Pump.fun Token Launch: Opportunities and Risks at a $4 Billion Valuation

TechFlow Selected TechFlow Selected

Pump.fun Token Launch: Opportunities and Risks at a $4 Billion Valuation

In-depth analysis of $PUMP's bull and bear market scenarios.

Author: GLC

Translation: TechFlow

The upcoming token launch of Pump.fun could become one of the most watched events in crypto this year. Since 2024, the launchpad has been at the heart of the Memecoin frenzy, establishing what is arguably the most successful and controversial retail traffic channel in the ecosystem.

Love it or hate it, Pump.fun has demonstrated undeniable product-market fit.

Its permissionless token issuance platform has attracted tens of thousands of users and creators through viral, gamified user experiences (UX), generating staggering trading volumes. Despite a broader cooling in Memecoin activity, Pump.fun has maintained strong moats and continues to push forward with new initiatives like PumpSwap.

As of this year, Pump’s median monthly revenue is approximately $45 million, making it not only one of the most widely used platforms in crypto but also one of the most profitable. With the imminent launch of the $PUMP token, the protocol stands at a pivotal inflection point.

The key question is whether the team will treat this moment as an opportunity to build a sustainable, investable asset—or choose instead to aggressively extract value. Their past behavior raises some concerns, but the opportunity remains real.

Either way, the risk/reward (R/R) appears asymmetric.

Below, we’ll break down the bull and bear cases for $PUMP.

Agenda

-

Data & Performance: Revenue, volume, and user base

-

Team & Narrative Shift: Can they align with holders?

-

Valuation: Cash flows, earnings, and P/E considerations

-

Growth Catalysts: Airdrops, acquisitions, and vertical expansion

-

Key Risks: Execution, competition, and market structure

-

Final Thoughts

Key Metrics: More Resilient Than Expected

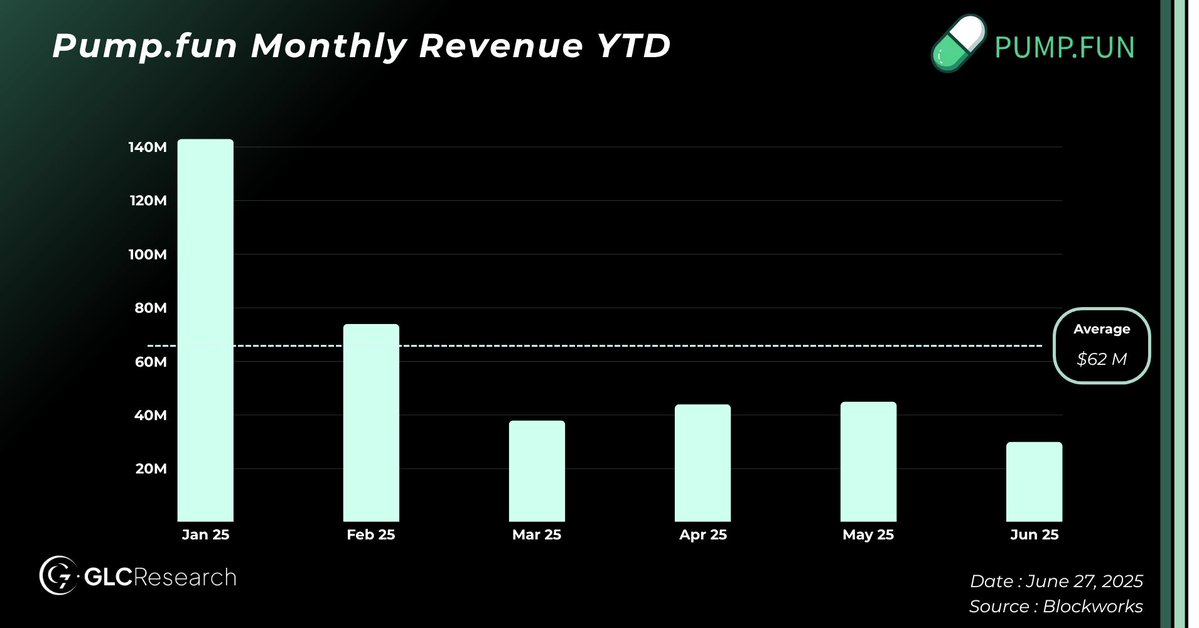

In January, the Memecoin market surged following former President Trump’s personal token launch—marking the peak of industry-wide activity. That month, Pump.fun generated a staggering $140 million in revenue. Shortly after, however, Memecoin trading volumes began to decline sharply, and sentiment turned negative.

“The end of Memecoins” quickly became a popular narrative.

Yet Pump.fun has proven far more resilient than most expected.

Even amid broad market downturns, Pump.fun has successfully retained a large and active user base. Currently, daily active users hover around 340,000—only slightly down from 400,000 in January. True, PumpSwap hadn’t launched yet then, but the point stands: hundreds of thousands still use Pump’s products every day.

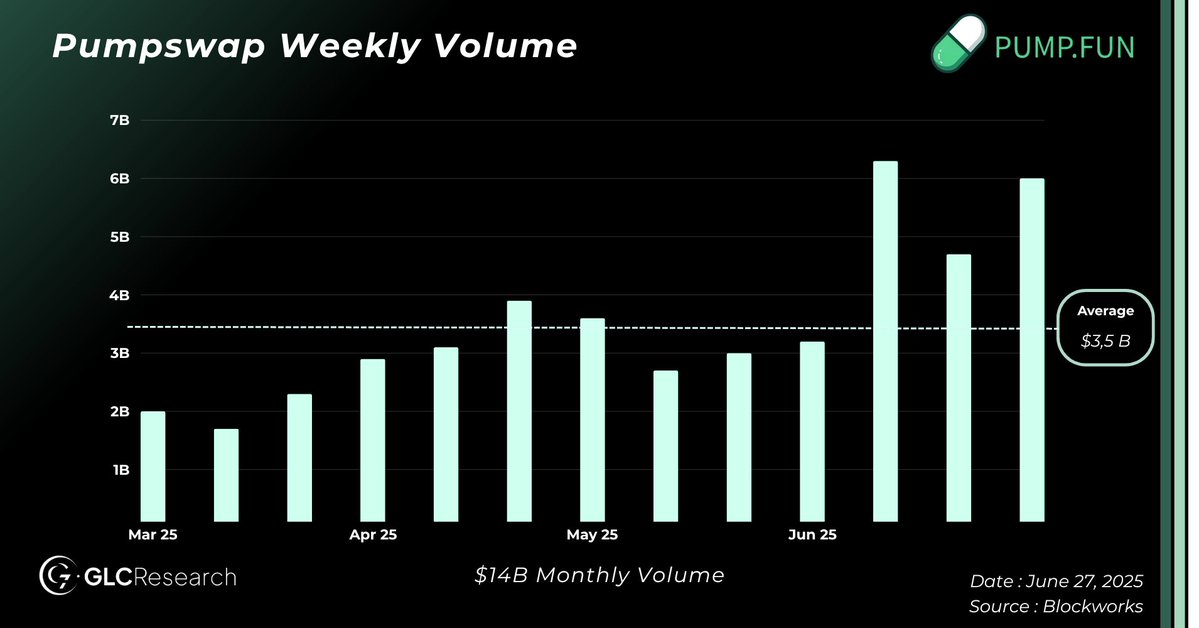

Since the beginning of the year, Pump.fun has averaged around $14 billion in monthly trading volume on PumpSwap, with a total fee rate of 0.3% (0.2% to LPs, 0.05% to creators, 0.05% to Pump).

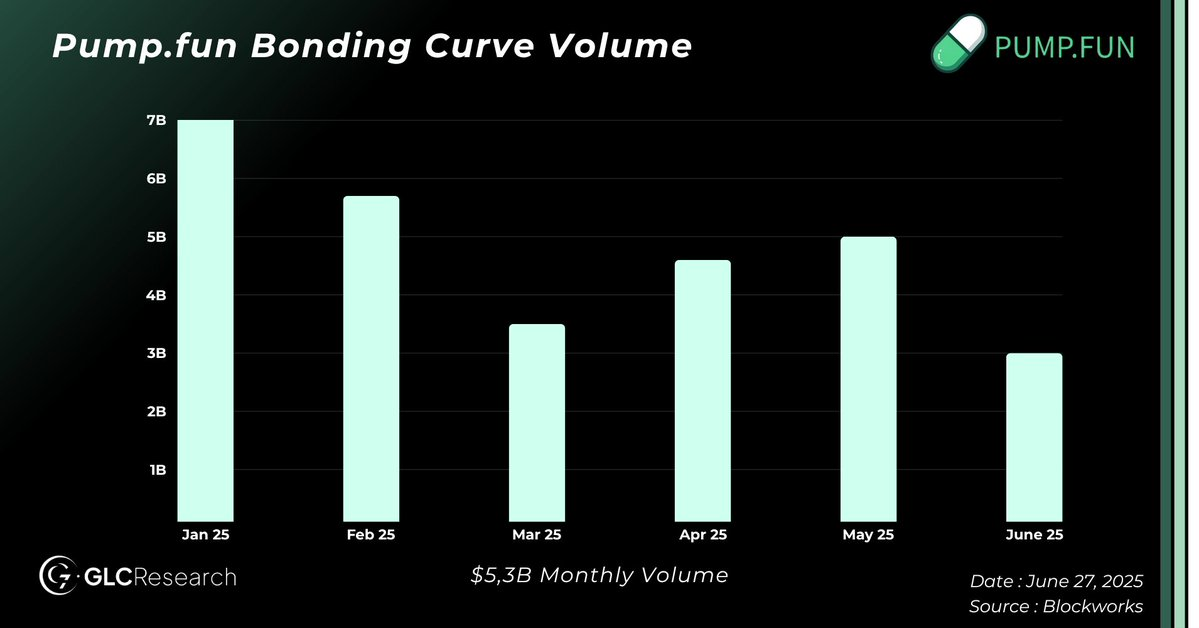

Its core Bonding Curve product maintains around $5 billion in monthly volume, charging 1% fees on both buys and sells.

These active metrics explain why the platform consistently generates $45–60 million in monthly revenue, annualizing to roughly $500 million. This makes $PUMP one of the highest-earning tokens in crypto.

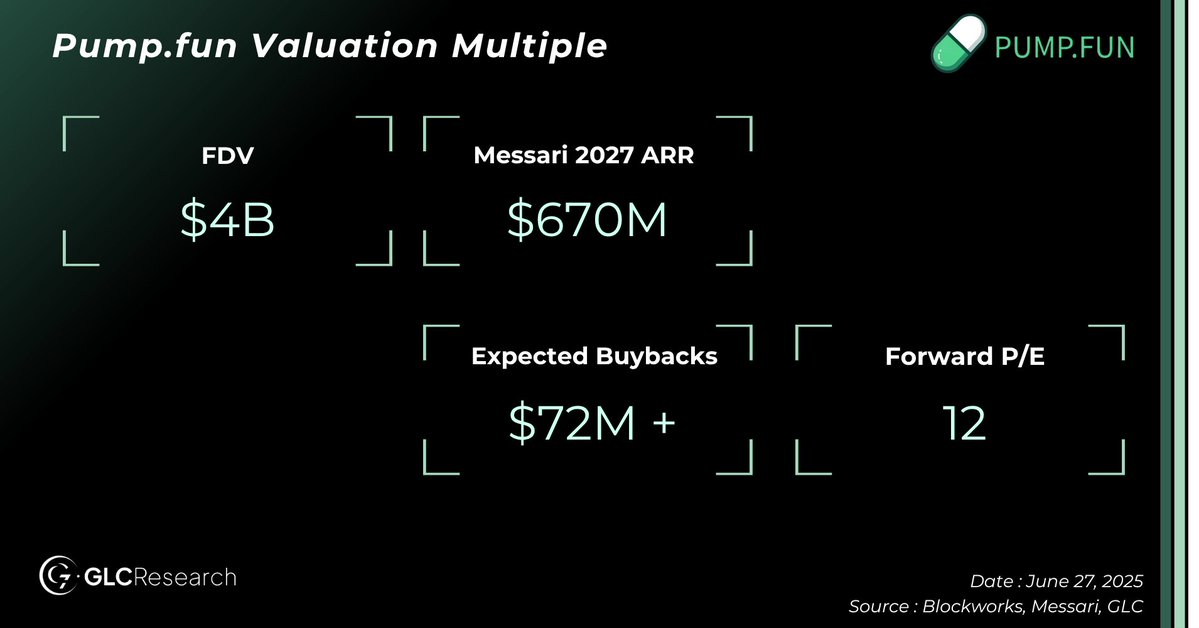

With $PUMP expected to launch at a $4 billion fully diluted valuation (FDV), it’s no surprise this is one of the most anticipated launches of the year.

We’ll dive deeper into valuation mechanics later, but the core takeaway is simple: even in a weak market, $PUMP keeps “printing money.”

Team: Can They Flip the Script?

Pump.fun has built one of the most profitable products in crypto, but the team hasn’t earned equal respect. Critics argue they’ve prioritized value extraction over community reinvestment. Many also view Memecoins as a reputational drag on the industry rather than a growth catalyst.

Still, their success isn’t accidental. Speculation remains a core driver in this space, and Pump.fun was the first team to truly capture that demand through genuine product-market fit.

Now, they have a chance to rewrite the narrative.

The upcoming $PUMP token launch is an opportunity to align with holders. Reports suggest a portion of protocol revenue may go toward buybacks, though the exact percentage remains unconfirmed.

We don’t expect a Hyperliquid-style 100% revenue return. While that can boost short-term price action, it undermines long-term sustainability. Pump is not a Layer 1; its growth requires capital. A more realistic approach might be allocating 50% of revenue to buybacks—similar to Raydium or Jupiter.

This strikes a competitive balance while leaving room to reinvest in new business lines, acquisitions, or ecosystem development. Pump.fun is a young company with real growth potential. We’d prefer to see them target ~10% annual dividend payouts while compounding the rest for long-term value creation.

More important than the numbers is transparency. If the team wants to be taken seriously, they must disclose how funds are used—covering operating expenses, capex, treasury plans, and governance structure.

Raising $1 billion demands real accountability.

If they do this, even modest buybacks could work. But if they fall back into silent value extraction, the market response may be harsh.

That said, even if they misstep, the downside appears limited. We’ll explore that next.

$PUMP Valuation Analysis

I won’t provide a full valuation framework here as we typically do at GLC. The reason is simple: we’re not experts in the Memecoin space, and any modeling would carry high subjectivity.

That said, Messari’s @defi_monk has proposed a solid valuation framework, and I find his assumptions reasonable. He’s a skilled analyst who leans conservative rather than optimistic—aligning well with my own approach.

In his base case, Monk expects Bonding Curve volume to decline but AMM activity to grow, projecting ~$670 million in annualized revenue by 2027. These estimates reflect broader on-chain volume growth, potential market share gains vs. Raydium, and advantages from vertical integration.

To me, this outlook is not just reasonable—it’s highly realistic.

Of course, we don’t know the team’s actual plans. That’s part of what makes this an asymmetric opportunity. If revenue reaches that range, it’s hard to argue $PUMP is overvalued at a $4B FDV, especially with a P/E ratio of ~12.

Yes, the long-term viability of Memecoins remains uncertain. But the fact is, they’ve lasted far longer than many expected. Memecoins enjoy strong community support, and if Bitcoin breaks new highs later this year, speculation will surge again—with $PUMP likely among the main beneficiaries.

In the past, investing in Memecoins meant going through $SOL. Now, $PUMP is emerging as a more direct and logical choice. If markets turn bullish, $PUMP could act as a high-beta asset, rapidly reflecting that shift.

All things considered, buying $PUMP at a $4B valuation—given the protocol already earns ~$500M annually, holds $1B in cash, and potentially allocates 75% of supply to community incentives or airdrops—appears to offer limited downside risk.

Unless we unexpectedly enter a deep bear market with collapsing on-chain volume (a scenario I didn’t believe in back in February, and still don’t), this opportunity looks compelling.

Growth Catalysts: Airdrops & Acquisition Engine

There are several reasons $PUMP is seen as an asymmetric play:

First, most participants in crypto now recognize that Hyperliquid’s model works—build for the community, share profits, and ultimately win. Game theory strongly favors founding teams that follow this path. Now, $PUMP is launching with full control over its token supply, backed by a highly profitable business, $1B in cash reserves, and potential for large-scale airdrops—checking all the boxes for success.

Notably, the team generated hundreds of millions in revenue without ever issuing a token. It’s reasonable to assume most team members are already extremely wealthy. Now, with all resources in hand, they have the ability—and incentive—to make $PUMP a long-term success.

While predicting growth purely from airdrop speculation is difficult, a more tangible source lies in vertical acquisition potential. With its war chest and strong profitability, Pump.fun is well-positioned to acquire businesses that perfectly complement its model.

Jack Kubinec recently shared insights in Blockworks’ Lightspeed newsletter, highlighting two potential acquisition targets that align closely with Pump’s strategy:

-

Telegram Trading Bots (e.g., BullX)

Telegram trading bots are heavily used by active traders for sniping and copy-trading. These bots earn revenue by taking a cut of trading volume. According to Blockworks, Solana-based trading bots alone generate at least $500 million annually. Acquiring such tools would integrate seamlessly with Pump’s core product and add a significant new revenue stream.

-

DEX Screener:

As Jack noted, another pain point for Pump is token discovery. Traders often rely on platforms like DEX Screener for real-time, data-rich analytics. DEX Screener itself earns substantial revenue by charging Memecoin projects for visibility boosts. Per DeFiLlama, it earned over $100 million in the past year alone. Acquiring such a platform would help Pump control the user experience and improve retention.

These are just two examples of vertical integrations that could strengthen Pump’s position—but the possibilities extend much further. We believe Pump will actively use its raised capital and operating cash flow to acquire businesses that expand its moat, drive diversification, and accelerate growth.

With strong fundamentals, deep cash reserves, and clear paths for vertical expansion, Pump is likely to evolve into a full-fledged acquisition engine powering its next phase of growth.

Risks & Downside Factors

Clearly, there are risks with Pump.fun.

Competition comes first to mind. Everyone sees how profitable Pump’s model is, so multiple teams—including Launchlabs, Believe App, Moonshot—are attempting to capture market share. One of them might succeed.

Another risk is regulatory scrutiny. Pump has already faced some issues, and its current model doesn’t fully align with regulatory expectations. Further oversight is entirely possible.

But in my view, the biggest risk lies in the team’s future operational choices. As mentioned earlier, for this launch to be positively received, the team must embrace transparency, maintain consistent reporting, and properly align with token holders. If they repeat past behaviors—engaging in extractive practices or transferring value to insiders without clear communication—the market is unlikely to respond favorably.

Right now, the market expects the team to follow Hyperliquid’s example: treating the token as a long-term, community-aligned asset rather than a short-term extraction tool.

Even if they fail to meet these expectations, I believe the downside may be capped at around -50%, assuming on-chain volume remains stable. Of course, broader market shifts could change that.

Still, I find it hard to believe a company with $1B in cash and $500M in annual revenue would trade below a $2B valuation for long.

Final Thoughts

Pump.fun sits at the intersection of crypto speculation and on-chain infrastructure. While the Memecoin narrative remains controversial, the platform has demonstrated clear product-market fit, becoming one of the most profitable and widely used applications in the space.

The upcoming $PUMP launch is a critical moment. Beyond being a headline-grabbing event, it represents a broader test:

“Can the team transition from a closed, extractive model to a transparent, holder-aligned, and sustainably focused operation?”

If yes, $PUMP has the potential to evolve into a more enduring asset within the ecosystem.

Long-term success may also depend on the team’s ability to move beyond Memecoins and diversify. To compete with more mature platforms like Jupiter and become a broader on-chain “super app,” they’ll need sustained product development, deeper integrations, and strategic acquisitions. This path is uncertain, but the foundation is already in place.

This report focuses specifically on the asymmetric opportunity presented by $PUMP at launch, based on current fundamentals and market expectations. Given its ~$500M annual revenue, $1B cash reserve, and flexible token supply mechanism, a $4B fully diluted valuation (FDV) does not appear excessive—provided the team executes a credible, investor-aligned strategy. Moreover, as demand grows for direct exposure to Memecoin infrastructure, $PUMP could command a higher valuation premium.

To be clear, we typically don’t focus on the Memecoin space and don’t consider it our core expertise. However, from a financial standpoint, if the team takes the right steps, $PUMP’s valuation at launch seems reasonable. Given its current cash flows and balance sheet strength, the near-term downside appears limited unless macro conditions or on-chain activity deteriorate significantly.

In short, $PUMP is a high-risk, high-reward opportunity with several clear potential growth drivers, while offering seemingly limited near-term downside. Though we’re usually cautious about such sectors, this is indeed a textbook example of an asymmetric opportunity worth watching.

Disclosure: The analyst behind this research intends to purchase the asset upon $PUMP’s listing.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News