Tesla Robotaxi hits the road, by invitation only, 30 yuan per ride—money can't buy an experience

TechFlow Selected TechFlow Selected

Tesla Robotaxi hits the road, by invitation only, 30 yuan per ride—money can't buy an experience

Whether there's a steering wheel and pedals actually doesn't really matter.

Author: siqi

Tesla's Robotaxi, a self-driving dream Elon Musk has been touting for 10 years, is finally hitting the road.

On June 22 local time, Tesla launched its Robotaxi service in Austin, the capital of Texas. The initial rollout includes around 10 to 20 vehicles and will initially invite select investors and social media KOLs to experience the service.

Since the two-door “true driverless” Cybercab unveiled last year hasn't entered mass production yet, the first batch of Robotaxis are currently based on Tesla’s existing Model Y production models. This means these vehicles still come equipped with a steering wheel and accelerator and brake pedals. Additionally, each car has a safety operator seated in the front passenger seat, and operations are subject to certain geographic limitations.

Musk announced on X that the fixed fare for early riders will be $4.20 per trip—an introductory “taste-testing” price, as long-term pricing remains unknown. Currently, in Austin, Waymo—the autonomous driving subsidiary of Google—is already operating Robotaxis in partnership with Uber. According to previous reporting by TechCrunch, Waymo charges approximately $3.50 per mile within the 2.7–5.8 mile range.

Tech blogger shares Robotaxi ride experience: 10 miles, 22 minutes | Image source: X

Compared to mainstream Robotaxi solutions available today, Tesla's approach differs in two key ways:

First, unlike current major players such as Waymo or Baidu Apollo Go, Tesla is using its mass-produced vehicles directly powered by FSD software—without adding complex sensor hardware or developing entirely new software systems. This could significantly reduce both hardware and R&D costs.

Second, Tesla aims to use this initial Robotaxi deployment to attract more "owners" (rather than just "users"). If this model proves viable, Tesla won’t need to purchase vehicles itself before deploying them into service. Instead, it could transition from being a traditional taxi operator to becoming a ride-hailing platform like Didi or Uber.

Therefore, despite some shortcomings in form factor, Tesla’s Robotaxi launch remains the most closely watched event in the entire autonomous driving industry.

Currently, Tesla has a market capitalization of $1.01 trillion and a price-to-earnings ratio of 177x—far exceeding that of traditional automakers. In recent years, Musk has repeatedly emphasized that Tesla has transformed from an automotive company into an AI company. Launching Robotaxi into the market serves as a critical demonstration of this capability and product vision. According to Morgan Stanley's valuation model, 60–80% of Tesla’s future valuation hinges on expectations for Robotaxi and FSD businesses.

"Driverless" Cars With Steering Wheels and Safety Operators

Most people expected Tesla’s Robotaxi to resemble the “driverless” Cybercab unveiled by Musk last October at Warner Bros. Studios in Hollywood. That vehicle completely eliminated the steering wheel and pedals, featured a two-door, two-seater design, and used a central screen in the front as the primary human-machine interface.

As a result, many may have fallen into Musk’s rhetorical trap, subconsciously equating Cybercab with Robotaxi. But in reality, Cybercab hasn't even started mass production. The Robotaxis now launching in Austin are provided by the 2025 Tesla Model Y. These vehicles run on Tesla’s HW4.0 (also known as AI4) autonomous driving hardware and software system, relying solely on a vision-based perception system equipped with eight cameras and Tesla’s proprietary chips to achieve 360-degree visibility.

In released test ride videos, each Robotaxi can be seen with a human safety operator in the front passenger seat. U.S. media reports indicate that Tesla has also established geofenced zones for these Robotaxis; only invited users can book rides, and services are currently limited to a small area in southern Austin.

Customer photos (top) vs official marketing images (bottom) of Tesla Robotaxi | Image source: X

Why the discrepancy between expectation and reality?

First, from a technical standpoint, Cybercab still faces significant hurdles before large-scale production can begin.

As Musk previously indicated during an earnings call, Cybercab is not expected to hit the market until the end of 2026. Moreover, under current regulations, vehicles without steering wheels or pedals require special exemption approvals before going on sale—and manufacturers are limited to producing no more than 2,500 units annually.

Second, from a marketing perspective, Cybercab was always intended more as a showcase.

Just as Xiaomi used its prototype and production SU7 Ultra to set lap records at the Nürburgring, the goal wasn’t to educate consumers about engineering nuances or target only track enthusiasts. Rather, it was to demonstrate brand capability: Xiaomi’s EVs offer thrilling performance—even faster than Porsches.

Likewise, Cybercab symbolizes Tesla’s claim that its FSD software can enable full self-driving anywhere. Removing the steering wheel and pedals becomes a metaphor for “driving everywhere.”

Traditional automakers often build supercars to enhance brand image, even though those models rarely sell in high volumes. Cybercab is Tesla’s version of a supercar in the era of smart vehicles—priced at just $25,000, yet supporting over 60% of Tesla’s sky-high market valuation.

So if one day Musk announces that Cybercab won’t be mass-produced after all, don’t be surprised. In his plan, its purpose may never have been volume sales.

Prominent "Robotaxi" branding visible on the side door of the Model Y | Image source: X

Robotaxi: A Business Needing a New Approach

This time, Tesla is only deploying 10–20 Robotaxis across a limited area in Austin. It seems modest in scale—but why does it still make headlines in the tech world?

A major reason is that it might offer a fresh solution to the notoriously capital-intensive Robotaxi business.

In 2024, Waymo—the largest Robotaxi provider in the U.S.—delivered over 4 million rides with a fleet of about 1,500 vehicles, generating $50–70 million in revenue while suffering losses of a staggering $1.5 billion.

The imbalance between revenue and expenditure represents the biggest pain point in the current Robotaxi business model.

Revenue is constrained by fleet size and market demand, while expenses fall into two main categories: software development (for autonomous driving capabilities) and hardware costs (vehicle purchases and additional sensor installations).

Unlike Tesla, most current Robotaxi providers rely on retrofitting production vehicles with extra sensing hardware to ensure functional and safety redundancy. This typically involves expensive components such as lidar sensors and high-performance computing chips, with BOM (bill of materials) costs reaching tens of thousands—or even over 100,000 RMB per vehicle.

Waymo's current model featuring an autonomous driving system mounted on top | Image source: Waymo

Beyond hardware, today’s Robotaxi companies operate much like traditional public transit agencies: they buy vehicles, hire personnel (in the form of software developers and safety operators), and then deploy services—all before earning any meaningful revenue.

This process is clearly inefficient. Running Robotaxi operations under this “traditional” model requires massive investment: acting like an AI firm funding R&D, a hardware company purchasing equipment, and possibly subsidizing fares during early operations.

Musk’s envisioned Robotaxi business doesn’t depend on manufacturing taxis himself, but rather on leveraging owners’ personal vehicles to generate income for Tesla.

Musk has stated his ambition for Tesla’s Robotaxi fleet to reach 1 million vehicles globally.

At $25,000 per vehicle, the hardware cost alone would amount to $25 billion—more than triple Tesla’s net profit in 2024. Clearly, launching such a project by first building hundreds of thousands of Cybercabs would represent an enormous financial burden—even if regulatory approvals were granted instantly worldwide.

Thus, these initial 10 Robotaxis can essentially be seen as “demo units.” This is another round of strategic marketing: last year’s Cybercab served as a concept demo, while these 10 vehicles aim to prove the real-world deployment capability of Tesla’s FSD software on mass-market vehicles.

A U.S. user shares footage of Tesla Robotaxi navigating nighttime conditions using pure vision technology | Image source: X

Musk’s ultimate goal is to prove that standard Model Y and Model 3 vehicles can function directly as Robotaxis. If regular Tesla owners opt into the Robotaxi network, Tesla could shift from being a car-owning operator to becoming a ride-hailing platform—a “Tesla-branded Didi or Uber.” And Tesla could collect revenue twice: once when selling the car, and again by taking a commission on each ride.

A Reality Check: Technical Readiness Isn’t Enough

In Morgan Stanley’s valuation framework, over 60% of Tesla’s future value comes from FSD and Robotaxi.

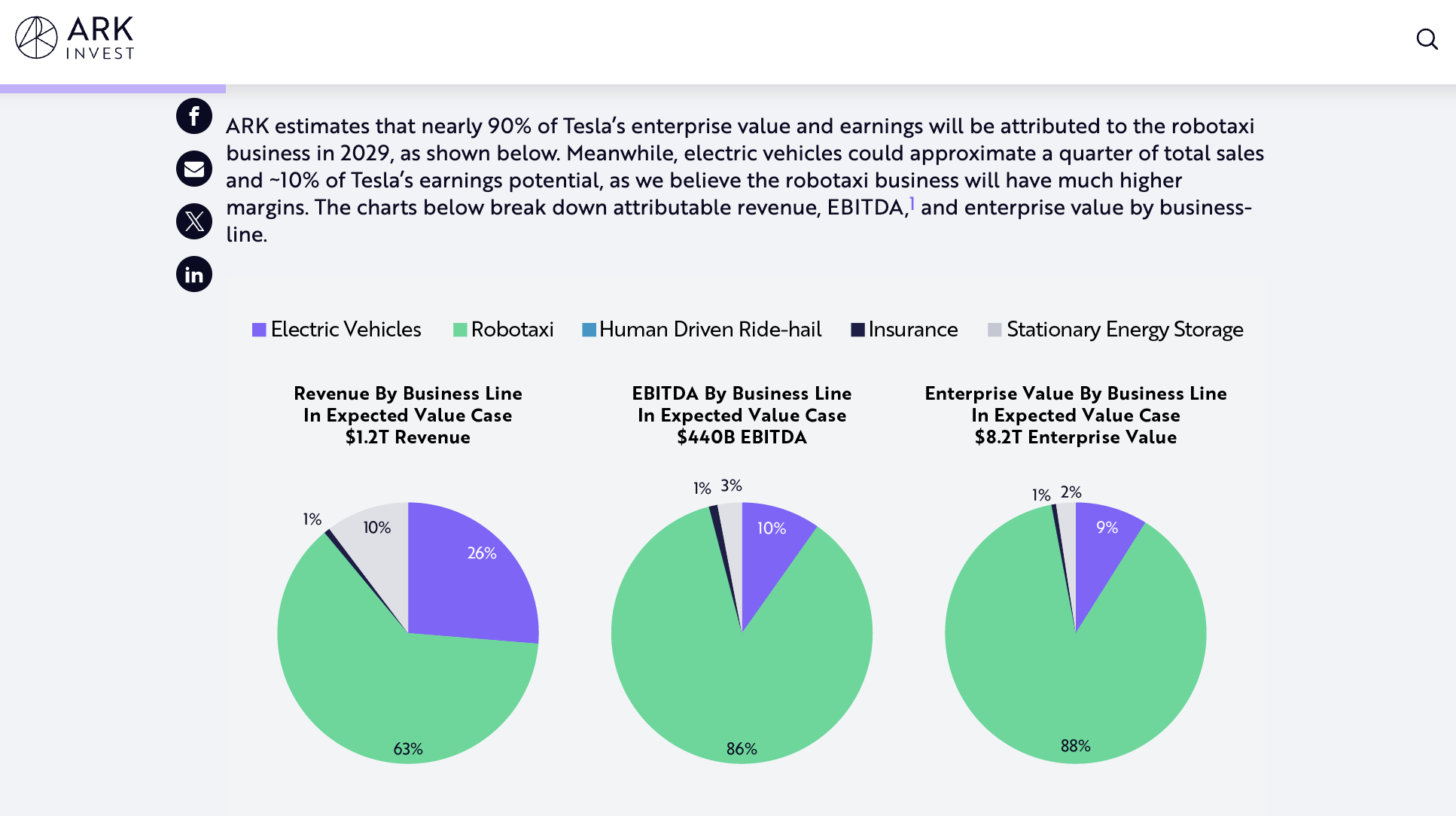

At ARK Invest, led by famed investor Cathie Wood, the projected contribution of Robotaxi to Tesla’s future value exceeds 90% | Image source: ARK Invest

As mentioned earlier, Tesla aims to bridge the gap from L2 to L4 autonomy through mass-production technology, unlocking two new business models beyond car sales: Robotaxi services and FSD software subscriptions.

Thanks to the global sales volume and ownership base of Model Y and Model 3, in theory, any Tesla owner with HW4.0 or newer hardware could turn their idle vehicle into a “Tesla-branded Didi.” In this scenario, achieving Musk’s vision of a million-vehicle fleet might not seem far-fetched.

However, even assuming flawless technology, operations, and regulatory approvals, there remains a fundamental question:

Will Tesla owners actually do this?

For existing owners, would they really want to use their private cars for public transportation services?

For potential buyers, would anyone specifically purchase a Tesla just to operate it as a Robotaxi for profit?

Take China as an example: a new Tesla Model Y equipped with HW4.0 starts at 263,500 RMB. Under current regulations, this vehicle qualifies for premium ride-hailing services. But as a new product category, Robotaxi will likely need to offer price subsidies to gain user traction—just as past ride-hailing platforms did. Who will bear these costs?

And then there’s the classic dilemma: Musk often says owners can send their Model Y or Model 3 out to earn money when not in use, but what if there’s no demand for rides at that moment (e.g., late at night)?

From a sobering perspective, Robotaxi and full autonomy remain industries that cannot succeed overnight. Yet from an investor standpoint, even though Tesla’s pure-vision, mass-production strategy hasn’t been fully validated, its potentially ultra-low cost structure makes it worth betting on the future.

This explains why, despite a series of controversies this year, Tesla still commands a P/E ratio as high as 177x—triple that of any of the “Magnificent Seven” tech giants in Silicon Valley.

Until Robotaxi delivers tangible results, Tesla and Musk’s top priority remains selling cars—non-Robotaxi cars.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News