IMF Did Not Kill Bitcoin

TechFlow Selected TechFlow Selected

IMF Did Not Kill Bitcoin

Countries carrying heavy IMF loan burdens have faced overwhelming resistance in adopting Bitcoin.

Author: Daniel Batten

Translation: Luffy, Foresight News

In recent years, the International Monetary Fund (IMF) has been weaving a network of measures aimed at curbing Bitcoin adoption:

-

Successfully pressured El Salvador to abandon Bitcoin as legal tender and roll back several other Bitcoin-related policies

-

Through regional banking institutions, successfully pressured the Central African Republic to repeal its Bitcoin law in 2023

-

Caused Argentine President Milei’s Bitcoin promises during his campaign to fail to materialize into action

-

Expressed “serious concerns” about Pakistan’s Bitcoin plans

-

Consistently treats cryptocurrencies as a “risk” in loan negotiations

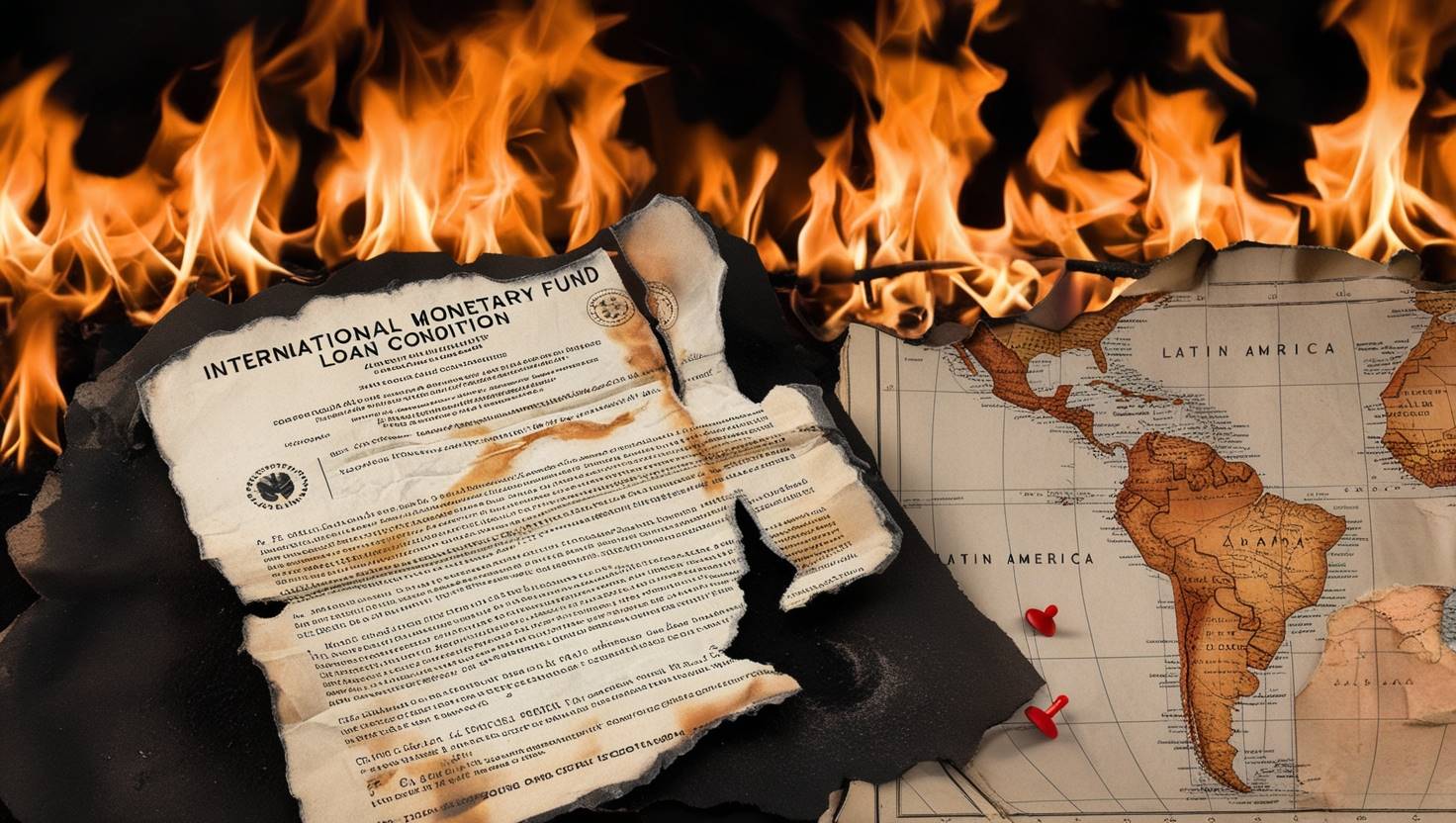

Below is a summary table:

As we can see, the only countries resisting IMF pressure are those not receiving IMF loans—El Salvador (prior to 2025) and Bhutan. Every nation that accepted IMF funding and attempted national-level Bitcoin adoption has either been blocked or significantly undermined by the IMF.

Why has the IMF been so effective at stopping global Bitcoin adoption (except in Bhutan)? And why is it so actively opposed?

In this detailed report, we analyze three countries where the IMF successfully resisted Bitcoin adoption and examine how it may achieve similar results in Pakistan. In the final section, we explore five core concerns the IMF has about Bitcoin—and how, despite top-down abandonment or partial retreats by nation-states, Bitcoin continues to thrive at the grassroots level.

1. Central African Republic: When Colonial Currency Meets Digital Hope

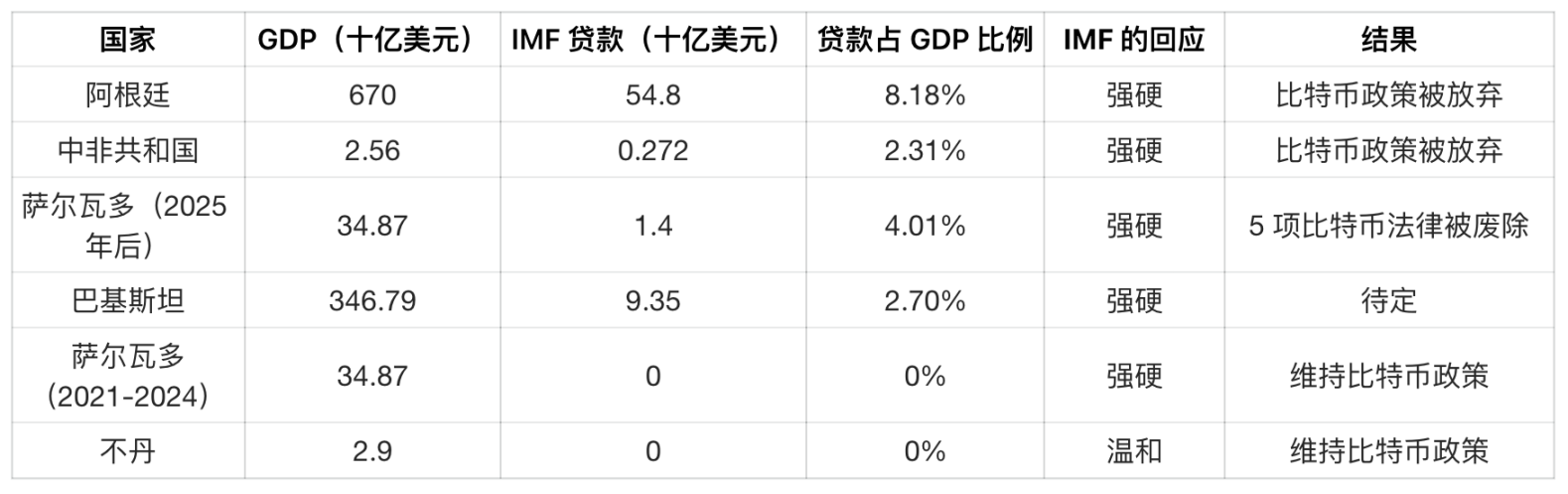

The Central African Republic (CAR) uses the CFA franc, issued by the Bank of Central African States (BEAC). The CFA franc is more than just currency—it's a geopolitical chain backed by France. Among its 14 member states, six Central African nations—including CAR—are required to deposit 50% of their foreign exchange reserves in Paris.

This control over reserves creates economic dependency and grants preferential access to French exporters. For example, under Western—particularly IMF—pressure in 1994, the CFA franc was devalued by 50%, causing import costs to skyrocket while EU exporters could buy resources from CFA countries at half price. Domestically, the impact was devastating: wage freezes, mass layoffs, and widespread social unrest followed.

When CAR announced Bitcoin as legal tender in 2022, BEAC and its regulatory body, the Central African Economic and Monetary Community (CEMAC), immediately declared the move invalid, citing violations of regional treaties. This wasn’t bureaucratic inertia—it was a warning from the guardians of “Francophone Africa.”

Why does this matter? CAR remains heavily dependent on IMF aid, with $1.7 billion in external debt (61% of GDP). Defying BEAC risks financial isolation.

The IMF’s Quiet Intervention

The IMF moved swiftly. On May 4, 2022—just two weeks after CAR’s announcement—the IMF publicly condemned what it called a “dangerous experiment,” citing legal conflicts with CEMAC’s crypto ban. It warned of “significant legal, transparency, and macroeconomic policy challenges,” echoing earlier concerns about El Salvador: risks to financial stability, consumer protection, and fiscal liability (risks that, notably, never materialized in El Salvador).

But its real weapon was leverage. As CAR’s largest creditor, the IMF tied a new $191 million Extended Credit Facility to policy compliance.

Timeline of Covert Action

The table below traces the IMF’s behind-the-scenes maneuvers:

The key to undermining CAR’s Bitcoin ambitions was ensuring the Sango project—a government-led blockchain initiative aiming to sell digital residency and citizenship for 6 BTC ($60,000)—would not succeed.

Sango Project: Coincidence or Conspiracy?

In July 2022, CAR launched the Sango project, aiming to raise $2.5 billion—equivalent to an entire year of GDP.

The project failed. By January 2023, only $2 million had been raised (0.2% of target). The IMF attributed failure to “technical barriers due to only 10% internet penetration.” Our analysis reveals a different story. Two factors destroyed Sango:

-

Investor flight

-

A Supreme Court ruling halting the Sango project

Yet closer inspection suggests IMF involvement in both.

Investor Flight

The IMF’s role was indirect but compelling:

-

On May 4, 2022, the IMF expressed concern over CAR’s Bitcoin adoption, highlighting risks to financial stability and regional integration—statements made before Sango’s launch, likely deterring investors.

-

In July 2022, during staff visits for program reviews, the IMF cited “economic downturn due to rising food and fuel prices,” further dampening investor sentiment.

-

Reports also indicate the IMF and CEMAC warned of inherent risks in CAR’s crypto initiatives, amplifying market skepticism.

The timing of these statements aligns precisely with observed investor withdrawal, suggesting the IMF’s authoritative voice shaped market perception.

Supreme Court Ruling

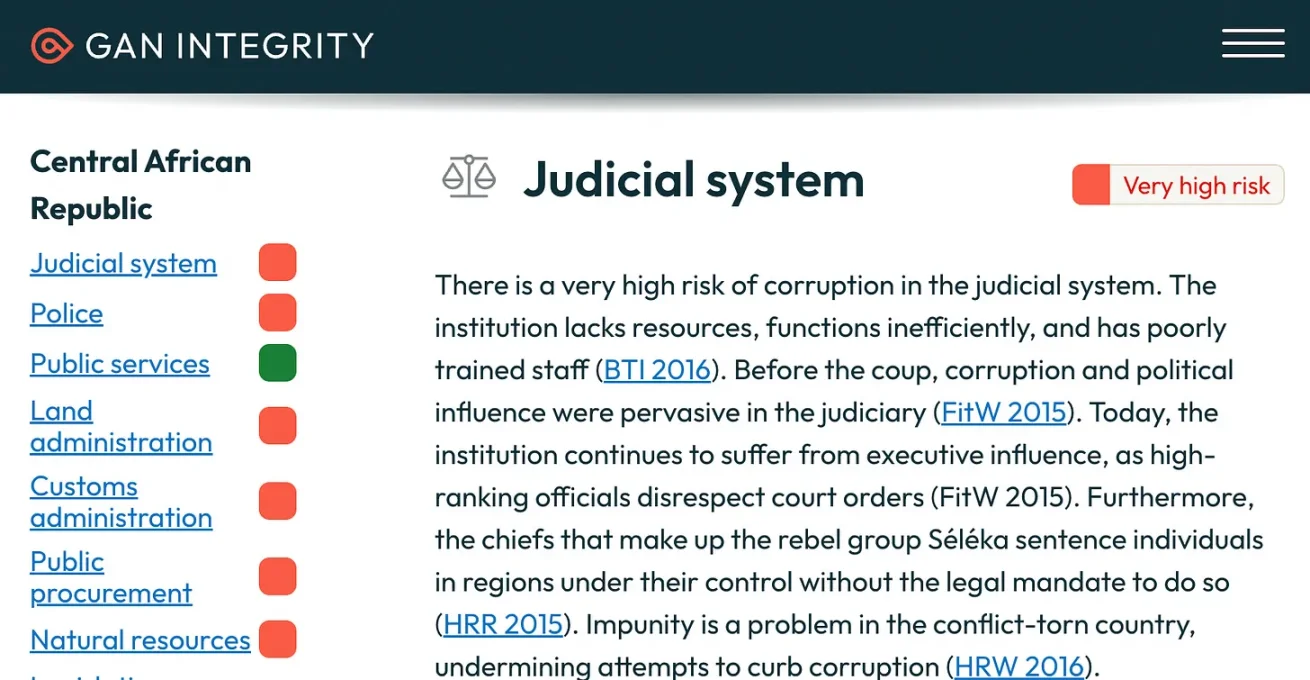

On the surface, the court decision appears independent. But deeper scrutiny reveals doubts about judicial independence—CAR ranks 149 out of 180 on Transparency International’s Corruption Perceptions Index.

Just one week after CAR announced its Bitcoin strategy, on May 4, 2022, the IMF voiced concerns over financial stability, transparency, anti-money laundering efforts, and macroeconomic volatility.

117 days later, on August 29, 2022, CAR’s Supreme Court ruled the Sango project illegal. Organizations like Gan Integrity report that the judiciary—including the Supreme Court—is among the most corrupt institutions in CAR, plagued by inefficiency, political interference, and susceptibility to bribery.

The collapse of Sango became the IMF’s Exhibit A: “proof” that Bitcoin cannot function in fragile economies. But the reality is that the IMF’s persistent warnings poisoned the environment well in advance, making this outcome inevitable.

Over 5,200 miles away, in tiny Bhutan, a different picture emerges: Bitcoin thrives in the absence of IMF “engagement.”

The Unspoken Conclusion: Bitcoin’s Resilience Transcends Borders

CAR’s reversal has nothing to do with Bitcoin’s viability—and everything to do with power. The IMF leveraged regional banking alliances to cut off CAR’s capital access and used a $191 million loan to eliminate threats to financial sovereignty. When Sango faltered, the trap snapped shut.

Yet this failure also revealed Bitcoin’s enduring strength. Note what the IMF could *not* destroy:

-

Nigerian Bitcoin remittances continue bypassing dollar channels, saving millions in fees

-

Kenyan Bitcoin trade flourishes without IMF approval

-

El Salvador continues accumulating Bitcoin despite 221 mentions of Bitcoin in loan conditions

The pattern is clear: wherever grassroots adoption takes root, Bitcoin survives. But for nations announcing top-down Bitcoin strategies while carrying heavy IMF loans, all face overwhelming resistance: El Salvador, CAR, Argentina, and now Pakistan.

CAR’s outstanding $115.1 million IMF balance keeps it under pressure. In countries like Bhutan—with no IMF loans—Bitcoin slips through the cracks. Every peer-to-peer payment, every Lightning Network transaction, erodes the foundations of the old system.

The IMF won this round in CAR—but the battle for global financial sovereignty has only begun.

2. Argentina: The $45 Billion Barrier to Bitcoin Adoption

If CAR’s Bitcoin plan was defeated, Argentina never even started. President Milei’s pre-election rhetoric suggested bold moves—but ultimately led nowhere. Was this just political posturing, or something deeper? This section uncovers the truth behind Argentina’s failed Bitcoin agenda.

Understanding Bitcoin adoption is like assessing whether a rocket reaches escape velocity—we must evaluate both thrust and resistance.

I’m an optimist: I believe Bitcoin will win because it’s clearly a superior solution to our broken fiat system. But I’m also a realist: most people underestimate the entrenched power opposing it.

Running tech companies taught me the same lesson. Our systems were 10x better—faster, cheaper—but incumbents don’t surrender monopolies easily.

What Happened in Argentina?

When libertarian Javier Milei was elected president in November 2023, many Bitcoin advocates celebrated. He called central bankers “thieves,” vowed to abolish Argentina’s central bank, and praised Bitcoin as “the natural response to central bank fraud.” This became a test case: could Bitcoin gain mainstream legitimacy through government adoption, not just grassroots growth?

Yet 18 months into his presidency, Milei’s Bitcoin vision remains unfulfilled. Why? Because $45 billion in IMF-controlled funds dictate Argentina’s monetary path.

The IMF’s Veto Power

The constraints existed long before Milei took office. On March 3, 2022, Argentina’s previous government signed a $45 billion IMF bailout agreement. Weeks later, details emerged revealing an unusual clause: a requirement to “prevent cryptocurrency use.” This wasn’t advice—it was a loan condition documented in the IMF’s Letter of Intent, citing fears of “financial disintermediation.”

Immediate consequences:

-

Argentina’s central bank banned financial institutions from handling crypto transactions

-

Despite Milei’s pro-Bitcoin rhetoric, this policy remained enforced during his tenure

Milei’s Pivot

After taking office, Milei achieved significant reforms:

-

Reduced monthly inflation from 25% to under 5% (by May 2024)

-

Lifted currency controls (April 2025)

-

Secured a new $20 billion IMF deal (April 2025)

Yet his flagship proposals—Bitcoin adoption and abolishing the central bank—were conspicuously absent. The reason is simple: Argentina owes more to the IMF than any other country, giving the IMF unparalleled leverage.

The irony? Despite IMF blocking official Bitcoin adoption, Argentinians are embracing Bitcoin anyway. From 2023–2024, Latin America saw a 116.5% increase in crypto ownership, with Argentina leading at 18.9%—nearly triple the global average. This surge is driven by citizens hedging against 47.3% annual inflation (as of April 2025). It’s a quiet rebellion the IMF cannot stop.

What Comes Next?

All eyes are on the October 2025 midterm elections. If Milei gains stronger support, he may challenge IMF red lines. For now, the lesson is clear: when a country borrows from the IMF, its monetary sovereignty is compromised.

Key Takeaways

-

The 2022 IMF loan explicitly tied Argentina’s bailout to anti-crypto policies

-

Milei prioritized economic stabilization over Bitcoin advocacy to maintain IMF support

-

Parallels with El Salvador, CAR, and now Pakistan reveal a consistent IMF strategy

-

Argentinians circumvent restrictions through grassroots Bitcoin adoption

3. El Salvador: The IMF’s Partial Victory

When El Salvador made Bitcoin legal tender in 2021, it wasn’t just adopting a cryptocurrency—it was declaring financial independence. President Nayib Bukele framed it as resistance against dollar dominance and a lifeline for the unbanked. Three years later, that resistance hit a $1.4 billion roadblock: the IMF.

The Price of Rescue

To secure its 2024 loan, El Salvador agreed to dismantle key pillars of its Bitcoin policy:

-

Voluntary Use: Businesses no longer required to accept Bitcoin

-

Public Sector Ban: Government entities prohibited from Bitcoin transactions or issuing debt, including tokenized instruments linked to Bitcoin

-

Bitcoin Purchases Frozen: All government buying halted (over 6,000 BTC reserves now frozen), with full audit required by March 2025

-

Trust Fund Liquidation: Fidebitcoin (conversion fund) to be dissolved upon transparent audit

-

Chivo Wallet Phased Out: With surveys showing most users immediately convert BTC to USD, the $30 incentive program will be gradually discontinued

-

Tax Rollback: Taxes collected exclusively in USD, eliminating Bitcoin’s utility as sovereign payment

Bukele’s Strategic Retreat

The concessions made fiscal sense:

-

With bond repayments looming, the loan stabilized debt (84% of GDP)

-

Dollarization remains intact (USD still primary currency)

Yet given Bukele’s 2021 stance, the reversal is striking. Low usage of the Chivo wallet likely motivated compromise.

What Remains of the Experiment?

The IMF didn’t kill Bitcoin in El Salvador—it killed official adoption. Grassroots use persists:

-

Bitcoin Beach remains active—and thriving

-

Tourism attracts growing numbers of Bitcoin enthusiasts

But without state backing, Bitcoin may shrink—at least temporarily—from a monetary revolution to a niche tool.

The Road Ahead

Two scenarios lie ahead:

-

Slow Fade: As IMF conditions fully take effect, Bitcoin becomes a tourist curiosity

-

Shadow Revival: Private sector sustains Bitcoin despite government retreat

One thing is certain: when the IMF writes the check, it sets the rules.

Key Takeaways

-

IMF loan forced El Salvador to reverse six major Bitcoin policies

-

Sets precedent for other nations seeking IMF support

-

Grassroots Bitcoin use may prove more durable than government involvement

El Salvador made many concessions on Bitcoin. While arguably not damaging domestically, it sent a strong signal to other Latin American nations like Ecuador and Guatemala, who were watching closely and considering replication—until they checked their own IMF loan balances. Overall, this represents a partial victory for the IMF and a partial victory for El Salvador.

4. Bhutan: A Success Story Beyond IMF Control

Bhutan’s Bitcoin experiment has now run for two years, giving us reliable data on its economic impact.

The IMF warned that embracing Bitcoin would undermine economic stability, reduce foreign direct investment, and jeopardize decarbonization and environmental initiatives. It specifically cited “lack of transparency” in Bhutan’s crypto adoption.

What Does the Data Say?

-

Bitcoin reserves directly addressed urgent fiscal needs: “In June 2023, Bhutan allocated $72 million from its Bitcoin holdings to raise civil servant salaries by 50%”

-

Bhutan was able to “use Bitcoin reserves to avoid crisis as foreign exchange reserves dropped to $689 million”

-

Prime Minister Tshering Tobgay stated in an interview that Bitcoin also “supports free healthcare and green projects”

-

Tobgay added that Bitcoin reserves help “stabilize the country’s $3.5 billion economy”

-

Independent analysts say “this model could attract foreign investment, especially for countries with untapped renewable resources”

Given that the IMF’s analysis was not only incorrect but almost entirely inverted, a question arises: are IMF predictions based on data?

5. Five Reasons the IMF Might Fear Bitcoin

“Get all your friends—liberals, Democrats, Republicans—get everyone to buy Bitcoin… then it becomes democratized.” — John Perkins at the 2025 Bitcoin Conference

What if the IMF’s greatest fear isn’t inflation… but Bitcoin? Could Bitcoin break the IMF/World Bank debt-control system?

In my recent conversation with John Perkins, author of *Confessions of an Economic Hit Man*, things became clear. Alex Gladstein previously exposed how IMF “structural adjustment” didn’t alleviate poverty but enriched creditor nations. Perkins supplemented this with firsthand accounts.

Perkins revealed how the Global South is trapped in a debt cycle designed to channel wealth westward. But here’s the twist: Bitcoin is already dismantling this script in five key ways.

1) Lowering Remittance Costs to Loosen the Debt Grip

Chris Collins’ sculpture depicts the debt noose

Remittances—money migrant workers send home—form a significant portion of many developing economies’ GDP. Traditional intermediaries like Western Union charge 5–10%, effectively a hidden tax. Countries like El Salvador or Nigeria rely on central banks holding USD to stabilize local currencies—reserves often provided by the IMF.

Bitcoin changes the game

With the Lightning Network, transaction fees approach zero and settlements occur in seconds. In 2021, President Bukele optimistically predicted Bitcoin could save $400 million in remittance costs. In practice, there’s little evidence Bitcoin remittances have reached that scale yet. But the potential is undeniable: more Bitcoin remittances mean higher USD reserves, reducing reliance on IMF loans.

No wonder the IMF mentioned Bitcoin 221 times in El Salvador’s 2025 loan conditions—they want to remain relevant as lenders.

Bitcoin doesn’t just lower fees—it bypasses the dollar system entirely. In Nigeria, with a weak naira, families now hold Bitcoin as a harder asset than local currency. No need to burn USD reserves, no need for IMF bailouts.

The numbers speak:

-

Pakistan loses $1.8 billion annually in remittance fees—most recoverable via Bitcoin

-

El Salvador saves over $4 million yearly with just 1.1% Bitcoin remittance usage

Currently, Bitcoin adoption is limited. Only 12% of Salvadorans use Bitcoin regularly; over 5% of Nigerian remittances flow via crypto. But the trend is clear: each Bitcoin transfer weakens the debt dependency loop.

The IMF sees the threat. The question is: how fast will this silent revolution spread?

Nigeria’s 2024 remittance inflows neared $21 billion—over 4% of GDP

2) Evading Sanctions and Trade Barriers

Oil-rich Iran, Venezuela, and Russia were cut off from dollar access due to U.S. sanctions in 1979, 2017, and 2022, drastically reducing oil exports.

Regardless of ideological alignment, Bitcoin breaks this cycle. Iran already uses Bitcoin to “export oil” and evade sanctions; Venezuela uses Bitcoin to pay for imports under sanctions.

Iran also mines Bitcoin using energy exports, monetizing stranded assets to bypass the IMF’s “reform-for-cash” ultimatum while keeping its economy running. As Russia and Iran pioneer Bitcoin-oil trades, the petrodollar’s grip weakens.

Another country using Bitcoin to avoid humanitarian hardship under sanctions is Afghanistan. NGOs like “Code to Inspire” bypass Taliban banking freezes. The “Digital Citizen Fund” delivered aid via Bitcoin after the Taliban takeover, preventing some families from starving.

Afghanistan’s NGO 'Code to Inspire' uses Bitcoin donations—uncensorable by the Taliban—to train women in software development

While Bitcoin’s share in sanctioned trade remains small—under 2% of oil exports in Iran and Venezuela—the trend is upward.

Sanctions are a key geopolitical lever, typically supported by the IMF and World Bank due to alignment with major economies like the U.S. Sanctioned nations using Bitcoin reduce IMF control over capital flows and threaten dollar dominance.

3) Bitcoin as a National Inflation Shield

When countries like Argentina face hyperinflation, they borrow USD from the IMF to prop up reserves and stabilize local currency. But when they default, they face austerity or are forced to sell strategic assets cheaply. Bitcoin offers an alternative: a global, non-inflationary currency beyond government control, capable of appreciating in value.

El Salvador’s experiment shows Bitcoin can reduce dollar dependence. By holding Bitcoin, nations can hedge against currency collapse without needing IMF loans. If Argentina had allocated 1% of its reserves to Bitcoin in 2018, it could have offset over 90% of that year’s peso depreciation—avoiding IMF assistance altogether. Bitcoin’s neutrality means no single entity can impose conditions, unlike IMF loans that demand privatization or unpopular reforms. In promoting adoption, Bitcoin lacks both debt leverage and the IMF’s long history of intervention. Yet due to the Lindy Effect (see below), Bitcoin grows more viable each year.

Lindy Effect: The longer something has survived, the more likely it is to continue surviving

4) Bitcoin Mining: Turning Energy into Debt-Free Wealth

Many developing nations are rich in energy but burdened by debt, trapped in IMF loans for dams or power plants. When they default, these loans demand cheap energy exports or resource concessions. Bitcoin mining flips this model: stranded energy (flared gas, excess hydropower) is converted into liquid wealth—no middlemen, no transport costs.

Paraguay earns $50 million annually from hydro-powered mining, covering 5% of its trade deficit. Ethiopia earned $55 million in 10 months. Bhutan leads: with $1.1 billion in Bitcoin (36% of its $3.02 billion GDP), its hydro-mining could generate $1.25 billion annually by mid-2025, paying off its $403 million World Bank and $527 million Asian Development Bank debts. Unlike IMF loans, mined Bitcoin appreciates in value and can serve as collateral for non-IMF borrowing. This model—monetizing energy without surrendering assets—threatens IMF control over energy sectors.

Bhutan PM Tshering Tobgay calls Bitcoin a “strategic choice to prevent brain drain”

5) Grassroots Bitcoin Economies: Bottom-Up Power

Bitcoin isn’t just for nations—it’s for communities. In El Salvador’s Bitcoin Beach or South Africa’s Bitcoin Ekasi, locals use Bitcoin for daily transactions, savings, and community projects like schools or clinics. These circular economies, often charity-initiated, aim for self-sufficiency. In Argentina, where inflation often exceeds 100%, 21% of people used crypto to preserve wealth by 2021. If such models scale, reliance on IMF-funded national debt projects declines—the last thing the IMF wants.

Bitcoin Ekasi founder Hermann Vivier says his community, inspired by El Salvador’s Bitcoin Beach, replicated the circular Bitcoin economy in South Africa

Conclusion

By strengthening local resilience, Bitcoin undermines the IMF’s “crisis leverage.” Prosperous communities don’t need bailouts—so the IMF can’t demand privatization to repay loans. In Africa, projects like Gridless Energy use renewable microgrids tied to Bitcoin mining to lift 28,000 rural Africans out of energy poverty, reducing need for IMF-backed megaprojects. If thousands of towns adopt this model, dollar shortages cease to matter, and trade can bypass the dollar system.

While the IMF occasionally spreads misinformation about Bitcoin’s energy use and environmental impact to slow adoption, its far greater tool is leveraging financial influence over debtor nations to “encourage” compliance with its Bitcoin-free future vision.

The IMF opposed Bitcoin adoption in El Salvador, CAR, and Argentina. Now it opposes Pakistan’s intent to mine Bitcoin as a nation-state. As these grassroots forces grow, the IMF may be forced into more direct suppression.

Children in one of South Africa’s poorest villages learn to surf through the Bitcoin Ekasi project

Grassroots Bitcoin economies empower communities to thrive without IMF aid. We need people power and innovative resistance to counter the IMF’s crackdown.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News