Trend Research: Written Before the Surge — Why We’re Bullish on ETH

TechFlow Selected TechFlow Selected

Trend Research: Written Before the Surge — Why We’re Bullish on ETH

Ethereum remains the most important infrastructure for on-chain finance.

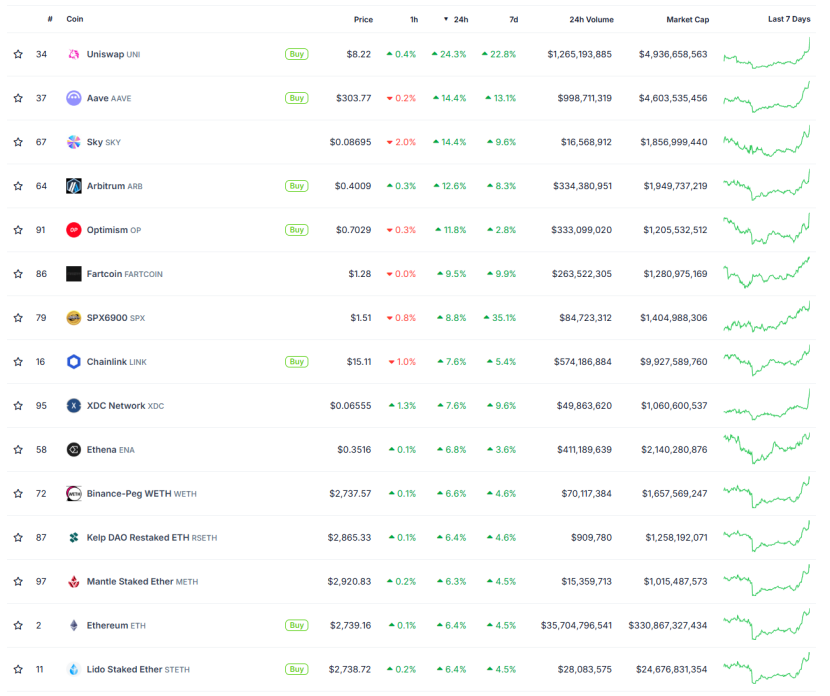

Yesterday, ETH and blue-chip assets within its ecosystem surged in price, with ETH rising 6.4%, UNI—highlighted in our previous research report—up 24.4%, AAVE up 13.1%, and ENA up 6.6%. This round of Trend Research has practiced what we preach: from establishing positions at $1,400 onwards, we have maintained a bullish stance on ETH-related assets, increasing our holdings and recently purchasing ETH call options. We are now the first secondary-market investment institution to publicly disclose our bullish positioning and portfolio addresses.

Currently, our continued optimism for ETH rests on the following fundamental logic: The Trump administration aims to build a stablecoin system by leveraging blockchain’s decentralized and on-chain characteristics to absorb M2 liquidity from countries worldwide, thereby increasing demand for U.S. Treasuries. To this end, the administration has relaxed macro-regulation of crypto, pushed forward regulatory implementation, and standardized the sector across multiple dimensions to accommodate greater capital inflows. Ethereum is the most critical infrastructure for stablecoins and on-chain finance (DeFi). The influx of stablecoins and ongoing development of RWA (Real World Assets) will further fuel DeFi’s growth, increase Ethereum fee burn and GAS revenue, and drive market cap expansion.

1. Sustained Optimism Around Crypto Regulation

(1) Shift in Regulatory Philosophy

The Trump administration is pro-crypto. John Atkins, SEC Chair appointed in April 2025, has clearly advocated for a transformation in digital asset regulation.

1. Public Statements Emphasizing Process Simplification

Rules Before Enforcement: Atkins criticized his predecessor's model of "defining compliance through litigation," stressing instead the need for clear, predictable rules to reduce industry uncertainty.

Classification-Based Regulatory Framework: Plans to release token classification standards within 90 days, along with a “safe harbor” regime for compliant projects.

2. Long-Term Policy Direction

On-Chain Securities Compliance: In May 2025, Atkins proposed exploring listings on “on-chain securities exchanges,” potentially reshaping issuance and trading processes.

Cross-Agency Collaboration: Intends to work with CFTC and FTC to establish joint regulatory frameworks, minimizing jurisdictional conflicts.

DeFi aligns with core American values; an “innovation exemption” framework will be introduced.

(2) Further Refinement and Relaxation of Crypto Regulatory Legislation

1. CLARITY Act

The CLARITY Act aims to create a structural regulatory framework for the crypto market, effectively overseeing the $3.3 trillion digital asset sector. Its objectives are twofold: First, clarify asset classification by distinguishing security tokens (regulated by the SEC), commodity tokens (regulated by the CFTC), and licensed payment stablecoins—resolving the long-standing debate over whether tokens qualify as securities or commodities. Second, regulate institutions by requiring financial entities holding digital assets to meet capital reserve requirements and keep customer funds segregated, preventing risks like those seen with FTX. On June 11, 2025, the bill passed the House Committee by 47 votes in favor and 6 opposed, and will now move to the House Financial Services Committee for further review.

Under this act, major cryptocurrencies such as Bitcoin and Ethereum are classified as commodity tokens. Company equity tokens (representing ownership with voting rights or dividends), bond-like tokens (promising fixed interest returns), and DeFi governance tokens that distribute earnings dependent on ongoing project operations fall under security tokens. This clarity replaces prior ambiguity and enforcement uncertainty, creating a more actionable environment. Clearer rights and responsibilities will promote prosperity across DeFi platforms.

The likelihood that infrastructure-focused tokens like SOL may be categorized as commodities is increasing. On June 11, the SEC requested potential Solana ETF issuers to submit revised S-1 forms within the coming week, stating it would respond within 30 days of submission—indicating accelerating and loosening recognition of crypto commodities.

2. Genius Act

The Genius Act fills regulatory gaps around stablecoins, strengthens the dollar’s global dominance, and addresses weakening demand for U.S. debt. It is the first comprehensive federal regulatory framework for stablecoins, defining issuer qualifications, reserve requirements, and operational standards. It mandates a 1:1 peg between stablecoins and the U.S. dollar, promoting dollar penetration into the global crypto economy and cross-border payments, reinforcing the dollar’s leadership in international finance. By mandating reserves in short-term U.S. Treasuries or cash, it creates structural demand for U.S. debt, alleviating fiscal pressure.

In past years, stablecoins USDT and USDC faced repeated rumors of regulatory and redemption risks, leading to de-pegging events exceeding 10%. Federal oversight would enhance their safety and credibility. Moreover, once legislative intent becomes clear, more issuers are likely to enter the space, drawing additional capital into crypto markets. Standard Chartered forecasts that stablecoin supply could reach $2 trillion by 2028 if the bill passes.

3. Regulatory Easing Announcements Regarding Crypto Issuance, Custody, and Trading

SEC Chair Atkins stated that regulation across three key areas—issuance, custody, and trading—will become significantly more lenient.

On issuance, the SEC will develop clear and reasonable guidance for launching crypto assets governed by securities or investment contract laws. To date, only four crypto issuers have issued securities under Regulation A—a simplified exemption mechanism for small offerings allowing issuers below certain thresholds to issue stocks and bonds. Due to unclear definitions of whether crypto assets constitute securities—and what type—they are—the fear of violating securities law has deterred most projects from using this route. Atkins has instructed SEC staff to consider mechanisms such as administrative guidance, registration exemptions, and safe harbors to streamline domestic crypto issuance.

On custody, registrants will gain greater autonomy in determining how to hold crypto assets. Investment advisors and fund managers can adopt advanced self-custody solutions beyond current custodians’ technical capabilities. This change stems from legacy issues where traditional custodians lack sufficient IT readiness to meet blockchain needs.

On trading, investors will be allowed to trade a broader range of assets on exchanges, which may offer both securities and non-securities, as well as other financial services. The SEC has directed staff to explore whether guidelines or rules should be established to allow crypto assets to list and trade on national securities exchanges.

4. DeFi Likely to Receive “Innovation Exemption”

SEC Chair Paul S. Atkins explicitly stated during the June 9, 2025 “DeFi and the American Spirit” roundtable: “The foundational principles of DeFi—economic freedom, private property rights, disintermediation—are highly aligned with core American values. Blockchain technology represents revolutionary innovation, and the SEC must not hinder its progress.”

The SEC is formulating conditional exemption rules for DeFi to rapidly enable both registered and unregistered parties to bring on-chain products and services to market. These innovation exemptions aim to position the U.S. as the “global crypto capital,” encouraging developers, entrepreneurs, and compliant companies to innovate on-chain.

UNI, despite being one of the most important DEXs on-chain, previously struggled with compliance and poor price performance. If these innovation exemptions apply swiftly, UNI could be among the first beneficiaries—an important reason behind the sharp rally in top-tier DeFi tokens after the roundtable discussion.

5. Anticipated Approval of Staking for Ethereum ETFs

On May 29, 2025, the SEC Division of Corporation Finance released a statement clarifying that staking activities on certain proof-of-stake (PoS) blockchain protocols do not constitute securities transactions. During the “DeFi and the American Spirit” roundtable, Atkins further emphasized: “Voluntary participation in proof-of-work (PoW) or proof-of-stake (PoS) networks as ‘miners,’ ‘validators,’ or ‘staking-as-a-service’ providers falls outside the scope of federal securities laws.” The SEC intends to formalize regulations accordingly—meaning Ethereum staking (including direct node staking and staking via service providers) will not be treated as a securities transaction under specific conditions. This paves the way for current Ethereum ETFs to incorporate staking features.

If the SEC approves Ethereum ETFs that include staking yields, institutional investors could earn ETH staking rewards through ETFs, making ETH function like a “bond” in the crypto sector. Massive inflows of traditional institutional capital would legally flow into ETH. On one hand, large amounts of ETH would be locked up in staking, enhancing decentralization and security of on-chain finance; on the other, compliant on-chain yield generation would significantly boost ETH demand and push prices higher.

In summary, the Trump administration is implementing a more systematic and adaptive regulatory approach toward digital assets and markets. Regulation is becoming clearer and looser, encouraging blockchain innovation to attract greater capital inflows into crypto.

2. Ethereum Remains the Core Infrastructure for On-Chain Finance

The “DeFi” declaration and concrete legislation will break down compliance barriers, open channels for traditional capital, and bring trillions in incremental funding into on-chain finance via stablecoins. Ethereum remains the largest and safest “soil” for hosting this growth.

(1) Ethereum Foundation Champions “Defipunk”

The Ethereum Foundation’s 2030 Plan explicitly calls for developing an evaluation mechanism for “Defipunk” and promoting related transformations in DeFi projects. “Defipunk” centers on building a DeFi ecosystem aligned with cypherpunk principles, aiming to ensure user sovereignty, privacy, and censorship resistance through technological means.

Core Defipunk principles include: (i) Security—prioritizing battle-tested, tamper-proof, open-source architectures without reliance on centralized trust models (e.g., multisig or legal recourse); (ii) Financial Sovereignty—ensuring full user control over assets, supporting permissionless self-custodial wallets and on-chain transactions to minimize intermediary dependence; (iii) Technology Over Trust—achieving trustlessness via cryptography and smart contracts, including zero-knowledge proofs for enhanced privacy; (iv) Open Source and Composability—promoting transparent code development, protocol interoperability, and modular design to foster innovation.

The Ethereum Foundation holds strong expectations for DeFi development, and the Ethereum ecosystem continues expanding its DeFi footprint. Ethereum possesses the foundational conditions to become the next-generation paradigm for on-chain finance.

(2) Current State of Stablecoin Issuance and Distribution

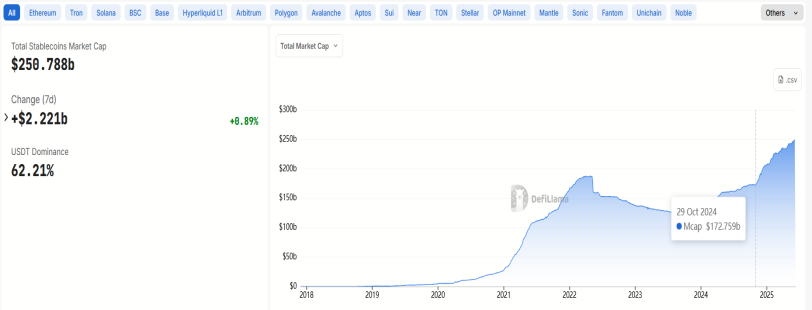

1. Total Stablecoin Supply

Since Trump took office, total stablecoin supply has increased by approximately $76 billion—an over 40% rise in seven months. This growth rate exceeds even the stablecoin expansion observed during the 2023 bull market recovery.

In September 2023, stablecoins hit a four-year low of about $123.7 billion. By November 2024, supply had grown to $173.7 billion—an increase of $50 billion over 13 months, representing roughly a 40% gain.

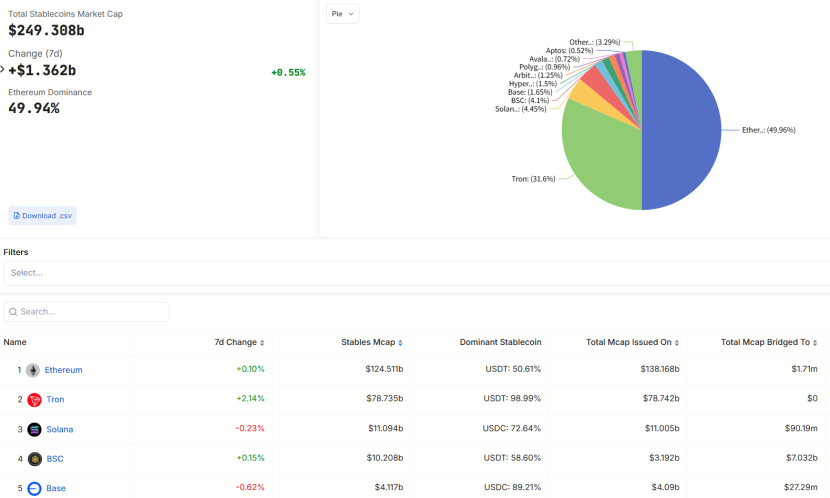

2. Stablecoin Distribution Across Blockchains

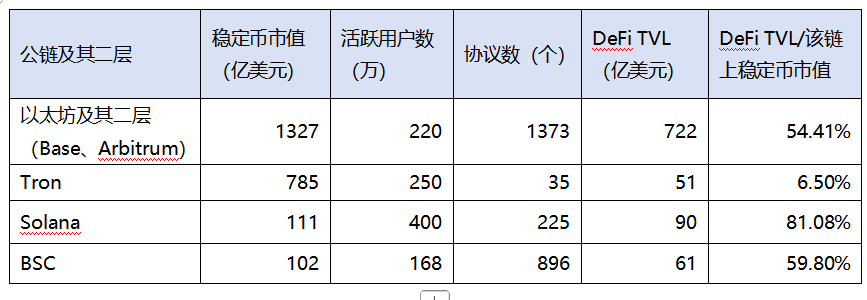

About 50% of all stablecoins circulate on Ethereum, 31% on TRON, 4.5% on Solana, and 4% on BSC. Ethereum commands half of stablecoin liquidity.

3. Current State of Major Chain Ecosystems and DeFi Stablecoin Usage

As shown above, over 50% of funds on Ethereum are deposited in DeFi protocols, giving it the largest DeFi TVL. While Tron hosts substantial stablecoin volume, most are used for payments, with few ecosystem protocols and only 6.5% of TVL in DeFi. Though Solana and BSC have relatively high DeFi TVL ratios, their absolute scale remains small, and infrastructure maturity is moderate.

Given this, upon passage of stablecoin legislation, Ethereum is best positioned to absorb the largest capital inflows.

(2) Flow of New Stablecoins

We currently anticipate four primary directions for new stablecoins:

1. Flow into native crypto markets with higher-yielding DeFi opportunities

The high volatility of crypto enables numerous on-chain DeFi protocols offering returns far exceeding traditional finance, with easier access. Incremental stablecoins entering the chain will naturally seek smarter, more efficient, and higher-return investment opportunities. Ethereum’s high decentralization, security, and scale make it the top destination for such capital. UNI, as the largest on-chain DEX, and AAVE, the leading lending protocol, stand out as blue-chip investments. Smaller-cap DeFi protocols with solid fundamentals, such as COMP, also warrant attention.

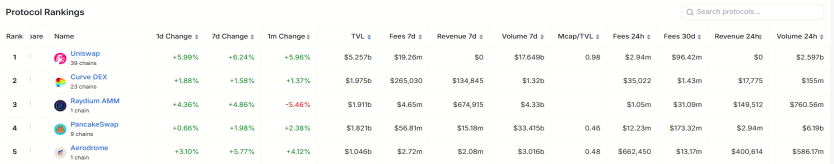

Among DEXs, UNI holds a clear advantage: $5.1B TVL, $17.6B 7-day trading volume, and $19.26M in fees over 7 days—its TVL significantly surpasses peers.

Pancake is notable: $33.4B 7-day volume and $56.81M in fees. Its volume exceeds UNI’s largely due to wash trading driven by Binance alpha.

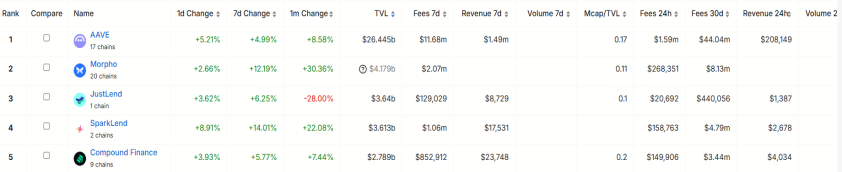

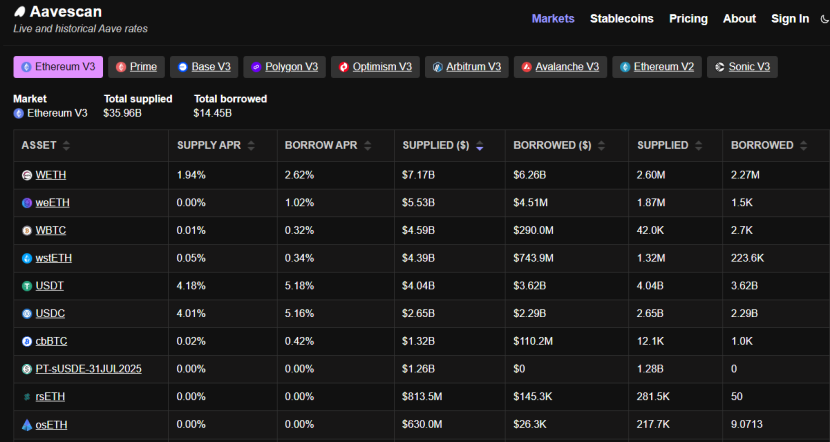

In lending, AAVE dominates with $2.64B TVL, $11.68M in 7-day fees, and $1.49M in protocol revenue. Other lending markets have less than $5B TVL.

2. Flow into RWA Markets Built by U.S.-Based Regulated Institutions

Much traditional capital entering on-chain environments avoids altcoin speculation and instead targets RWA markets developed by leading U.S. financial innovators, such as BlackRock’s BUILD fund.

BUIDL Fund invests primarily in: Cash—highly liquid cash or equivalents ensuring stability and instant redeemability; U.S. Treasuries—short-term Treasuries providing low-risk, high-credit-rated income; Repurchase Agreements—short-term loans collateralized by Treasuries, balancing liquidity and yield. This mix maintains BUIDL’s target value ($1 per token) while distributing daily accrued returns as newly minted tokens monthly. Managed by BlackRock Financial Management, custodied by BNY Mellon, and tokenized via Securitize.

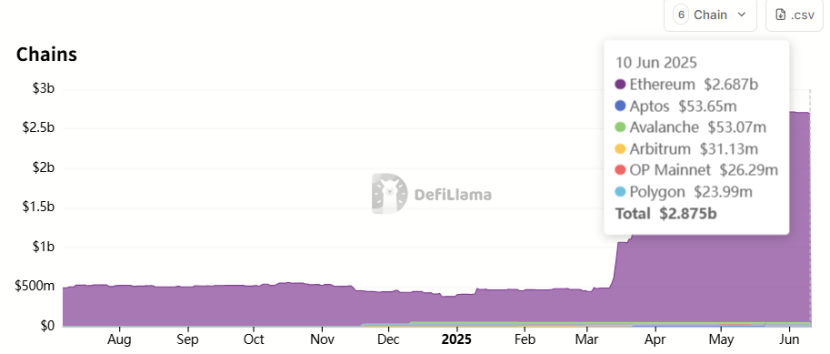

Platform-managed TVL has grown rapidly over the last three months: surpassing $1B in March 2025, now reaching $2.87B—a 187% increase. Of this, $2.687B is on Ethereum, accounting for 93%.

Native crypto projects are closely monitoring the RWA space. Circle, issuer of USDC, acquired Hashnote—the U.S. Yield Coin (USYC) issuer—to strengthen its RWA capabilities.

Hashnote, incubated with a $5M investment from Cumberland Labs, focuses on tokenized U.S. Treasury products. Its flagship product, USYC (U.S. YieldCoin), pegged to short-term U.S. Treasuries, reached $1.3B before acquisition. Circle integrates USYC tightly with USDC, creating a closed-loop of “cash + yield-generating assets” to meet institutional demand for on-chain collateral and yield instruments.

Besides BUIDL and Circle, major RWA players include ENA and ONDO. ENA mainly serves funding rate arbitrage in crypto derivative contracts, limiting its market size to trading volumes and posing a learning curve for external capital—resulting in little growth over the past six months. ONDO, however, grew from $600M to $1.3B since early 2025—an increase of ~116%. Although the stablecoin bill hasn’t fully passed, tokenization of debt assets is already advancing. Additionally, Chainlink plays a crucial role in RWA as the dominant oracle bridging off-chain assets with on-chain DeFi.

3. Flow into Payment Solutions Addressing Traditional Finance Inefficiencies

A significant use case for converting traditional capital into stablecoins is improving payment systems—such as optimizing SWIFT—enhancing transaction efficiency. For example, JPMorgan’s Kinexys platform (formerly Onyx) specializes in wholesale payments, cross-border transfers, FX trading, and securities settlement. It supports multi-currency cross-border payments, reduces intermediaries and settlement time, offers digital asset tokenization, and explores stablecoin and tokenized bond applications. Built on Ethereum’s tech stack, Kinexys leverages smart contracts and distributed ledger technology. It currently handles over $2B in average daily transaction volume.

4. Flow into Native Crypto Speculative Markets

A smaller portion of incremental capital flows quickly into speculative altcoin markets.

In conclusion, compared to other ecosystems, Ethereum and its DeFi protocols represent the largest destination for incremental stablecoins. DeFi may experience a new “DeFi Summer” in 2025, accompanied by growing demand for staking to enhance network security. Furthermore, the SEC’s June 10 “DeFi” statement may pave the way for staking-enabled ETH ETFs. If approved, ETH could become a “bond” in the crypto market, triggering massive buying. These developments may push ETH back into deflationary territory (currently at 0.697% annual inflation).

3. Record High Derivatives Positions, Bearish Sentiment Persists; Spot ETFs See Sustained Inflows, Options Turn Bullish

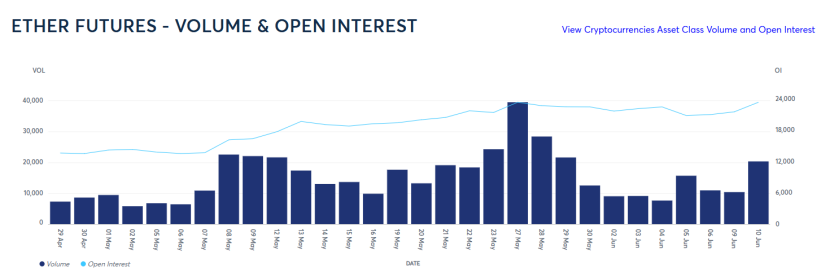

1. Record High Contract Holdings, Active Liquidity

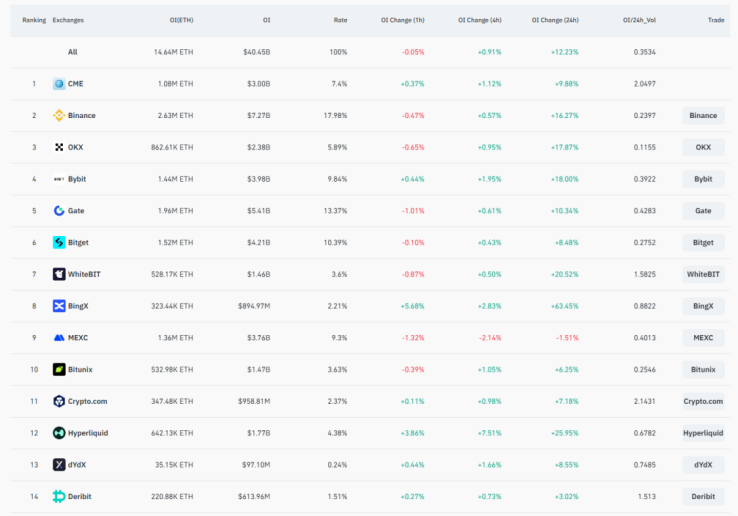

ETH remains about 40% below its all-time high (ATH), yet total open interest across derivatives platforms has reached a record $37 billion, indicating excellent market liquidity.

2. Market Sentiment Has Not Peaked

At the same time, market sentiment has not yet peaked. The Fear & Greed Index has just shifted from neutral to greedy, suggesting peak bullishness has not arrived and external capital inflows have not begun.

3. Increasing Number of Short Sellers on Exchanges

Exchange-level futures long-short ratios show declining long-to-short holder ratios, with more traders opening short positions. Concurrently, total open interest continues rising, meaning overall short exposure is increasing. However, the ratio remains relatively balanced, and funding rates stay stable.

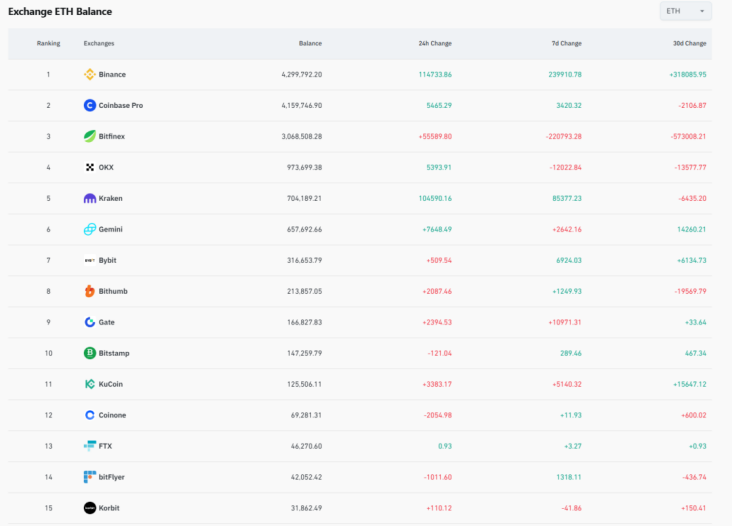

4. Some Exchanges Hold Less Spot ETH Than Derivatives Exposure

In April, when we published our trend reversal report, we noted that some exchanges held far less spot ETH than their derivatives exposure. This situation persists: Bybit reports 1.44M ETH in open contracts but only 316K ETH in exchange wallets—4.5x the balance; Gate.io shows 1.96M ETH in contracts vs. 166K ETH in wallet—11.8x the balance. Bitget has 1.52M ETH in contracts, though wallet balances are undisclosed.

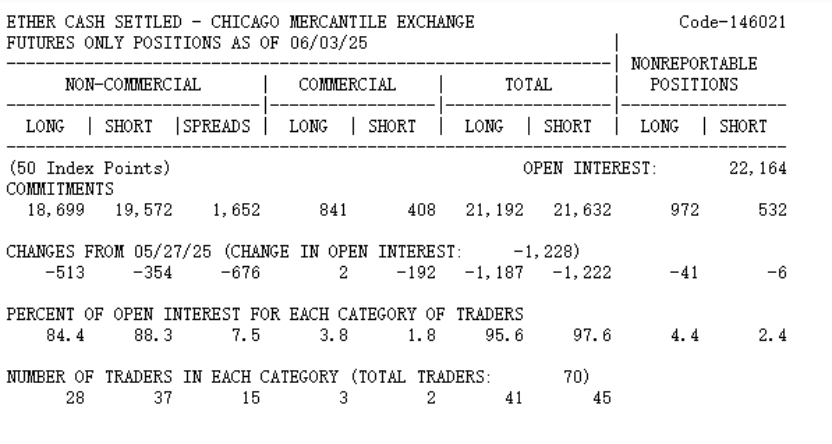

5. CME Contracts Reach New Highs in Open Interest

CME data shows ETH trading volume has not yet reached new highs, but open interest (OI) is near all-time highs. Among non-commercial traders, long positions stand at 18,699 contracts, shorts at 19,572, resulting in a net short of 873 contracts—indicating dominant bearish sentiment among speculators. Assuming 30%-40% of non-commercial shorts are hedged, uncovered short exposure accounts for 60%-70%. At $2,750 per contract, speculative naked shorts on CME amount to approximately $1.6–1.8 billion.

6. $680 Million ETH Borrowed on AAVE

Data from AAVE, the largest on-chain lending protocol, shows approximately $680 million worth of ETH is currently borrowed. Based on market norms, not all borrowers hedge fully; many likely use leverage for shorting. We estimate uncovered short exposure from this source exceeds $100 million.

7. Spot ETFs Continue Net Inflows, Options Market Turns Bullish

Derivatives data suggest bearish sentiment remains, with billion-dollar-level naked shorts present. However, spot and options markets reflect meaningful bullish positioning.

In the spot market, ETH ETFs reversed earlier weakness, posting sustained net inflows over the past 15 days. On June 10 alone, net inflow reached $125 million, with $450 million accumulated in June. BlackRock led purchases with $360 million, signaling strong bullish conviction.

BlackRock’s ETH spot ETF holdings have been steadily increasing since May 2025:

BlackRock is selling part of its BTC holdings to buy ETH.

Deribit data show significantly more call options outstanding than puts. While the gap is narrow for options expiring before June 20, calls dominate for later-dated options.

Liquidation monitoring indicates $2.1 billion in ETH short positions will be triggered at $3,000, setting up a short squeeze that could propel ETH upward in the near term.

8. SBET Ethereum Treasury Creates New Demand

Under favorable regulations, several U.S. public companies are mimicking MSTR’s strategy by acquiring BTC, ETH, SOL, and other major tokens as treasury assets.

Joe Lubin, Ethereum co-founder and CEO of ConsenSys, announced he will serve as Chairman of SharpLink Gaming (ticker: SBET), leading its $425 million Ethereum treasury strategy. The treasury will be actively managed—not only benefiting from price appreciation but also staking most ETH to support network security. Investors will receive at least 2% in staking yield. This model introduces new demand for ETH.

9. Wave of Crypto Firm IPOs Generating Ongoing Capital Interest

Stablecoin issuer Circle listed on Nasdaq in early June, surging over 200% on its debut, igniting investor enthusiasm for crypto-linked equities. Multiple crypto firms have revealed Nasdaq listing plans. Bullish Global (backed by Peter Thiel), legacy exchange Kraken, crypto asset manager Galaxy Digital, institutional crypto custodian Bitgo, and mining hardware maker Bgin Blockchain all plan to go public, with some having already filed applications. These upcoming listings will generate sustained capital interest, drawing more investors into the crypto space.

In summary, ETH futures open interest is at record highs with active liquidity; market sentiment is warming but not yet at greed extremes; short-side participation is rising on exchanges but without severe imbalance. Spot ETH sees sustained inflows, and options markets turn bullish. Price has broken through key support-resistance flip zones and short-term resistance levels. Accumulated longs and squeezed shorts may further extend the rally. Combined with easing digital asset regulation, growing stablecoin supply, expanding Ethereum treasury strategies in U.S. equities, and increasing acceptance of crypto firms on Wall Street, ETH could potentially exceed $14,000 in the medium to long term.

4. Conclusion

U.S. crypto regulation is becoming increasingly systematic, standardized, and transparent, streamlining issuance, custody, and trading procedures while promoting stablecoin adoption and exploring innovative asset classes like DeFi and RWA. These measures will expand the scale of digital assets. Ethereum hosts the most mature on-chain financial ecosystem and is best positioned to capture capital inflows driven by stablecoin legalization. DeFi and RWA projects built on Ethereum will benefit significantly and achieve sustainable long-term growth.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News