Can retail crypto investors buy SpaceX equity? Here’s a look at three major private equity tokenization platforms

TechFlow Selected TechFlow Selected

Can retail crypto investors buy SpaceX equity? Here’s a look at three major private equity tokenization platforms

Private equity tokenization is reshaping how retail investors participate in primary markets.

Author: kkk, TechFlow

Beyond the stablecoin boom, equity tokenization is emerging as a new market narrative.

On June 27, Web3 startup Jarsy announced a $5 million Pre-seed funding round led by Breyer Capital. While the amount drew attention, what truly captured market interest was the problem they aim to solve: why should the early growth红利 of top private companies remain accessible only to institutions and ultra-wealthy individuals? Jarsy’s answer is to use blockchain technology to reconstruct participation—tokenizing private company shares into asset-backed tokens, enabling ordinary people to bet on the growth of star companies like SpaceX and Stripe with just a $10 minimum investment.

Following the funding announcement, market attention quickly turned to "private equity tokenization"—an alternative asset class previously confined to VC boardrooms and high-net-worth circles, now being packaged as blockchain-native assets and expanding onto public chains.

Private Equity Tokenization: The Next Frontier of On-Chain Assets

If there remains any underutilized financial opportunity in this era, the private markets stand out as the most representative financial silo.

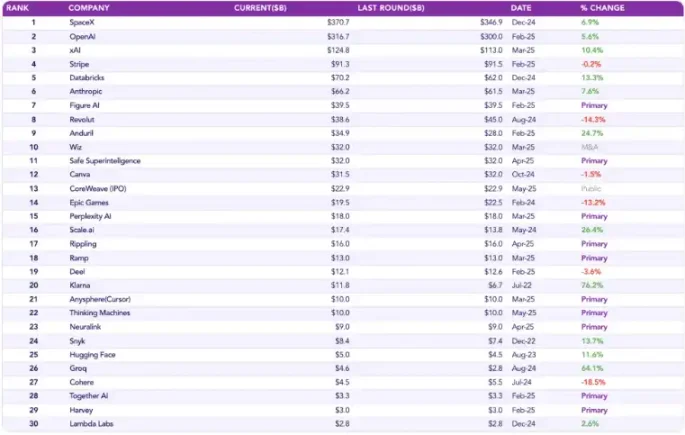

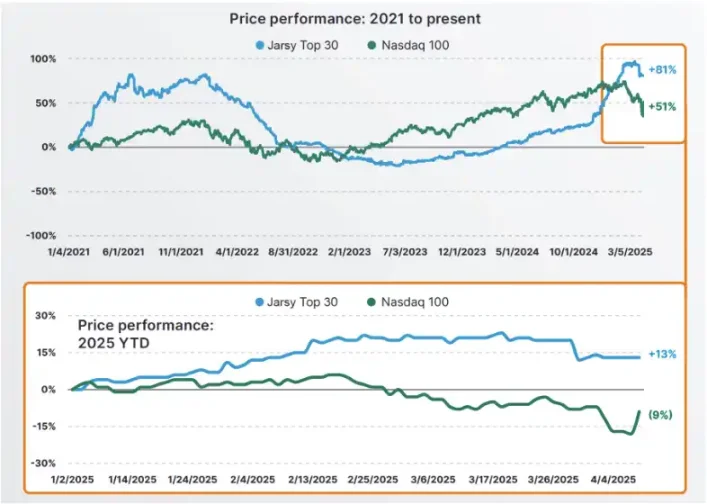

Jarsy has built an index covering the 30 largest and most active pre-IPO companies—the "Jarsy 30 Index"—to measure the overall performance of top-tier Pre-IPO firms. Focusing on high-profile names such as SpaceX and Stripe, this index represents the most promising and capital-intensive segment of the private market. Data shows these companies offer highly attractive returns.

From early 2021 to Q1 2025, the Jarsy 30 Index rose 81%, significantly outperforming the Nasdaq 100’s 51% gain over the same period. Even during Q1 2025, when broader markets declined (with the Nasdaq dropping 9%), these leading private firms逆势 gained 13%. This stark contrast not only affirms strong fundamentals but also reflects a market vote for value creation in the pre-IPO growth phase—these assets remain in a golden window of significant mispricing.

The issue, however, is that this "value capture window" remains accessible to only a select few. With average transaction sizes exceeding $3 million, complex structures (often requiring SPVs), and no public liquidity, this market is effectively a "spectator zone" for retail investors.

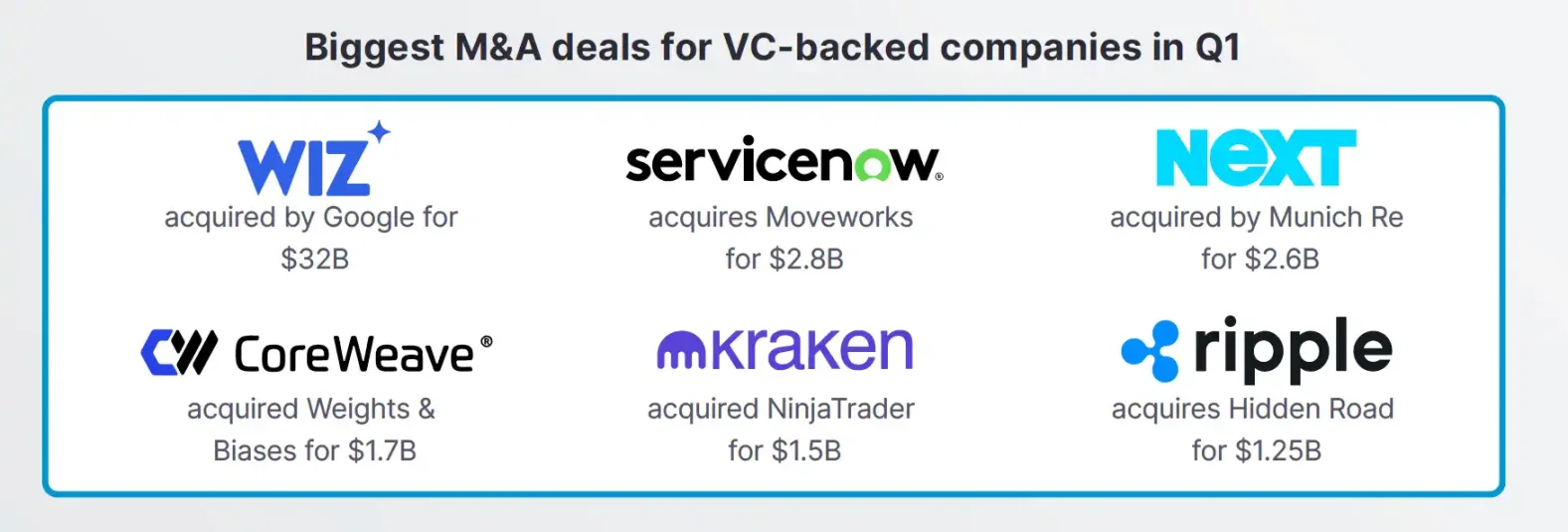

Moreover, exit paths for these companies are increasingly diverse—not limited to IPOs, with M&A becoming a dominant route, further raising barriers for retail participation. In Q1 2025 alone, M&A volume among venture-backed firms hit a record $54 billion, including Google’s $32 billion acquisition of cybersecurity unicorn Wiz.

Thus, we see a classic picture of traditional finance: the most promising growth assets remain locked within elite circles of wealthy individuals and institutions, while ordinary investors are shut out.

Private equity tokenization aims to dismantle this structural inequality by transforming high-barrier, illiquid, opaque private equity into on-chain native assets—lowering entry from $3 million to $10, replacing cumbersome SPV agreements with smart contracts, and enhancing liquidity so long-locked assets can be priced continuously and transparently.

Bringing the Capital Feast of Private Markets Into Every Digital Wallet

Jarsy

As a blockchain-based asset tokenization platform, Jarsy seeks to break down walls in traditional finance, turning Pre-IPO assets once reserved for the wealthy into publicly accessible investment products for global users. Its vision is clear: democratize access to financial opportunities by eliminating barriers of capital, geography, and regulatory labels.

The mechanism is straightforward yet powerful. Jarsy first acquires real equity stakes in target companies, then issues tokens representing those stakes on-chain at a 1:1 ratio. This isn't mere securities mapping—it's a genuine transfer of economic rights. Crucially, all token supply, circulation paths, and holdings are fully transparent and verifiable on-chain. By combining on-chain traceability with off-chain real-world backing, Jarsy technologically reimagines the traditional SPV and fund structure.

At the same time, Jarsy shields retail users from diving into the deep end of complex processes. The platform handles due diligence, structuring, legal custody, and other heavy lifting, allowing users to build their own Pre-IPO portfolios starting at $10 via credit card or USDC. Complex risk controls and compliance procedures remain invisible to end users.

In this model, token prices are tightly linked to company valuations, and user returns stem directly from real corporate growth—not platform-driven speculation. This architecture enhances authenticity and, at a systemic level, opens up the historically elite-controlled revenue pipeline between retail investors and primary markets.

Republic

On June 25, veteran investment platform Republic launched a new product line—Mirror Tokens—with its first offering, rSpaceX, built on the Solana blockchain. It aims to mirror one of the world’s most visionary companies as a publicly subscribable on-chain asset. Each rSpaceX token tracks the expected valuation trajectory of SpaceX, the $350 billion aerospace unicorn, with a minimum investment of just $50 and support for Apple Pay and stablecoin payments—opening the temple doors of private markets to global retail investors.

Unlike traditional private equity investments, Mirror Tokens do not confer voting rights. Instead, they employ a unique “tracker” mechanism: the tokens are essentially debt instruments dynamically tied to the target company’s valuation. When SpaceX undergoes an IPO, acquisition, or other liquidity event, Republic will distribute proportional stablecoin payouts—including potential dividends—to token holders’ wallets. This novel structure enables “earning returns without ownership,” minimizing legal hurdles while preserving core economic exposure.

Naturally, there are still some restrictions. All Mirror Tokens are subject to a 12-month lock-up after initial issuance before they can be traded on secondary markets. From a regulatory standpoint, rSpaceX is offered under U.S. Regulation Crowdfunding rules, open to investors regardless of accreditation status, though eligibility may be filtered based on local laws.

More excitingly, this is just the beginning. Republic has signaled plans to launch Mirror Tokens pegged to other star private companies such as Figma, Anthropic, Epic Games, and xAI—and even allow users to nominate the next “unicorn” they want to back. From structural design to distribution mechanisms, Republic is building a parallel on-chain private equity market that operates independently of IPO timelines.

Tokeny

Tokeny, a Luxembourg-based RWA tokenization solutions provider, is also entering the private market securitization space. In June 2025, Tokeny partnered with local digital securities platform Kerdo to reshape how European professional investors access private markets—including real estate, private equity, hedge funds, and private credit—using blockchain infrastructure.

Its key advantages lie in standardized product structures, embedded compliance logic, and rapid cross-jurisdictional scalability through Tokeny’s white-label technology. Tokeny focuses on granting assets “institutional-grade legitimacy”: its use of the ERC-3643 standard enables KYC, transfer restrictions, and other control mechanisms to be encoded throughout the token lifecycle. This ensures regulatory compliance and transparency while allowing investors to self-verify security on-chain without relying solely on platform trust.

Against the backdrop of increasingly stringent regulations like MiFID II, demand for compliant on-chain assets is accelerating across Europe. Tokeny is addressing the trust gap between institutional investors and on-chain assets through technically sophisticated means. The partnership reflects a broader trend: competition in the RWA sector is no longer just about technical implementation on-chain, but about mastering the combination of regulation, standardized product design, and multi-jurisdictional issuance channels. The Tokeny-Kerdo alliance exemplifies this shift.

Conclusion

The rise of private equity tokenization signals a structural transformation of primary markets driven by blockchain technology. Yet this path remains fraught with real-world challenges. While it may redefine access rules, it cannot instantly dismantle the deep structural divides between retail and institutional players. RWA is not a "magic key," but rather a long-term博弈 around trust, transparency, and institutional reinvention. The true test has only just begun.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News