50 Million Dollar OTC Crypto Scam: Prominent Token Involved, VCs and Whales Caught in the Trap

TechFlow Selected TechFlow Selected

50 Million Dollar OTC Crypto Scam: Prominent Token Involved, VCs and Whales Caught in the Trap

Despite early warning signs and public alerts, trust, greed, and so-called social "proof" became powerful weapons in the hands of scammers.

Author: darwizzynft

Translation: TechFlow

A major over-the-counter (OTC) cryptocurrency scam involving multiple well-known tokens has recently been exposed, affecting dozens of prominent projects including SUI, NEAR, Axelar, and SEI—yet shockingly, almost no one is talking about it!

Estimates suggest that this scam defrauded investors of over $50 million over several months, only becoming widely known in recent weeks.

The victim list includes venture capitalists (VCs), key opinion leaders (KOLs), and heavyweight crypto whales. Below is a detailed breakdown of how the scam unfolded, thanks to in-depth research by @AltcoinAlphaOnX.

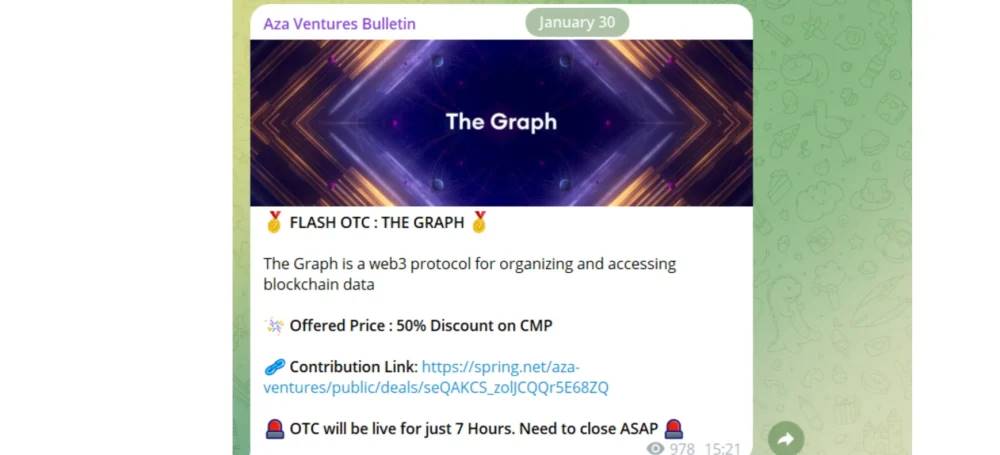

Phase One: Building Trust (November 2024 – January 2025)

Starting in November 2024, various venture capital groups and private investment pools began promoting seemingly legitimate top-tier OTC deals within Telegram groups.

These offers claimed to sell tokens from high-profile projects such as The Graph (GRT), Aptos (APT), SEI, and SWELL at steep discounts—up to 50% off market prices—with a promised lock-up period of 4–5 months.

Source: @AltcoinAlphaOnX

This was the bait phase.

The initial transactions were delivered on time, with investors receiving their tokens as promised. This apparent legitimacy quickly built trust.

Early success stories and smooth operations attracted more investors, many of whom increased their investment amounts.

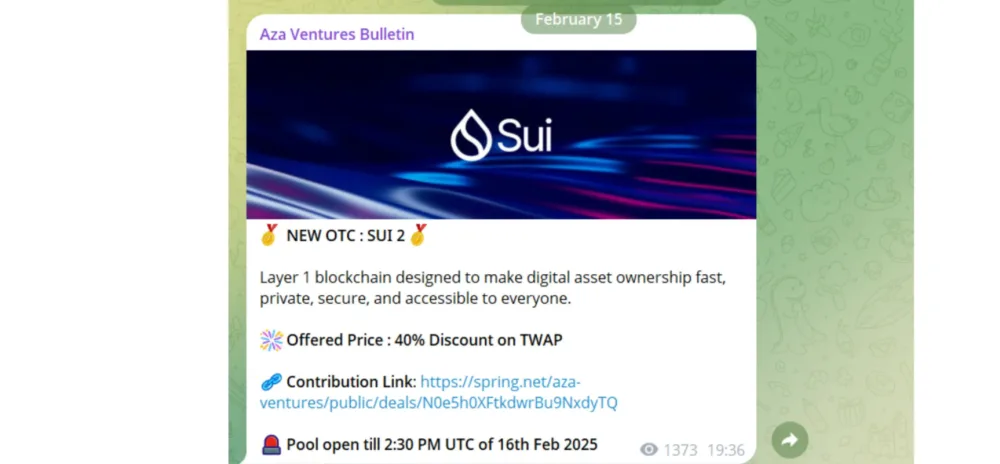

Phase Two: Scaling the Scam (February 2025 – June 2025)

By February 2025, the scope of these OTC deals rapidly expanded.

New rounds flooded Telegram groups with larger volumes and a broader range of tokens, including SUI, NEAR, GRASS, and Axelar.

The deal structure remained unchanged: deep discounts paired with fixed lock-up periods.

These attractive terms further drew in investors, reinforcing the scam’s credibility and enabling explosive growth.

Source: @AltcoinAlphaOnX

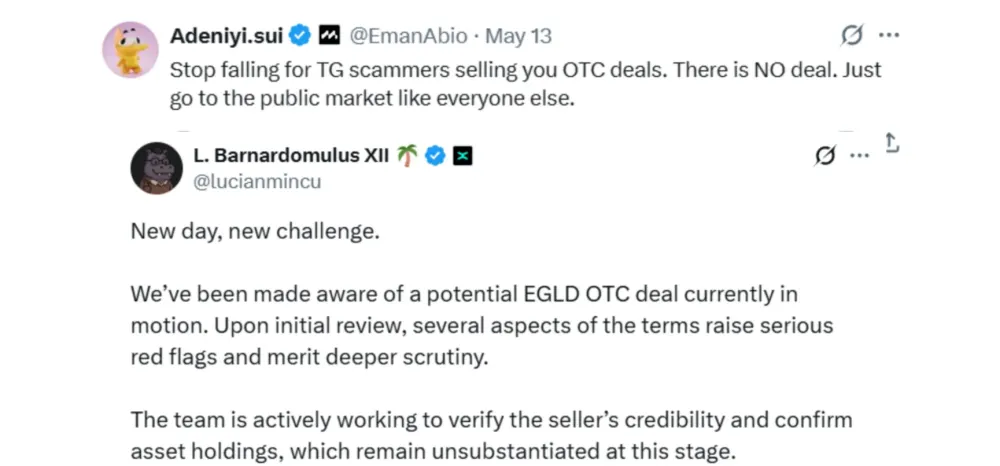

Phase Three: Ignoring Warnings (May 2025)

By May 2025, cracks began to appear in the scheme.

Industry leaders started issuing public warnings.

Eman Abio from the SUI team warned users on X (formerly Twitter) to avoid fake Telegram OTC deals, explicitly stating: "There are no such deals!"

Likewise, Lucian Mincu from MultiversX (formerly Elrond) issued similar alerts.

Source: @AltcoinAlphaOnX

Despite these red flags, the community largely ignored the warnings.

Drawn in by past returns, successful cases, and the apparent involvement of credible groups, investors continued pouring money into new deals.

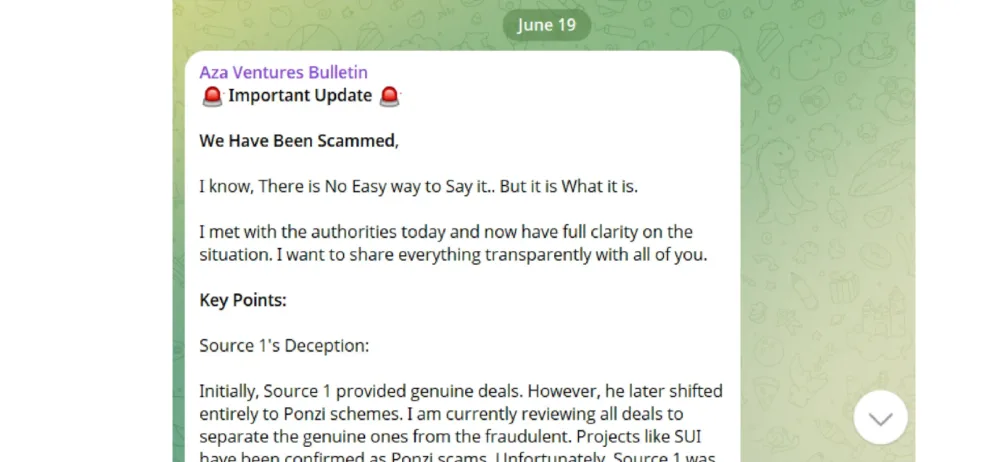

Phase Four: Exposure and Collapse (June 2025)

The turning point came on June 1.

The final known transaction was launched, involving Fluid tokens.

At the same time, token distributions for earlier OTC deals suddenly halted.

Investors seeking updates received only vague excuses—travel delays, exchange issues, or KYC problems.

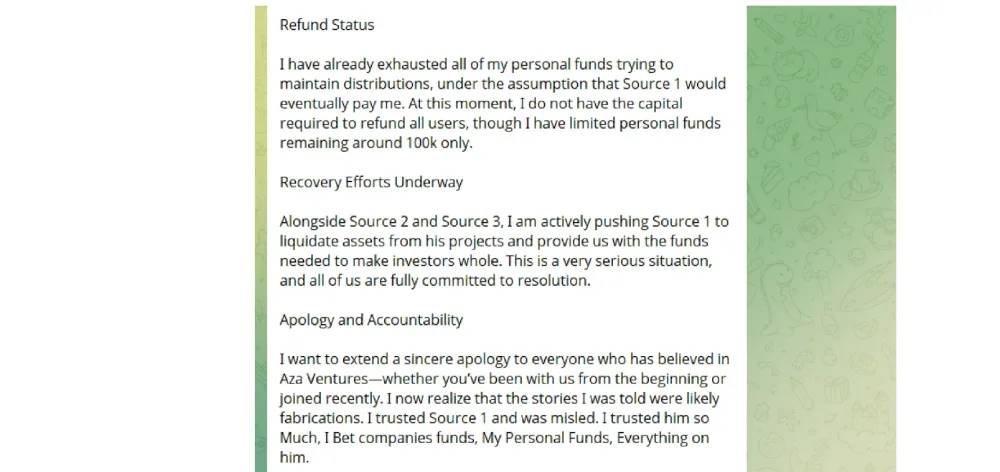

On June 19, Aza Ventures, the VC group leading these transactions, publicly announced they themselves had become victims of the scam.

Aza Ventures accused their primary dealer, “Source 1,” of running a Ponzi scheme. According to Aza, early deals were genuine, but later payouts relied entirely on funds from new investors—a classic hallmark of a Ponzi scheme.

Source: @AltcoinAlphaOnX

Worse still, Aza Ventures revealed that their other sources, “Source 2” and “Source 3,” were actually sourcing deals through “Source 1.”

The situation rapidly deteriorated into chaos.

List of Involved Tokens

Early Deals (November 2024 – January 2025)

Aptos, Sei, Swell, Coti, Kava, Fluid, OG, Aethir

Late-Stage Deals (February 2025 – June 1, 2025)

SUI, NEAR, Aptos, Sei, Highstreet, Altlayer, Kava, Grass, Movement, Bio, Sandbox, Graph, Ronin, Axelar, Celestia, LayerZero, Renzo, Beam, Conflux, Wormhole, Arkham, Adventure Gold, Immutable, Vana, Berachain, Virtuals, EGLD, Fluid, and others.

Who Is “Source 1”? The Mastermind Behind the Scam

Aza Ventures claims to know the identity of “Source 1.”

Insiders suggest “Source 1” is believed to be Indian and allegedly the founder of a project currently listed on Binance. However, Aza Ventures has chosen not to disclose the name publicly, instead applying private pressure to recover stolen funds.

@AltcoinAlphaOnX has shared additional updates on the identity of “Source 1” via X.

This scam highlights the hidden risks within the crypto industry and serves as a stark reminder for investors to remain vigilant when faced with deals that seem too good to be true.

Losses and Impact

Total losses from this scam are estimated to exceed $50 million.

Reports indicate that many investors committed over $1 million per transaction.

Victims include retail investors, major crypto whales, project teams, and venture capital firms (VCs).

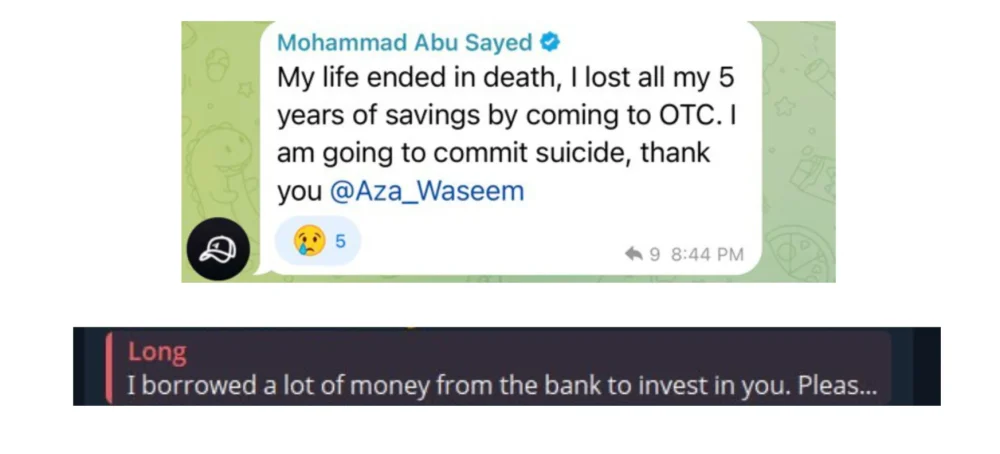

Some victims have suffered life-altering financial losses, with reports of severe emotional distress and even mental breakdowns linked to the incident.

Source: @AltcoinAlphaOnX

Next Steps

Aza Ventures says they are actively negotiating with “Source 1” to recover funds, setting a deadline by month-end. Meanwhile, the broader crypto community is working to trace wallet addresses, identify accomplices, and gather evidence to hold perpetrators accountable.

Source: @AltcoinAlphaOnX

This incident serves as a wake-up call for the entire crypto industry, highlighting the immense risks of unregulated OTC trading through informal channels like Telegram and Discord.

Despite early warning signs and public alerts, trust, greed, and perceived social "proof" proved powerful tools in the hands of scammers.

For now, the community watches and waits, hoping justice will prevail and victims may eventually receive restitution.

Disclaimer: The information provided in this article is for informational and educational purposes only and does not constitute any investment advice.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News