BIS: Stablecoins are not money, fail to pass "three key tests"

TechFlow Selected TechFlow Selected

BIS: Stablecoins are not money, fail to pass "three key tests"

BIS stated that digital assets pegged to fiat currencies fail the "three key tests" required to make them a cornerstone of the monetary system: singleness, resilience, and integrity.

Author: Daniel Kuhn

Translation: far, Centreless

The Bank for International Settlements says stablecoins are not money.

The institution, sometimes referred to as the "central bank of central banks," stated in a report released on Tuesday that fiat-linked digital assets fail what it calls the "three key tests" required to serve as pillars of a sound monetary system: singleness, resilience, and integrity.

"The role that innovations such as stablecoins might play in a future monetary system remains to be seen," the BIS said in its annual report reviewing the next generation of finance. "But they perform poorly against three desirable features of sound monetary arrangements and thus cannot serve as pillars of a future monetary system."

Stablecoins do have certain advantages—such as programmability, pseudonymity, and "user-friendly access for new users," according to the report's authors. In addition, their "technical characteristics mean they could offer lower costs and faster transaction speeds," especially in cross-border payments.

However, compared with currencies issued by central banks and instruments issued by commercial banks and other private-sector entities, stablecoins may pose risks to the global financial system by undermining government monetary sovereignty (sometimes through "stealth dollarization") and facilitating criminal activities, the authors noted.

Although stablecoins play a clear role as gateways into and out of crypto ecosystems and are increasingly popular in countries with high inflation, capital controls, or limited access to U.S. dollar accounts, these assets should not be treated as cash.

The Three Key Tests

In particular, due to their structural design, stablecoins fail the resilience test. Take Tether's USDT, for example—a stablecoin backed by "nominally equivalent assets"—where any additional issuance requires full prepayment from holders, imposing a "cash-in-advance constraint."

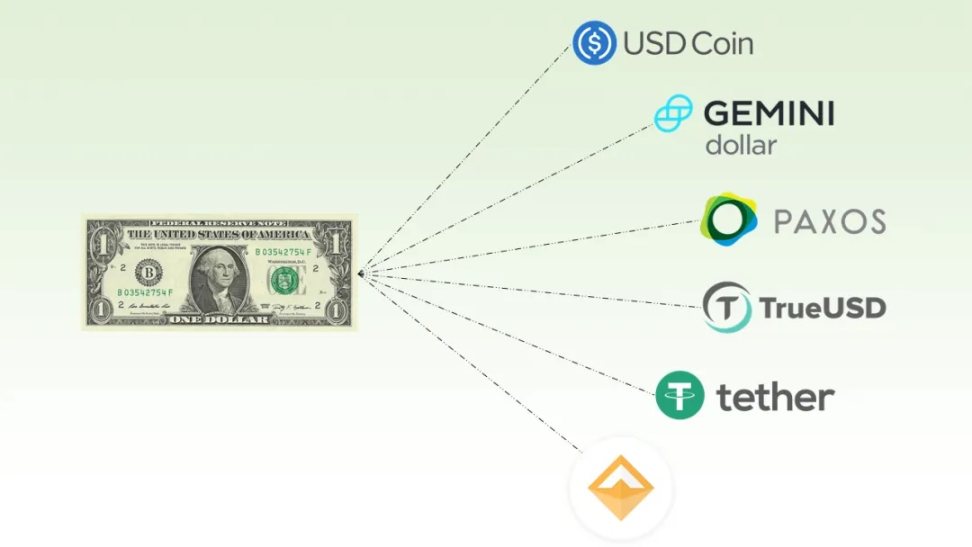

Moreover, unlike central bank reserves, stablecoins do not meet the requirement of monetary "singleness"—the idea that money can be issued by different banks yet accepted unconditionally by all—because they are typically issued by centralized entities that may set different standards and do not necessarily provide uniform settlement guarantees.

"Holders of stablecoins bear the name of the issuer, much like the private banknotes circulating during America’s 19th-century Free Banking Era," the authors wrote. "As a result, stablecoins often trade at varying exchange rates, undermining monetary singleness."

For similar reasons, stablecoins also exhibit "significant shortcomings" in promoting the integrity of the monetary system, since not all issuers follow standardized Know Your Customer (KYC) and anti-money laundering (AML) rules, nor can they effectively guard against financial crime.

Transformative Tokenization

Sector-wise, Circle, the issuer of the stablecoin USDC, saw its stock fall more than 15% on Tuesday following the release of the BIS report. The day before, CRCL shares had hit a record high of $299, up over 600% from its initial public offering price of around $32.

Despite expressing concerns, the organization remains optimistic about the potential of tokenization, calling it a "revolutionary innovation" across areas ranging from cross-border payments to securities markets.

"Tokenized platforms built around central bank reserves, commercial bank money, and government bonds could lay the foundation for the next generation of money and finance," the authors wrote.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News