views expressed herein represent the author's interim thoughts as of publication and may evolve over time. These opinions are highly subjective and may contain factual inaccuracies, data errors, or flawed reasoning. All statements are for informational purposes only and do not constitute investment advice. Feedback and discussion from industry peers and readers are welcome.

According to rwa.xyz, the current tokenized stock market, ranked by issuance size, includes the following projects:

We will introduce the business models of Exodus, Backed Finance, and Dinari (Montis Group focuses on European stocks; SwarmX operates similarly to Backed Finance but at a smaller scale), along with updates from other key players actively advancing U.S. stock tokenization.

Exodus

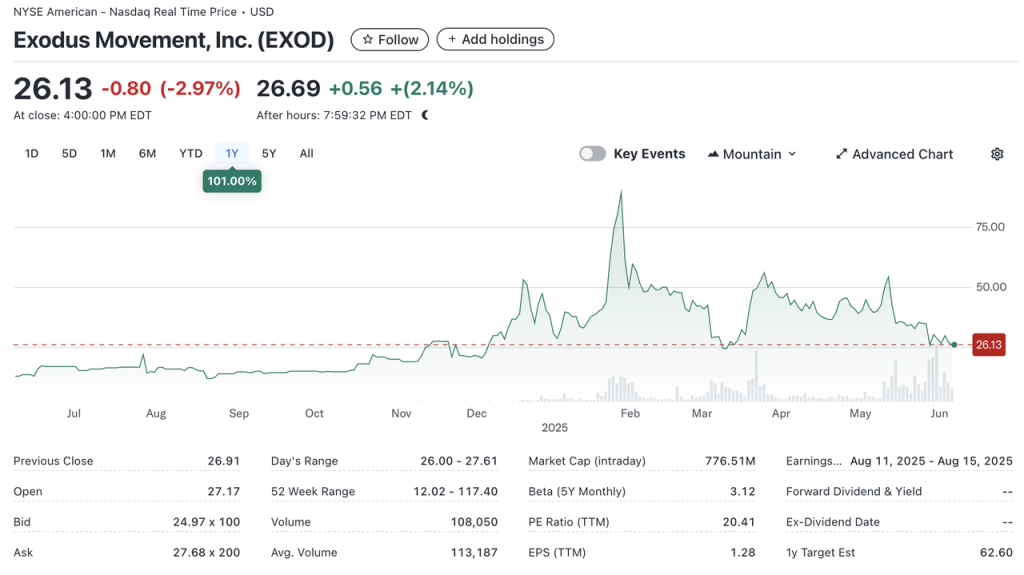

Exodus (NYSE: EXOD) is a U.S.-based company primarily developing non-custodial cryptocurrency wallets, publicly traded on the New York Stock Exchange under the ticker EXOD. In addition to its own branded wallet, Exodus previously collaborated with NFT marketplace MagicEden to launch a joint wallet product.

As early as 2021, Exodus allowed users to migrate its common shares onto the Algorand blockchain via Securitize. However, these on-chain tokens could neither be traded nor transferred and did not confer governance rights or economic benefits such as dividends. The Exodus token was more akin to a "digital twin" of real-world shares—symbolic rather than functional.

Currently, EXOD has a market cap of $770 million, with approximately $240 million worth of shares represented on-chain.

Exodus became the first company approved by the SEC to tokenize its common stock—or more precisely, the first SEC-approved stock listed on NYSE capable of being tokenized. This process was far from smooth, with Exodus’ NYSE listing delayed multiple times from May 2024 before finally going live in December.

However, Exodus' stock tokenization applies only to its own shares, and the tokenized shares cannot be traded. Thus, for web3 investors, its significance remains minimal.

Dinari

Dinari is a U.S.-registered company founded in 2021, focused since inception on tokenizing stocks within the U.S. regulatory framework. It raised $10 million in seed funding in 2023 and $12.7 million in Series A funding in 2024, backed by Hack VC, Blockchange Ventures, Coinbase CTO Balaji Srinivasan, F Prime Capital, VanEck Ventures, Blizzard (Avalanche Fund), among others. Notably, F Prime is a fund under Fidelity, one of the largest asset managers globally. Investments from Fidelity and VanEck signal traditional finance institutions’ recognition of the tokenized U.S. equities market.

Dinari only serves non-U.S. users. The process for trading U.S. stocks is as follows:

-

User completes KYC

-

User selects desired U.S. stock and pays with USD+, a short-term Treasury-backed stablecoin issued by Dinari (exchangeable from USDC)

-

Dinari submits the order to partner brokers (Alpaca Securities or Interactive Brokers). After execution, the shares are held in custody, and Dinari mints corresponding dShares for the user

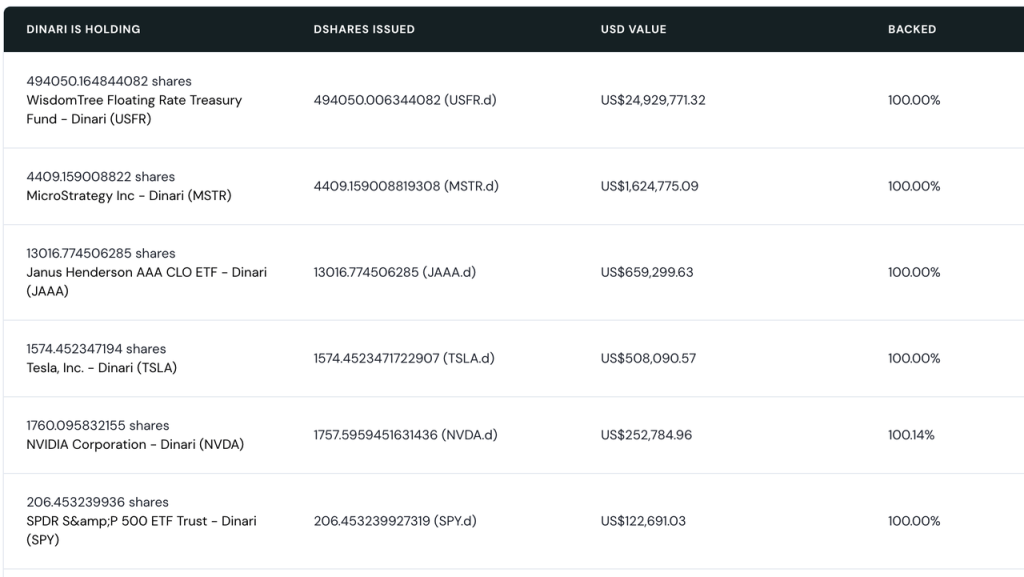

Dinari currently operates on Arbitrum, Base, and Ethereum mainnet. All dShares are backed 1:1 by real-world equity holdings. Users can verify their underlying share ownership via Dinari’s official website. Dinari also distributes dividends and handles stock splits for dShare holders.

However, dShares cannot be traded on-chain. To sell, users must go back through Dinari’s website—the reverse of the purchase process. Trading also adheres strictly to U.S. market hours, meaning no trades can occur outside those times. Beyond direct stock trading, Dinari offers APIs for integration with third-party trading front-ends.

In essence, Dinari’s workflow—"KYC → payment/conversion → settlement via compliant broker"—mirrors how non-U.S. investors currently access U.S. equities. The key difference lies in the payment method: while traditional platforms accept fiat like HKD or EUR, Dinari accepts crypto assets. Otherwise, all operations comply fully with SEC regulations.

Dinari’s decision to incorporate in the U.S.—unlike most similar projects registered in Europe—demonstrates strong confidence in its compliance capabilities. Its tokenization product launched in 2023 during the tenure of former SEC Chair Gary Gensler, known for his strict stance on crypto regulation, yet he found no fault with Dinari’s model. Under new SEC Chair Paul Atkins, the agency even held a dedicated meeting with Dinari, requesting system demonstrations and Q&A sessions—further underscoring the robustness of Dinari’s compliance posture and team connections.

Nevertheless, because Dinari’s tokenized stocks do not support on-chain trading, crypto functions merely as an entry point and payment rail. Functionally, Dinari’s offering differs little from platforms like Futu or Robinhood. For its target users, the experience offers no clear advantage over competitors. A Hong Kong-based user, for example, would find no meaningful improvement using Dinari versus Futu, lacking features like margin trading and potentially facing higher fees.

Precisely for these reasons, Dinari’s tokenized stock market remains small. Currently, only MSTR exceeds $1 million in tokenized value, and only five stocks exceed $100,000. Most of its TVL comes from participation in floating-rate Treasury yield products.

Current Market Cap of Dinari-Tokenized Stocks Source

In summary, Dinari’s tokenized stock model has earned regulatory validation, but strict adherence limits functionality—no on-chain trading or staking—which sacrifices composability. As a result, holding dShares offers a subpar user experience compared to traditional brokers, making the product less appealing to mainstream web3 users.

Other projects similar to Dinari include mystonks.org, a community initiative linked to the meme coin Stonks. According to self-disclosed reserve reports, their U.S. stock portfolio exceeds $50 million, with significantly more active user trading than Dinari.

However, mystonks.org’s compliance structure has notable gaps—such as unclear custodian qualifications and unverifiable reserve reporting.

Backed Finance

Backed Finance is a Swiss company founded in 2021, launching its product in early 2023. It raised $9.5 million in 2024 led by Gnosis, with participation from Cyber Fund, Blockchain Founders Fund, Blue Bay Capital, and others.

Like Dinari, Backed does not serve U.S. users. Its operational flow is:

-

Institutional issuers complete KYC and verification on Backed Finance

-

Issuers select desired U.S. stocks and pay in stablecoins

-

Backed submits orders to partner brokers for execution, then mints bSTOCK tokens representing the shares and delivers them to the issuer

-

bSTOCK and its wrapped version wbSTOCK can be freely traded on-chain (wrapping facilitates handling dividends, etc.). Retail investors can directly buy bSTOCK/wbSTOCK on-chain

Unlike Dinari, where retail users directly buy stocks, Backed relies on institutional investors to acquire shares first, then transfer exposure to end users. This significantly improves operational efficiency and enables 24×7 trading. Another key distinction: bSTOCK is an unrestricted ERC-20 token, allowing users to create liquidity pools (LPs) for peer-to-peer trading.

Backed Tokenized Stock Liquidity Source

On-chain liquidity for Backed Finance centers around SPX index, Coinbase, and Tesla. Users pair bSTOCK with stablecoins in AMMs. Total TVL in liquidity pools approaches $8 million, with average APY at 32.91%. Liquidity is distributed across Balancer and Swapr on Gnosis, Aerodrome on Base, and Pharaoh on Avalanche. The bCOIN-USDC pool offers an APY as high as 149%.

Notably, Backed Finance imposes no restrictions on bSTOCK’s on-chain tradability, creating a second access path:

On-chain users (no KYC required) can directly use USDC or sDAI to purchase bSTOCK

This effectively bypasses KYC requirements, and the trading experience mirrors that of any standard on-chain token—making adoption easier within the web3 community. An unrestricted ERC-20 design also unlocks composability—for instance, pairing with stablecoins to earn ~33% APY via liquidity provision. This may explain why Backed Finance’s TVL is nearly ten times that of Dinari.

On compliance, Backed Finance’s legal entity is registered in Switzerland. The model—allowing free transfer of stock-representing ERC-20 tokens—is recognized by European regulators (source). Backed also publishes proof-of-reserves audited by The Network Firm.

However, the U.S. SEC has not yet evaluated Backed Finance’s operations. While approval from Switzerland helps, the critical question remains: How will U.S. regulators view a platform trading U.S. securities?

SwarmX operates similarly to Backed Finance, though its scale and compliance depth lag significantly behind.

Despite Backed Finance’s tokenized stock market cap being ten times larger than Dinari’s, $20+ million in assets and $8 million TVL remain modest. On-chain trading activity is still low, due to several factors:

-

Limited use cases: Currently, the primary use is liquidity provision. Composability advantages remain underutilized—likely due to uncertainty among lending and stablecoin protocols about the legality of such assets

-

More importantly, insufficient liquidity: Backed itself is not an exchange and lacks “native” liquidity. Its model depends entirely on issuers—how many bSTOCKs they’re willing to hold and how much liquidity they add to LPs. So far, issuers show little incentive to increase commitment

-

If the SEC clarifies its regulatory framework and affirms the viability of Backed’s model, both issues could improve

xStocks

In May, U.S. exchange Kraken announced a collaboration with Backed Finance and Solana to launch xStocks.

On June 30, the xStocks product officially launched. Partners include centralized exchanges Kraken and Bybit; Solana-based DEXs Raydium and Jupiter; lending protocol Kamino; Bybit-incubated DEX Byreal; oracle Chainlink; payment protocol Alchemy Pay; and brokerage Alpaca.

Source: xStocks Official Website

xStocks uses the same legal architecture as Backed Finance and supports over 200 stock products, with Kraken operating on a 5×24 schedule. Key roles:

- Kraken, Bybit, Jupiter, Raydium, and Byreal act as supporting exchanges

- Kamino supports xStocks as collateral and enables trading via Kamino Swap

- Solana serves as the underlying blockchain

- Chainlink provides reserve reporting

- Alpaca acts as the brokerage

Given the product’s recent launch, comprehensive metrics are not yet available, and trading volume remains low. However, compared to Backed Finance’s standalone offering, xStocks brings significantly more strategic partners:

- CeFi side: Kraken and Bybit bring established user bases and market makers, potentially injecting far greater liquidity into xStocks

- DeFi side: Integration with multiple DEXs and Kamino introduces new use cases beyond LP provision. Future protocol integrations could further expand composability

From this perspective, despite being newly launched, xStocks is poised to quickly surpass existing players and become the largest issuer of tokenized U.S. equities.

Robinhood

Robinhood, which has been actively expanding into crypto, submitted a report to the SEC in April 2025, urging the establishment of an RWA regulatory framework including tokenized stocks. In May, Bloomberg reported Robinhood plans to build a blockchain platform enabling European investors to invest in U.S. equities, with Arbitrum or Solana as potential chain choices.

On June 30, Robinhood officially launched its tokenized U.S. stock trading product for European investors, supporting dividend distribution and 5×24 access.

The product initially runs on Arbitrum. In the future, it will operate on Robinhood’s own L2, built using Arbitrum’s stack.

However, according to Robinhood’s official documentation, its current offering is not true stock tokenization. Instead, it consists of contracts tracking U.S. stock prices, with underlying assets securely held by licensed U.S. institutions under Robinhood Europe’s account. Robinhood Europe issues and records these contracts on-chain. Currently, these tokenized stocks can only be traded on Robinhood and are non-transferable.

Other Players Entering the Space

Beyond the above live products, several other major players are preparing to enter the tokenized U.S. equities market:

Solana

Solana places high strategic importance on tokenized stocks. In addition to xStocks, Solana established the Solana Policy Institute (SPI), aiming to educate policymakers on why decentralized networks like Solana are foundational infrastructure for the digital economy.

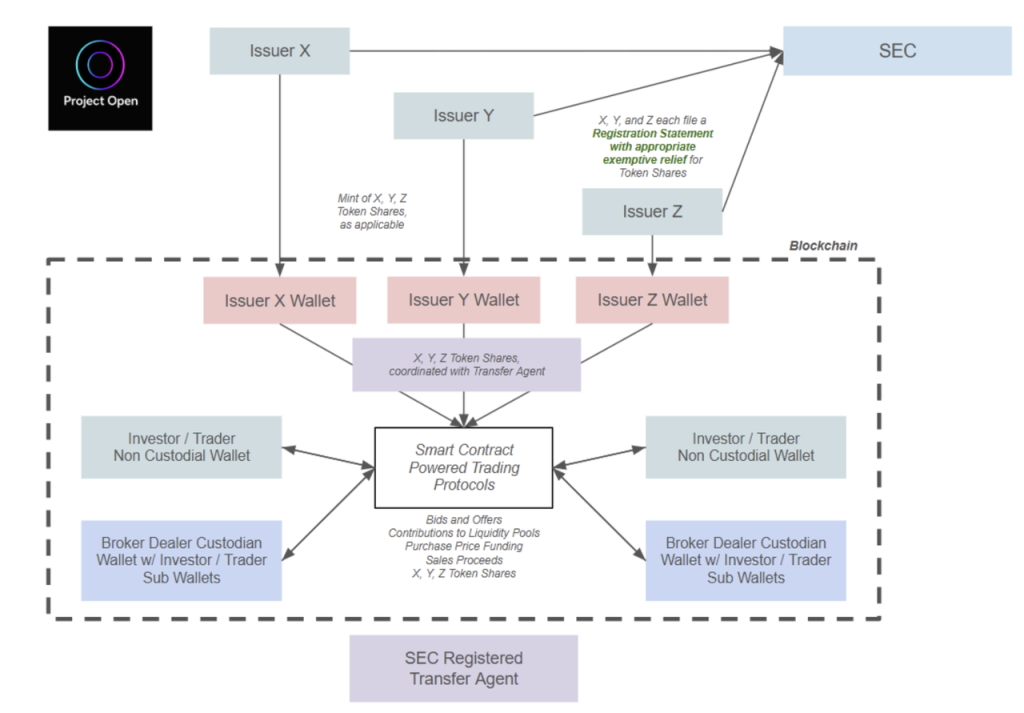

Two key initiatives are underway. First, SPI launched Project Open—an effort to enable compliant blockchain-based securities issuance and trading, leveraging blockchain to create more efficient, transparent, and accessible capital markets while maintaining strong investor protections. Project Open members include SPI, Solana-based DEX Orca, RWA provider Superstate, and law firm Lowenstein Sandler LLP.

Since April, Project Open has submitted multiple written comments to the SEC’s Crypto Task Force. On June 12, the SEC met with Project Open members, followed by additional post-meeting explanations from each member.

Project Open proposes the following process for tokenized U.S. stock issuance and trading:

The proposed workflow:

-

Issuers must apply in advance for SEC approval before issuing tokenized stocks

-

Users wishing to buy must complete KYC, after which they can use crypto to purchase tokenized stocks from approved issuers

-

A SEC-registered transfer agent records share transfers on-chain

Project Open specifically advocates for SEC approval of peer-to-peer trading of tokenized stocks via smart contract protocols—i.e., allowing holders to trade on AMMs—thus unlocking on-chain composability. However, per the proposal, all token holders must complete KYC. To implement this, Project Open has requested 18 months of exemptive relief or confirmatory guidance from the SEC (see references for details).

Overall, Project Open builds upon Backed Finance’s model by adding mandatory KYC. From the author’s perspective, this framework is almost certain to pass under the current SEC leadership, which has shown relative openness toward DeFi. The only uncertainty is timing.

Coinbase

As early as 2020, when Coinbase filed for its Nasdaq IPO, its prospectus included plans to issue a tokenized version of COIN on-chain—but dropped the idea due to non-compliance with then-current SEC rules. Recently, Coinbase has begun seeking a no-action letter or exemptive relief from the SEC to launch tokenized stock trading.

No detailed filings are public, but one confirmed fact from press releases is:

Coinbase plans to offer tokenized stock trading to U.S. users.

This sets it apart from current market players and positions Coinbase to directly compete with online brokers like Robinhood and traditional firms like Charles Schwab. While this move may have limited impact on web3 investors, it could significantly affect Nasdaq-listed COIN.

Ondo

Ondo, already successful in the treasury-based RWA space (see prior Mint Ventures articles), has long planned to expand into tokenized U.S. equities. According to their documentation, their product will feature:

-

Available to non-U.S. users

-

24×7 trading availability

-

Real-time minting and burning of tokens

-

Ability to use tokenized U.S. stocks as collateral

These characteristics closely resemble Solana’s proposed framework. Ondo also announced at Solana’s Accelerate conference its intention to launch tokenized U.S. equities on the Solana network.

Ondo Global Markets, its tokenized U.S. equities product, is expected to go live later this year.

The above outlines the current state of the tokenized U.S. equities market and key players preparing to enter.

Derivatives-Based Access to U.S. Equities

At the core of user motivation: investors seek exposure to stock price movements. They care primarily about exchange liquidity, settlement reliability, and whether trading can occur without KYC. Whether the tokenization is conducted by a regulated entity is often secondary. Hence, synthetic derivative products have long existed in web3 to provide U.S. stock exposure.

Primary providers of U.S. equity derivatives include Gains Network (on Arbitrum and Polygon) and Helix (on Injective). These platforms do not involve actual stock trading and thus avoid full tokenization.

Their core logic applies perpetual futures mechanics to U.S. stocks:

-

No KYC required; users post stablecoins as collateral and can trade with leverage

-

Trading hours align with U.S. market hours

-

Prices sourced directly from trusted oracles like Chainlink

-

Funding rates balance differences between market price and fair value

However, platforms like Gains, Helix, Synthetix, and Mirror have failed to generate substantial trading volume. Helix’s daily U.S. equity trading volume remains below $10 million, while Gains averages under $2 million. Reasons include:

-

Clear regulatory risk: Although they don’t facilitate actual stock trades, these platforms function de facto as stock exchanges. Regulators have strict requirements for exchanges, with KYC being a fundamental component. While small-scale operations may fly under the radar, growth attracts scrutiny

-

Inadequate liquidity: These platforms must bootstrap liquidity internally, unable to rely on external sources. None offer sufficient trading depth to meet real user demand

Helix’s U.S. Equity & Forex Trading Volume and Order Book Depth for Most-Traded COIN Pair

On the centralized exchange side, Bybit recently launched an MT5-based U.S. stock trading platform using a similar perpetual-style logic—no actual stock ownership, trading indices backed by stablecoin collateral.

Another upcoming project, Shift, introduces Asset-Referenced Tokens (ARTs), claiming to enable KYC-free U.S. stock trading. Proposed workflow:

-

Shift purchases U.S. stocks and pledges them with compliant brokers like Interactive Brokers, using Chainlink for proof of reserves

-

Shift issues ARTs backed by these stocks. Each ART corresponds to real stock assets, but ARTs are not tokenized stocks

-

Retail users can buy ARTs without KYC

Shift ensures 100% backing of ARTs by underlying stocks, but ARTs do not confer ownership, dividends, or voting rights—thus avoiding classification as securities and sidestepping associated regulations, enabling KYC-free access (source).

However, regulatory frameworks generally prohibit ARTs from being pegged to securities. It remains unclear how Shift intends to technically achieve “ARTs tracking U.S. stocks,” or whether the final product will match the described workflow. Nevertheless, this approach exploits potential loopholes in regulations to offer KYC-free U.S. stock exposure and warrants close attention.

What Kind of Tokenized U.S. Equity Product Does the Market Need?

Regardless of approach, the core process of stock tokenization involves two steps:

-

Tokenization: Typically handled by a regulated entity, involving regular proof-of-reserves. Essentially, KYC-compliant entities buy stocks and represent them on-chain. Differences between models here are minor

-

Trading: End users trade the tokenized stocks. This is where models diverge: some prohibit trading (Exodus); some allow only off-chain trading via traditional brokers (Dinari, mystonks.org); others support on-chain trading (Backed Finance, Solana, Ondo, Kraken). Backed Finance is unique in leveraging Swiss compliance to allow KYC-free users to buy tokenized stocks directly via AMM

For retail users, the tokenization process mainly raises concerns about compliance and asset security—areas most current players handle adequately. The real differentiator lies in the trading experience. Dinari, for example, restricts trading to traditional channels and offers no liquidity mining, lending, or other DeFi utilities. This largely negates the value of tokenization. No matter how compliant the backend, poor user experience limits adoption.

In contrast, solutions like xStocks, Backed Finance, and Solana represent more meaningful long-term visions: post-tokenization, trading occurs on-chain rather than through legacy brokers, fully harnessing DeFi’s 7×24 availability and composability.

Yet, in the short term, on-chain liquidity will struggle to match traditional venues. A low-liquidity exchange is effectively unusable. If tokenized equity platforms fail to attract deep liquidity, their influence will remain limited. This is why we believe xStocks has strong potential to rapidly dominate the tokenized U.S. equities landscape.

Ultimately, if regulatory clarity emerges and tokenized equities gain traction in web3, the winners will likely be platforms already possessing strong liquidity and large trader communities.

This pattern was evident in the previous cycle: Synthetix, Mirror, and Gains all launched U.S. stock trading products in 2020, but the most impactful was FTX. FTX’s model resembled Backed Finance’s, yet its trading volume and AUM vastly exceeded later entrants.

Potential Investment Opportunities

While the market potential for tokenized U.S. equities is vast, current investment options remain limited.

Among existing players, neither Dinari nor Backed Finance has issued a token. Dinari has explicitly stated it won’t issue one. Only mystonks.org’s meme token STONKS qualifies as a potential investment.

Among active entrants, Coinbase, Solana, and Ondo already have high market cap tokens, and tokenized equities are not their core business. Progress in this area may impact their tokens, but the extent is uncertain.

xStocks partners include leading Solana DEXs Raydium and Jupiter, and lending protocol Kamino. However, the incremental benefit to these protocols appears limited.

Within SPI’s Project Open: Phantom and Superstate haven’t issued tokens; only Orca has.

Among derivative platforms, Helix hasn’t launched a token; only GNS is currently investable.

Due to differing business models and levels of involvement in tokenized equities, valuation comparisons are impractical. Below is a summary of relevant token fundamentals:

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News