Tesla's next chapter: merging with xAI?

TechFlow Selected TechFlow Selected

Tesla's next chapter: merging with xAI?

Merging a hotshot startup with a valuation of tens of billions of dollars (xAI) into a trillion-dollar giant (Tesla) is certainly not a spur-of-the-moment decision.

By GuiTu Jun

In the world of technology and capital, some rumors start as whispers in enthusiast forums, then escalate into speculative reports by financial media, and eventually land—unavoidably—on the most serious agendas.

The potential merger between Tesla and xAI, another AI startup under Elon Musk’s umbrella, is precisely such a prophecy inching toward reality.

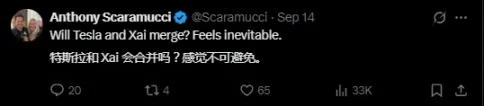

Last Sunday, a tweet from Anthony Scaramucci, founder of SkyBridge Capital, poured fuel on an already blazing expectation. He stated outright that with Musk accelerating the integration of AI across his business empire, a merger between Tesla and xAI “feels inevitable.”

This was no isolated callout. When a shareholder proposal urging Tesla to invest in xAI was formally filed, and when Morgan Stanley uncovered a hidden "merger clause" within Musk’s potentially trillion-dollar compensation package, everyone realized: an AI behemoth spanning the digital and physical worlds, possibly valued at $8.5 trillion, is emerging.

Is this merely a fantasy of capital, or part of Musk’s grand design? Today, combining insights from GuiTu Jun and our expert team, we will deeply unpack the likelihood of this century-defining merger and the AI future it heralds.

Merging a red-hot, billion-dollar AI startup (xAI) into a multi-trillion-dollar giant (Tesla) is no impulsive act. We can clearly trace this path through four key signals.

1. A Formal Proposal: From Grassroots Demand to Official Agenda

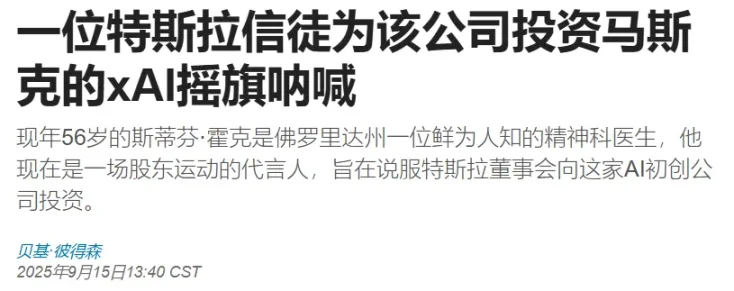

It all began with Stephen Hawk, a retail Tesla shareholder. His formal proposal recommends that the company invest in xAI and will be put to a vote at the annual shareholder meeting on November 6.

Though seemingly minor, this step carries immense symbolic weight. It marks the first time the idea of a capital union between Tesla and xAI has moved from public discourse into official corporate governance.

As Hawk himself noted, his inspiration came directly from Musk’s hints on social media. He believes that “formally establishing this partnership is crucial to ensuring clear mutual interests for both sides.” This reflects the sentiment of the most loyal investors: We invested in Tesla because we believe in Musk’s AI vision—we don’t want xAI’s massive success to pass us by.

2. The Trillion-Dollar Pay Package: The Hidden 'Merger Clause' in the Fine Print

If the shareholder proposal represents a bottom-up push, Musk’s new decade-long compensation plan is top-down architectural design. Analysts at Morgan Stanley and other elite investment banks view this plan as the “key” to unlocking the merger mystery.

Adam Jonas, a sharp analyst at Morgan Stanley, pointed out that a supplementary clause regarding acquisitions holds the critical clue:

“Market cap and adjusted EBITDA milestone targets may be adjusted to account for Tesla acquisition activities deemed to have a material impact on achieving those milestones.”

In plain terms: if Tesla makes a “material” acquisition in the future (e.g., xAI), Musk’s performance benchmarks can be recalibrated accordingly.

Wall Street’s interpretation is straightforward: this is the most flexible institutional backdoor预留 for a future xAI merger. It indicates that this potential merger has long been part of Tesla’s strategic toolkit—awaiting only the right moment.

3. Musk’s Own 25% Control Stake

Musk himself has shown no reluctance toward the idea of a merger. Not only has he publicly polled fans on X, but he has also told investors directly, “I will act according to shareholder wishes.”

Underlying this is his deeper calculus on control over Tesla. Musk has repeatedly stated his desire to hold at least 25% of Tesla’s shares—to maintain veto power over any change in corporate control. However, increasing his stake purely through secondary market purchases would be prohibitively expensive.

A merger with xAI offers a perfect solution. Musk holds a significant stake in xAI; if xAI were acquired by Tesla, his xAI shares could be converted into newly issued Tesla shares. This would dramatically increase his ownership percentage while addressing investor concerns about his divided attention, consolidating all core businesses firmly within the Tesla platform—a two-birds-with-one-stone move.

4. Wall Street's Frenzy

Financial markets are greedy for compelling narratives. When Gene Munster, a well-known analyst at Deepwater Asset Management, boldly proclaimed that “the combination of Tesla and xAI could propel the former’s market cap to $8.5 trillion,” Wall Street erupted.

This view reflects a fundamental revaluation of Tesla’s business model—it would no longer be seen merely as an electric vehicle or energy company, but as a true end-to-end, integrated hardware-and-software artificial intelligence platform. And such a company deserves a far higher “AI valuation premium” than traditional manufacturing firms.

Market excitement must rest on solid business logic. The reason a Tesla-xAI merger is seen as a “match made in heaven” is that they each occupy opposite poles of the AI world, perfectly complementing each other.

1. The Final Piece of the Puzzle

Musk has emphasized more than once that Tesla is a “real-world AI company.” Its core mission is enabling AI to understand and interact with the physical world. This manifests concretely in:

Full Self-Driving (FSD): Teaching cars to perceive, understand, and make decisions in complex real-world traffic environments.

Humanoid Robots (Optimus): Enabling robots to perform tasks in unstructured physical spaces like factories and homes.

Meanwhile, xAI focuses on “digital-world AI.” Its flagship product, the Grok large language model, aims to understand and generate human language, code, and logic.

For hardware platforms like Optimus, physical perception and execution capabilities are its “body,” while the cognitive and reasoning abilities of a language model constitute its “soul.”

Only through deep integration can such a robot truly understand complex instructions and break them down into actions. The Tesla-xAI merger is precisely aimed at creating a general-purpose AI agent that is “whole in body and mind.”

2. The Ultimate Closed Loop: From 'Seeing' to 'Understanding'

At its core, AI competition is a battle for data. Tesla possesses the world’s largest—and still exponentially growing—real-world driving video dataset, the most valuable resource for training physical-world AI.

But until now, this data has primarily trained “perception” tasks, such as identifying vehicles, pedestrians, and lane markings. With the xAI merger, Grok’s powerful multimodal capabilities can perform deeper “annotation” and “understanding” of these vast video streams, creating an unparalleled data flywheel:

Tesla’s fleet collects massive video data → Grok models in the cloud perform deep understanding and logical annotation → train smarter FSD and Optimus models → deploy back to fleets and robots, improving performance, encouraging more user engagement and higher-quality data generation → repeat, evolving exponentially.

Once this flywheel starts spinning, its moat will leave competitors far behind.

3. Deep Hardware-Software Co-Design

The endgame of the large model race will inevitably be vertical integration of software and hardware. You need not only the best algorithms, but also custom chips and data center architectures optimized specifically for them.

Tesla has its self-developed Dojo chip; xAI has the Grok model. After a merger, they could achieve extreme optimization—from chip design and data center construction to upper-layer model training—converting every watt of energy into effective computing power.

In fact, collaboration between the two companies is already quietly underway: Grok has been integrated into certain Tesla vehicles and Optimus prototypes; and the stable power supply for xAI’s computing centers is secured by Tesla Energy’s Megapack industrial battery storage systems.

When all logic points toward a merger, the remaining questions are simply: when, and how?

For Tesla shareholders, this is an urgent matter. Watching xAI’s valuation surge from billions to seeking $200 billion in new funding, while being unable as Tesla investors to directly participate in the biggest windfall of this AI revolution, is undeniably painful.

The potential merger between Tesla and xAI is far more than a simple “left pocket to right pocket” capital maneuver. It is Musk’s inevitable next step toward building an unprecedented vertically integrated AI empire—from foundational energy, to custom chips, supercomputing, top-tier algorithms, and finally deployed across two physical platforms: cars and robots.

The shareholder meeting on November 6 will be a pivotal moment in this drama. Regardless of the vote outcome, what we are witnessing may not just be a corporate restructuring, but the dawn of a new AI era.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News