Introducing Virtuals' New Launch Mechanisms: Pegasus, Unicorn, and Titan

TechFlow Selected TechFlow Selected

Introducing Virtuals' New Launch Mechanisms: Pegasus, Unicorn, and Titan

Each release mechanism of Virtuals is based on our experience gained from builder practices and real market behaviors.

Author: Virtuals Protocol

Compiled by: TechFlow

The Single Launch Model Is No Longer Sufficient

Virtuals Protocol was created to support builders, not to confine them to a single path. As the agent market evolves, so does our launch mechanism.

In 2024, our focus was on validating the viability of the agent market itself. Early launch prototypes prioritized speed and experimentation, aiming to verify whether agents could exist on-chain, be publicly traded, and begin coordinating real economic value. The goal of this phase was not optimization, but exploration.

By 2025, the focus shifted to "fair access." We introduced the Genesis model to ensure large-scale fairness, allowing everyone to participate through contribution rather than capital. This model successfully democratized launches and established transparency. However, over time, its limitations became apparent: fairness alone does not strengthen conviction, and the lack of a built-in funding path makes it difficult for high-quality builders to sustain long-term development.

The Unicorn model emerged as a correction to the above issues. It refocused the system's core on "conviction," rewarding early trust and providing asymmetric returns by linking capital to performance. For builders seeking funding support and public accountability, the Unicorn model indeed achieved the desired effect. However, as the ecosystem matured, it became evident that different builders face different challenges.

Startup teams need distribution channels, growth-stage teams need capital formation, and teams with established credibility and large-scale launches need a clear market entry path.

A Single Launch Model Cannot Meet All Needs

Figure: Pegasus (left), Titan (middle), Unicorn (right)

We proudly introduce Pegasus, Unicorn, and Titan. These three mechanisms together form a unified agent launch framework, supporting early experimentation, conviction-based growth, and large-scale launches, while maintaining shared liquidity, unified ownership, and a coherent ecosystem.

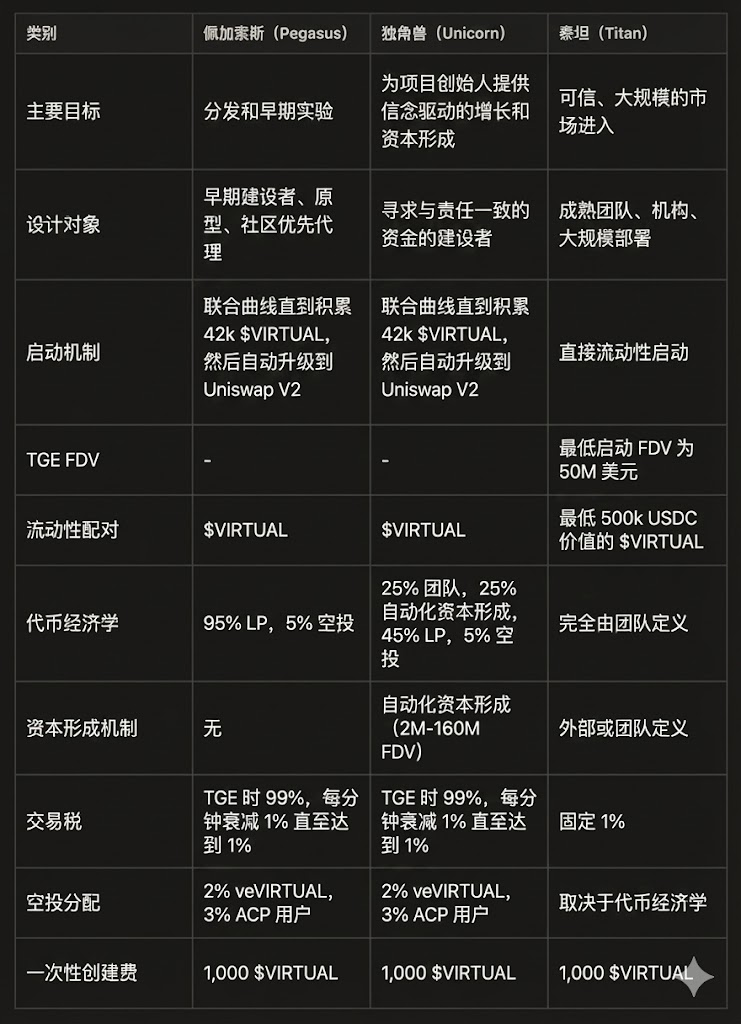

Launch Mechanism Comparison

Image translation: Gemini

How to Choose the Right Launch Mechanism?

Pegasus: Distribution-First, No-Preference Allocation

Pegasus is designed for early builders who want to launch quickly, test ideas, and gain credibility through actual use rather than preferential token allocation. It prioritizes distribution and community formation while keeping the launch structure lightweight.

Pegasus does not include protocol-reserved team allocations or automated funding mechanisms. Almost all token supply is allocated to liquidity, with only a small portion reserved for ecosystem airdrops. Founders wishing to hold tokens must purchase them under the same market conditions as everyone else, ensuring token holding is earned through actual performance rather than pre-allocation.

Transparent price discovery is achieved through a bonding curve, automatically transitioning to Uniswap once a threshold is reached. Pegasus efficiently answers a core question: Does the market actually need this agent?

Unicorn: Conviction, Capital, and Accountability

Unicorn is designed for builders who want to raise significant capital without sacrificing alignment. It maintains open participation while introducing structures that reward conviction and reinforce accountability.

All Unicorn launches begin with a small-scale, open model—no presales, whitelists, or restrictive allocations. Anti-sniper mechanisms prevent bots from dominating early trading, converting initial volatility into protocol-native buybacks that enhance liquidity.

The core feature of Unicorn is Automated Capital Formation (ACP). A portion of team tokens is automatically and transparently sold only after the project achieves genuine market traction, with proceeds ranging from $2 million to $160 million in Fully Diluted Valuation (FDV). Founders do not receive funds until the project proves market value; they earn capital through market validation.

Unicorn restores real meaning to ownership by linking rewards, funding, and credibility directly to performance, not promises.

Titan: Large-Scale Structured Launches Tailored for Credible Teams

Titan is designed for teams that already have a clear foundation in credibility, scale, and capital needs. Titan launches are suitable for projects that have reached a high baseline of readiness.

This typically includes teams with existing products, a verified track record, institutional backing, or a clear real-world deployment path. Because these teams do not require early market validation, Titan does not rely on bonding curves, phased discovery, or protocol-enforced distribution mechanisms.

Titan launches require a minimum valuation of $50 million and must pair at least $500,000 USDC worth of $VIRTUAL liquidity at Token Generation Event (TGE). This requirement ensures market depth, reduces volatility from insufficient liquidity, and aligns Titan launches with builders prepared for large-scale operations.

Titan launches have a fixed trading tax of 1%. Tokenomics, vesting schedules, and allocation structures are fully defined by the founding team but must comply with standard protocol and compliance constraints.

Teams choosing Titan must commit capital upfront and accept higher expectations for transparency, liquidity, and long-term engagement with the Virtuals ecosystem. In return, they gain a clear market entry or migration path, deep initial liquidity, and instant legitimacy without artificial constraints.

Titan exists to support agent projects already prepared to operate at an institutional or ecosystem scale.

Titan Migration

Titan also supports the migration of existing agent tokens into the Virtuals ecosystem. This path is for projects that already have active tokens, existing holders, or existing liquidity and wish to integrate more deeply with the Virtuals stack, including $VIRTUAL liquidity, ACP compatibility, and long-term ecosystem alignment.

Titan migrations follow the same baseline requirements as Titan launches, including a minimum implied valuation of $50 million and at least $500,000 USDC paired with $VIRTUAL liquidity. These requirements ensure market depth upon migration, minimize disruption for existing holders, and maintain consistency in large-scale integration.

The Path Forward

The agent market is still evolving. As it evolves, so does Virtuals Protocol.

Each launch mechanism in Virtuals is built on lessons learned from builder practices and real market behavior. Early prototypes taught us how agents are born; the Genesis model showed how fairness scales; the Unicorn model proved how conviction and capital formation can align. Pegasus, Unicorn, and Titan are the synthesis of these lessons, building a flexible yet unbroken system.

This framework is not static but designed to adapt as agents mature, builder needs change, and agent economies expand into new domains. Our goal is not to lock builders into a model but to ensure the right model is available at the right time, without sacrificing liquidity, ownership, or ecosystem coherence.

By listening, iterating thoughtfully, and launching publicly, Virtuals Protocol continues to set the standard for agent launch, growth, and integration.

There has never been only one path for agent launches.

The only right way is to adapt to the needs of the current market and maintain the discipline to evolve as the market changes.

– aGDP

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News