Make USDT payments as convenient as using Alipay

TechFlow Selected TechFlow Selected

Make USDT payments as convenient as using Alipay

Payment is the most intuitive use case in the Web3 world, and also the first step for more users entering crypto.

In the past, stablecoins like USDT and USDC primarily served as "neutral assets" within the Web3 ecosystem, mostly used for transaction intermediation or specific payments such as salaries and crypto product purchases. However, starting in the second half of 2024, stablecoins are rapidly evolving from "on-chain intermediaries" into "compliant payment tools."

On the policy front, the U.S. has officially passed the GENIUS Act, the EU’s MiCA regulation has fully taken effect, and Hong Kong's stablecoin regulatory rules will come into force in August 2025. On the industry side, Circle’s successful IPO—its stock surging over 245% in one week—has prompted giants like JPMorgan, Ant Group, and Xiaomi to enter the space, creating unprecedented synergy between regulation and capital for stablecoins.

This shift sends a clear signal: the "payment functionality" of stablecoins is awakening. The second half of 2025 is set to become a breakout moment for crypto payments, with a comprehensive transition underway—from "holding" to "using," and from "managing" to "spending." Users are no longer satisfied with on-chain operations alone; they increasingly expect to use stablecoins to buy coffee, top up memberships, or even travel abroad with seamless, no-foreign-exchange-needed transactions via QR codes.

Crypto Payments Are Poised for Explosion—But Experience Remains Immature

Yet behind the narrative of explosive growth, everyday users still face significant hurdles when it comes to actual payment experiences:

-

Few merchants accept crypto, making widespread adoption difficult;

-

Payment flows are complex, involving multiple app switches, cumbersome steps, high gas fees, and slow confirmations;

-

Technical barriers such as chain switching, slippage, and failed transactions remain daunting.

These issues prevent stablecoins from being truly “usable.” While crypto payments theoretically offer advantages in decentralization and cross-border efficiency compared to Web2 solutions like WeChat Pay or Apple Pay, they often fail to gain traction due to high usability thresholds and poor reliability.

Bitget Wallet Opens Three Key Stablecoin Payment Scenarios

To address these pain points, leading-edge Web3 wallets are moving beyond merely serving as asset gateways and instead building end-to-end experiences that bridge “on-chain” and “real life.” Bitget Wallet stands out as a pioneer, leveraging product innovation and scenario integration to unlock three high-frequency stablecoin payment pathways:

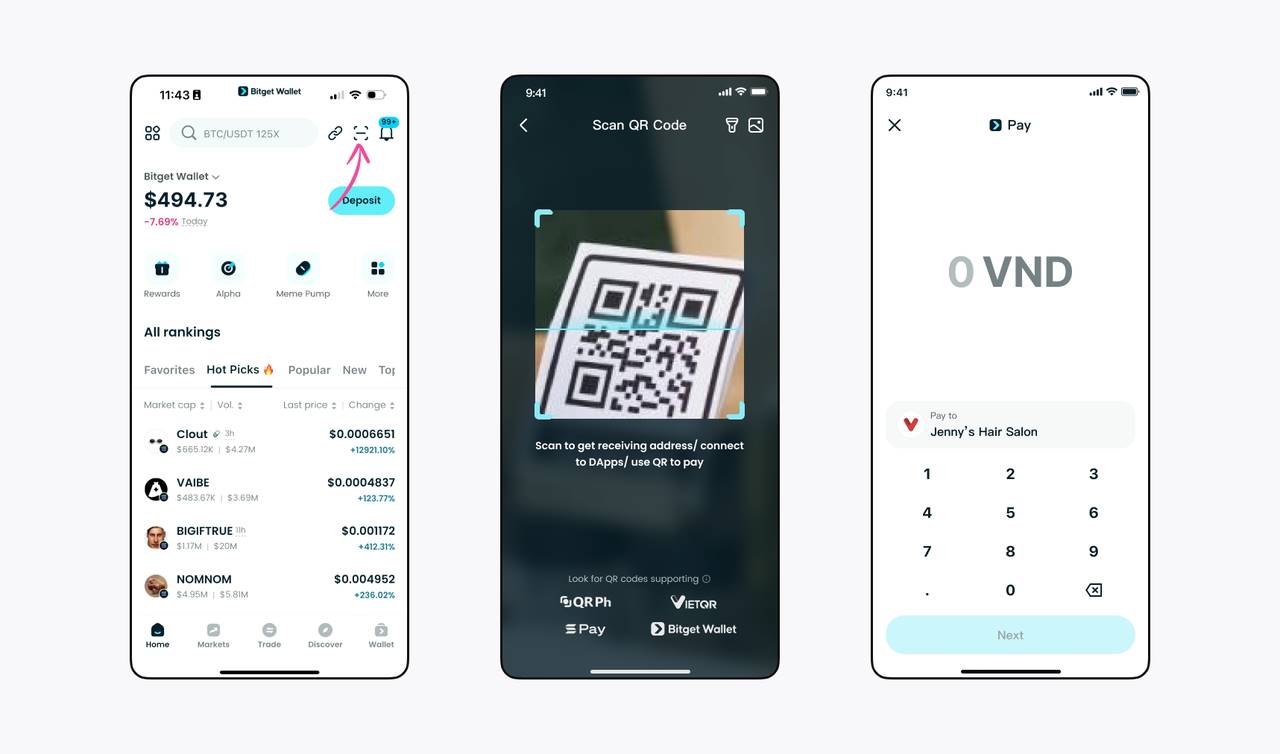

First Wallet to Support National-Level QR Code Payments

Imagine strolling through Ho Chi Minh City, Vietnam, having just discovered a trendy restaurant on social media. After your meal, instead of pulling out cash or switching apps, you simply open Bitget Wallet, scan the bill’s QR code, and pay instantly—your USDT settles in seconds.

Bitget Wallet’s QR payment feature supports major stablecoins including USDT and USDC, integrates Solana Pay, and connects with unified payment codes across multiple countries. In June 2025, it became the world’s first self-custodial wallet natively integrated with a national QR payment system—launching VietQR payments in Vietnam. The service now connects over 55 Vietnamese banks and payment systems, supports major public chains including Ethereum, Solana, Base, and BNB Chain, and will soon enable automatic token conversion for any supported asset.

Powered by MasterCard: Visa-Level Crypto Card Experience

The market has seen countless crypto debit cards in recent years—but have you actually used one that works smoothly and reliably?

Lengthy KYC processes, delayed settlements, frequent transaction failures, and hidden fees—these are common user complaints.

The Bitget Wallet Card, issued through a strategic partnership between Bitget Wallet and MasterCard, delivers a global payment experience as seamless as using a Visa card—but powered by stablecoins like USDT and USDC from your own wallet.

This “on-chain assets to fiat” spending card can be linked to Apple Pay, Google Pay, Alipay, and WeChat Pay, and is accepted at any merchant worldwide that supports MasterCard. Whether shopping on Taobao or Amazon, hailing a ride via DiDi or Grab, or purchasing a GPT subscription, this card enables instant payments.

When swiping, the system automatically converts your stablecoins at real-time exchange rates. The process is fully transparent to merchants and frictionless for users—no foreign exchange needed, just tap and go.

Compared to traditional crypto U-cards, Bitget Wallet Card offers a significantly smoother and more user-friendly experience:

-

No credit checks, no collateral required—apply and activate quickly;

-

Zero annual fee, zero deposit fee, and superior exchange rates;

-

Funds arrive instantly via on-chain deposits or multi-chain Swap;

Currently available for application in the UK and EU, with plans to expand to more regions gradually.

Shop Online: One-Click Global Purchases with Cryptocurrency

Beyond offline use cases, online shopping needs are also being addressed. Bitget Wallet’s built-in marketplace, “Shop with Crypto,” allows users to skip currency conversion and card binding altogether—enabling one-click checkout directly with USDT and USDC. Now, crypto assets can be spent “just like on e-commerce platforms.”

The store supports purchasing recharge cards, game credits, and digital goods for platforms like Amazon, Steam, and Shopee, and even booking flights and hotels. Prices mirror global markets, and during promotional periods, select items can be up to 30% cheaper than on traditional e-commerce sites. Currently, the marketplace covers over 300 platforms and includes most mainstream digital products globally.

A More Open, Secure, and Inclusive Payment Experience

The payment system built by Bitget Wallet goes beyond mere “functionality”—it delivers a genuinely better, smoother user experience.

True freedom: No local bank account or FX conversion needed—just USDT/USDC, and you’re ready to pay;

Self-custody: As a decentralized wallet, all assets are controlled by users’ private keys; the platform does not hold or access user funds;

Broad ecosystem, full chain support: Integrated with over ten licensed payment providers, compatible with major global QR code and card payment systems;

Lower costs: On-chain settlement combined with local clearing reduces intermediaries, making transaction fees negligible—far superior to traditional cross-border payments.

For users, this means that regardless of location or banking status, anyone can use USDT/USDC as effortlessly as WeChat Pay, Alipay, or Apple Pay—bringing crypto assets into daily life.

Making Crypto Assets Accessible, Usable, and Within Reach for Everyone

Payments represent the most tangible use case in Web3—and the first step for most people entering the crypto world.

Going forward, as more regions complete stablecoin regulatory frameworks, crypto payments will gradually expand into retail, travel, content platforms, and every aspect of daily life. Wallets will evolve from “asset management tools” into “gateways to life”—helping every user bring their on-chain assets offline, turning complex technology into simple, intuitive experiences.

It is precisely for this reason that Bitget Wallet continues to push the boundaries of payment innovation, striving for ultimate usability. True to its vision of “Crypto for Everyone,” Bitget Wallet aims to move crypto assets from wallet balances to streets and shops—into the everyday lives of people everywhere.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News