Arthur Hayes: The stablecoin narrative is heating up, IPOs may be a "dead end," but I'd advise against shorting

TechFlow Selected TechFlow Selected

Arthur Hayes: The stablecoin narrative is heating up, IPOs may be a "dead end," but I'd advise against shorting

These new stocks will wipe out the shorts.

Author: Arthur Hayes

Translation: TechFlow

(The views expressed here are those of the author alone and should not be considered as a basis for investment decisions, nor interpreted as a recommendation or advice to engage in any investment transactions.)

Given that Circle CEO Jeremy Allaire appears to have no choice but to fall into line under the "guidance" of Coinbase CEO Brian Armstrong (the author uses irony here, implying lack of independence and control by Coinbase), I hope this article will help investors who trade any assets related to “stablecoins” on public equity markets avoid significant risks and losses when promoters push worthless assets onto unsuspecting retail investors. With this preface, I shall begin my discussion on the past, present, and future of the stablecoin market.

In capital markets, professional crypto traders are somewhat unique. To survive and thrive, they must deeply understand how money flows through the global fiat banking system. In contrast, stock investors or foreign exchange speculators do not need to know how stocks or currencies are settled and transferred, because their brokers silently provide these services in the background.

First, buying your first bitcoin is not easy; the best and safest options aren’t clear. For most people, the first step (at least back when I started in crypto in 2013) was purchasing bitcoin by directly sending a wire transfer via the traditional banking system or paying cash in person to another individual. Then you’d graduate to trading on exchanges with bilateral markets, where you could trade larger amounts of bitcoin at lower fees. However, depositing fiat currency into exchanges has never been easy or straightforward—past or present. Many exchanges lacked solid banking relationships or operated in regulatory gray zones within their jurisdictions, meaning you couldn’t wire funds directly to them. Exchanges devised workarounds, such as directing users to send fiat to local agents who would then issue cash vouchers on the exchange, or setting up adjacent businesses seemingly unrelated to crypto so they could open bank accounts without raising red flags, then funnel user funds there.

Scammers exploited this friction to steal fiat in various ways. The exchange itself might misrepresent where funds went, and then one day… poof — the website, along with your hard-earned fiat, disappears. If third-party intermediaries are used to move fiat in and out of the crypto capital market, those individuals may vanish with your funds at any moment.

Due to the risks involved in moving fiat within the crypto capital market, traders must thoroughly understand and trust the cash flow operations of their counterparties. When money moved within the banking systems of Hong Kong, mainland China, and Taiwan (a region I refer to as Greater China), I learned how to handle global payments.

Understanding how money flowed in Greater China helped me grasp how major Chinese and international exchanges (like Bitfinex) conducted business. This is important because all genuine innovation in the crypto capital market originated in Greater China. This is especially true for stablecoins. Why this matters will become evident shortly.

The greatest success story among Western crypto exchanges belongs to Coinbase, which opened shop in 2012. However, Coinbase’s innovation lay solely in securing and maintaining banking relationships in one of the most financially hostile environments—the Pax Americana (American Empire). Beyond that, Coinbase is just an extremely expensive crypto brokerage account—and that was all it took to make its early shareholders billionaires.

I’m writing yet another long piece about stablecoins because of the massive success surrounding Circle’s IPO. Make no mistake: Circle is severely overvalued, but the price will continue rising. This listing marks the beginning—not the end—of the current stablecoin frenzy. After some stablecoin issuer goes public on a major market (most likely in the U.S.), the bubble will burst. That issuer will use financial engineering, leverage, and dazzling showmanship to separate tens of billions of dollars from fools. As usual, most people surrendering their precious capital won’t understand the history of stablecoins and crypto payments, why the ecosystem evolved as it did, or what that means for which issuers will succeed. A very confident, charismatic guy will take the stage, spew nonsense, wave his hands (likely male) dramatically, and convince you his leveraged pile of dogshit is poised to dominate the multi-trillion-dollar total addressable market (TAM) for stablecoins.

If you stop reading here, the only question you should ask yourself when evaluating an investment in a stablecoin issuer is: How will they distribute their product?

To achieve mass distribution—meaning the ability to reach millions of users at affordable cost—the issuer must utilize pipelines from crypto exchanges, Web2 social media giants, or traditional banks. Without access to such distribution channels, success is impossible. If you cannot easily verify whether the issuer has rights to push its product through one or more of these channels, run!

I hope my readers don't burn their capital this way, since having read this article, they can critically evaluate the stablecoin investment opportunities presented to them. This article will discuss the evolution of stablecoin distribution.

First, I’ll explain how and why Tether grew strong in Greater China, laying the foundation for its conquest of stablecoin payments across the Global South. Then I’ll discuss the Initial Coin Offering (ICO) boom and how it created real product-market fit for Tether. Next, I’ll cover Web2 social media giants’ first attempts to enter the stablecoin game. Finally, I’ll briefly touch on how traditional banks will get involved.

Let me reiterate—because I know X (the platform) makes long-form prose difficult to digest beyond a few hundred characters—if a stablecoin issuer or technology provider cannot distribute via crypto exchanges, Web2 social media giants, or traditional banks, they shouldn’t even be in this business.

Greater China's Crypto Banking System

All currently successful stablecoin issuers—Tether, Circle, and Ethena—have the ability to distribute their products through large crypto exchanges. I will focus primarily on Tether’s evolution, mentioning Circle briefly to illustrate how nearly impossible it is for any new entrant to replicate their success.

Initially, crypto trading was largely ignored. For example, from 2014 until the late 2010s, Bitfinex held the crown as the largest non-Chinese global exchange. At the time, Bitfinex was owned by a Hong Kong operating company that held various local bank accounts. This was great for arbitrage traders like me living in Hong Kong, allowing near-instant transfers of funds to the exchange. Across the street from my apartment in Sai Ying Pun were almost all the local banks. I’d walk cash between banks to reduce fees and the time needed to receive funds. This was crucial—it allowed me to turn over my capital once per business day.

Meanwhile, in China, the three major exchanges—OKCoin, Huobi, and BTC China—all had multiple bank accounts with large state-owned banks. A 45-minute bus ride to Shenzhen, plus my passport and basic Mandarin skills, enabled me to open various local bank accounts. As a trader active in both mainland China and Hong Kong, having banking relationships meant access to all global liquidity. I also felt confident my fiat wouldn’t disappear. Conversely, every time I wired funds to certain Eastern European-registered exchanges, I lived in fear—I didn’t trust their banking rails.

But as crypto gained visibility, banks began shutting down accounts. Every day you had to check the operational status of each bank and exchange relationship. This hurt my trading profits significantly—the slower money moved between exchanges, the less I could earn via arbitrage. But what if you could transfer electronic dollars across a crypto blockchain instead of using traditional banking channels? Then the U.S. dollar—then and now the lifeblood of the crypto capital market—could move between exchanges 24/7, nearly free of charge.

The Tether team collaborated with Bitfinex’s original founders to create exactly such a product. In 2015, Bitfinex enabled the use of Tether USD on its platform. At the time, Tether used the Omni protocol—a primitive smart contract layer built atop the Bitcoin blockchain—to send Tether USD (USDT) between addresses.

Tether allowed certain entities to wire dollars into its bank accounts, and in return, Tether would mint USDT. The USDT could then be sent to Bitfinex and used to buy cryptocurrencies. Wow, impressive—but why was it exciting that some random exchange offered this product?

Stablecoins, like all payment systems, only become valuable when a large number of economically significant participants become nodes on the network. For Tether, other than Bitfinex, crypto traders and other major exchanges needed to adopt USDT for it to solve any meaningful problems.

Everyone in Greater China faced the same challenge: banks were closing accounts for traders and exchanges. Add to that Asians’ desire for U.S. dollars, whose domestic currencies are vulnerable to sharp devaluations, high inflation, and low domestic bank deposit rates. For most Chinese people, accessing U.S. dollars and American financial markets is extremely difficult, if not impossible. Thus, Tether’s digital version of the dollar—accessible to anyone with internet—was super appealing.

The Bitfinex/Tether team seized the opportunity. Jean-Louis van der Velde, CEO of Bitfinex since 2013, previously worked at a Chinese auto manufacturer. He understood Greater China and worked hard to make USDT the preferred dollar bank account for crypto-minded Chinese. Although Bitfinex never had ethnic Chinese executives, it built enormous trust between Tether and the Chinese crypto trading community. So yes, you can be sure the Chinese trusted Tether. And in the Global South, overseas Chinese dominate the scene—as citizens of the empire discovered during that unfortunate trade war—so the Global South became banked by Tether.

Merely having a large exchange as a founding distributor didn’t guarantee Tether’s success. Market structure shifted so that trading altcoins against the dollar could only be done via USDT. Let’s fast-forward to 2017, at the peak of the ICO craze, when Tether truly cemented its product-market fit.

ICO Babies

August 2015 was a pivotal month because the People’s Bank of China (PBOC) executed a shock depreciation of the yuan against the dollar, while ether (the native currency of the Ethereum network) began trading. Macro and micro stages shifted in sync. This was legendary stuff and ultimately fueled the bull run from then until December 2017. Bitcoin surged from $135 to $20,000; ether rose from $0.33 to $1,410.

When money printing occurs, the macro environment is always favorable. Chinese traders were the marginal buyers of all crypto (back then, essentially just bitcoin). If they sensed instability in the yuan, bitcoin would skyrocket. That was the narrative at the time.

The PBOC’s shock depreciation intensified capital flight. By August 2015, bitcoin had fallen from its pre-Mt. Gox bankruptcy all-time high of $1,300 in February 2014 to a low of $135 on Bitfinex earlier that month, when ZhaoDong, China’s largest OTC bitcoin dealer, received the biggest margin call in history—6,000 bitcoins—on Bitfinex. The narrative of Chinese capital flight drove prices up; BTCUSD more than tripled from August to October 2015.

The micro side is always where the fun begins. The altcoin surge truly ignited when the Ethereum mainnet and its native currency, ether, launched on July 30, 2015. Poloniex was the first exchange to allow ether trading, and this foresight propelled it into the spotlight by 2017. Ironically, Circle nearly bankrupted itself by buying Poloniex near the top of the ICO market. Years later, they sold the exchange at a huge loss to the esteemed Justin Sun.

Poloniex and other Chinese exchanges capitalized on the new altcoin market by launching pure-crypto trading platforms. Unlike Bitfinex, they didn’t interface with the fiat banking system. You could only deposit and withdraw crypto to trade other cryptos. But this wasn’t ideal—traders instinctively wanted to trade altcoin/dollar pairs. Without the ability to accept fiat deposits and withdrawals, how could exchanges like Poloniex and Yunbi (once China’s largest ICO platform) offer these pairs? Enter USDT!

After the Ethereum mainnet launch, USDT could move on the network using ERC-20 standard smart contracts. Any exchange supporting Ethereum could easily support USDT. Thus, pure-crypto trading platforms could offer altcoin/USDT pairs to meet demand. It also meant digital dollars could flow seamlessly between major exchanges (like Bitfinex, OKCoin, Huobi, BTC China)—where capital entered the ecosystem—and more speculative venues (like Poloniex and Yunbi)—where gamblers played.

The ICO mania birthed the beast that would become Binance. CZ (Changpeng Zhao) stormed out of OKCoin years earlier after a personal dispute with CEO Star Xu, quitting his role as CTO. After leaving, CZ founded Binance aiming to become the world’s largest altcoin exchange. Binance had no bank accounts—and to this day, I’m not sure if you can deposit fiat directly into Binance without going through some payment processor. Binance used USDT as its banking rail, quickly becoming the go-to place for altcoin trading. The rest is history.

From 2015 to 2017, Tether achieved product-market fit and built moats against future competitors. Thanks to trust from the Chinese trading community, USDT was accepted across all major trading venues. At this point, it wasn’t used for payments—but it was the most efficient way to move digital dollars within, into, and out of the crypto capital market.

By the late 2010s, exchanges struggled to maintain bank accounts. Taiwan became the de facto crypto banking hub for all major non-Western exchanges, which controlled much of the global crypto trading liquidity. Several Taiwanese banks allowed exchanges to open USD accounts and somehow maintained correspondent banking relationships with major U.S. money center banks like Wells Fargo. However, as those correspondents demanded the Taiwanese banks expel all crypto clients or lose access to the global dollar market, the arrangement began to collapse. As a result, by the late 2010s, USDT became the only viable way to move large sums of dollars across the crypto capital market. This cemented its position as the dominant stablecoin.

Western players, many of whom raised funds based on a crypto-payments narrative, scrambled to create Tether competitors. The only one to survive at scale was Circle’s USDC. Yet Circle was clearly at a disadvantage: headquartered in Boston, USA, it had no connection to the core of crypto trading and usage—Greater China. Circle’s unspoken message then and now: China = scary; USA = safe. This messaging is laughable because Tether never had ethnic Chinese executives, yet it has always been associated with Northeast Asia—and now the Global South.

Social Media Wants In

Stablecoin mania isn’t new. In 2019, Facebook (now Meta) decided it was time to launch its own stablecoin, Libra. The appeal was clear: Facebook could offer dollar bank accounts to nearly the entire world (except China) via Instagram and WhatsApp. Here’s what I wrote about Libra in June 2019:

The event horizon has passed. With Libra, Facebook is entering the digital asset industry. Before I analyze further, let’s be clear: Libra is neither decentralized nor censorship-resistant. Libra is not cryptocurrency. Libra will destroy all stablecoins, but who gives a damn. I won’t shed a single tear for every project deemed valuable simply because some obscure sponsor created a fiat money market fund running on a blockchain.

Libra could cause commercial and central banks to decline. It might reduce their utility to mere stupid, regulated digital fiat warehouses—which is exactly where these institutions belong in the digital age.

Libra and other stablecoins from Web2 social media companies could have dominated. They possess the largest customer bases and nearly complete knowledge of their preferences and behaviors.

Ultimately, U.S. political institutions stepped in to protect traditional banks from real competition in payments and FX. At the time, I said:

I have zero sympathy for U.S. Representative Maxine Waters’ foolish statements and actions before the House Financial Services Committee. But the outburst of concern from her and other officials doesn’t stem from altruistic feelings toward their constituents—it arises from fear of disruption to the financial services industry, which enriches them personally and sustains their power. The speed with which government officials rushed to condemn Libra tells you there was something in this project with potentially positive value for human society.

That was then. Now, the Trump administration will allow financial market competition. Trump 2.0 holds deep resentment toward the banks that deplatformed his entire family during President Biden’s tenure. Therefore, social media companies are reviving plans to natively embed stablecoin technology into their platforms.

This is good news for shareholders of social media companies. These firms could fully capture revenue streams from traditional banking, payments, and FX. However, this is bad news for any entrepreneur launching a new stablecoin, because social media companies will build everything internally to support their stablecoin operations. Investors in next-gen stablecoin issuers must beware of promoters boasting partnerships with or distribution through any social media company.

Other tech firms are joining the stablecoin trend too. Social platform X, Airbnb, and Google are all in early discussions about integrating stablecoins into their operations. In May, Fortune reported that Mark Zuckerberg’s Meta—after previous failed attempts with blockchain technology—has been discussing with crypto firms the introduction of stablecoins for payments.

– Source: Fortune Magazine

My article “Libra: Zuck Me Gently”

Extinction-Level Event for Traditional Banks

Whether banks like it or not, they will no longer earn hundreds of millions of dollars annually just holding and transferring digital fiat, nor collect the same fees when facilitating foreign exchange trades. I recently spoke with a board member of a major bank who said, “We’re screwed.” They believe stablecoins are unstoppable, pointing to Nigeria as proof. I hadn’t realized the extent of USDT penetration there, but they told me one-third of Nigeria’s GDP is transacted in USDT—even though the central bank has seriously tried to ban crypto.

They added that because adoption is bottom-up rather than top-down, regulators are powerless to stop it. By the time regulators notice and try to act, it’s already too late—adoption is widespread among the population.

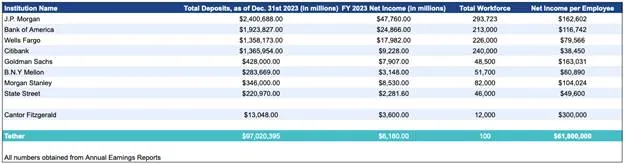

While individuals like this exist in senior roles at every major traditional bank, the banking organism itself resists change because transformation implies death for many of its cells—i.e., employees. Tether employs fewer than 100 people yet performs key functions of the entire global banking system using blockchain technology. Contrast this with JPMorgan Chase—the world’s best-run commercial bank—employing just over 300,000 staff.

Banks face a critical juncture—adapt or die. But what prevents them from streamlining bloated workforces and delivering what the global economy needs are prescriptive regulations dictating how many people must be hired to perform certain functions. For instance, I considered opening a Tokyo office for BitMEX and obtaining a crypto trading license. The management team debated whether to establish a local office and license to conduct limited types of crypto trading alongside our core derivatives business. The compliance cost was prohibitive—you couldn’t use technology to satisfy requirements. Regulators mandated hiring one qualified person per listed compliance and operational function. I don’t recall the exact number, but it was roughly 60 people annually, each earning at least $80,000—totaling $4.8 million per year. All these tasks could have been automated via SaaS providers for under $100,000 annually. And, I might add, with far fewer errors than employing fallible humans. Oh—and you can’t fire anyone in Japan unless you shut down the entire office. Oops!

Bank regulation is essentially an employment creation program for over-educated populations—a global issue. They’re over-educated in bullshit, not in things that actually matter. They’re just highly paid box-tickers. Though bank executives might love cutting headcount by 99% and boosting productivity, as regulated entities, they simply can’t.

Stablecoins will eventually be adopted by traditional banks in limited form. They’ll run two parallel systems: the old slow, expensive one, and the new fast, cheap one. The degree to which they can truly embrace stablecoins will be determined office-by-office by prudent regulators. Remember, JPMorgan isn’t a single organism—each national instance of JPMorgan is regulated differently. Data and personnel often can’t be shared across instances, hindering company-wide tech-driven rationalization. Good luck, asshole bankers—regulation protected you from Web2, but it will seal your fate against Web3.

These banks certainly won’t collaborate with third parties on tech development or stablecoin distribution. They’ll do everything in-house. In fact, regulators may explicitly prohibit such collaborations. Therefore, for entrepreneurs building their own stablecoin tech, this distribution channel is closed. I don’t care how many proofs of concept (PoCs) a particular issuer claims to be doing with traditional banks. None will ever lead to enterprise-wide adoption. So if you’re an investor and a stablecoin promoter claims they’ll partner with traditional banks to bring their product to market—run.

Now that you understand the difficulty new entrants face in achieving mass distribution for their stablecoins, let’s discuss why they attempt this impossibility anyway. Because stablecoin issuers can be extremely profitable.

The Dollar Interest Rate Game

An issuer’s profitability depends on the net interest margin (NIM) available. Their cost base is fees paid to holders; revenue comes from investing cash in Treasury debt (like Tether and Circle) or certain crypto market arbitrage strategies (like spot holding arbitrage basis trades, as with Ethena). The most profitable issuer, Tether, pays zero yield to USDT holders or depositors and captures the full NIM based on short-term Treasury bill (T-bill) yields.

Tether retains its full NIM because it enjoys the strongest network effects and its customers have no alternative dollar banking options. Potential customers don’t choose other dollar stablecoins because USDT is accepted throughout the Global South. A personal example: how I pay during ski season in Argentina. I spend several weeks skiing in rural Argentina each year. Back in 2018, payment was troublesome if vendors didn’t accept foreign credit cards. But by 2023, USDT had taken over—my guide, driver, and chef all accept USDT. This is fantastic because even if I wanted to, I couldn’t pay in pesos—bank ATMs dispense a maximum of $30 equivalent per transaction and charge a 30% fee. It’s criminal—long live Tether. For my employees, receiving digital dollars stored in crypto exchanges or mobile wallets, which they can easily use to buy goods and services domestically and internationally, is excellent.

Tether’s profitability is the best advertisement for social media companies and banks to launch their own stablecoins. Neither group needs to pay depositors because they already possess rock-solid distribution networks—meaning they capture the full NIM. This could thus become a massive profit center for them.

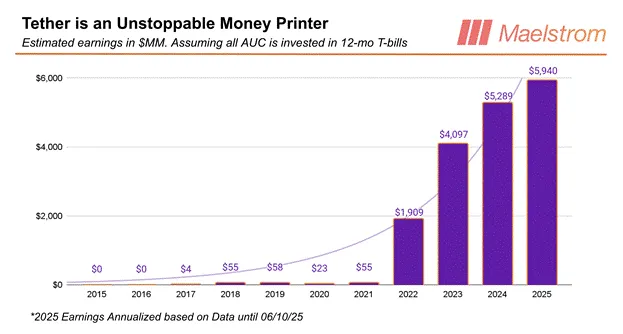

Tether earns more annually than this chart estimates. The chart assumes all AUC (assets under custody) are invested in 12-month T-bills. The key takeaway is that Tether’s earnings are highly correlated with U.S. interest rates. You can see the massive jump in earnings from 2021 to 2022, driven by the Fed hiking rates at the fastest pace since the early 1980s.

This table, published in my article “Dust on Crust Part Deux,” clearly shows using 2023 data that Tether is the world’s most profitable bank per employee.

Distributing stablecoins can be very costly unless you're affiliated with an exclusive exchange, social media company, or traditional bank. The founders of Bitfinex and Tether are the same group. Bitfinex has millions of customers, so Tether instantly had millions of users out of the box. Tether didn’t have to pay for distribution because it’s partially owned by Bitfinex, and all altcoins trade against USDT.

Circle, and any other stablecoin issuer afterward, must pay exchanges some form of distribution fee. Social media companies and banks will never partner with third parties to build and operate their stablecoins—therefore, crypto exchanges are the only option.

Crypto exchanges can build their own stablecoins, as Binance did with BUSD, but many eventually decide building a payment network is too difficult and distracts from their core business. Exchanges require either equity in the issuer or a share of the issuer’s NIM to list their stablecoin.

Even then, all crypto/fiat trading pairs will likely remain paired with USDT, meaning Tether will continue dominating the market. That’s why Circle had to cozy up to Coinbase. Coinbase is the only major exchange not orbiting Tether, because its user base is primarily American and Western European.

Before U.S. Commerce Secretary Howard Lutnick favored Tether and provided banking services via his firm Cantor Fitzgerald, Western media relentlessly attacked Tether as some foreign-made scam. Coinbase’s existence depends on favor from U.S. political institutions, so it needed an alternative. Hence, Jeremy Allaire struck a pose and complied with Brian Armstrong’s demands.

The deal: Circle pays 50% of its net interest income to Coinbase in exchange for distribution across the entire Coinbase network. Yacht secured (Yachtzee)!!

The situation for new stablecoin issuers is dire. No open distribution channels exist. All major crypto exchanges either own issuers or partner with existing ones—Tether, Circle, and Ethena. Social media companies and banks will build their own solutions.

Therefore, a new issuer must give up a substantial portion of its NIM to depositors in an attempt to lure them away from more established stablecoins. Ultimately, this is why, by the end of this cycle, investors will lose nearly everything on every publicly traded stablecoin issuer or tech provider. But this won’t stop the party—let’s dive into why investor judgment will be clouded by the massive profit potential of stablecoins.

Narrative

Three business models have generated crypto wealth beyond merely holding bitcoin and altcoins: mining, exchange operation, and stablecoin issuance. In my case, my wealth came from owning BitMEX (a derivatives exchange), and Maelstrom (my family office)’s largest position and highest absolute-return asset is Ethena, the issuer of the USDE stablecoin. Ethena grew from zero to become the third-largest stablecoin in less than a year in 2024.

What makes the stablecoin narrative unique is that it offers the largest and most obvious total addressable market (TAM) to traditional finance (TradFi) fools.

Tether has proven that a chain-based bank that merely holds people’s money and allows them to transfer it back and forth can become the most profitable financial institution per capita in history. Tether succeeded despite legal warfare (lawfare) waged by all levels of the U.S. government.

What if U.S. authorities weren’t at least hostile toward stablecoins and allowed them some operational freedom to compete with traditional banks for deposits? The profit potential would be insane.

Now consider the current setup: U.S. Treasury staffers believe stablecoin AUC (assets under custody) could grow to $2 trillion. They also believe dollar stablecoins could serve as the spearhead for advancing/maintaining dollar dominance—and as yield-insensitive buyers of Treasury debt.

Wow—that’s a major macro tailwind. As a delicious bonus, remember Trump harbors deep resentment toward big banks for deplatforming him and his family after his first presidential term. He has no intention of blocking free markets from offering better, faster, safer ways to hold and transfer digital dollars. Even his sons have jumped into the stablecoin game.

This is why investors are salivating over investable stablecoin projects. Before I continue with my prediction on how this narrative will translate into money-burning opportunities, let me define the criteria for what constitutes an investable project.

The issuer in question must be able to go public on a U.S. equity market in some form. Second, the issuer must offer a mobile digital dollar product; none of that foreign crap—this is “Murica.” That’s it. As you can see, there’s plenty of room for creative interpretation here.

The Road to Ruin

The most obvious candidate to IPO and kick off the party is Circle. It’s a U.S. company and the second-largest stablecoin issuer by AUC.

Circle is severely overvalued at this stage. Remember, Circle gives 50% of its interest income to Coinbase. Yet Circle’s market cap is 39% of Coinbase’s. Coinbase is a one-stop crypto financial shop with multiple profitable business lines and tens of millions of global customers. Circle excels at fellatio—an extremely valuable skill, admittedly—but they still need to improve and care for their stepchildren.

Should you short Circle? Absolutely not! Maybe if you think the Circle/Coinbase ratio is unreasonable, you should buy Coinbase. Although Circle is overvalued, when we look back years from now at the stablecoin mania, many investors will wish they just held Circle. At least they’d have preserved some capital.

The next wave of IPOs will consist of Circle imitators. Relatively speaking, these stocks will be even more overvalued than Circle on a price/AUC basis. In absolute terms, they’ll never generate more revenue than Circle.

Promoters will boast meaningless TradFi credentials, trying to convince investors they have the connections and capability to disrupt traditional banks in global dollar payments via partnerships or leveraging distribution channels. The scam will work; issuers will raise a goddamn fortune. For us veterans who’ve spent time in the trenches, watching suited clowns deceive the public into investing in their pile of shit companies will be hilarious.

After this first wave, the scale of the fraud entirely depends on the stablecoin regulations enacted in the U.S. The more freedom issuers have regarding reserve assets backing stablecoins and whether they can pay yield to holders, the more financial engineering and leverage can be used to mask the underlying garbage. If you assume a light-touch or hands-off regulatory regime, you might witness a replay of Terra/Luna—a scammy algorithmic stablecoin Ponzi scheme. The issuer could pay high yields to holders, funded by leveraged exposure to certain assets.

As you can see, I have little positive to say about the future. There is no real future because new entrants’ distribution channels are closed. Forget about it.

But don’t short. These new stocks will rip the faces off shorts. Macro and micro are synchronized. As former Citigroup CEO Chuck Prince said when asked if his firm participated in subprime mortgage lending: “When the music stops, in terms of liquidity, things will be complicated. But as long as the music is playing, you’ve got to get up and dance. We’re still dancing.”

I’m not sure how Maelstrom will dance, but if there’s money to be made, we’ll go make it.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News