Ma Gang: He Changed Pop Mart and Bitcoin

TechFlow Selected TechFlow Selected

Ma Gang: He Changed Pop Mart and Bitcoin

Mai Gang not only helped build Pop Mart, but also to some extent changed Bitcoin.

By TechFlow

Labubu is taking the world by storm, and Pop Mart’s HK$340 billion market cap has made its founder Wang Ning the richest person in Henan.

A joke is being brought up again:

Before Pop Mart went public, investors described Wang Ning as: average academic background, never held a formal job, speaks in a calm tone without charisma, and leads a non-elite team. After Pop Mart's IPO, their assessment changed to: Wang Ning has a steady temperament, speaks little, shows no emotion, and embodies many outstanding qualities of a "consumer-focused entrepreneur."

The same reversal of fortune applies to Pop Mart’s angel investor—Michael Mai (Mai Gang).

Prior to the rise of this潮玩 giant, Mai jokingly referred to himself as an “outsider” who had been kicked out of mainstream capital circles. But when Pop Mart’s valuation skyrocketed, he was invited back onto the pedestal, transforming overnight into a legendary figure in the investment world.

Yet Mai’s legend extends far beyond the realm of designer toys—he also played a pivotal role in shaping the course of cryptocurrency history.

Mai was also the mentor and early backer of Xu Mingxing, founder of OKX, one of the world’s leading crypto exchanges. He invested in and co-founded Xu’s earliest startup, Docin.com, and later jointly established OKCoin.

In fact, Mai was also the gateway for Binance co-founder He Yi into the crypto space.

In 2014, at a private gathering organized by Mai, he introduced He Yi—then a TV host—to Xu Mingxing, which led to He Yi joining OKCoin. She then recommended Zhao Changpeng (CZ), today’s Binance CEO, to join the team, setting off the chain of events that launched the global battle among crypto exchanges.

His investment portfolio spans two seemingly unrelated industries, yet in both fields he helped nurture dominant giants that reshaped entire sectors. It’s fair to say that Michael Mai not only helped build Pop Mart but also indirectly influenced the trajectory of Bitcoin.

Early Bitcoin Evangelist

"In 2013, I was removed from two WeChat groups of mainstream VC circles simply for discussing Bitcoin. The group members were all highly educated individuals, and I thought my presentation was professional—but some still suspected me of peddling something. At that moment, I felt deeply discouraged. As social beings, we all crave recognition."

"That was the first time I felt 'cast out' by the VC community, and it made me realize there are mainstream and fringe circles—and vast differences in individual perception."

So said Michael Mai in a 2021 interview with Family Office New Point.

In 2025, his article titled *Michael Mai: The Years I Was ‘Cast Out’ by the VC Circle* went viral once again on social media.

Today, Pop Mart’s market cap exceeds HK$340 billion—up more than 20,000x from Mai’s initial angel investment valuation of RMB 10 million.

Today, Bitcoin trades above $100,000—up over 5,000x from its ~$20 price at the beginning of 2013.

Mai has never hidden his identity—as one of China’s earliest investors and most vocal advocates for Bitcoin education.

Back in 2013, when most people either didn’t know about Bitcoin or dismissed it as a financial bubble, Mai was tirelessly promoting Bitcoin knowledge and insights across the country.

Shentu Qingchun, a veteran in the crypto industry, recalled: "I met renowned angel investor Michael Mai in July 2013, and we casually talked about Bitcoin."

"Mai studied finance, and his understanding of Bitcoin was remarkably accurate and ahead of its time—for example, he predicted national Bitcoin reserves, which has now become reality. I must say, Mai is a powerful Bitcoin evangelist. His words greatly strengthened my resolve to enter the Bitcoin industry. He told me he had invested in OKCoin and introduced me to Xu Mingxing. Immediately, I pulled all my money out of the stock market and bought 800 Bitcoins via OKCoin at $90 each."

To Mai, Bitcoin can be explained in two sentences: First, Bitcoin is a perfect monetary system simulated by mathematicians, hackers, and network scientists using distributed algorithms; second, this system is secured by massive computational power running on a distributed network.

He divides humanity’s monetary systems into three eras: first, commodity-backed money like gold; second, fiat currency backed by government credit. The emergence of Bitcoin ushers in a third era. He emphasizes that these three forms will coexist long-term—just as fax machines and telephones still exist despite the internet.

As early as 2014, Mai made a bold prediction about Bitcoin: Bitcoin will become a tool in great-power competition.

"I’m not an anarchist, nor am I advocating replacing the RMB with Bitcoin. But I can tell you this: within the next 10 to 30 years, the U.S. will rebuild a new global monetary system. In that system, the dollar may be pegged to a new set of assets—including cryptocurrencies like Bitcoin. To achieve this, the U.S. only needs to gain dominance in the Bitcoin space—whether through hash power, reserve holdings, or pricing authority. Why does the U.S. have an edge? Because it has Wall Street—the elite of elites."

This kind of insight may sound familiar today, but remember—it came from a speech Mai delivered in 2014. His mission in spreading Bitcoin awareness was to help Chinese entrepreneurs, businesses, and ordinary citizens gain a voice in the Bitcoin arena.

"I hope every individual—and even government institutions—recognize the grandeur and complexity of this Bitcoin game. It truly affects future generations. In the last century, Americans leveraged the dominance of the dollar to gain seigniorage, making the whole world work for them. If they gain control over Bitcoin in the coming decades, they’ll continue extracting value globally."

Possibly driven by this vision, Mai chose to invest in and incubate OKCoin from its inception in 2013.

Mai first met Xu Mingxing back in 2011, when Xu was CTO at Docin.com, and Mai was its angel investor.

Mai and his partner, Tim Draper—the founding partner of DFJ in Silicon Valley—jointly invested RMB 5 million as angel investors. Tim Draper is a renowned American investor who backed early-stage companies like Baidu and Tesla.

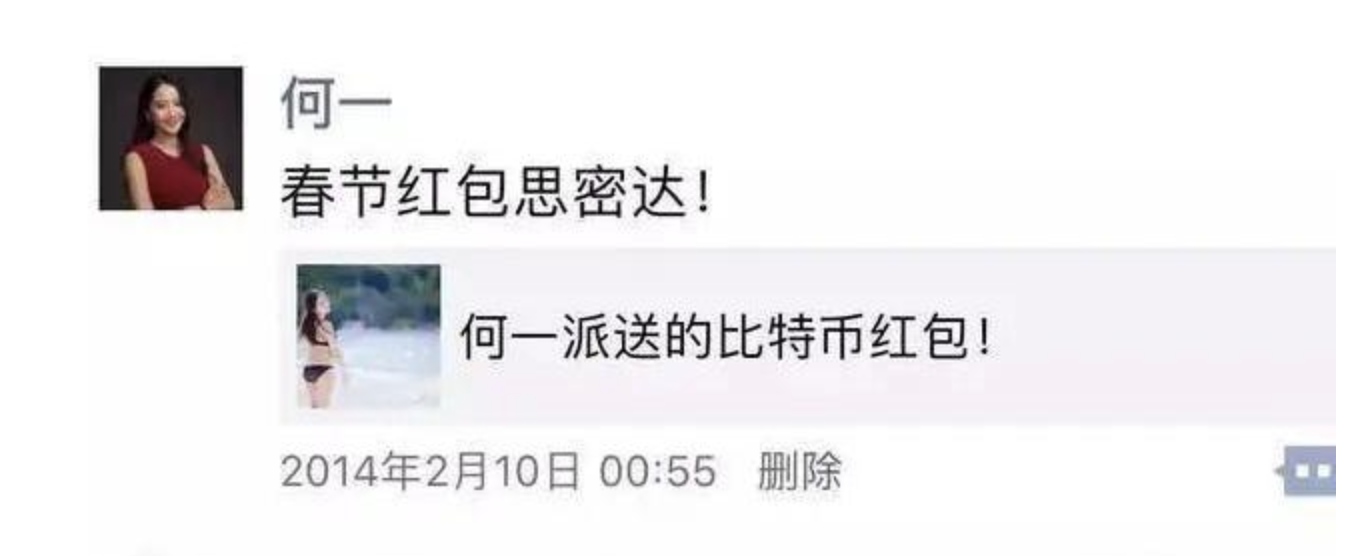

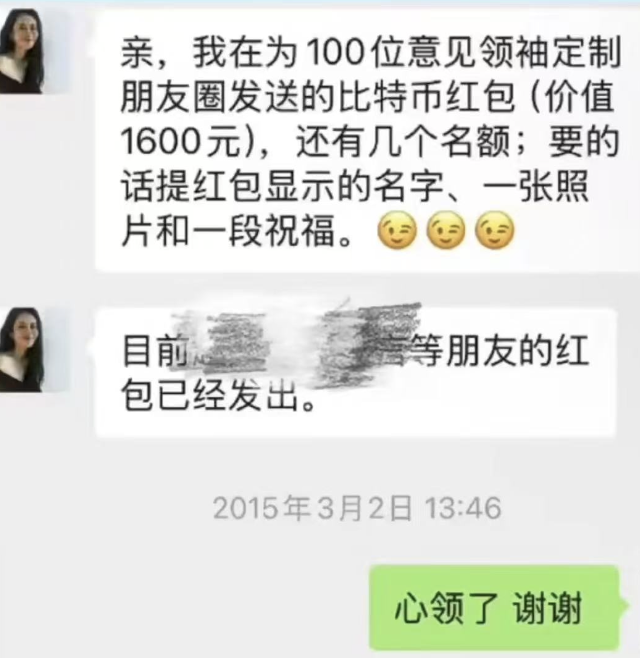

During the Spring Festival in 2014, Mai approached He Yi, then a TV host, and asked her to distribute Bitcoin red packets from OKCoin on her social media. She happily agreed.

From that moment on, fate began to turn—a simple act that opened the door to Bitcoin for He Yi and altered the course of crypto history.

After the holiday, Mai hosted a thank-you dinner for everyone who helped spread the red packets, bringing He Yi and Xu Mingxing together.

Xu had a technical background; He excelled in marketing. At the dinner, Mai suddenly said: "Hey, Mingxing, aren’t you looking for someone in marketing? Isn’t this a perfect match?"

The following week, He Yi joined OKCoin as Vice President, overseeing branding and marketing. Leveraging her media connections, she appeared on the TV show *Not Your Destiny* as a boss panelist to promote OKCoin and orchestrated the company’s billboard debut in New York’s Times Square. Influencer marketing, now standard practice, was already part of He Yi’s playbook a decade ago.

Moreover, He Yi recruited Zhao Changpeng, who previously worked at the Tokyo Stock Exchange, to join OKCoin as CTO.

Mai’s seemingly casual introductions and connections ultimately reshaped the competitive landscape of cryptocurrency exchanges.

Later, Zhao Changpeng left OKCoin to found Binance, with He Yi joining him shortly after. Together, they built Binance into the world’s largest crypto exchange, while OKCoin evolved into OKX, now one of the top global platforms.

Pop Mart’s First Investor

In June 2020, six months before Pop Mart’s Hong Kong IPO, Mai published an article on the VenturesLab official account titled *The Pop Mart Story: From 100 Million to 100 Billion*, where “100 million” refers to the valuation at his angel investment, and “100 billion” was his ambitious target.

"One hundred billion is both a number and a goal. I believe Wang Ning and his Pop Mart team have the potential to reach it and become a truly global company."

As it turned out, Pop Mart surpassed the RMB 100 billion market cap on its first trading day. Five years post-IPO, its market cap has exceeded HK$300 billion, firmly establishing itself as a star among Hong Kong-listed firms.

Going back to 2012, Pop Mart was just a small startup operating out of a modest apartment in Beijing. That May, founder Wang Ning sent Mai an email—which sat unread in Mai’s inbox for three months.

This accidental discovery forged a lasting investment relationship.

In August 2012, 25-year-old Wang Ning met Mai for the first time. Notably, Wang wore a pair of trendy shorts from a brand not yet available in China—an observation that instantly signaled to Mai his sharp sense of style. From first meeting to signed deal, the entire process took just five days.

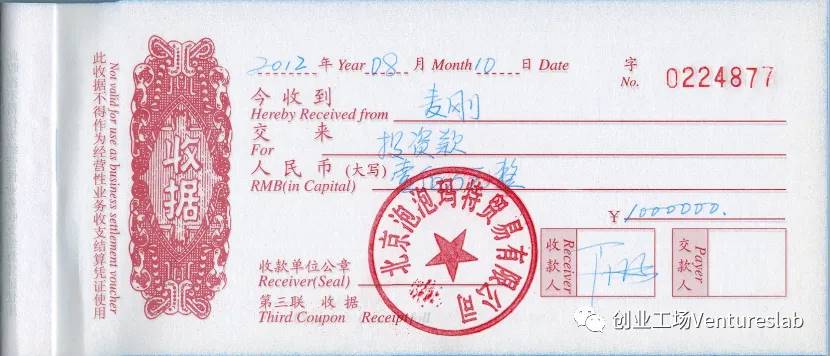

On August 10, 2012, Mai wired the first tranche of investment—RMB 2 million—becoming Pop Mart’s very first angel investor.

According to 36Kr, after signing the agreement, the two went to a bar in Wudaokou. Amid the noise, the usually calm Wang Ning raised his voice slightly and said: "Brother Mai, if I’m Jay Chou, you’re Wu Zongxian."

Reflecting later on why he invested, Mai emphasized the qualities he saw in Wang Ning: "Composure, calmness, integrity, and authenticity."

At a time when most investors and founders were focused on e-commerce and viewed offline retail as outdated, Mai and Wang Ning both believed in the untapped potential of physical retail—especially for well-designed, emotionally resonant潮流 products.

For Wang Ning, the investment was life-changing. Right after closing the round, he called his father: "Dad, starting today, your son is a millionaire—my stake is worth 10 million RMB."

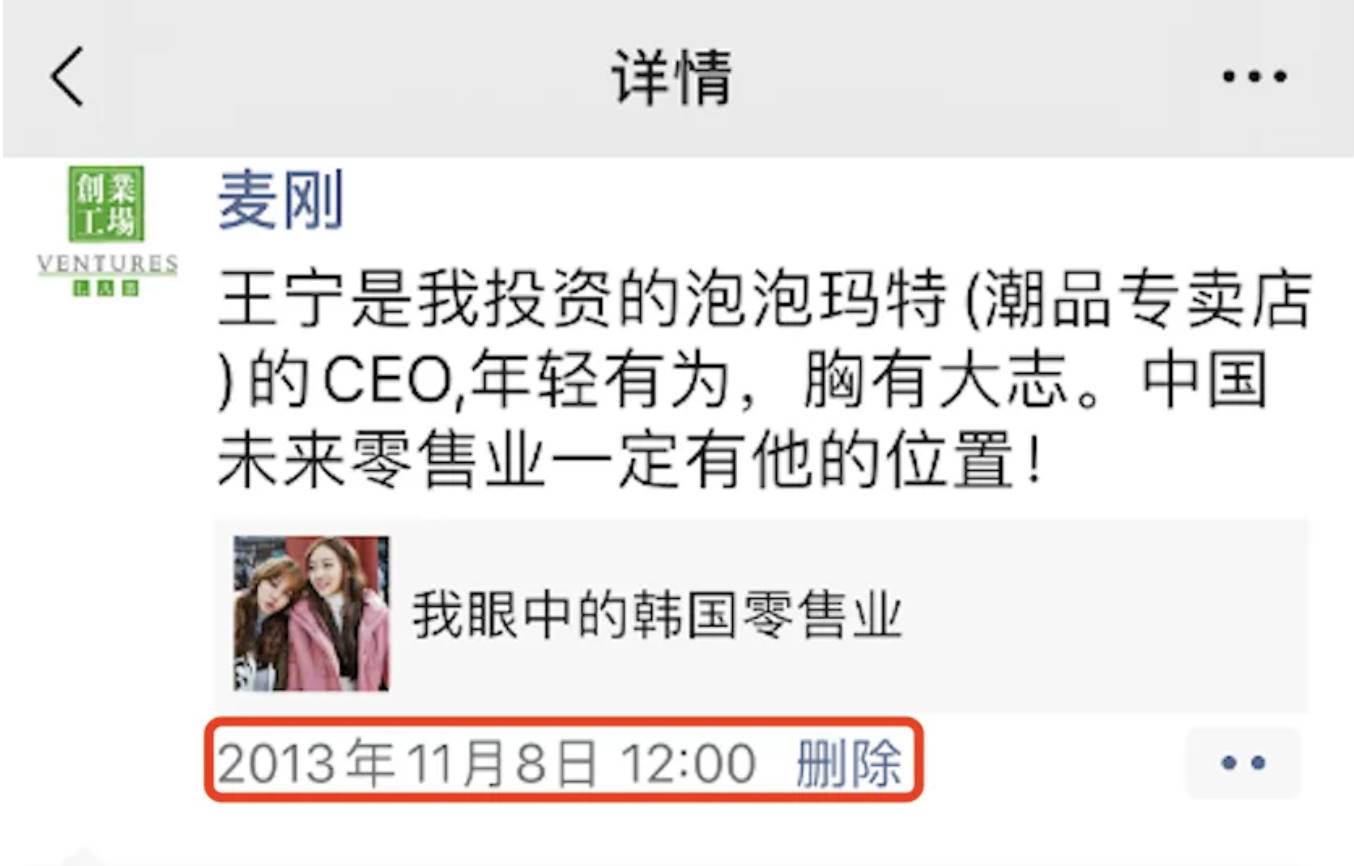

Rarely one to praise, Mai posted high praise for Wang Ning on social media just a year later: "Young, talented, and full of ambition—Wang Ning will surely have a place in China’s future retail industry."

But aside from Mai, few in the capital markets truly believed in Wang Ning or Pop Mart.

Wang Ning pitched nearly every investor and financial advisor, visiting not only traditional VCs but also industrial funds like Light Media and Alpha Group—only to be repeatedly rejected.

A telling example: a fund affiliated with Hunan TV conducted extensive due diligence but ultimately passed. At their final meeting, they bluntly told Wang Ning: "How could such a once-in-a-lifetime opportunity possibly fall into your hands?"

Constant fundraising failures left Pop Mart chronically cash-strapped—there were times when the company had less than RMB 1 million in the bank, barely enough to pay salaries.

"The funding figures circulating online are inaccurate. Many numbers reflect secondary share transfers between shareholders after the company succeeded, not actual external fundraising. In reality, Pop Mart raised very little from outside sources. In its early days, fundraising was extremely difficult. Almost every major investment firm reviewed the deal—I still don’t know why none followed through."

Mai later recalled that he deeply empathized with Wang Ning’s struggles during those tough times, yet through it all, he could always sense Wang Ning’s inner confidence and unwavering belief in his company’s value.

On the night of Pop Mart’s IPO in 2020, a 36Kr article titled *Behind Pop Mart’s HK$100 Billion Valuation: A Collective Miss by China’s Top Funds* swept through the venture capital community—an emotional release and a clear statement of defiance.

The scene echoed a classic trope from fantasy martial arts novels—the protagonist once labeled a “nobody” rises spectacularly, leaving all former doubters humbled.

In Mai’s view, the repeated fundraising rejections were actually a crucial trial for Pop Mart. Without that hardship, the company might never have reached where it is today.

"First, because of limited funding, Pop Mart spent every cent carefully. Second, the constant search for breakthroughs forced the founder to think deeply and innovate relentlessly."

Mai has always been skeptical of chasing trends. He believes that precisely because Pop Mart never raised massive capital, it avoided excessive media attention and never rode any wave—yet eventually became the creator of its own wave (a new industry).

Who Is Michael Mai?

By now, you might be wondering: Who exactly is Michael Mai? How did this “outsider” in the eyes of mainstream VCs manage to back giants like Pop Mart, Bitcoin, and OKCoin?

In 1996, right after graduating from Renmin University of China, Mai entered the venture capital industry, becoming one of China’s earliest VC practitioners.

In 2001, he went to the University of California, Los Angeles (UCLA) for an MBA, where he won first place in the UC Entrepreneurship Competition and fifth place in the National Collegiate Entrepreneurs Organization competition. In the U.S., he met his “Wu Zongxian”—Tim Draper, the godfather of Silicon Valley venture capital—launching his entry into the Silicon Valley VC scene.

"Tim Draper is my mentor, former boss, and my earliest angel investor. I’m deeply grateful—he nurtured me and funded my early ventures."

In 2005, he co-founded VenturesLab with Tim Draper—one of China’s earliest startup incubators.

Unlike mainstream VCs, Mai has chosen a distinctly “alternative” investment path.

He has never raised external funds,始终坚持 using his own capital for investments. He believes the current VC industry suffers from a “curse of scale”—many large funds adopt a “spray and pray” approach to boost hit rates, often lowering returns for LPs. In his view, the optimal model is a small, artisanal team—a leader with three to five skilled members, meticulously cultivating 20 projects with the aim of seeing three or five succeed.

When it comes to market trends, he remains cautious. He believes entrepreneurs and investors should focus on the essence of opportunities rather than blindly follow fads. He uses three key questions to evaluate startups:

-

What problem does your company solve?

-

Who are your competitors?

-

Why will you win?

Based on extensive entrepreneurial and investment experience, Mai developed a famous framework for internet business models—the “Mouse and Cement Theory.”

The first is the “Mouse Model”—pure internet businesses like early search engines and social sites, where founders operate mainly through computers.

The second is the “Mouse + Cement Model,” such as 58.com and Qunar, which use the internet to capture traffic and convert it into value in traditional industries.

The third is the “Cement + Mouse Model,” exemplified by Xiaomi and Huang Taiji, where traditional businesses leverage internet tools for innovation.

You might assume Mai, who started in VC straight out of college, lacks real entrepreneurial experience—but he has another identity: a serial entrepreneur.

In 1999, during his time at Pudong Venture Capital, Mai invested in EasyForum, the champion of China’s College Student Entrepreneurship Competition. This connection sparked a series of co-foundings with fellow entrepreneurs.

In 2003, Mai co-founded Eyou with EasyForum co-founder Ma Yun (not Alibaba’s Jack Ma) and served as CEO. The company attracted angel investments from Silicon Valley’s Tim Draper and Japanese billionaire founder of So-net, and was later acquired by French publicly traded company Meetic.

In 2005, Mai angel-invested in ChineseOnline, founded by EasyForum co-founder Tong Zhilei, which went public on China’s ChiNext in January 2015.

In 2006, Mai co-founded Tongka, China’s largest O2O CRM software provider at the time, with another EasyForum co-founder Lu Jun. It was later acquired by Tencent.

In 2007, Mai co-founded Docin.com, once the world’s largest Chinese document-sharing site, with Jonathan Lin, who had interned at Eyou.

In 2010, Mai co-invested with Deng Yu, another Tongka co-founder, to launch TJMedia, China’s largest smart TV content aggregator.

In 2013, Mai co-founded the Bitcoin exchange OKCoin with Docin’s CTO Xu Mingxing.

Beneath these seemingly magical ventures runs a clear thread: "Be kind to others, build good relationships."

"Life is the continuation of your relationships with the people around you. Only by treating friends and others well can you achieve success. Of course, you need to choose wisely—associating with the wrong people harms you. Whether in entrepreneurship or investing, what eventually comes back to you, I believe, is your character—or the amplification of your character." Mai once said.

But what moves me most is a small detail.

Twenty years ago, when Mai founded VenturesLab, he personally designed the logo, built the website, and wrote this message on the homepage: You may spend your life aiming to build a successful company, but in the end, your epitaph will likely read 'Loving Father (Mother),' 'Dearest Partner,' or 'Generous Friend'—not 'Great CEO.' You can’t take fame or wealth with you. What remains are emotions and memories.

Today, that message still stands on the homepage.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News