CRCL hits new high as Circle executives and VCs collectively sell $2 billion worth of shares

TechFlow Selected TechFlow Selected

CRCL hits new high as Circle executives and VCs collectively sell $2 billion worth of shares

Even if you're a founder, you might underestimate market greed in a bull market.

Text: Protos

Translation: Ismay, BlockBeats

Editor's Note: Since its listing, Circle’s stock price has surged dramatically, with CRCL skyrocketing from an IPO price of $29.30 to $300, emerging as one of the biggest winners at the intersection of Wall Street and the crypto world. Yet, in this equity windfall for the stablecoin leader, early executives and venture capitalists have ironically become the "losers" who missed out on the main rally. Many of them chose to sell immediately on IPO day, missing out on potential gains worth billions of dollars within just two weeks. This not only reveals a severe misjudgment of market expectations but also reflects the cognitive gap between private markets and public markets in the new era of crypto finance. When even founders fail to anticipate the true value of their own company's stock, perhaps we should reconsider: in this age driven by narratives and emotional leverage, who are the real smart money?

Below is the original article:

The executives and venture investors who chose to sell shares during Circle’s (ticker: CRCL) IPO missed out on a rocket-like surge in its stock price.

As of June 6, 2025, these early sellers had collectively forfeited approximately $1.9 billion in potential gains. It wasn’t so much selling as it was “losing by not buying”—a decision that proved painfully costly.

These executives and VCs cashed out at $29.30 per share, netting around $270 million in total. But had they simply held on for a few more weeks, the value of those shares would have ballooned into the billions.

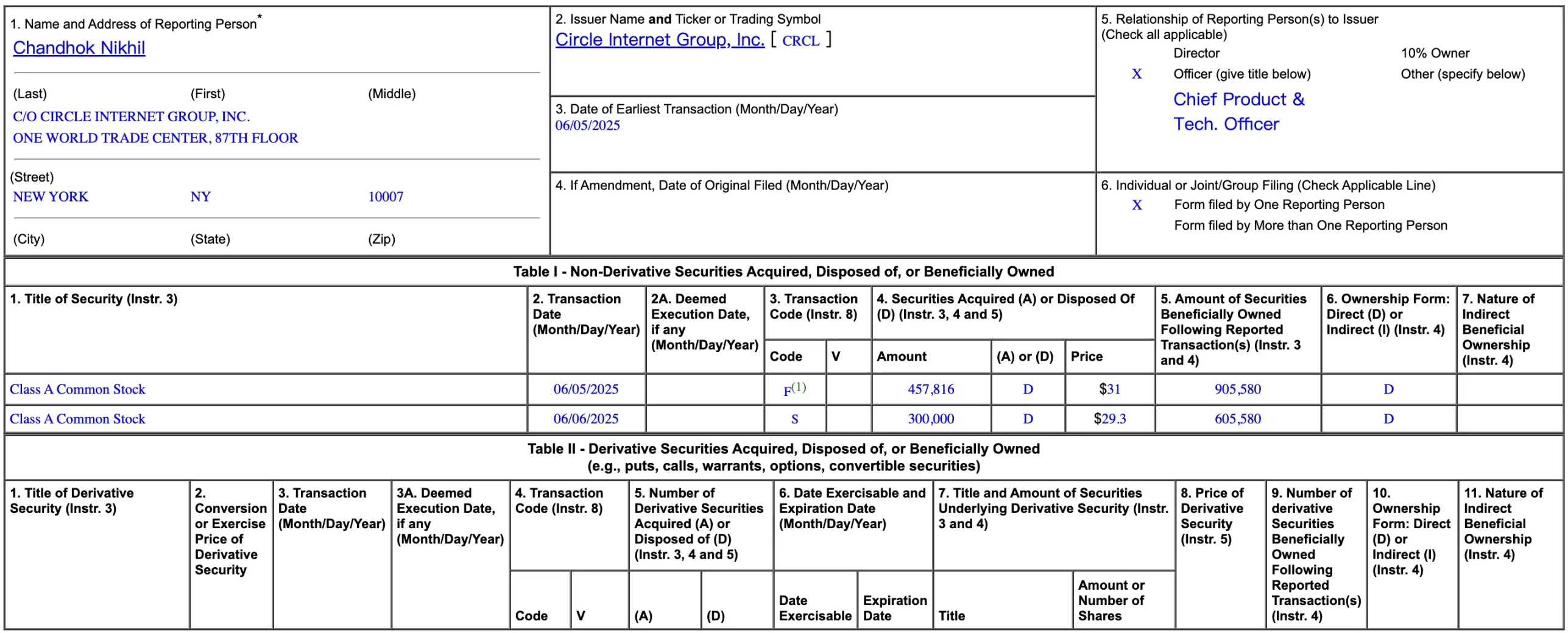

Take Circle’s Chief Product and Technology Officer, for example. He sold 300,000 Class A ordinary shares during the IPO at $29.30 each. Had he held onto them, those shares were worth $240.28 apiece as of last Friday’s close—costing him roughly $63 million in unrealized gains.

Circle’s CFO also sold 200,000 shares at the same IPO price, missing out on approximately $42 million in gains.

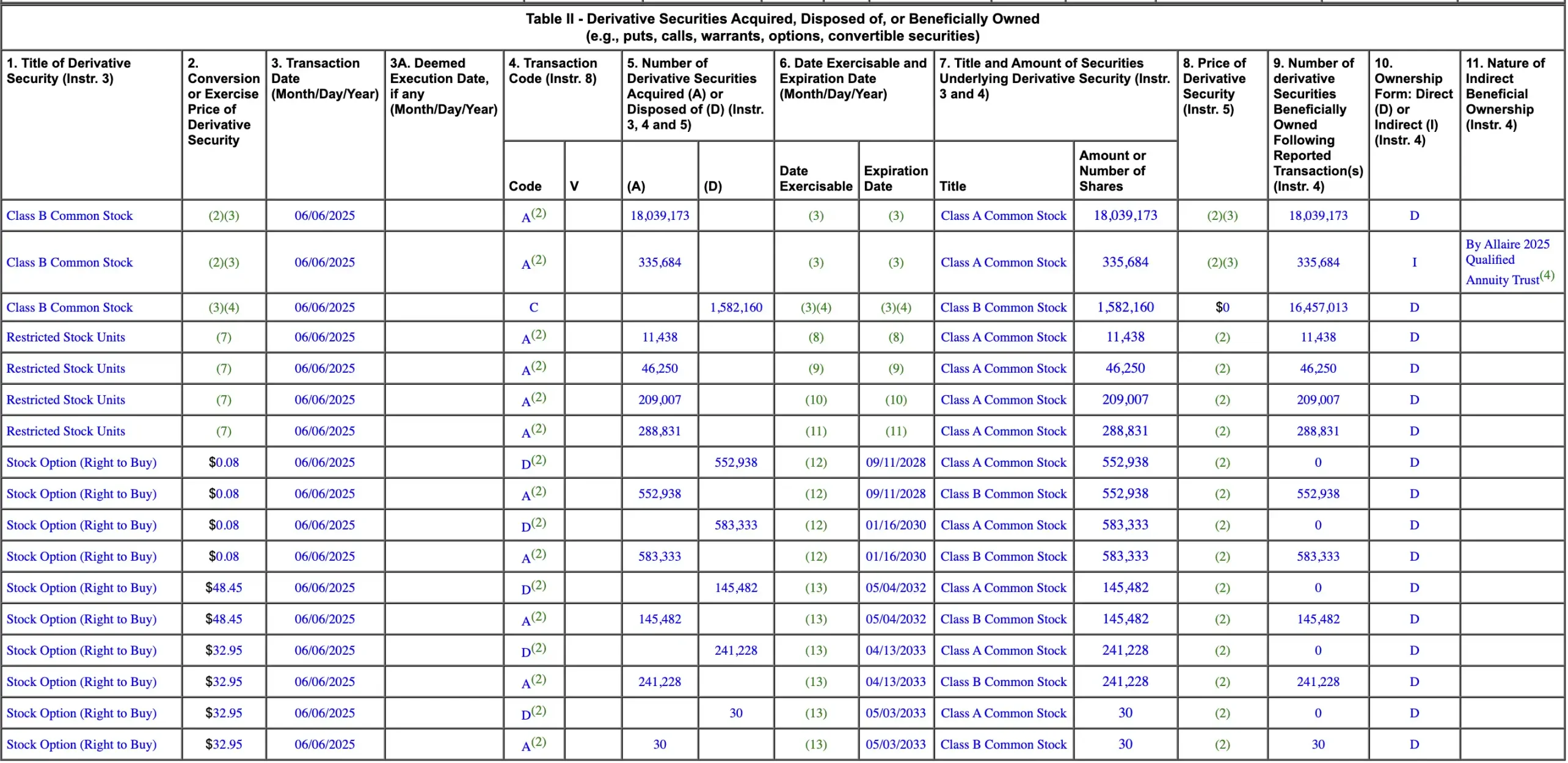

Even founder Jeremy Allaire was not spared. He offloaded 1.58 million shares during the IPO at $29.30 per share. Had he held, he would now have an additional $333 million in paper profits.

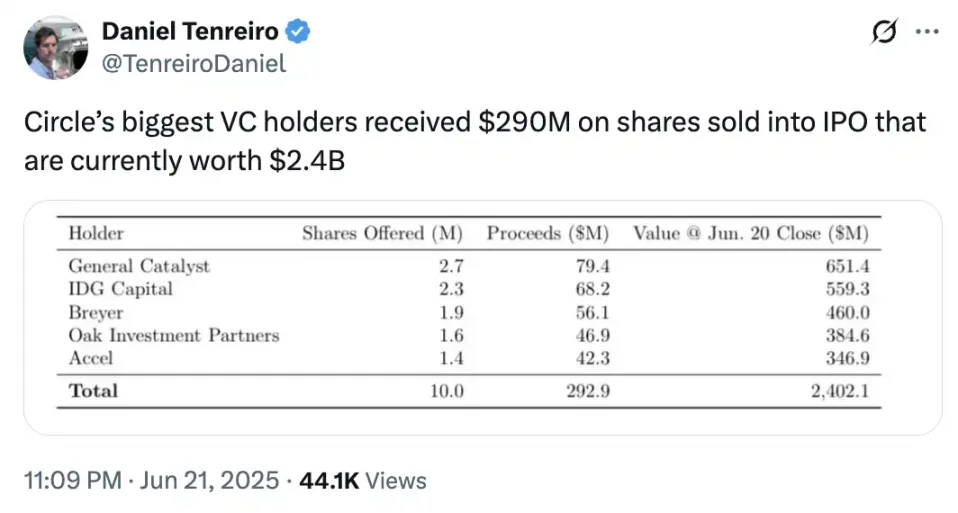

Circle’s VCs Miss Out on Billion-Dollar Gains

During Circle’s initial public offering (IPO), venture capital firms, executives, and other insiders collectively sold at least 9,226,727 ordinary shares at $29.30 per share.

While the sale brought them a substantial $270 million in immediate proceeds, the opportunity cost of that decision became staggering just two weeks later.

Had they held onto those shares instead, they could have earned an additional $1.9 billion today.

To be fair, some VCs only sold a portion of their stakes during the IPO. For instance, prominent venture firm General Catalyst disposed of only about 10% of its CRCL holdings. According to its latest Form 4 filing with the U.S. Securities and Exchange Commission (SEC), the firm still owns over 20 million shares.

Founder Jeremy Allaire is in a similar position, retaining more than 17 million shares along with stock options and restricted stock. Many other VCs and company executives also kept significant portions of their original stakes.

Nevertheless, the decision to sell at $29.30 now looks awkward in hindsight, especially with CRCL’s share price having soared to $240.28. While no one can predict the future perfectly, a forecasting error of nearly 88% constitutes a monumental miscalculation—one that has already secured its place in financial history.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News