US-listed companies flock to "buy coins"—how effective is this second growth curve?

TechFlow Selected TechFlow Selected

US-listed companies flock to "buy coins"—how effective is this second growth curve?

Short-term effectiveness, long-term mystery.

By: Fairy, ChainCatcher

Edited by: TB, ChainCatcher

"Buying crypto" has become a cheap and fast way to boost market capitalization in the stock market.

The "meme season" in U.S. stocks is surging—core businesses have become secondary, while digital assets have turned into new engines for market valuation.

But the question grows sharper: Will the market keep paying for this valuation game played under the guise of crypto?

Valuation Logic: How Does Buying Crypto Affect Corporate Value?

"Buying crypto" resembles an experimental shift in valuation driven by sentiment, liquidity, and narrative.

In traditional valuation frameworks, a company's market cap stems from core variables such as profitability, balance sheet structure, growth potential, and free cash flow. However, during this wave of "crypto buying," companies have leveraged the "financial allocation" of holding crypto assets to trigger a re-pricing of their valuations by the market.

When a company adds Bitcoin or other major cryptocurrencies to its balance sheet, the market attaches a premium multiple based on the price elasticity and trading expectations of those digital assets. In other words, a company’s market value is no longer derived solely from value creation—it is also leveraged upward by speculation around potential "token price increases."

Yet this structure places "liquidity narratives" above actual business operations, turning financial allocations into the central axis of capital maneuvering.

Short-Term Boost, Long-Term Questions Remain

There's no denying that entering the crypto space can provide short-term stock price stimulation. Take Cango, an auto transaction service provider, as an example. In November 2023, it announced its entry into Bitcoin mining, investing $400 million to acquire 50 EH/s of computing power, after which its stock surged 280%. Similarly, many companies with lackluster core operations—or even those deeply entangled in financial distress—have attempted to use the "buying crypto" narrative to seek revaluation in capital markets.

We’ve compiled stock performance data from a group of public companies that achieved “crypto-stock correlation” through purchasing cryptocurrencies:

Judging by market performance, the phenomenon of “price soars upon buying crypto” has occurred repeatedly. As long as the “crypto asset” concept is introduced, short-term capital rushes in swiftly. Yet after these initial spikes, many “crypto-holding companies” face stock pullbacks. Without continuous crypto purchases or other positive catalysts, gains are difficult to sustain.

Therefore, although the "buy crypto" strategy can ignite market enthusiasm in the short term, whether it translates into long-term competitiveness and sustainable growth remains highly uncertain. The market is also unlikely to genuinely embrace followers who attract attention merely through one-off crypto buys or vague "holding plans."

Are Speculators Starting to Sell?

The story of "buying crypto to inflate valuations" continues to unfold, but some key players appear to be quietly taking profits.

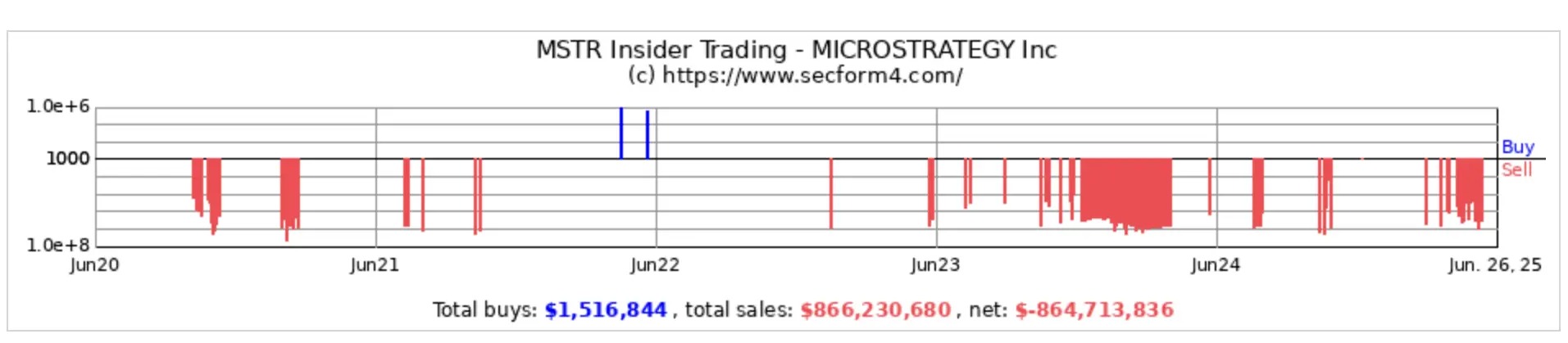

Strategy, the proponent of this "infinite growth" theory, has seen its internal executives consistently reducing their holdings in $MSTR. According to SecForm4.Com data, insiders at Strategy entered a concentrated selling phase starting June 2023. Protos reported that within just the past 90 days, executives sold a total of $40 million worth of shares—ten times the number of buy transactions.

Image source: secform4.com

Upexi, dubbed the "Solana version of MicroStrategy," is also facing pressure. It previously raised $100 million to establish a Solana treasury. However, Upexi plunged 61.2% during yesterday’s trading session after investors registered to sell 43.85 million shares—equivalent to its entire initial float volume in April.

On another front, Circle, the stablecoin issuer, saw its stock briefly surge to nearly $300 following its listing. Yet Ark Invest, which strongly supported Circle prior to its IPO, has been steadily reducing its position. Reports indicate Ark Invest has sold Circle stock four times consecutively, cumulatively cutting more than 36% of its holdings.

When "buying crypto" becomes packaging, a market-cap tool, or even a narrative shell used to avoid scrutiny of fundamentals, it is bound to fail as a universal "key to success." Today’s market may pay for "financial allocation," but tomorrow’s market might return to demanding real answers about growth and profitability.

Buying in the secondary market isn’t necessarily endorsement—it could simply be rotating speculative chips.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News