Robinhood's high-profile product launch at Cannes this summer has completely ignited the competition in on-chain brokerage.

TechFlow Selected TechFlow Selected

Robinhood's high-profile product launch at Cannes this summer has completely ignited the competition in on-chain brokerage.

"The foundation of future global finance will be Robinhood Chain."

By BlockBeats

Can a brokerage disrupt not just the commission model, but the entire underlying architecture of global asset trading? Robinhood appears to have an answer. At its recent launch event in Cannes, France, the U.S. securities giant—famous for popularizing zero-commission trading—unveiled an ambitious vision: leveraging blockchain and tokenization to bring stocks, derivatives, and even private equity onto the chain, ultimately building a new Layer2 public blockchain capable of hosting all real-world assets globally—Robinhood Chain.

This wasn't just a product rollout; it was Robinhood’s declaration of intent for the next decade. Three distinct markets—Europe, the U.S., and the global stage—are each assigned strategic entry points that interconnect to form a new, always-on trading order driven by tokenized assets. This article breaks down Robinhood’s grand “on-chain brokerage” strategy in three parts, combining insights from the live presentation with broader industry context.

Targeting Europe: Tokenized U.S. Stocks + Perpetual Contracts + All-in-One Investment App

Main product highlights:

1. Launch of tokenized trading for 200+ U.S. stocks and ETFs on Arbitrum, expanding to more assets by year-end

2. European app upgraded from "Robinhood Crypto" to "Robinhood," repositioned as a comprehensive investment platform

3. Perpetual futures launching this summer with simplified mobile order placement

4. Bitstamp serves as liquidity engine for perpetuals and derivatives

5. Tokenized stocks support real-time dividend payouts and stock splits

6. Coverage across 31 European countries; SpaceX and OpenAI private equity tokens available for subscription starting July

Key details to note:

1. Three-phase roadmap:

a. TradFi custody → Robinhood mints tokens

b. Bitstamp enables weekend trading → 24/5 liquidity

c. Future support for self-custody and cross-chain transfers

2. Users who deposit funds before July 7 receive a 2% bonus

3. App rebranding and UI upgrade reinforce positioning as an "investment super app"

Robinhood sees European users as pioneers in its tokenization strategy—and for good reason. The EU recently implemented MiCA (Markets in Crypto-Assets Regulation), offering clearer regulatory guidance than the U.S., while Robinhood's market penetration in Europe remains far from saturated.

The company announced that over 200 U.S.-listed stocks and ETFs will now be tradable as tokenized assets on Arbitrum Layer2. European users can buy and sell these tokenized equities within the Robinhood app much like cryptocurrencies. Thanks to Robinhood’s on-chain settlement sync mechanism, corporate actions such as dividends and stock splits are automatically reflected in token holders’ accounts. Users don’t need to understand blockchain intricacies—they seamlessly gain access to a 24/5 tradable U.S. stock market.

Robinhood plans to expand this offering to "thousands of U.S. stocks and ETFs" by year-end. Currently, all trades are backed by physical shares purchased through traditional broker-dealers and mirrored 1:1 with issued tokens. Over time, this process will migrate to Robinhood’s proprietary Robinhood Chain, enabling cross-chain interoperability and self-custody capabilities.

Beyond tokenized stocks, Robinhood also unveiled perpetual futures trading in Europe, powered by Bitstamp for matching and clearing. This marks the first deep integration since Robinhood acquired Bitstamp for $200 million last year. The platform emphasized user experience innovation: complex features like margin settings, stop-loss, and take-profit orders are simplified into intuitive sliders on mobile, lowering the barrier for retail investors to use advanced leveraged tools.

To align with these updates, Robinhood renamed its European app from "Robinhood Crypto" to simply "Robinhood," positioning it as an All-in-One investment super app integrating crypto, tokenized stocks, and perpetuals. The goal is to establish first-mover advantage across 31 EU countries plus the EEA.

Most surprisingly, Robinhood revealed plans for "private equity tokens": starting July 7, European users can apply to receive tokenized shares in SpaceX and OpenAI. This move breaks the long-standing monopoly of high-net-worth individuals and institutions over top-tier private tech startups, opening ownership to everyday retail investors via tokenization.

This approach directly addresses a long-standing question in the blockchain community: How can ordinary people fairly participate in future wealth creation? Robinhood’s answer: private equity must also be tokenized—and accessible to all.

Targeting the U.S.: Advanced Crypto Trading + AI Assistant + Staking

Main product highlights:

1. Legend platform’s advanced charts and indicators coming to mobile

2. Smart Exchange Routing launched to auto-match best rates

3. Precise position selection for easier tax management

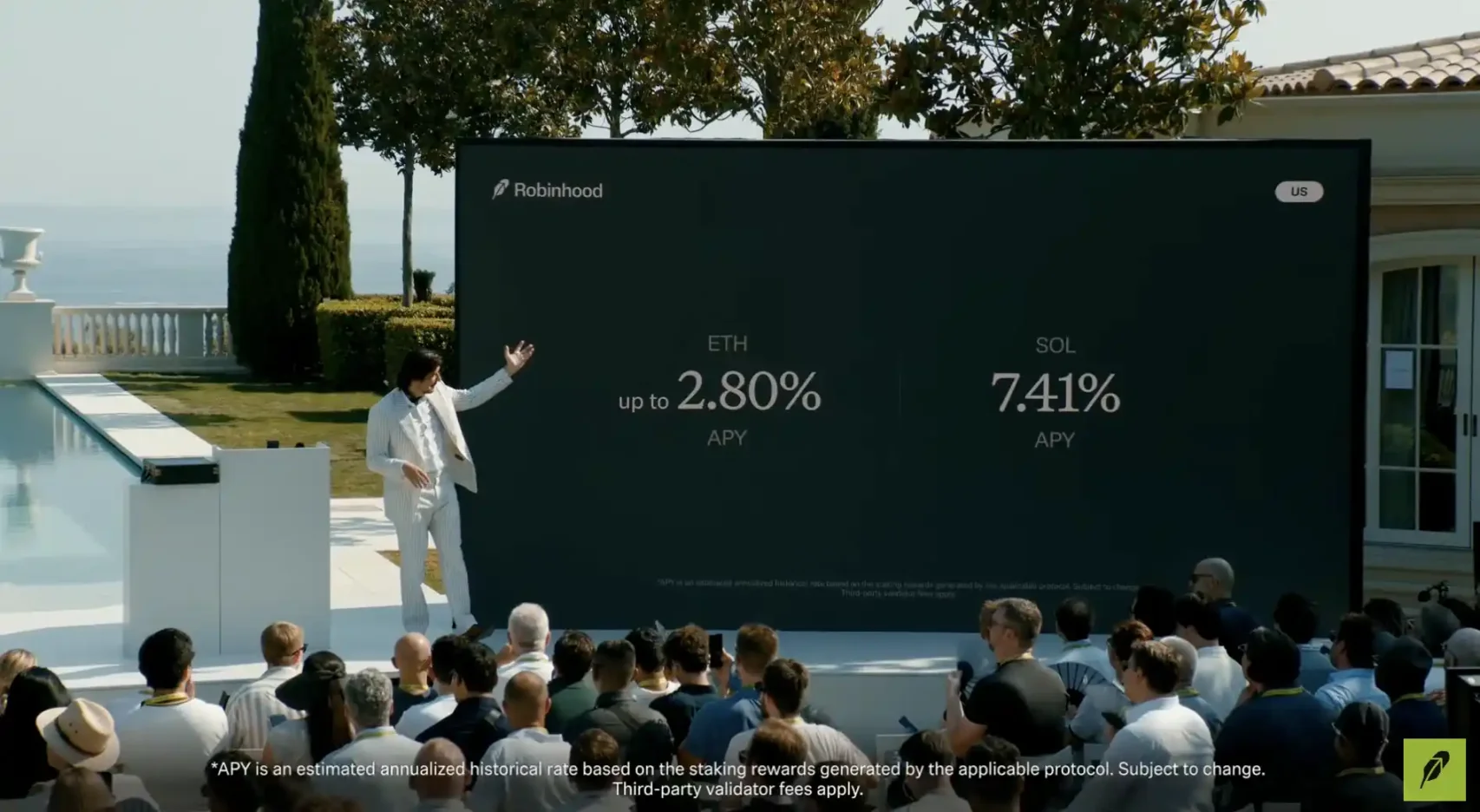

4. Staking launched in the U.S., initially supporting ETH and SOL

5. AI assistant Cortex available to Robinhood Gold users

6. Rabbit Gold Card to offer crypto cashback

7. These features planned for future rollout in Europe

Notable details:

1. Staking promotion includes 2% rewards with no minimum threshold

2. Cortex feed includes token updates and on-chain events

3. Smart Routing enables all-in fees as low as 0.1% for large trades

4. Staking positioned as a way to contribute to "network security"

If Europe is Robinhood’s tokenization testing ground, the U.S. remains its core stronghold. With this launch, Robinhood rolled out domestic upgrades aimed at reinforcing its status as the "go-to platform for active traders" through deeper tools and expanded investment opportunities.

First, Robinhood introduced staking in the U.S., initially supporting Ethereum and Solana—with no minimum stake requirement. During the promotional period, users earn a 2% deposit bonus regardless of amount. CEO Vlad Tenev emphasized another dimension of staking: beyond earning yield, it represents a chance for every user to help secure the network. He stated, "Blockchain security comes from people. Staking reflects Robinhood’s effort to involve users in co-building the financial system."

On the trading front, Robinhood’s flagship desktop platform, Legend, will bring advanced charting, customizable indicators, and deep order book functionality to mobile this summer—an upgrade particularly appealing to mobile traders who previously faced significant feature gaps compared to the desktop version.

Complementing Legend, Robinhood launched Smart Exchange Routing, which scans multiple exchanges to find optimal liquidity and routes trades automatically. Fees are dynamically calculated based on 30-day rolling volume, going as low as 0.1%, and eliminating the traditional maker/taker fee distinction. This mirrors smart routing used in traditional finance and is key to attracting institutional and quantitative crypto traders.

In addition, Robinhood introduced Cortex, an AI-powered investment assistant designed for Robinhood Gold subscribers. It delivers integrated analysis covering market movements, major on-chain transfers, token news, and even corporate earnings reports. Unlike simple price alerts, Cortex aims to help users understand the root causes behind digital asset volatility.

Finally, the Robinhood Gold credit card (Rabbit Gold Card) will add a "crypto cashback" feature, allowing cardholders to automatically convert daily spending rewards into selected cryptocurrencies. Robinhood calls this a break from traditional cashback models, aiming to seamlessly connect everyday life with on-chain asset management.

Overall, Robinhood is evolving in the U.S. from a "zero-commission broker" into a full-stack "on-chain wealth management platform." From staking to AI, from credit cards to intelligent routing, each move reflects a deeper engagement with the user lifecycle.

Global Strategy: Robinhood Chain + Private Equity Tokens + Full Ecosystem Onboarding

Main product highlights:

1. Robinhood Chain built on Arbitrum technology stack

2. Mid-term ability to switch between Bitstamp and TradFi liquidity

3. Long-term support for self-custody and cross-chain migration

Key details:

1. SpaceX and OpenAI private equity tokens to go live first—seen as critical to breaking down high-net-worth barriers

2. Actively collaborating with regulators to ensure compliant onboarding; plans to open platform to developers to grow RWA ecosystem

All the products mentioned above converge into Robinhood’s overarching global vision: Robinhood Chain.

Evolved from the Arbitrum tech stack, Robinhood Chain is positioned as the "first Layer2 public blockchain purpose-built for real-world assets." It will not only host tokenized stock trading but also support the future tokenization of real estate, bonds, art, carbon credits, and more.

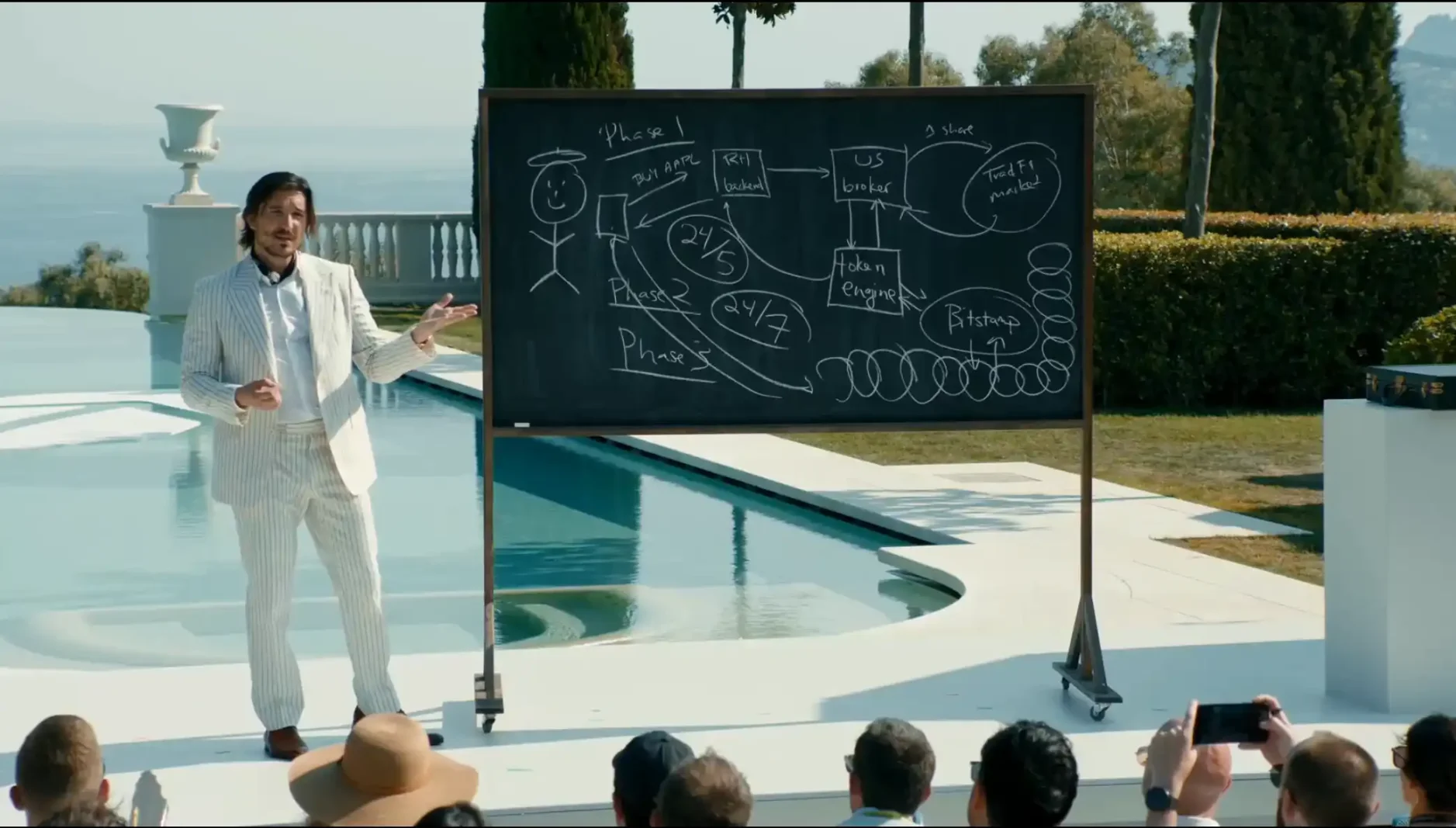

At the event, Vlad Tenev outlined a "three-phase" plan:

Phase One: After user orders, Robinhood’s U.S. broker-dealer purchases corresponding stocks on traditional exchanges and holds them in custody, while Robinhood issues 1:1 backed tokens.

Phase Two: Integration with Bitstamp and traditional financial (TradFi) liquidity allows continued trading during traditional market closures (e.g., weekends, holidays).

Phase Three: Full unlocking of self-custody and cross-chain transfer capabilities, enabling users to move Robinhood-issued assets to personal wallets or use them across other DeFi protocols.

In essence, Robinhood Chain isn't just an internal "Layer2 settlement layer"—it's intended to become a developer-accessible public chain ecosystem where third parties can issue their own real-world asset tokens.

This positions Robinhood in direct competition with Coinbase and Kraken, both actively exploring RWA (Real World Assets) strategies. But unlike pure crypto exchanges, Robinhood holds broker-dealer licenses and has built a fully compliant brokerage pipeline from day one. This gives it a faster path to bridging traditional finance and blockchain under regulatory compliance.

Notably, Robinhood simultaneously announced the immediate issuance of OpenAI and SpaceX private equity tokens. These tokens will remain tradable on Robinhood Chain during weekends, independent of any single custodian, and will eventually support free cross-chain usage. Such initiatives could reshape the liquidity structure of the entire private investment industry—mirroring Robinhood’s earlier zero-commission revolution with similarly disruptive potential.

Industry observers believe that if Robinhood successfully establishes Robinhood Chain as the foundational layer for global real-world assets—not just stocks or futures, but real estate, art, and carbon credits—these could become composable assets in users’ wallets. Such a transformation would represent a profound reinvention of the global financial system.

The Emergence of the On-Chain Broker

From zero commissions to fractional stock trading, and now declaring "Robinhood Chain," Robinhood has followed a consistent innovation trajectory—each step targeting inefficiencies and barriers in traditional finance and using technology to dramatically lower access thresholds.

When tokenization extends from a single Apple share to buildings, private equity stakes, or artworks, blockchain ceases to be merely a speculative tool and begins to fulfill its true potential as an "internet of assets." Robinhood sees this opportunity clearly and aims to leverage its massive user base and brand trust to lead the charge during this window of gradually clarifying regulation.

A report by Ripple and BCG forecasts that the global tokenized real-world asset market could reach $18.9 trillion by 2033. Robinhood clearly doesn't intend to be just a participant—it wants to build the foundation. Perhaps the closing line from the Cannes keynote says it best: "The foundation of global finance in the future will be Robinhood Chain."

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News