Why are equity or hybrid investments more suitable for Web3 games?

TechFlow Selected TechFlow Selected

Why are equity or hybrid investments more suitable for Web3 games?

Although the prospects for Web3 gaming are promising, token fundraising by many companies and projects has encountered some issues, making equity investment or hybrid investment a potential solution.

Author: Nemo.eth

Compiled by: TechFlow

TLDR

While the outlook for Web3 gaming is promising, token-based fundraising has already caused issues for many companies and projects.

Equity investment or hybrid investment may offer a viable solution.

Market Status and Outlook

In the second half of 2021, the concept of Web3 gaming/metaverse emerged, capturing capital and traditional game developers with its strong short-term profitability. An increasing number of venture capital firms began searching for high-quality early-stage projects.

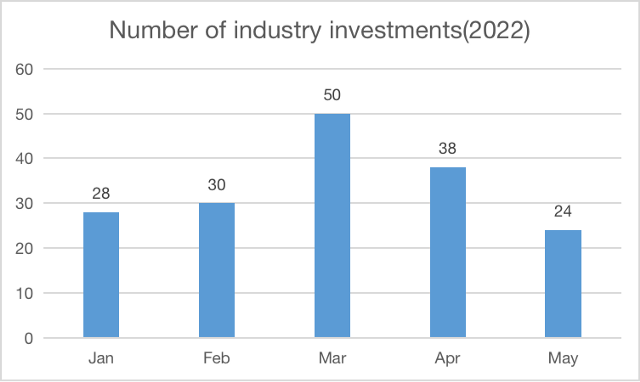

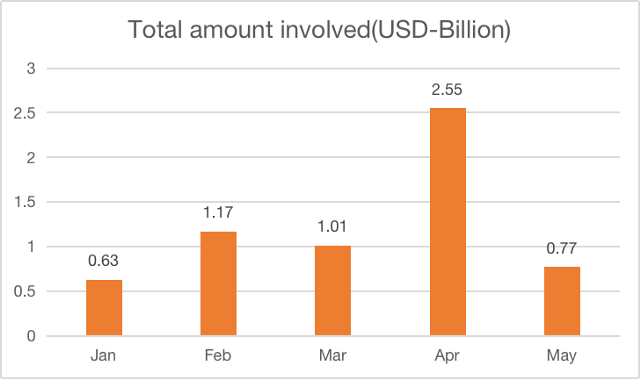

Over the past five months, VC firms have invested in 170 Web3 gaming and metaverse projects, totaling $6.13 billion.

Even during the bear market, investment in Web3 gaming remains significant. For example, a16z launched two Web3 gaming funds in May, ultimately securing up to $5.1 billion in funding—a move reflecting strong market optimism toward Web3 gaming.

As implied by the concept of ownership in blockchain: most Web3 games feature open economies where in-game assets can be traded on secondary markets.The traditional market for in-game virtual items is estimated at $50 billion—mostly from primary sales, as secondary trading is usually prohibited. In 2015, the black market for secondary game items was valued at around $5 billion.

According to Vida Research, traditional games will converge with Web3 gaming, accelerating industry growth. The open economic model of Web3 gaming will attract speculators and financial capital, driving the cumulative size of the game NFT market beyond $100 billion.

Current Shortcomings

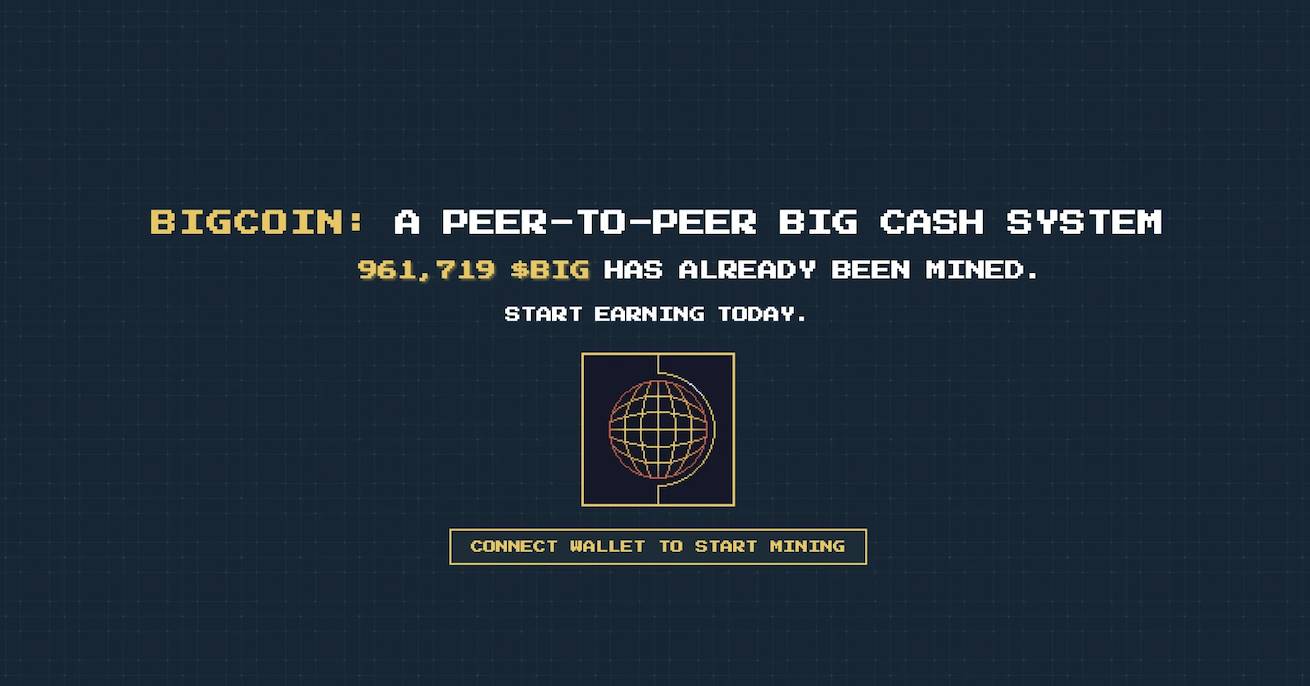

Currently, most Web3 projects raise funds through tokens, including seed and private rounds. Only a small fraction pursue equity financing or strategic investments.

Token fundraising does offer certain advantages for project teams and potential users, such as value distribution to holders and quick liquidity.

However, token fundraising also has drawbacks, especially for investors.

Unclear Distribution of Implicit Revenue

According to definitions by Web3 Index and FutureMoney Research, revenue can be categorized as explicit or implicit. The latter is common in x-to-earn and Web3 gaming, similar to supply-side revenue in DeFi. Participants use the protocol to gain speculative income from tokens, contributing "revenue" in ETH or SOL, receiving tokens, and later selling them for profit.

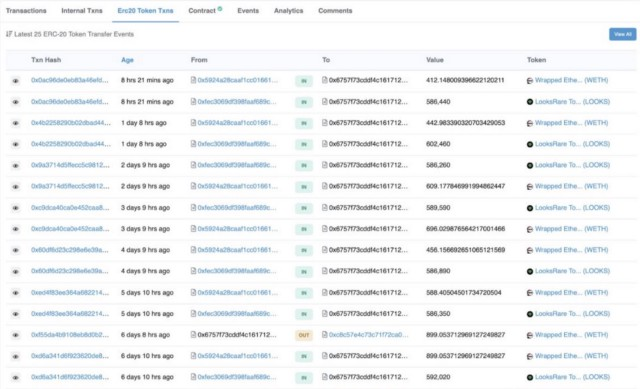

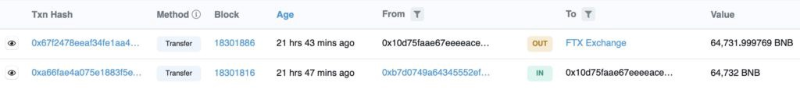

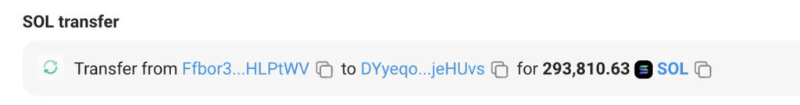

Two typical examples: Looksrare charges users transaction fees in ETH, while Stepn collects fees denominated in SOL.

This implicit revenue is essentially another form of public token sale, significantly increasing the liquid supply of capped governance tokens. Since investors typically face linear unlocking periods of 1–3 years, they are almost unable to capture this profit—and it may even dilute their own returns.

This portion of revenue is taken solely by the project team. Looksrare operates this way, while Stepn is slightly better, having announced a buyback plan in Q1—though unfortunately, no follow-up occurred.

Buybacks are the most common method of value return to token holders, including early investors.

Risks Posed by Utility Tokens

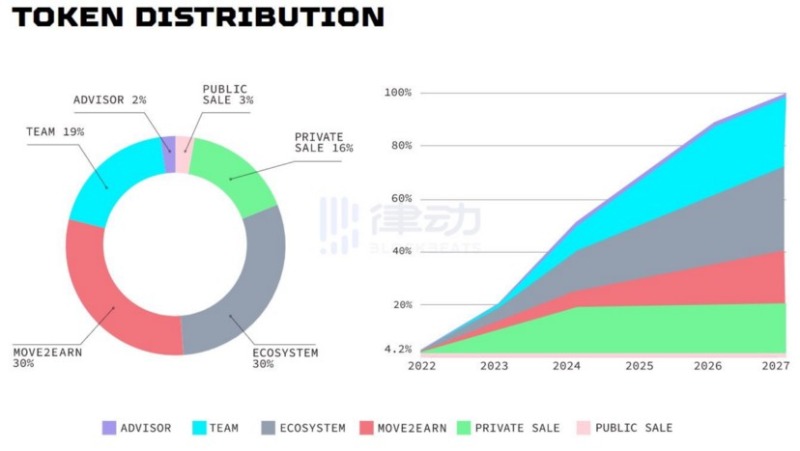

Under GameFi’s dual-token system, utility tokens serve as key rewards for players. They are typically uncapped and not subject to buybacks. While well-intentioned, this design aims to stabilize the in-game economy and insulate it from investor influence.

On the flip side, it creates a Trojan horse effect. Project teams may repeatedly trade utility tokens across multiple addresses to extract excessive profits. Centralized rule-makers are under no obligation to disclose the flow of utility tokens to the community or investors.

Although governance tokens are designed to be deflationary, utility tokens may siphon value away from the entire in-game economy—leaving investors in the dark during this process.

Tokens May Lack Positive Externalities

Gaming is a content consumption industry—the ultimate value stems from IP. Every game product has a lifecycle, but IP and production capabilities are inheritable core assets. For current Web3 games, most tokens are tied to the profits of a single product and cannot be linked to IP or production capacity.

It's easy to imagine that if a product fails, the game’s token becomes largely unusable, eliminating investor returns. Even if a Web3 game succeeds, there is often no IP value for investors to share.

Recommendations

Equity investment or hybrid investment can address the above issues.

Standardizing Opaque Revenue Distribution

Equity investment typically includes dividends. Project teams would then be contractually obligated to share implicit revenues with investors under clearly defined written terms.

For instance, a16z general partners David Haber and Jonathan Lai joined the board of "Carry1st" as observers.

Fostering Long-Term Shared Interests

Through equity, investors form long-term partnerships with project teams, helping improve products and support user growth.

Investors leverage their resources to provide legal, financial, technical, and marketing support in the early stages. Upon success, project teams can also share external benefits such as IP rights and content.

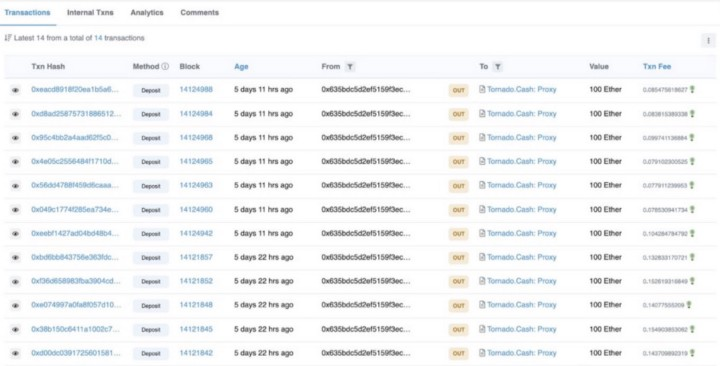

Binance’s strategic investment in Stepn in April may offer valuable insights.

Supporting Healthy Growth of Web3 Gaming

Under asymmetric risk conditions, bad money often drives out good (Gresham’s Law). This explains why most Web3 games today focus on fundraising and Ponzi-like schemes rather than content and gameplay. Of course, some companies avoid investment pressures altogether and focus purely on product development.

As key market participants, investors have a responsibility to promote the healthy development of this industry through more rational investment approaches.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News