Iran Becomes Flashpoint in Financial Markets: Can Bitcoin Hold the $100,000 Level?

TechFlow Selected TechFlow Selected

Iran Becomes Flashpoint in Financial Markets: Can Bitcoin Hold the $100,000 Level?

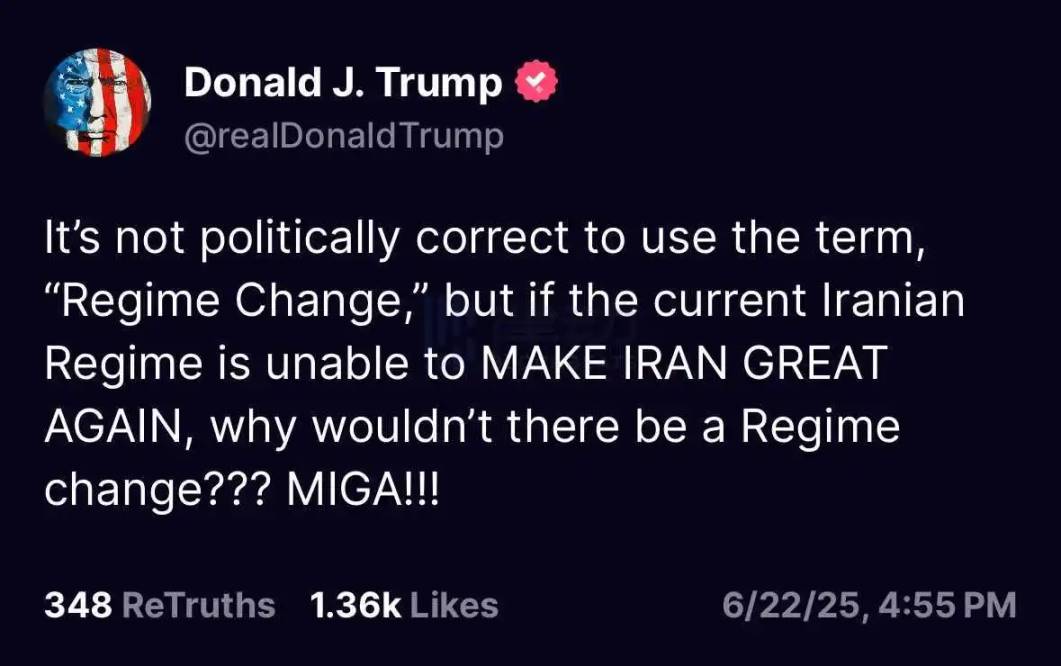

Trump says he would make Iran "great again" by pushing for regime change.

By 1912212.eth, Foresight News

On the evening of June 22, Iranian parliament's National Security Committee member Kousari stated that the parliament had concluded it should close the Strait of Hormuz, but the final decision rests with Iran's Supreme National Security Council. Following the announcement, BTC dropped from $102,810, breaking below $100,000 to reach a low of $98,200 before recovering to around $100,800. ETH fell to $2,111, marking four consecutive daily declines. SOL dipped to $126, down 3.45% over 24 hours, with most altcoins broadly declining.

In terms of futures data, CoinGlass reported $658 million in liquidations across all markets within 24 hours, including $526 million in long positions liquidated. The largest single liquidation occurred on HTX - BTC-USDT, valued at $35.45 million.

Markets have turned volatile—BTC briefly dropped below $100,000. Will Iran ultimately shut the Strait of Hormuz?

The Strait of Hormuz lies between Oman and Iran, connecting the Gulf of Oman in the east with the Persian Gulf in the west. It is the only maritime passage through which oil from the Gulf region reaches global markets. Approximately one-third of seaborne crude oil trade passes through this strait. Iran controls key highlands, cave depots, and strategic islands along the western shore of the strait, such as Hormuz Island, Farur Island, and Larak Island. If ordered to block the strait, Iran could rapidly establish a "layered firepower blockade network."

Historically, Iran has repeatedly threatened to block the Strait of Hormuz but never followed through. For example, during the Iran-Iraq War in the 20th century, Iran made threats but ultimately refrained from full implementation. In recent years, after the U.S. withdrew from the JCPOA (Iran nuclear deal) and reinstated sanctions, Iran again issued similar warnings.

Iran’s economy heavily relies on energy exports via the Strait of Hormuz. Closing the strait would severely damage Iran's economy, worsen living conditions for its population, and potentially accelerate a crisis of governmental legitimacy. Moreover, blocking the strait would drastically deteriorate Iran’s international relations, further isolating it globally.

Dr. Liu Qiang, Deputy Director and Chair of the Academic Committee at Shanghai's Pacific International Strategic Research Center, said: “If Iran acts rationally, it will most likely not decide to block the strait. The disadvantages far outweigh any benefits. Currently, much of the international community leans toward sympathizing with Iran. Implementing a blockade would trigger widespread opposition and reverse favorable global sentiment.”

U.S. Vice President Vance stated: “Iran’s attempt to block the Strait of Hormuz would be economically suicidal. In my view, it’s unlikely Iran will actually make this decision.”

Trump posted early morning Beijing time on June 23 via his social platform Truth: “Using the term ‘regime change’ is politically inappropriate, but if the current Iranian regime cannot make Iran great again, why shouldn’t a regime change happen? MIGA.”

What choice will Iran ultimately make? Markets are holding their breath.

The crypto world is filled with despair—does a bull market still exist? Is now a good time to buy the dip?

Trader Eugene Ng Ah Sio posted last night at 10 PM on his personal channel: “I’ve gone quite aggressively long here, including on Bitcoin and some altcoins. I believe today’s earlier U.S. bombing operation, combined with the closure of the Strait of Hormuz, dealt consecutive blows to early bulls—enough to shake out weak hands. Now is precisely the time to 'buy the dip.' If the market gaps straight down to $95,000, then I’d just say ‘goodnight.’ But this is the last stand for the bulls—and I’m already in position.”

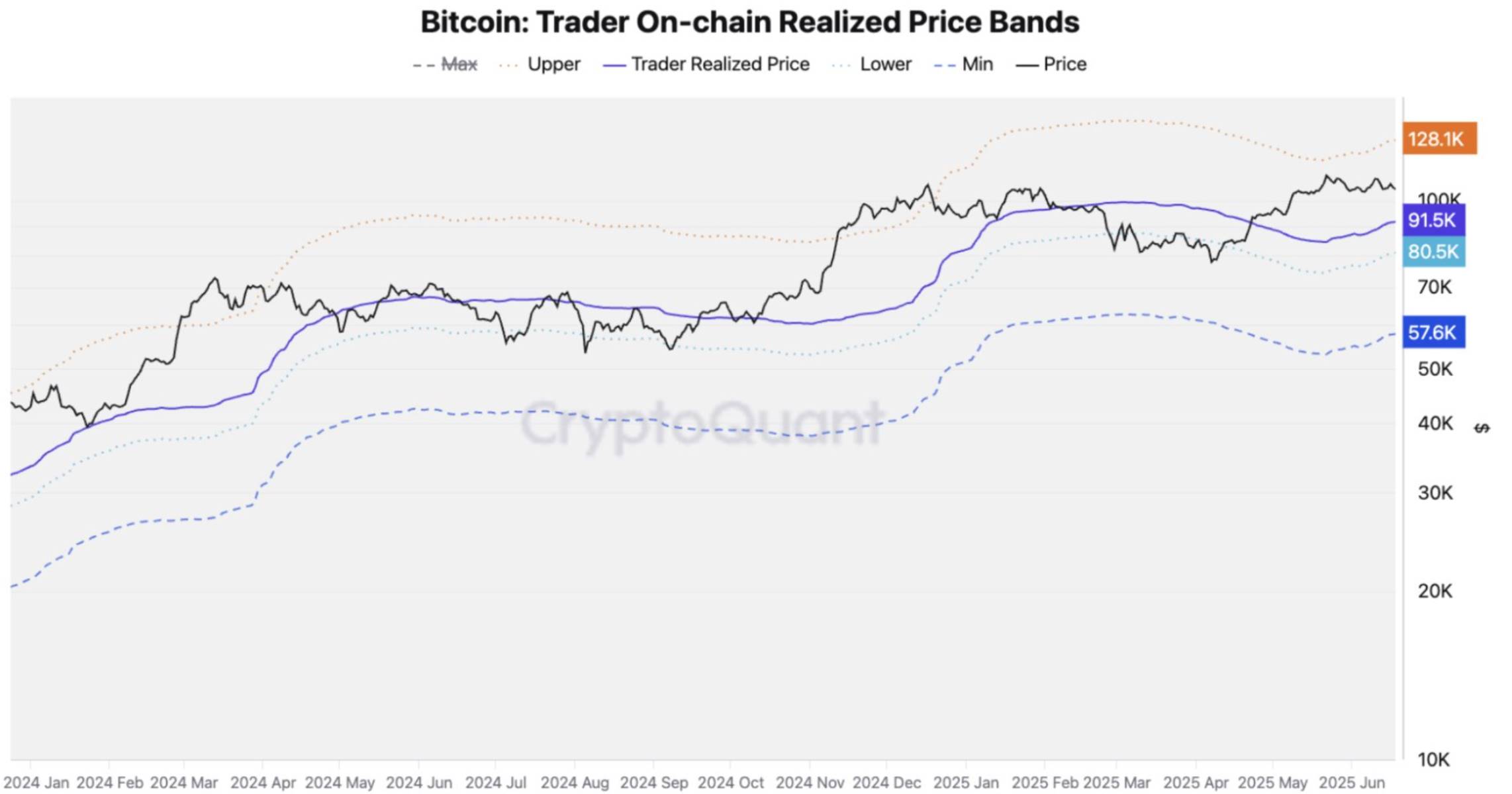

Julio Moreno, Research Head at CryptoQuant, said demand for Bitcoin is showing signs of cooling after a period of accelerated growth when prices neared $112,000. Spot demand continues to grow, but at a slower pace, currently below historical trends. Whale and ETF Bitcoin purchases have halved. Demand from new investors is also declining. In the futures market, investors recently chose to take profits and began establishing new short positions.

If demand remains weak, Bitcoin may find support near $92,000—a level corresponding to on-chain actual cost basis for traders, typical of bull market support zones. Should this level fail, the next potential support could be around $81,000, close to the lower bound of on-chain actual cost.

On-chain data analyst Murphy tweeted that although ETH price has corrected nearly 20% from its peak, he still doesn't consider this an ideal buying opportunity. The percentage of supply in profit remains at 55%, meaning even at current levels, 55% of circulating supply is still in the green. Historically, the best value-entry points occur only when the majority of circulating supply is underwater.

Mike Novogratz, founder of Galaxy Digital, tweeted: “The next 72 hours are critical—but if Iran does not launch a real counterstrike, markets will surge by the weekend.”

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News