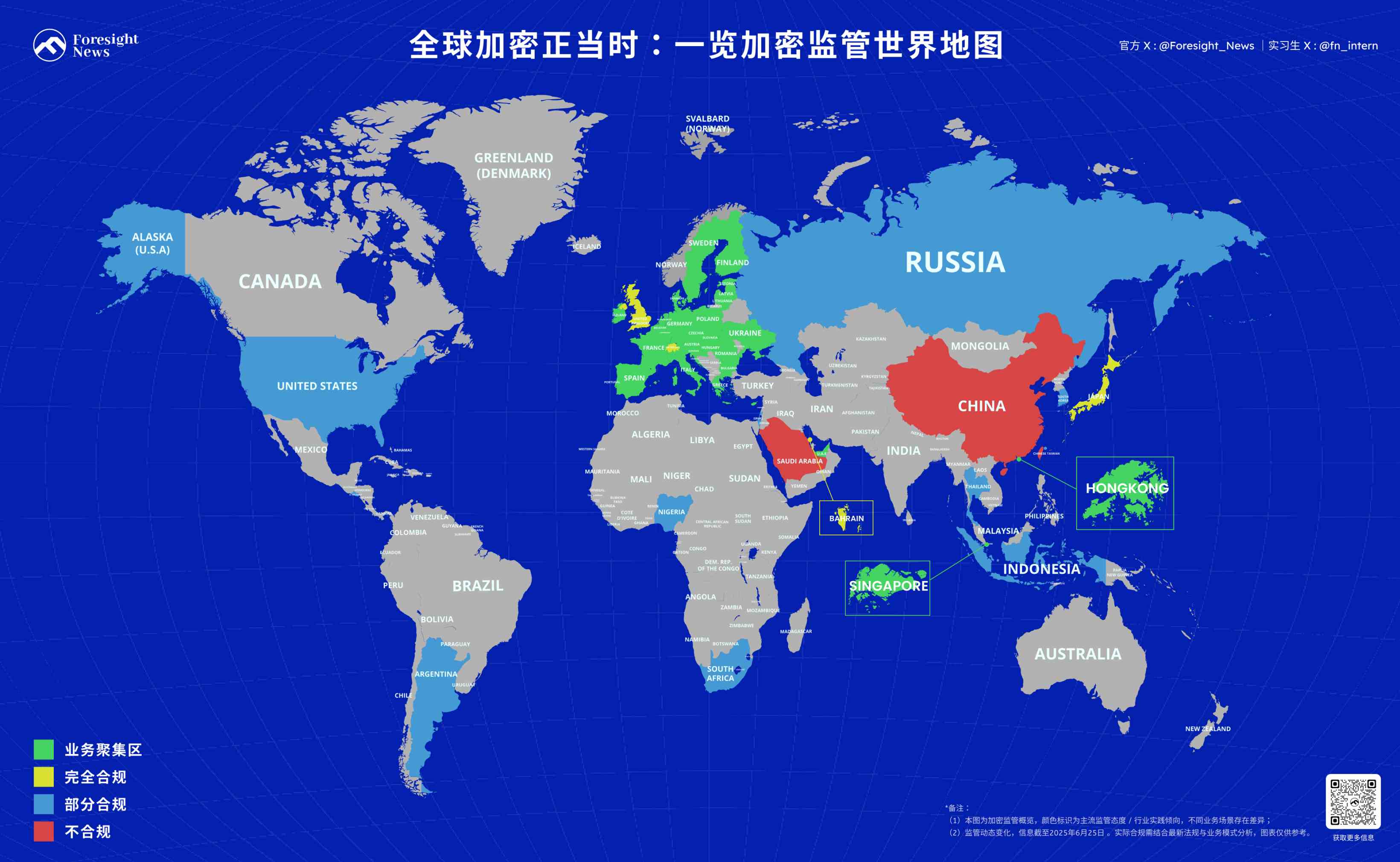

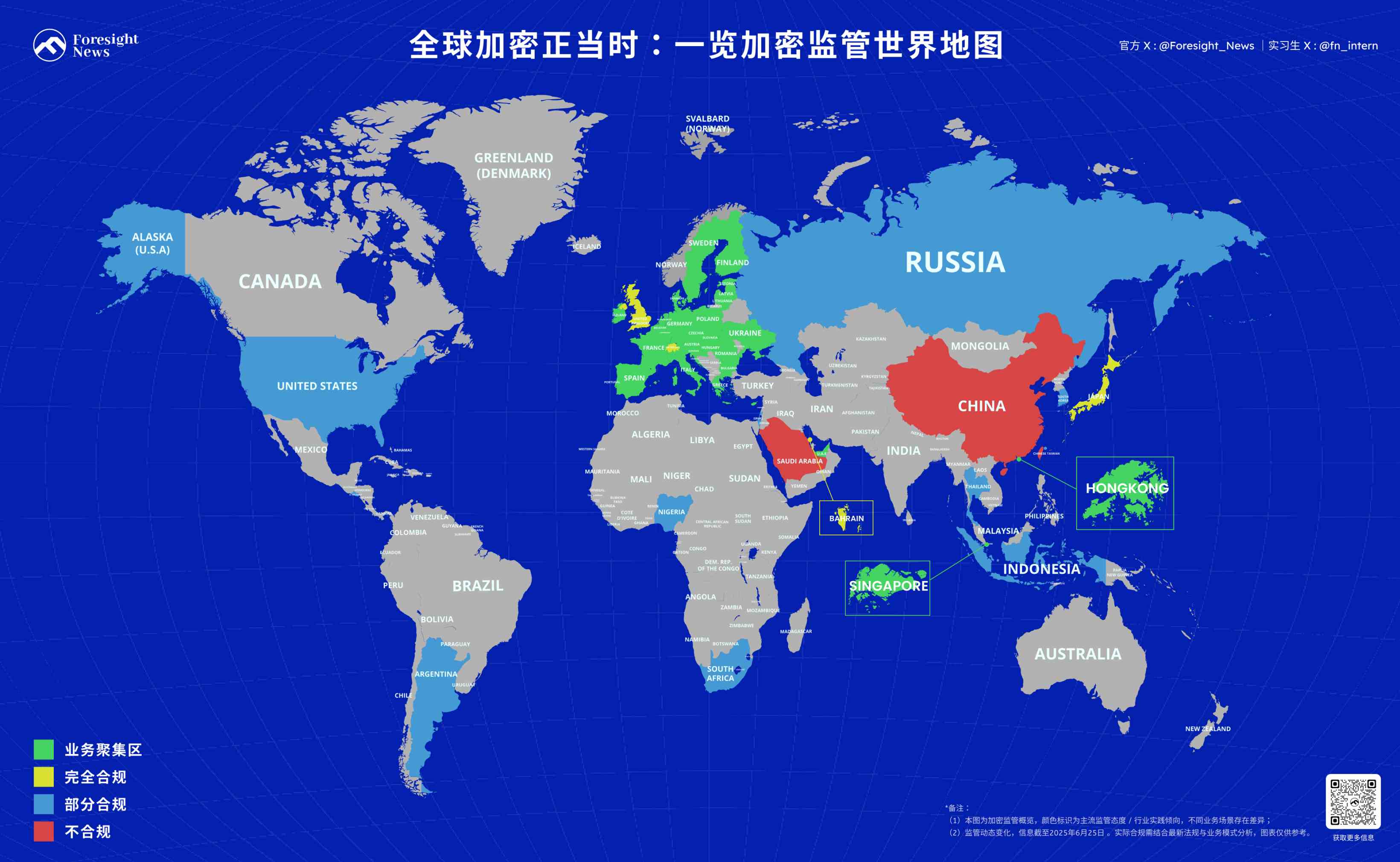

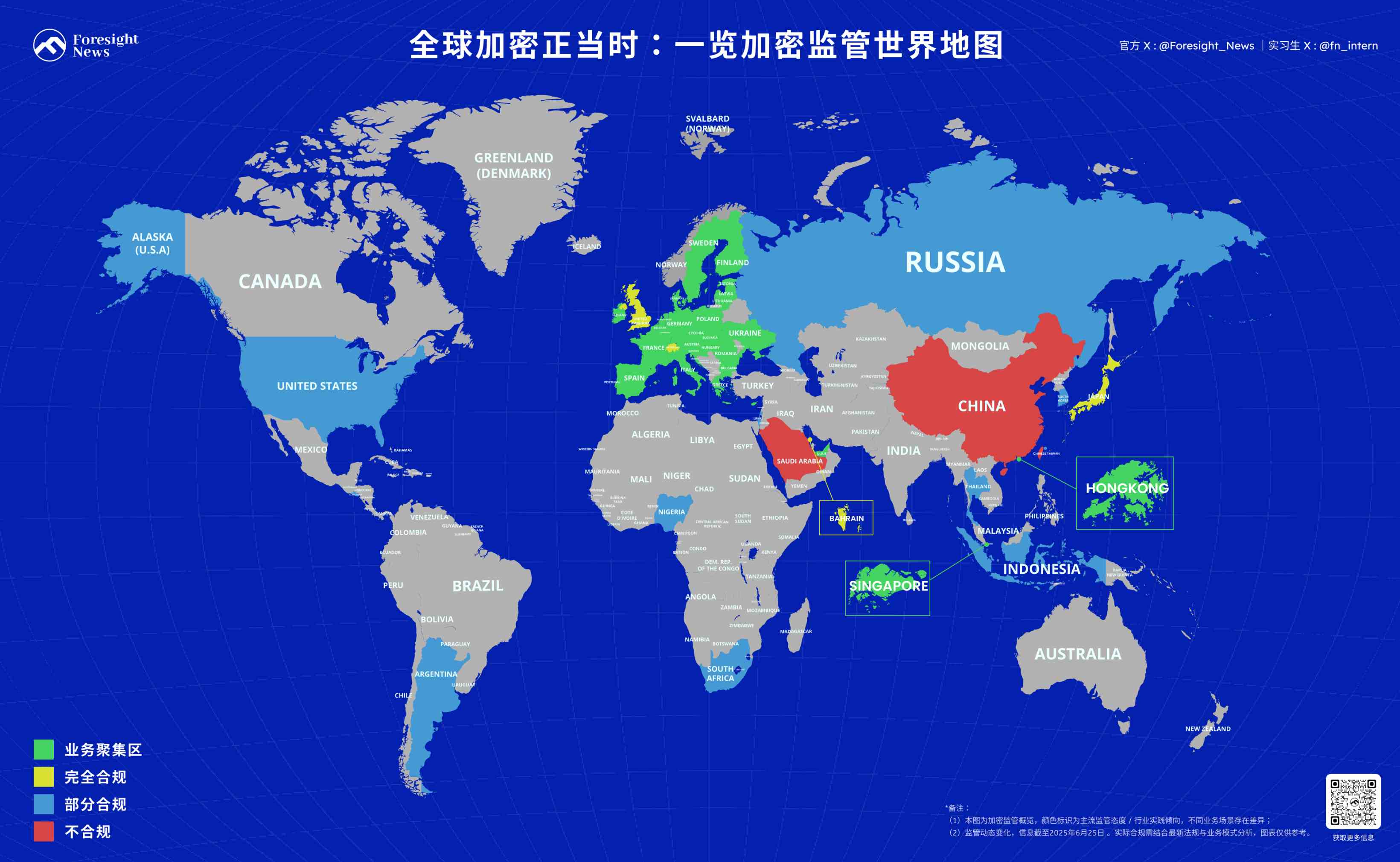

Global Crypto at a Turning Point: A Glimpse at the World Map of Cryptocurrency Regulation

TechFlow Selected TechFlow Selected

Global Crypto at a Turning Point: A Glimpse at the World Map of Cryptocurrency Regulation

Explore the map of crypto regulation together and uncover the hidden patterns beneath this global regulatory wave.

Author: Pzai, Foresight News

In recent years, as the cryptocurrency market has drawn increasing attention from various sectors, the need for regulatory oversight has become more urgent than ever. Driven by their own economic systems, financial structures, and strategic priorities, countries and regions worldwide have introduced distinctive regulatory policies—ranging from the U.S. SEC's ongoing legal battles with crypto firms, to the EU’s comprehensive MiCA framework for crypto-assets, to emerging economies carefully balancing innovation against risk. The global crypto regulatory landscape is now more complex and diverse than ever before. Let us now unfold a world map of crypto regulation, tracing the hidden currents beneath this global wave of oversight.

On the map, we classify countries into four categories: business hubs, fully compliant, partially compliant, and non-compliant. Evaluation criteria include the legal status of crypto assets (50%), the existence and implementation of regulatory frameworks and legislation (30%), and exchange presence (20%).

Asia

Greater China Region

Hong Kong

In Hong Kong, crypto assets are recognized as "virtual assets," not currency, and fall under the supervision of the Securities and Futures Commission (SFC). For stablecoins, Hong Kong operates a licensing regime, where the Stablecoin Ordinance restricts licensed institutions from issuing Hong Kong dollar-pegged stablecoins. Other tokens are regulated differently: NFTs are treated as virtual assets, while governance tokens are regulated under the rules for "collective investment schemes."

Regulatory-wise, Hong Kong revised its Anti-Money Laundering Ordinance in 2023, requiring crypto exchanges to obtain licenses. Additionally, the SFC has issued guidelines for virtual asset ETFs. The SFC oversees licensing, with HashKey and OSL being the first to receive licenses, and over 20 other entities currently in the application process. Licensed exchanges are permitted to serve retail investors. Notably, Bitcoin and Ethereum ETFs were launched in Hong Kong in 2024.

By actively embracing Web3 and virtual assets—especially allowing retail trading and launching virtual asset ETFs—Hong Kong aims to reinforce its status as an international financial center, standing in sharp contrast to mainland China’s strict ban. The SFC mandates exchange licensing and permits licensed platforms to serve retail users, while also launching Bitcoin/Ethereum ETFs. Against the backdrop of mainland China’s blanket crypto prohibition, Hong Kong has chosen a markedly different path, building a clear and regulated virtual asset market. Allowing retail participation and introducing ETFs are key moves to attract global crypto capital and talent, boost market liquidity, and enhance international competitiveness.

Taiwan

Taiwan maintains a cautious stance toward cryptocurrencies, not recognizing them as legal tender but regulating them as speculative digital commodities, gradually improving its anti-money laundering (AML) and security token offering (STO) frameworks.

Legal Status of Crypto Assets: Taiwan does not recognize cryptocurrencies as currency. Since 2013, the Central Bank of Taiwan and the Financial Supervisory Commission (FSC) have maintained that Bitcoin should not be considered money but rather a "highly speculative digital virtual commodity." The legal status of tokens such as NFTs and governance tokens remains unclear, though in practice, profits from NFT transactions are subject to capital gains tax. Security tokens are classified as securities by the FSC and regulated under the Securities and Exchange Act.

Regulatory Framework: Taiwan’s Money Laundering Control Act regulates virtual assets. The FSC has ordered local banks since 2014 not to accept Bitcoin or offer any related services. For STOs, specific regulations apply based on issuance amount (NT$30 million), determining the regulatory pathway. In March 2025, the FSC announced plans to draft a dedicated law for Virtual Asset Service Providers (VASPs), aiming to transition from a basic registration system to a full licensing regime.

Licensing: Under the Money Laundering Control Act, the FSC introduced new rules in 2024 requiring VASPs to register with the FSC before offering any virtual asset-related services—such as operating exchanges, trading platforms, transfer services, custody, or underwriting. Failure to register may result in criminal penalties. For STOs, issuers must be Taiwan-registered joint-stock companies, and STO platform operators must hold securities dealer licenses with at least NT$100 million in paid-in capital.

Mainland China

Mainland China has imposed a complete ban on crypto asset trading and all related financial activities. The People’s Bank of China (PBOC) argues that cryptocurrencies disrupt the financial system and facilitate crimes like money laundering, fraud, pyramid schemes, and gambling.

However, in judicial practice, virtual currencies are widely acknowledged to possess certain property attributes. Civil court rulings generally recognize that virtual currencies exhibit exclusivity, controllability, and tradability—characteristics similar to virtual goods—and thus acknowledge their property nature. Some judgments cite Article 127 of the Civil Code ("Where laws provide for the protection of data and virtual network property, such provisions shall apply") and reference Paragraph 83 of the National Court Financial Trial Conference Summary ("Virtual currencies possess some attributes of virtual network property"), concluding that virtual currencies constitute specific virtual property protected by law. In criminal cases, recent entries in the Supreme People’s Court case database have affirmed that virtual currencies qualify as “property” under criminal law, possessing legally recognized property attributes.

Since 2013, Chinese banks have been prohibited from engaging in crypto-related businesses. In September 2017, China decided to shut down all domestic cryptocurrency exchanges within a specified timeframe. In September 2021, the PBOC issued a notice banning all services related to virtual currency settlements and trader information provision, clarifying that illegal financial activities would incur criminal liability. Cryptocurrency mining operations have also been shut down, with no new facilities allowed. Overseas exchanges providing services to residents within China via the internet are deemed to be conducting illegal financial activities.

Singapore

Legal Status of Crypto Assets: Singapore treats crypto assets as "payment tools/commodities," primarily under its Payment Services Act. For stablecoins, Singapore enforces a licensed issuance regime; the Monetary Authority of Singapore (MAS) requires issuers to maintain 1:1 reserves and conduct monthly audits. For other tokens such as NFTs and governance tokens, Singapore applies a case-by-case assessment: NFTs are typically not considered securities, while governance tokens with dividend rights may be classified as securities.

Crypto Regulatory Framework: Singapore’s Financial Services and Markets Act (FSMA), enacted in 2022, regulates exchanges and stablecoins. However, recently implemented DTSP (Digital Token Payment Services) regulations have significantly narrowed compliance scope, potentially impacting offshore operations of crypto projects and exchanges. MAS typically issues three types of licenses to crypto firms: money-changing, standard payment institution, and major payment institution. Over 20 entities have obtained licenses, including Coinbase. Many international exchanges have established regional headquarters in Singapore, though they are now subject to the new DTSP rules.

South Korea

In South Korea, crypto assets are recognized as "lawful assets" but not legal tender, per the Act on Reporting and Use of Specific Financial Information (the "Special Financial Info Act"). The draft Digital Asset Basic Act (DABA) is progressing and could provide a more comprehensive legal framework. The current Special Financial Info Act focuses mainly on AML regulation. DABA proposes transparency requirements for stablecoin reserves. As for other tokens like NFTs and governance tokens, their legal status remains undefined: NFTs are temporarily regulated as virtual assets, while governance tokens may fall under securities regulation.

South Korea implements a real-name exchange licensing system, with five major exchanges—including Upbit and Bithumb—currently holding licenses. The market is dominated by local exchanges, and foreign platforms are prohibited from directly serving Korean residents. The DABA draft also calls for transparent stablecoin reserves. This strategy protects domestic financial institutions and market share while enabling regulators to effectively monitor onshore trading activities.

Indonesia

Indonesia is undergoing a shift in crypto regulatory authority—from the Commodity Futures Trading Regulatory Agency (Bappebti) to the Financial Services Authority (OJK)—indicating a move toward more comprehensive financial oversight.

Legal Status of Crypto Assets: Indonesia has not yet clearly defined the legal status of crypto assets. With the recent regulatory shift, crypto assets are now categorized as "digital financial assets."

Regulatory Framework: Previously, Indonesia’s Commodity Law governed exchanges. However, the newly issued OJK Regulation No. 27/2024 (POJK 27/2024) transfers regulatory authority over crypto asset trading from Bappebti to OJK, effective January 10, 2025. This new framework sets strict requirements for capital, ownership, and governance for digital asset exchanges, clearing institutions, custodians, and traders. All licenses, approvals, and product registrations previously issued by Bappebti remain valid unless they conflict with existing laws.

Licensing: Licensing authority has shifted from Bappebti to OJK. Crypto asset dealers must have a minimum paid-up capital of IDR 100 billion and maintain equity of at least IDR 50 billion. Funds used for capital must not originate from illegal activities such as money laundering, terrorist financing, or WMD financing. All digital financial asset service providers must fully comply with POJK 27/2024’s obligations by July 2025.

Exchange Presence: Local exchanges like Indodax operate actively. Indodax is a regulated centralized exchange offering spot, derivatives, and OTC services, requiring KYC compliance from users.

Thailand

Thailand is actively shaping its crypto market through tax incentives and strict licensing to encourage compliance and strengthen its position as a global financial hub.

Legal Status of Crypto Assets: In Thailand, owning, trading, and mining cryptocurrencies are fully legal, and profits are taxable under Thai law.

Regulatory Framework: Thailand has enacted the Digital Asset Act. Notably, it has approved a five-year exemption from capital gains tax on crypto sales conducted through licensed crypto asset service providers, effective from January 1, 2025, to December 31, 2029. This measure aims to position Thailand as a global financial center and incentivize residents to trade on regulated exchanges. The Thai Securities and Exchange Commission (SEC) oversees the crypto market.

Licensing: The Thai SEC issues licenses. Exchanges must obtain official approval and register as a Thai limited or public company. Requirements include minimum capital (50 million THB for centralized exchanges, 10 million THB for decentralized ones) and "fit and proper" standards for directors, executives, and major shareholders. KuCoin has obtained a license through acquisition.

Exchange Presence: Local exchanges like Bitkub are active and lead in trading volume. Other major licensed exchanges include Orbix, Upbit Thailand, Gulf Binance, and KuCoin TH. The Thai SEC has taken action against five global exchanges—including Bybit and OKX—blocking their operations due to lack of local licenses. Tether has also launched its tokenized gold digital asset in Thailand.

Japan

Japan was among the first countries globally to formally recognize the legal status of cryptocurrencies, with a mature and cautious regulatory framework.

Legal Status of Crypto Assets: Under the Payment Services Act, crypto assets are recognized as "legitimate means of payment." For stablecoins, Japan enforces a strict banking/trust-exclusive model, requiring yen pegging and redeemability, while explicitly banning algorithmic stablecoins. Other tokens: NFTs are treated as digital goods; governance tokens may be classified as "collective investment scheme interests."

Regulatory Framework: Japan amended the Payment Services Act and the Financial Instruments and Exchange Act in 2020, officially recognizing crypto assets as legitimate payment methods. The Financial Services Agency (FSA) oversees the crypto market. The revised Payment Services Act includes a "domestic holding order" clause, allowing the government to require platforms to keep certain user assets within Japan to prevent capital flight. The FSA issues exchange licenses, with 45 currently authorized. Key requirements include establishing a legal entity and office in Japan, meeting minimum capital thresholds (over JPY 10 million with specific holding rules), complying with AML/KYC, submitting detailed business plans, and conducting ongoing reporting and audits.

Exchange Presence: The market is dominated by local exchanges such as Bitflyer. International platforms usually enter via joint ventures (e.g., Coincheck).

Europe

European Union

As one of the most developed and extensive regulatory jurisdictions in the global crypto space, Europe is becoming the first port of compliance for many crypto projects. The EU demonstrates leadership through the Markets in Crypto-Assets Regulation (MiCA), establishing a unified regulatory framework.

Legal Status of Crypto Assets: Under MiCA, crypto assets are defined as "legitimate payment instruments, but not legal tender." MiCA imposes strict oversight on stablecoins, requiring 1:1 fiat backing and full reserves, with only licensed entities allowed to issue them. MiCA divides stablecoins into Asset-Referenced Tokens (ARTs) and E-Money Tokens (EMTs). For other tokens—NFTs and governance tokens—the EU adopts a classification approach: NFTs are generally seen as "unique digital assets" exempt from securities rules, while governance tokens may be treated as securities based on function and rights conferred. MiCA currently excludes security tokens, NFTs, and central bank digital currencies (CBDCs).

Regulatory Framework: The EU passed MiCA in June 2023, with stablecoin rules taking effect in June 2024 and full implementation on December 30, 2024. It applies across 30 countries—27 EU member states plus Norway, Iceland, and Liechtenstein in the EEA. MiCA addresses legal ambiguity, stablecoin risks, and insider trading by harmonizing rules to protect investors, ensure market integrity, and maintain financial stability. It details requirements for crypto asset issuance, service provider authorization, operations, reserve management, redemption, and AML. MiCA also incorporates the Travel Rule from the Funds Transfer Regulation (TFR), requiring Crypto Asset Service Providers (CASPs) to include sender and recipient information in every transaction to enhance traceability.

Licensing: MiCA adopts a "license once, operate everywhere" model: CASPs need authorization in just one member state to legally operate across all others, greatly simplifying compliance. Authorization is granted by national competent authorities. License requirements include good reputation, capability, transparency, data protection, and minimum capital ranging from €15,000 to €150,000 depending on service type (per MiCA Annex IV). CASPs must have a registered office in an EU member state and at least one director residing in the EU.

Stablecoin Adoption: Circle’s USDC and EURC have received MiCA compliance approval and are recognized as EU-standard stablecoins. Tether (USDT), failing to meet MiCA’s strict stablecoin rules, has been delisted for EU users by major exchanges like Coinbase and Binance.

United Kingdom

Post-Brexit, the UK has not fully adopted MiCA but instead pursued an independent yet comprehensive regulatory path to maintain its competitiveness as a global financial center.

Legal Status of Crypto Assets: In the UK, crypto assets are explicitly recognized as "personal property," a status confirmed in 2024 parliamentary legislation. This provides digital assets with the same legal protections as traditional property, enhancing certainty for owners and traders. For stablecoins, the UK takes a prudent approach, requiring approval from the Financial Conduct Authority (FCA), with reserve assets held in segregated custody. Based on court rulings, NFTs are also recognized as property. Governance tokens are assessed case by case, potentially classified as securities or utility tokens.

Regulatory Framework: The Financial Services and Markets Act (2023) brings crypto assets under regulatory purview and amends the definition of "specified investments" in the Financial Services and Markets Act 2000 to include crypto assets. The Bank of England also regulates stablecoins as digital payment tools, requiring issuers to obtain FCA authorization. The Economic Crime and Corporate Transparency Act 2023 empowers law enforcement to freeze and recover illicit crypto assets. The Treasury has released detailed proposals to establish a financial services regulatory regime for crypto assets, including new regulated activities such as "operating a crypto asset trading platform."

Licensing: The FCA issues relevant licenses. Companies engaging in crypto activities—including operating trading platforms, trading crypto as principal, or providing custody—must obtain FCA authorization. While there is no mandatory crypto exchange license yet, crypto firms must register with the FCA and comply with AML and counter-terrorism financing (CTF) rules. Registration requirements include incorporation in the UK, a physical office, maintaining detailed records, and appointing a resident director.

Russia

Legal Status of Crypto Assets: Russia classifies crypto assets as "property" for confiscation purposes, while declaring digital financial assets (DFAs) "not a means of payment," and the central bank does not recognize crypto as payment. Russia distinguishes between DFAs and digital currency in its legal framework. DFAs are defined as digital rights—including monetary claims or rights related to securities—based on distributed ledger technology. By law, DFAs are not considered means of payment. The Federal Law No. 259-FZ of July 31, 2020—"On Digital Financial Assets, Digital Currency, and Amendments to Certain Laws of the Russian Federation"—governs the issuance and circulation of DFAs. The law also recognizes hybrid rights combining DFA with rights to transfer goods, intellectual property, or services.

Industry Development: As an energy-rich nation, crypto mining is prevalent in Russia. In October and November 2024, the government began implementing two laws related to crypto mining, introducing legal definitions and registration requirements. Under the new legislation, only registered Russian legal entities and individual entrepreneurs can engage in mining. Individual miners consuming below government-set energy limits may operate without registration.

Despite these laws, only 30% of crypto miners had registered with the Federal Tax Service by late 2024, leaving 70% unregistered. Measures to encourage registration include harsher penalties—one bill increased fines for illegal mining from 200,000 to 2 million rubles (approx. $25,500). Enforcement actions are underway, with reports of illegal mining farms being shut down and equipment seized. The Interior Ministry has filed cases under Article 165 of the Russian Criminal Code.

Switzerland

Switzerland has long been a pioneer in crypto regulation, known for its flexible token classification and support for blockchain innovation.

Legal Status of Crypto Assets: While cryptocurrencies are legal in Switzerland, there are no specific regulations governing their purchase, sale, or use as payment for goods and services, so such activities typically do not require special financial market licenses. The Swiss Financial Market Supervisory Authority (FINMA) classifies crypto assets based on economic and practical use into payment tokens, utility tokens, and asset tokens, applying corresponding regulations. FINMA notes these categories are not mutually exclusive and hybrid tokens may exist. Asset tokens are generally treated as securities; utility tokens are not if they serve a genuine functional purpose at issuance, but may be if they have investment intent.

Regulatory Framework: Switzerland passed the Blockchain Act in 2020, fully defining token rights and amending multiple federal laws to integrate distributed ledger technology (DLT). FINMA has applied AML regulations to VASPs and issued Travel Rule guidance in August 2019, effective January 1, 2020. The act also improved the framework for book-entry securities on blockchain and enhanced legal certainty in bankruptcy by clearly specifying segregation of crypto assets.

Licensing: FINMA issues VASP licenses. Custody, exchange, trading, and payment services involving payment tokens fall under AML jurisdiction, requiring service providers to join a self-regulatory organization (SRO) in advance. In some cases, a FinTech license may suffice instead of a banking license, lowering entry barriers. Requirements include establishing a Swiss legal entity, meeting capital adequacy (CHF 20,000–100,000 depending on license type), implementing AML/KYC procedures, and complying with FATF Travel Rule. Zug Canton has piloted a "crypto-friendly" regulatory sandbox. Traditional banks like ZKB and exchanges like Bitstamp now hold licenses to offer crypto services.

Americas

United States

The U.S. crypto regulatory landscape is marked by significant variation between states and a lack of unified federal legislation, creating high market uncertainty. However, with Trump’s return and SEC leadership changes accelerating policy momentum, federal crypto legislation appears imminent.

Legal Status of Crypto Assets: The legal status of crypto assets varies notably across U.S. states. Federally, the IRS treats them as "property," while New York defines them as "financial assets." For stablecoins, the GENIUS Bill draft proposes that payment stablecoins should not be treated as securities but must have 100% highly liquid reserves. For other tokens—NFTs and governance tokens—the SEC leads classification efforts: NFTs may be deemed securities, while governance tokens are mostly classified as such.

Regulatory Framework: There is currently no unified federal crypto law in the U.S. The SEC primarily uses securities laws to regulate tokens. New York has its BitLicense regime. The GENIUS stablecoin bill is under review. Licensing is mainly handled at the state level (e.g., NYDFS) and through federal MSB (Money Services Business) registration for AML purposes. For example, New York enforces a strict BitLicense, required for crypto firms operating in the state. Many other states have enacted or are considering their own crypto legislation—some have updated the Uniform Commercial Code (UCC) for digital assets or set specific rules for crypto ATMs. Crypto firms engaged in money transmission or exchange must register with FinCEN as MSBs and comply with federal AML/CFT requirements, including KYC, suspicious transaction monitoring, and reporting.

Exchange Presence: Major platforms like Coinbase, Kraken, and Crypto.com operate compliantly in the U.S.; Binance.US recently enabled USD deposits. However, due to prior regulatory uncertainty, some international exchanges chose not to enter the U.S. market or offered limited services. The SEC also took enforcement actions during previous administrations against exchanges accused of operating unregistered securities trading.

El Salvador

El Salvador has undergone a unique journey in crypto legal status. It recognized Bitcoin as legal tender in 2022 but later abandoned that stance under pressure from the IMF. Currently, Bitcoin is not legal tender but remains permissible for private use following 2025 reforms.

Regulatory-wise, El Salvador passed the Digital Asset Issuance Act (2024). The National Commission for Digital Assets (NCDA) oversees regulation and plans to issue licenses. However, a full licensing system is not yet in place. Despite government promotion of crypto taxation, no major exchanges have established large-scale operations.

Argentina

Argentina’s severe economic instability and high inflation have driven widespread crypto adoption, prompting gradual improvements in its regulatory framework, especially for Virtual Asset Service Providers (VASPs).

Legal Status of Crypto Assets: In Argentina, cryptocurrencies are legal and can be used and traded. However, due to constitutional provisions granting the central bank sole authority to issue currency, crypto is not legal tender. Crypto assets may be classified as currency for transactional purposes, and contracts can be settled using crypto. For stablecoins and tokens (e.g., NFTs, governance tokens), there is currently no dedicated legislation defining their legal status.

Regulatory Framework: Although the new administration (President Milei) supports crypto, there is no dedicated crypto law yet. However, in 2024, Argentina passed Law No. 27739, incorporating VASPs (known locally as PASV) into its legal and financial framework. This requires VASPs to follow AML and KYC procedures to combat money laundering and bring industry practices in line with FATF international standards.

Licensing: Since 2024, VASPs must register with Argentina’s financial regulator, the Comisión Nacional de Valores (CNV), to offer crypto services. Requirements include customer identity screening and verification, reporting new client registrations, conducting risk assessments, maintaining detailed records (including transaction and customer data), monitoring suspicious activity, and establishing internal controls. Non-compliant entities face fines, legal action, or license revocation.

Middle East

United Arab Emirates

Legal Status of Crypto Assets: The UAE takes a proactive approach to crypto and blockchain, aiming to position itself as a global fintech and digital innovation hub. Within clearly defined regulatory frameworks, cryptocurrencies are legal. The Dubai Financial Services Authority (DFSA) defines crypto tokens as cryptographically secured digital representations of value, rights, or obligations usable as medium of exchange, payment, or investment. It explicitly excludes "excluded tokens" and "investment tokens." Only DFSA-approved crypto tokens are permitted in the DIFC, with limited exceptions. Abu Dhabi Global Market (ADGM) classifies stablecoins as virtual assets when involved in regulated activities.

Regulatory Framework: Key UAE regulators include:

-

Central Bank of the UAE (CBUAE): Regulates financial activities within the UAE, including crypto trading and banking services, ensuring financial stability and consumer protection. Oversees fiat-to-crypto transactions.

-

Securities and Commodities Authority (SCA): Regulates financial markets in the UAE, including digital securities and commodities. Collaborates with ADGM’s FSRA and Dubai’s VARA to maintain consistent standards.

-

Virtual Assets Regulatory Authority (VARA): Dubai’s dedicated virtual asset regulator, established in 2022. Focuses on compliance, investor protection, and market stability.

-

Dubai Financial Services Authority (DFSA): Regulates financial services involving crypto tokens within the Dubai International Financial Centre (DIFC).

-

Abu Dhabi Global Market (ADGM): Maintains a comprehensive regulatory framework for virtual assets, digital securities, and derivatives within its financial free zone, supervised by the Financial Services Regulatory Authority (FSRA).

This collaborative regulatory approach ensures digital assets are integrated into the legal system, promoting innovation while preventing abuse.

Licensing: On the licensing front, Dubai’s VARA 2.0 (June 2025) introduces multiple updates: strengthened margin trading controls (only for qualified and institutional investors; retail leverage products banned; VASPs must enforce strict collateral management, monthly reporting, and mandatory liquidation mechanisms); formal recognition of Asset-Referenced Virtual Assets (ARVA); regulated token distribution (issuance/distribution requires VARA approval, whitepapers must disclose transparently and misleading marketing is prohibited); establishment of a structured licensing regime for eight core activities (advisory, brokerage, custody, etc.), each requiring separate licensing with defined capital adequacy, risk control, and operational requirements; and enhanced supervision (expanded on-site inspections, quarterly risk assessments, fines, and criminal referrals, with a 30-day transition period and full enforcement starting June 19, 2025). ADGM’s FSRA oversees virtual asset regulation, with licensing requiring clear service definitions (custody, trading, etc.), compliance with capital, AML, cybersecurity standards, and submission of business plans. The 2025 revision streamlines the "Accepted Virtual Assets (AVA)" certification process, grants FSRA product intervention powers, and bans privacy tokens and algorithmic stablecoins. DFSA regulates crypto-token-related financial services in DIFC, requiring tokens to meet identification criteria for regulatory status and transparency. Stablecoins must demonstrate price stability, segregated reserves, and monthly verification; privacy and algorithmic tokens are banned. Mainstream tokens like Bitcoin have been identified, and a tokenization regulatory sandbox has been launched.

Saudi Arabia

Saudi Arabia adopts a cautious stance toward cryptocurrencies, influenced by Sharia law principles and the imperative to maintain financial stability.

Legal Status of Crypto Assets: Saudi Arabia approaches crypto cautiously, largely due to Sharia-related constraints. The banking system fully prohibits crypto use, and financial institutions are barred from crypto transactions. Private ownership is not prosecuted, but trading and exchange are strictly restricted. The Saudi Central Bank (SAMA) issued warnings about crypto risks in 2018 and tightened prohibitions on crypto financial transactions in 2021. Religious rulings (e.g., fatwas from Dar al-Ifta declaring crypto haram due to fraud and lack of tangible backing) influence these bans. Stablecoins or tokens backed by real assets may be considered halal (permissible).

Regulatory Framework: The Saudi Central Bank (SAMA) and Capital Market Authority (CMA) emphasize a "prudent approach" to crypto innovation, balancing technological advancement with financial stability. In July 2024, Mohsen AlZahrani was appointed to lead SAMA’s virtual asset initiative, highlighting its commitment to controlled integration of financial tech innovation. This reflects a broader regulatory shift—avoiding outright bans while engaging with global trends and regional successes like UAE’s VARA system. SAMA actively promotes blockchain adoption and involves international institutions like Rothschild and Goldman Sachs in tokenization projects. Saudi Arabia is advancing its own digital currency as part of Vision 2030. In 2019, SAMA and the UAE Central Bank conducted interoperability tests for cross-border CBDC transactions under the "Aber Project." Saudi Arabia joined the mBridge CBDC pilot in 2024. The country leads in "wholesale CBDC" pilots aimed at facilitating domestic settlement and cross-border transactions for financial institutions.

Licensing: The Saudi CMA announced that STO regulations would be released by end-2022, with applications accepted via its digital platform. Its FinTech Lab, launched in 2017, has worked to create a favorable environment for fintech startups. Saudi STOs are closely supervised under CMA’s strict securities regulations. Key considerations include registration (detailed documentation, prospectus), disclosure obligations (transparent, accurate information, financial statements, risk factors), and anti-fraud measures. CMA regulations also impose investor accreditation, restricting STO participation to qualified investors capable of independent risk assessment. Tokenization of traditional financial assets is a key focus, requiring legal frameworks to address ownership, transferability, and regulatory alignment, ensuring smart contracts comply with legal principles.

Bahrain

Legal Status of Crypto Assets: Bahrain is a Middle East pioneer in crypto and blockchain regulation, establishing a comprehensive framework under the Central Bank of Bahrain (CBB)'s Capital Markets Rulebook, specifically the Crypto-Asset Module (CRA). It clearly defines crypto assets as cryptographically secured digital representations of value or rights (excluding CBDCs).

Regulatory Framework: CRA sets legal and operational standards for crypto asset providers, covering licensing, risk management, and consumer protection. A March 2023 revision strengthened client asset safeguards and AML measures. Regulations ensure transparency and compliance aligned with FATF standards, fostering innovation through FinTech Bay and a regulatory sandbox, while exempting certain virtual asset activities from regulation.

Licensing: Entities in Bahrain offering regulated crypto services must obtain a CBB crypto asset license, covering order execution, trading, and more. VASP licenses are divided into four categories, each with different minimum capital and annual fee requirements. Applicants must be Bahraini companies meeting registration, business plan, and compliance criteria. Violations may result in heavy fines, license revocation, or imprisonment.

Israel

Legal Status of Crypto Assets: Israel lacks a comprehensive crypto-specific law; for tax purposes, crypto is treated as an asset, not currency. Sales are taxed at 25% capital gains, crypto-to-crypto trades are taxable events, and crypto business income is taxed as ordinary income. Crypto trading is generally VAT-exempt, though exchange platforms may be liable. Mining is subject to corporate income tax, and transactions require recordkeeping.

Regulatory Framework:

-

CMA: Since 2016, the primary regulator, requiring virtual currency brokers and custodians to be licensed, setting standards like ILS 1 million in capital, and supervising stablecoin pilots.

-

ISA: Regulates crypto-related securities activities, issuing regulatory guidance. In August 2024, allowed non-bank members to offer crypto services, adopting a token-type-based regulatory approach and pushing legislative reform.

-

Bank of Israel: Issued stablecoin principles in 2023, proposing full reserves and licensed oversight, researching the "digital shekel," launching tests and challenge programs in 2024.

Licensing: Crypto service providers must be licensed under relevant laws, requiring Israeli incorporation, sufficient capital, and clean criminal records. ISA revisions allow non-bank entities to offer crypto services under a "closed garden" model. AML regulations apply, with stablecoin pilots overseen by CMA.

Africa

Nigeria

Nigeria’s crypto regulatory landscape has undergone a significant shift—from initial restrictive measures to a more formal and comprehensive framework.

Legal Status of Crypto Assets: The Central Bank of Nigeria (CBN) initially imposed restrictions in February 2021, directing banks and financial institutions to close accounts linked to crypto trading, though personal ownership was not banned. However, in December 2023, the CBN lifted the restriction, allowing banks to serve crypto firms licensed by the Securities and Exchange Commission (SEC). Banks are now required to open designated accounts for Virtual Asset Service Providers (VASPs), conduct thorough KYC, and monitor fund flows. This shift acknowledges the necessity of regulating VASPs. ISA 2025 (Investment and Securities Act 2025) explicitly defines digital assets as securities and commodities, expanding SEC’s regulatory scope. The SEC’s position is that crypto assets are presumed to be securities unless proven otherwise, placing the burden of proof on operators, issuers, or sponsors. This covers a broad range of digital and crypto assets, including stablecoins, utility tokens, asset-referenced tokens, and e-money tokens.

Regulatory Framework: Nigeria’s regulatory environment has evolved from prohibition to regulation. The CBN’s initial "ban" was seen as ineffective, driving trading to P2P networks and creating regulatory conflicts with the SEC’s earlier recognition of digital assets. The change in government likely influenced this policy shift, prioritizing regulation over prohibition to enable oversight and taxation. This evolution reflects a maturing regulatory approach aimed at integrating the crypto economy into the formal financial system for better supervision, risk management (AML/CFT), and potential tax revenue.

Licensing: The SEC’s Digital Asset Rules Handbook—“New Rules on Digital Asset Issuance, Platforms, and Custody” (2022)—strengthened by ISA 2025, provides statutory basis for VASP regulation. A VASP license is mandatory for any platform that matches orders, converts crypto to fiat, or holds user assets—including OTC platforms operating via social media. Non-compliance may lead to penalties, including operational suspension, fines, and director prosecution. The SEC expanded its Accelerated Regulatory Incubation Program (ARIP) to expedite VASP approvals; ARIP is now incorporated into the Revised Digital Asset Rules as a registration pathway, with incubation periods capped at 12 months. Nigeria’s 2022 Money Laundering Act Section 30 (Financial Institutions) classifies crypto operators as reporting entities. Mandatory requirements include registration with the Nigerian Financial Intelligence Unit (NFIU), filing suspicious activity reports (SAR), transaction monitoring, and risk-based customer classification. Non-compliance may result in fines or enforcement actions.

South Africa

South Africa adopts a pragmatic and evolving approach to crypto regulation, treating crypto assets as financial products and working toward a comprehensive compliance framework.

Legal Status of Crypto Assets: In South Africa, the use of crypto assets is legal but they are not recognized as legal tender. For regulatory purposes, crypto assets are formally classified as financial products under the Financial Advisory and Intermediary Services Act (FAIS) of 2002. This classification requires providers of crypto-related financial services to obtain a Financial Services Provider (FSP) license.

Regulatory Framework: By declaring crypto assets as "financial products" rather than currency, South Africa establishes a clear legal basis for regulation within its existing financial services framework. The South African Reserve Bank (SARB) stated that "exchange control regulations do not govern the inflow and outflow of crypto within South Africa," suggesting the need for reform. The Interdepartmental Fintech Working Group (IFWG) recommended amending Exchange Control (Excon) to include crypto assets in the definition of capital. The tax treatment of crypto is clear: income and capital gains tax (CGT) apply. SARB prefers the term "crypto assets" over "currency."

Licensing: The Financial Sector Conduct Authority (FSCA) is the primary regulator for crypto service providers. The CASP licensing process began on June 1, 2023, with existing firms required to submit applications by November 30, 2023. As of December 10, 2024, the FSCA had approved 248 out of 420 CASP license applications, rejecting nine. Requirements include company registration, FSP license application (with crypto asset sub-category), meeting "fit and proper" criteria, and mandatory AML/CFT compliance. CASPs were formally designated as accountable institutions under the Financial Intelligence Centre Act (FICA) on December 19, 2022. As accountable institutions, CASPs must: register with the Financial Intelligence Centre (FIC), implement KYC/CDD, appoint a compliance officer, train staff, conduct AML/CFT/counter-proliferation financing risk assessments, establish and maintain risk management and compliance programs, file regulatory reports (SAR), and conduct sanctions screening. The FIC has issued directives requiring implementation of the "Travel Rule" for crypto asset transfers by April 30, 2025. The Travel Rule applies to all transactions, regardless of amount, with broader information requirements for transactions of ZAR 5,000 or more.

Summary

The global crypto regulatory landscape is continuously evolving, showing clear signs of both convergence and divergence.

Convergence Trends

Globally, anti-money laundering (AML) and counter-terrorism financing (CFT) have become universal consensus and core requirements in crypto regulation. The EU’s Markets in Crypto-Assets Regulation (MiCA), with its comprehensiveness and "one license, pan-EU access" model, is increasingly serving as a benchmark for other jurisdictions developing their own regulations.

Additionally, regulators commonly adopt a functional and economic substance-based classification of crypto assets rather than a one-size-fits-all approach. Categories include payment tokens, utility tokens, asset tokens, security tokens, and commodity tokens. This granular classification enables more precise regulation, avoids over- or under-regulation, and fosters global consensus on asset characterization.

Divergence Trends

Despite convergence, the legal status of crypto assets varies dramatically worldwide. From outright bans (e.g., mainland China, Egypt) to recognition as legitimate payment instruments (e.g., Japan), to classification as personal property (e.g., UK) or financial products (e.g., South Africa), fundamental legal characterizations differ significantly. These foundational differences mean global crypto firms still face complex legal environments and compliance challenges when operating across borders.

Challenges

Key challenges in global crypto regulation today include:

-

Difficulty in cross-jurisdictional coordination: While bodies like FATF and frameworks like MiCA promote partial convergence, countries’ differing economic, political, and legal systems make full regulatory alignment difficult. Fragmentation leads to regulatory arbitrage, high compliance costs, and regulatory gaps.

-

Pace of technological advancement vs. regulatory lag: Blockchain and crypto technologies evolve faster than traditional legislative and regulatory processes. New products, services, and business models—like DeFi, NFTs, DAOs—emerge rapidly, making it hard for regulators to develop timely, forward-looking rules.

-

Ongoing balancing act between innovation and risk: Governments and regulators strive to strike a balance—encouraging financial innovation to capture opportunities in the digital economy while effectively mitigating risks like money laundering, terrorism financing, inadequate consumer protection, and threats to financial stability. This balancing act is complex and uncertain, requiring continuous policy adjustments and market feedback.

In conclusion, global crypto regulation is moving toward greater maturity and granularity. Yet its inherent complexity, dynamism, and the divergent realities across nations will continue shaping the trajectory of the global crypto market in the years ahead.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News