Tesla and xAI to merge? Hedge fund billionaire: Feels inevitable

TechFlow Selected TechFlow Selected

Tesla and xAI to merge? Hedge fund billionaire: Feels inevitable

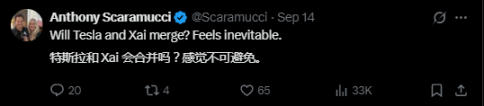

Positive comments from SkyBridge Capital founder Anthony Scaramucci have further heightened expectations of a potential merger between Tesla and xAI.

By Li Xiaoyin, Wall Street Insights

The possibility of a merger between Tesla and xAI, Elon Musk's AI startup, is evolving from market speculation into serious discussion.

On Sunday, Anthony Scaramucci, founder of SkyBridge Capital, posted on social platform X that as Musk accelerates the integration of AI across his business empire, a Tesla-xAI merger "feels inevitable." This statement further fueled already rising merger expectations.

Scaramucci’s post came after news broke that Tesla shareholders had filed a formal proposal. Reports indicate the proposal urges Tesla’s board to authorize an investment in xAI, marking the first time a capital linkage between the two companies has entered the official agenda.

A deeper signal lies within Tesla’s recently disclosed new 10-year compensation plan for Musk. As previously reported by Wall Street Insights, according to Morgan Stanley analysis, the plan includes a key clause allowing performance targets to be adjusted in the event of a "material" acquisition. This is widely interpreted as paving the way for a potential future merger with xAI, making synergy between the two companies part of Tesla’s long-term strategy.

Shareholder Proposal Fuels Merger Expectations

The immediate push to link Tesla and xAI comes from investors themselves. According to Tesla’s proxy filings, 56-year-old Florida-based investor Stephen Hawk submitted a shareholder proposal recommending the company invest in xAI. This proposal will be voted on at the company’s annual general meeting on November 6, alongside Musk’s controversial pay package.

In an email, Stephen Hawk said his inspiration came from Musk’s earlier social media posts hinting at collaboration between the two entities. He believes “formally establishing this partnership is critical to ensuring clear mutual interests.”

In fact, Musk himself has remained open to the idea. He not only previously solicited fan feedback on the topic via X, but also told investors in July, “We will act according to the will of the shareholders.” This makes the shareholder vote a potentially pivotal step in determining the future relationship between the two companies.

Musk’s New Pay Plan Hints at Merger Signal

For investors, something more substantial than the shareholder proposal may be Musk’s long-term compensation plan, potentially worth up to $1 trillion.

Earlier this month, Morgan Stanley analyst Adam Jonas and team noted in a research report that the plan aims to alleviate investor concerns about Musk diverting attention to other ventures like xAI and SpaceX.

The report states that Musk has clearly expressed his desire to maintain at least 25% ownership in Tesla to retain veto power over control changes, and the new plan provides exactly the incentive pathway for that. More importantly, a supplemental clause regarding acquisitions has drawn significant market attention. It states: “Market capitalization and adjusted EBITDA milestone targets may be adjusted to account for Tesla acquisition activities deemed to have a material impact on achieving such milestones.”

Analysts believe this language creates flexible institutional space for future alignment between Tesla and xAI. Morgan Stanley’s report explicitly states this provides a clear “interface” for a merger, indicating such integration is already part of Tesla’s long-term strategic planning.

Tesla’s Market Cap Could Reach $8.5 Trillion

Market anticipation for a merger is built upon existing synergies between the two companies.

Musk has consistently positioned Tesla as a “real-world AI” company, centered on powering autonomous driving and the Optimus humanoid robot. Meanwhile, xAI’s Grok large language model has already been integrated as an AI companion into Optimus and select Tesla vehicles. Additionally, xAI purchases Tesla’s industrial batteries to power its data centers.

Some analysts believe a merger would unlock immense value. Gene Munster, prominent tech analyst and co-founder of Deepwater Asset Management, suggested earlier this month that combining Tesla and xAI could help the former reach an ambitious market cap target of $8.5 trillion.

Today, this view is becoming mainstream. With xAI’s valuation already exceeding $100 billion and seeking as high as $200 billion, enabling Tesla shareholders to share in the massive returns from its AI breakthroughs has become a key challenge for Musk to address.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News