Ryan Cohen, the man who led GameStop's resurgence, has bet on Bitcoin

TechFlow Selected TechFlow Selected

Ryan Cohen, the man who led GameStop's resurgence, has bet on Bitcoin

"GameStop follows GameStop's strategy; we don't follow anyone else's strategy."

Author: Thejaswini M A

Translation: Luffy, Foresight News

Ryan Cohen has done it again—acting abruptly, without warning, explanation, or permission.

On a Tuesday in May 2025, buried within a routine SEC filing largely overlooked by investors, GameStop's Form 8-K quietly revealed a few words: "Purchased 4,710 bitcoins."

The CEO who once resurrected a failing video game retailer had just allocated over $500 million of company cash into Bitcoin—no press release, no investor call, only the bare minimum disclosure required by law.

When David Bailey of BTC Inc. asked Cohen the question on everyone’s mind, Cohen ended months of speculation with a simple reply:

"Did GameStop buy Bitcoin?"

"Yes. We currently hold 4,710 bitcoins."

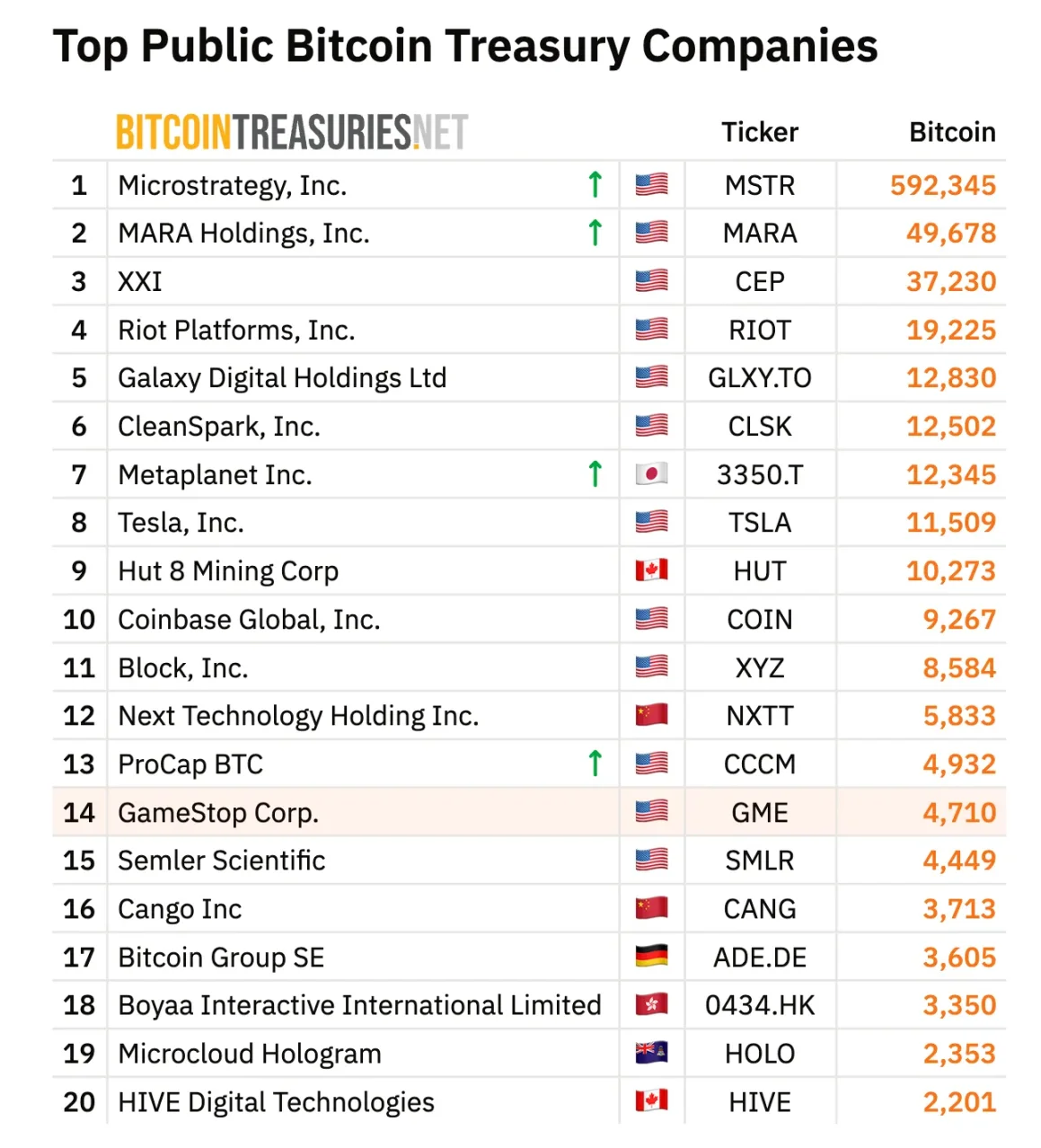

And just like that, Cohen, ever the master of understatement, turned GameStop into the world’s 14th-largest corporate holder of Bitcoin—mirroring the same approach he used to build Chewy from nothing into a $3.35 billion unicorn.

No one who’s been watching him should be surprised. It was this man whose involvement inspired millions of retail investors to short some of Wall Street’s most established hedge funds. He transformed a company many so-called experts believed was doomed into one that defied all traditional valuation models.

Cohen’s journey—from a college dropout selling pet food online to becoming an architect of new corporate strategy—began as a teenager in Florida, where he learned early that the best opportunities hide where others have given up.

From Dropout Teen to Business Disruptor

Ryan Cohen’s entrepreneurial awakening began before he was legally old enough to drive.

Born in 1986 in Montreal to a teacher mother and a father, Ted Cohen, who ran a glassware import business, Cohen moved with his family to Coral Springs, Florida, at a young age. At 15, he launched his first business, earning referral fees from various e-commerce websites.

By 16, his operations evolved beyond basic referrals into structured e-commerce ventures—while most still saw the internet as a passing trend, Cohen already understood the essence of online commerce.

His father, Ted, became his most important mentor, teaching him delayed gratification, work ethic, and the importance of treating business relationships as long-term partnerships. Eventually, Cohen decided to drop out of the University of Florida to fully commit to entrepreneurship. Having already proven he could acquire customers and generate revenue, college felt like a detour from his mission.

The Pet Food Revolution

In 2011, Amazon dominated e-commerce, causing most entrepreneurs to steer clear. But 25-year-old Cohen chose a different path: “competing without direct competition.”

Instead of trying to beat Amazon on product selection or logistics, Cohen identified a niche where customer relationships mattered more than operational efficiency: pet supplies. Pet owners weren’t just buying products—they were caring for family members. They needed advice, empathy, and someone who understood that a sick pet wasn’t just an inconvenience, but a crisis.

Chewy’s core idea was simple: combine Amazon’s logistics with Zappos’ customer service philosophy, tailored specifically for pet owners. The company sold pet supplies online—but more importantly, it built connections with customers that went far beyond individual transactions.

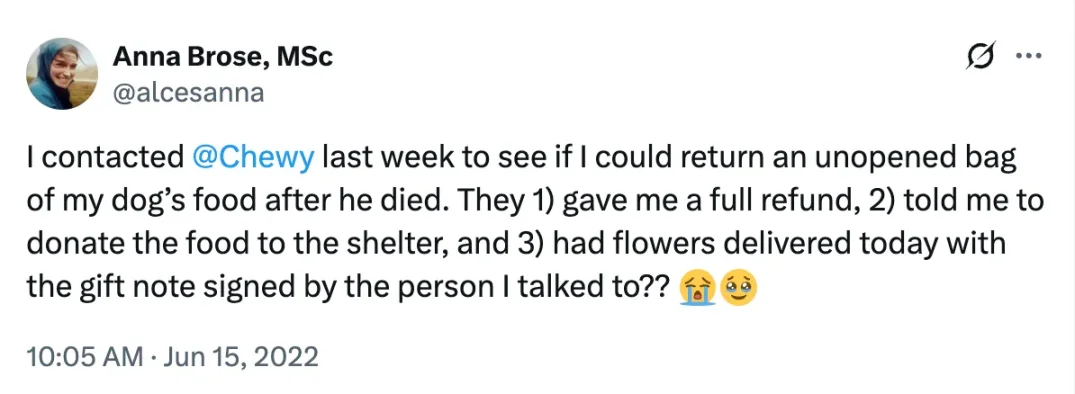

Execution in the early days was disciplined and customer-obsessed. Chewy’s support team didn’t just process orders—they sent handwritten holiday cards, commissioned custom pet portraits for loyal customers, and even delivered flowers when a beloved pet passed away. These gestures cost money and were difficult to scale. One widely shared tweet captured the sentiment:

Yet emotional connection alone doesn’t pay the bills. For its first two years, Cohen faced a problem fatal to most startups: no one wanted to fund a pet food company competing against Amazon.

A Hundred Rejections

Pitch meetings are a rite of pain for founders. Between 2011 and 2013, Cohen approached over 100 venture capital firms, explaining why pet supplies represented a massive opportunity for a customer-centric company. Most VCs saw only a college dropout with no traditional business background, attempting to carve out a sliver of a small market ruled by an unbeatable giant.

The breakthrough came in 2013, when Volition Capital offered a $15 million Series A. That funding allowed Cohen to scale Chewy’s operations while preserving its customer-first culture. By 2016, backed by BlackRock and T. Rowe Price, the company hit $900 million in annual sales.

Chewy’s customer retention was exceptionally high, average order value kept rising, and crucially, customers became vocal advocates, recommending the service to other pet owners.

By 2018, Chewy reached $3.5 billion in annual revenue and prepared for IPO. That’s when PetSmart made a $3.35 billion acquisition offer—the largest e-commerce acquisition in history at the time. At 31, Cohen became worth hundreds of millions, yet chose to leave Chewy and return home.

A Family Intermission

In 2018, at the peak of his career, Ryan Cohen made a decision that baffled the business world.

He stepped down as CEO of Chewy to spend time with his pregnant wife and prepare for fatherhood. He walked away completely from the company he’d spent seven years building. Financially independent, he intended to use that freedom to embrace one of life’s most meaningful chapters.

He sold most of his Chewy shares and focused on being a husband and father. For someone who had spent his teenage years obsessed with growth and competition, shifting to family life might have felt unnatural. Yet Cohen embraced it fully.

Even during this family-focused period, he remained an active investor. His portfolio included Apple (holding 1.55 million shares, making him one of the largest individual shareholders), Wells Fargo, and other blue-chip stocks.

He and his wife Stephanie founded a family foundation supporting education, animal welfare, and other charitable causes.

This intermission lasted three years—until he found GameStop.

The GameStop Gamble

In September 2020, when most investors viewed GameStop as a dying brick-and-mortar retailer being strangled by digital downloads and streaming services, Ryan Cohen saw something different: a company with strong brand recognition and a loyal customer base, but with leadership that failed to leverage either asset.

Cohen’s investment firm, RC Ventures, disclosed a nearly 10% stake in the struggling video game retailer, making it the company’s largest shareholder. The move puzzled Wall Street analysts, who couldn’t understand why someone of Cohen’s caliber would back a supposedly “obsolete” retail business.

Cohen believed GameStop wasn’t just a retail chain—it was a cultural landmark for the gaming community. Its customers were passionate enthusiasts who collected merchandise, traded cards, and valued social experiences, willing to pay a premium for emotional connection.

The issue? Management treated it as a traditional retailer, not a community-driven platform.

In January 2021, Cohen joined GameStop’s board—a move that triggered a wave of retail buying frenzy. Within two weeks, GameStop’s stock surged 1,500%, creating one of the most famous short squeezes in market history.

While financial media fixated on the “meme stock” phenomenon and the battle between retail traders and hedge funds, Cohen focused on deeper, structural transformation.

He rebuilt GameStop the same way he built Chewy.

“The company was a mess, losing money,” he later said.

First, he replaced the leadership team. Ten board members exited, replaced by executives from Amazon and Chewy—people who truly understood e-commerce. If you’re going to compete in the digital space, you need experienced talent.

Next came cost-cutting. Cohen eliminated inefficiencies across the board: redundant roles, underperforming stores, expensive consultants—while protecting every aspect tied to the customer experience. The goal? Profitability even with lower sales.

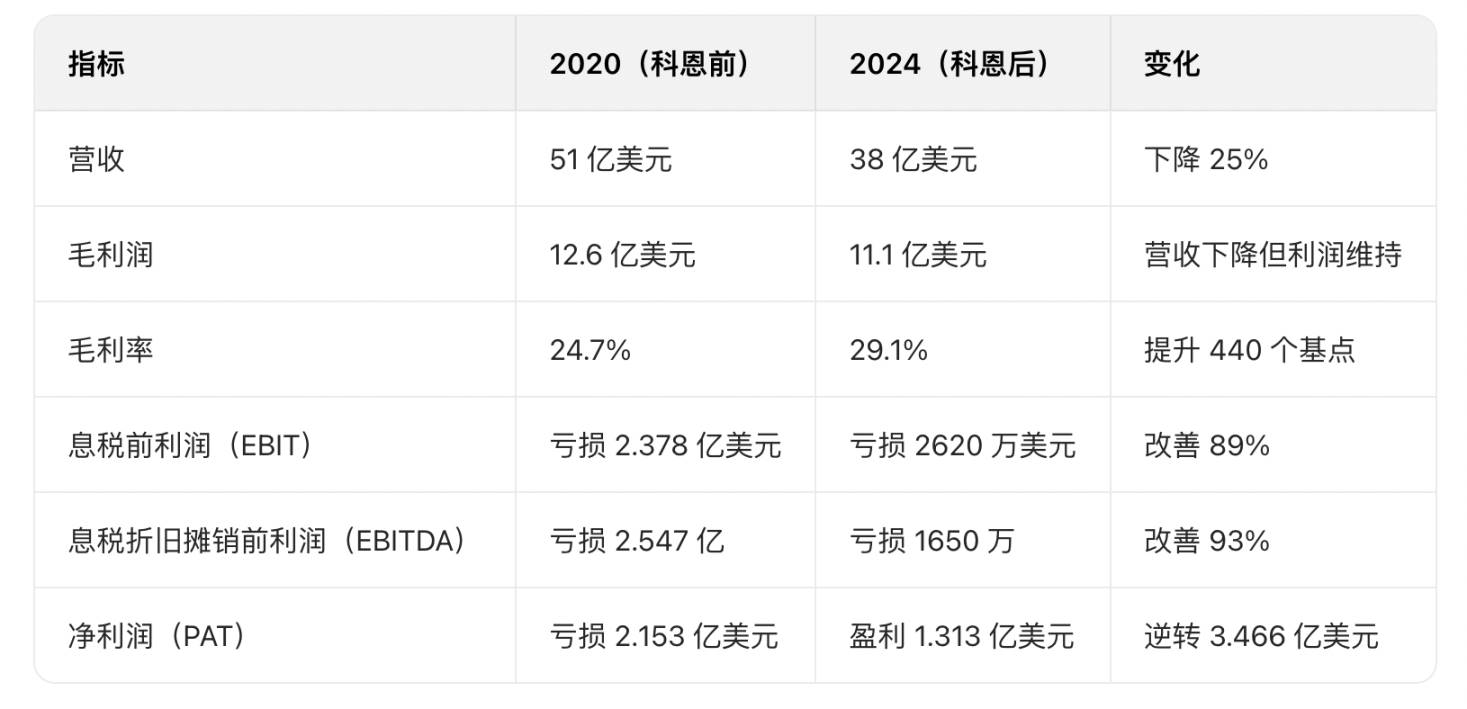

Consider the concrete changes after Cohen took over:

Cohen inherited a company with $5.1 billion in revenue and annual losses exceeding $200 million. After three years of systematic restructuring, he led GameStop to profitability for the first time in 2023–2024. Despite a 25% revenue decline due to store closures, he expanded gross margins by 440 basis points and turned a $215 million annual loss into a $131 million profit—proving a smaller company could still achieve meaningful profitability.

His bet was on digital transformation. Physical stores would survive—but only the strongest ones. GameStop’s future was online, serving gamers who wanted more than just digital games—collectibles, trading cards, merchandise, anything tied to gaming culture. Cohen also preserved cash and secured authority for strategic investments. On September 28, 2023, he became CEO while retaining the chairman role. His salary? Zero. His compensation was entirely tied to stock performance—meaning he only got paid if shareholders profited.

Then came the crypto bet.

GameStop’s initial foray into crypto assets illustrated both the promise and peril of emerging technologies.

In July 2022, the company launched an NFT marketplace focused on gaming-related digital collectibles. Initial results looked promising: over $3.5 million in transaction volume within the first 48 hours signaled real demand for gaming NFTs.

But the NFT market collapsed quickly and brutally. Sales plummeted from $77.4 million in 2022 to just $2.8 million in 2023. Citing “regulatory uncertainty in the crypto space,” GameStop discontinued its crypto wallet service in November 2023 and shut down NFT trading functionality in February 2024.

This failure could have ended GameStop’s crypto ambitions altogether. Instead, Cohen learned from it and formulated a more mature digital asset strategy.

Betting on Bitcoin

May 28, 2025. While markets fixated on Fed policy, GameStop quietly purchased 4,710 bitcoins—worth $513 million.

Cohen’s reasoning remained characteristically rigorous:

If this argument holds, Bitcoin and gold can serve as hedges against global currency devaluation and systemic risk. Compared to gold, Bitcoin offers distinct advantages: portability—it can be transferred instantly across the globe, while gold is bulky and costly to transport. Authenticity can be verified instantly via blockchain. Bitcoin can be securely stored in a wallet, while gold requires insurance and incurs high storage costs. And there’s scarcity: Bitcoin’s supply is fixed, whereas gold’s supply remains uncertain due to technological advances.

This move made GameStop the 14th-largest corporate holder of Bitcoin.

The company funded the Bitcoin purchase through convertible bonds rather than core capital, maintaining a robust cash reserve of over $4 billion. This reflected a diversified, cautious strategy—not an all-in gamble, but a secondary position alongside the core business.

“GameStop follows the GameStop strategy. We don’t follow anyone else’s.”

After the news broke, GameStop’s stock dipped—yet Cohen seemed unfazed.

On June 25, GameStop raised an additional $450 million by exercising its over-allotment option, bringing the total convertible bond issuance to $2.7 billion.

The over-allotment option is a clause in offering agreements allowing underwriters to issue up to 15% more securities than originally planned if demand is strong. Exercising this option enables a company to raise more capital and helps stabilize the stock price post-issuance. In GameStop’s case, it meant issuing more convertible bonds to increase total proceeds.

The funds will be used for “general corporate purposes and investments consistent with GameStop’s investment policy,” explicitly including Bitcoin purchases as a reserve asset.

Cohen commands an army of “apes.” The most unusual part of Cohen’s GameStop story is the millions of retail investors who refuse to sell.

They call themselves “apes,” and they behave unlike typical investors. They don’t trade based on earnings reports or analyst ratings. They hold because they believe in Cohen’s vision and want to see what happens next.

This is “patient capital”—rarely seen in public markets. Cohen can focus on long-term strategy without fear of quarterly volatility, because his core investor base won’t easily abandon ship.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News