Goldman Sachs trader: The wisest investment is not certainty, but the power to shape the future

TechFlow Selected TechFlow Selected

Goldman Sachs trader: The wisest investment is not certainty, but the power to shape the future

Schiavone believes that in a world shaped by beliefs, accelerated by imagination, and destabilized by repeated monetary interventions, the wisest investment is not certainty (bonds), but the forces that shape the future.

By Li Xiaoyin, Wall Street Insights

A top Goldman Sachs macro trader has delivered a powerful message: the "trend-following" strategy no longer works—investors must now learn to interpret "macro inflection points" in real time.

Recently, Paolo Schiavone, senior macro trader at Goldman Sachs, stated that markets have transitioned from the crisis phase of April into a "reaction phase" anticipating the Fed's first rate cuts. This macro backdrop is driving significant upward repricing of risk assets. He believes the core market driver is no longer trend, valuation, or pure liquidity, but rather sharp insight into shifts in the macro environment.

He noted that when investor positioning remains defensively biased, the market’s “most painful path” could be an upward short squeeze, with the S&P 500 potentially reaching a "Goldilocks" range of 6,400–6,700 points.

The Goldman trader pointed out that systematic macro strategies are losing dominance, with assets under management down about one-third from peak levels. Market behavior is becoming more dependent on subjective judgment and positioning rather than algorithmic trend tracking.

According to Schiavone, as we move deeper into 2025, markets are moving beyond old scripts into a new era dominated by policy pivots, event-driven moves, and psychological games.

Shift in Macro Environment: From Crisis to Reaction Phase

Since the stellar performance of systematic macro funds in 2021–2022, the market landscape has undergone profound changes.

Schiavone noted that April marked the crisis phase—characterized by economic slowdown and asset-class fragility—while the current period has entered the “reaction phase.” Global central banks are accelerating policy shifts. The Federal Reserve has moved from its 2024 “wait-and-see” stance toward adaptive adjustments, with a September rate cut nearly certain and a July cut also under discussion.

This shift has brought significantly looser financial conditions, reflected in lower long-end yields, tighter credit spreads, a weaker dollar, and improved real wage dynamics.

Schiavone said this backdrop supports the upward repricing of risk assets: equities are nearing all-time highs, volatility is compressed, and high-yield bonds and speculative sectors (such as biotech and laggard AI names) are showing renewed vigor.

Despite softness in housing and some labor data, accommodative financial conditions are currently outweighing these headwinds.

Changing Market Signals: From Trend-Following to Contextual Interpretation

In the past QE era, liquidity overwhelmed fundamentals, and trend-following strategies reigned supreme—price action alone could explain almost everything.

However, Schiavone emphasizes that liquidity is no longer the sole dominant force. Fiscal policy, geopolitics, and the Fed's reaction function have regained prominence as key drivers. Market narratives are shifting rapidly, and price movements have become more deceptive. Traders must shift from automation to real-time interpretation of macro turning points.

This shift in market psychology is also reflected in a redefinition of bull and bear markets.

Traditionally, bull and bear markets were defined by 20% price moves. But now, greater focus should be placed on the market’s reaction function: if good news lifts markets and bad news is ignored, it's a bull market; the reverse indicates a bear market. Current price signals suggest a bullish tone, but must be interpreted contextually rather than through momentum alone.

This psychological shift presents a new challenge for investors—traders who once relied on technical signals and volatility filters must now adapt to an event-driven macro market.

Schiavone warns that the biggest returns may not come from smooth trends, but from early detection of shifts in central bank stance, inflation inflection points, or turning points in consumer confidence.

The Wisest Investment Isn’t Certainty—It’s the Future

In this new environment, Schiavone notes that the influence of systematic macro funds is waning.

Estimates suggest their capital is down approximately one-third from peak levels, and they no longer dominate market flows. Instead, the interplay between policy and narrative, and the博弈 between positioning and surprises, are taking center stage.

He identifies the UK, artificial intelligence, China, biotechnology, the Brazilian real, and bitcoin as investment "elephants," particularly favoring technologies like bitcoin as profound expressions of a new era.

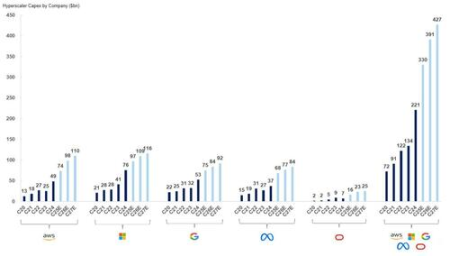

AI-related sectors are also demonstrating strong momentum. According to Schiavone’s estimates, total capital expenditure by U.S. hyperscale data center operators reached approximately $477 billion during fiscal years 2022–2024, and is projected to rise to $1.15 trillion during 2025–2027, underscoring strong conviction in future technologies.

For investors, the current bull market isn't driven by euphoria, but by relief over accommodative policy.

Schiavone emphasizes that in an era shaped by belief, accelerated by imagination, and destabilized by repeated monetary interventions, the wisest investment is not certainty (bonds), but the forces shaping the future.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News