Circle NYSE IPO Roadshow PPT Leaked: Valuation at $7.2 Billion, IDG and Accel Among Shareholders

TechFlow Selected TechFlow Selected

Circle NYSE IPO Roadshow PPT Leaked: Valuation at $7.2 Billion, IDG and Accel Among Shareholders

"For Circle, becoming a publicly traded company on the New York Stock Exchange is a continuation of our commitment to operating with the greatest transparency and accountability."

Compiled & Edited: Lei Jianping

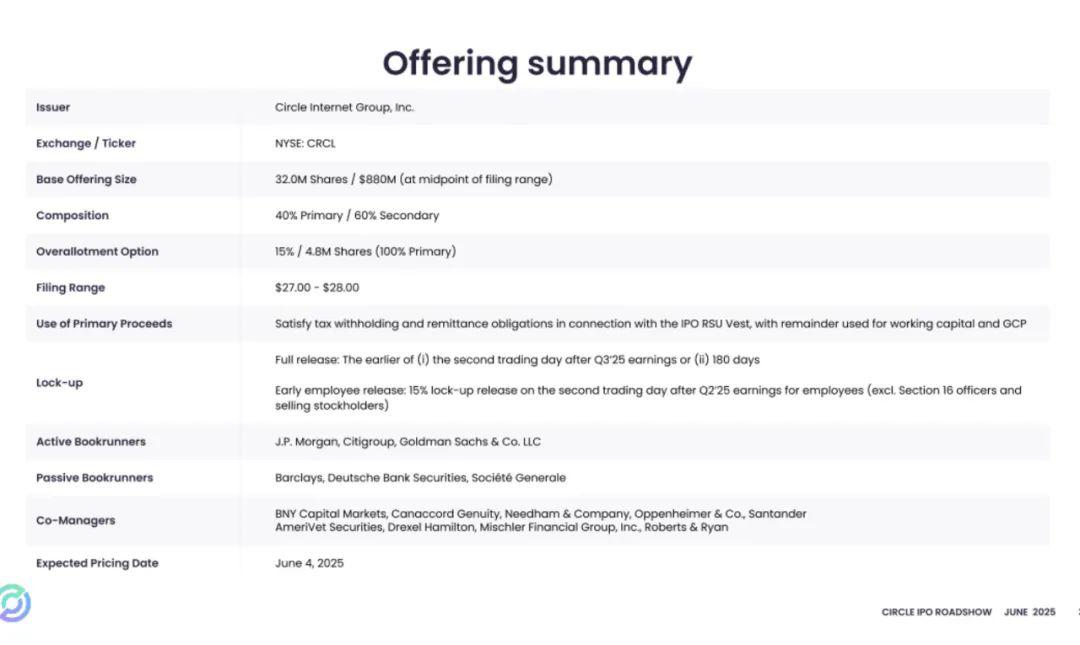

Circle, the issuer of the USDC stablecoin (ticker: "CRCL"), has recently opened its book-building process and is preparing for a listing on the New York Stock Exchange this week. Circle's offering price range is set between $27 and $28 per share, with 32 million shares offered, raising up to $896 million.

Of this amount, Circle will issue 12.8 million shares, raising up to $358 million, while existing shareholders will sell 19.2 million shares, generating $538 million in proceeds.

ARK Investment Management, LLC and its affiliated entities have expressed interest in purchasing up to $150 million worth of Class A common stock at the initial public offering price, under the same terms as other investors in this offering.

Circle’s target valuation has been raised from $5.65 billion to $7.2 billion.

Jeremy Allaire, CEO of Circle, said, “Becoming a publicly listed company on the New York Stock Exchange continues our commitment to operating with the highest levels of transparency and accountability.”

Previously Pursued SPAC Listing: Company Valued at $9 Billion

Circle's Push for NYSE Listing

Founded in Boston in 2013, Circle launched Circle Pay, a product offering fiat money transfer services, often referred to as the "Alipay of America."

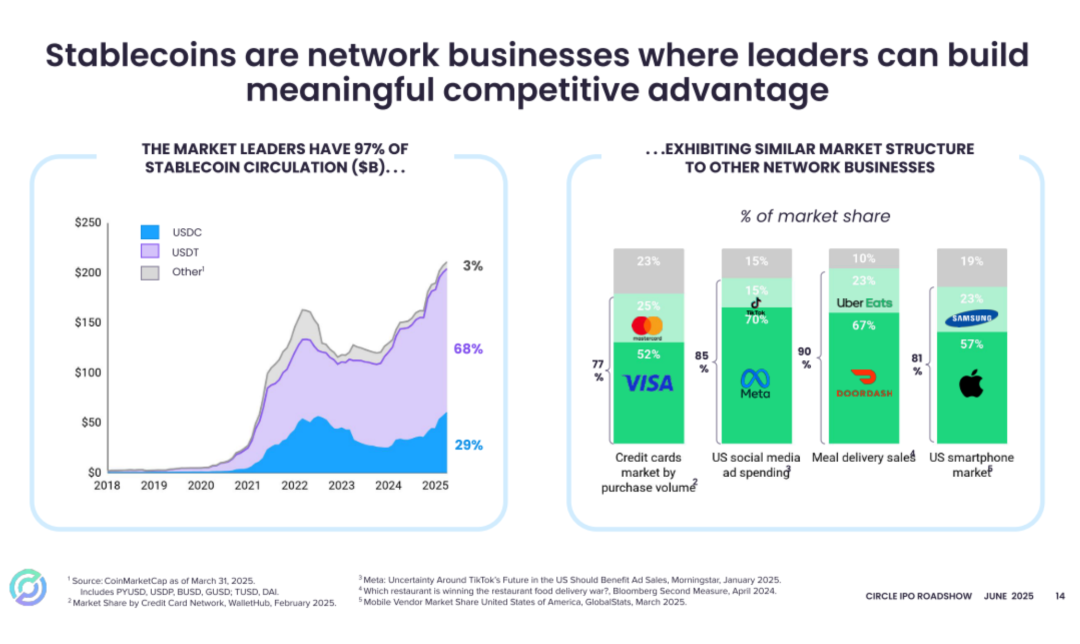

Circle previously partnered with Coinbase. In 2018, the two companies co-founded the Centre Consortium to launch USDC.

In August 2023, the Centre Consortium was dissolved. Circle acquired the remaining 50% stake in the consortium from Coinbase for a total consideration of $209.9 million, paid in approximately 8.4 million shares of fair value-measured common stock, granting Coinbase an equity stake in Circle.

Following the acquisition, Centre became an indirectly wholly-owned consolidated subsidiary of Circle, giving Circle full control over the USDC ecosystem. In December 2023, Circle dissolved Centre, and its net assets were distributed to another wholly-owned subsidiary of the company.

In June 2016, Circle announced a $60 million Series D funding round, led by IDG Capital, which had also led the Series C round. Breyer Capital and General Catalyst Partners continued their participation in this round.

Circle’s Series D round attracted several Chinese strategic investors, including Baidu, Zhongjin Jiazi, Everbright Holdings, Wanxiang, Yixin, as well as two key individual investors: Sam Palmisano, former Chairman and CEO of IBM, and Glenn Hutchins, co-founder and senior partner at SilverLake.

In May 2018, Circle announced a $110 million Series E round led by Bitmain. IDG Capital, a shared investor in both companies and lead investor in Circle’s Series C and D rounds, continued its support. Other returning investors included Breyer Capital and Accel, alongside new participants Blockchain Capital and Tusk Ventures.

On May 31, 2021, Circle announced a $440 million fundraising round, with participants including Digital Currency Group, Fidelity Management & Research Company, and cryptocurrency exchange FTX.

In 2022, Circle pursued a public listing through a special purpose acquisition company (SPAC), with a valuation of $9 billion. That transaction concluded in December 2022. At the time, Jeremy Allaire expressed disappointment over the "extended timeline" of the proposed deal but affirmed the company’s continued intention to go public.

Annual Revenue of $1.676 Billion

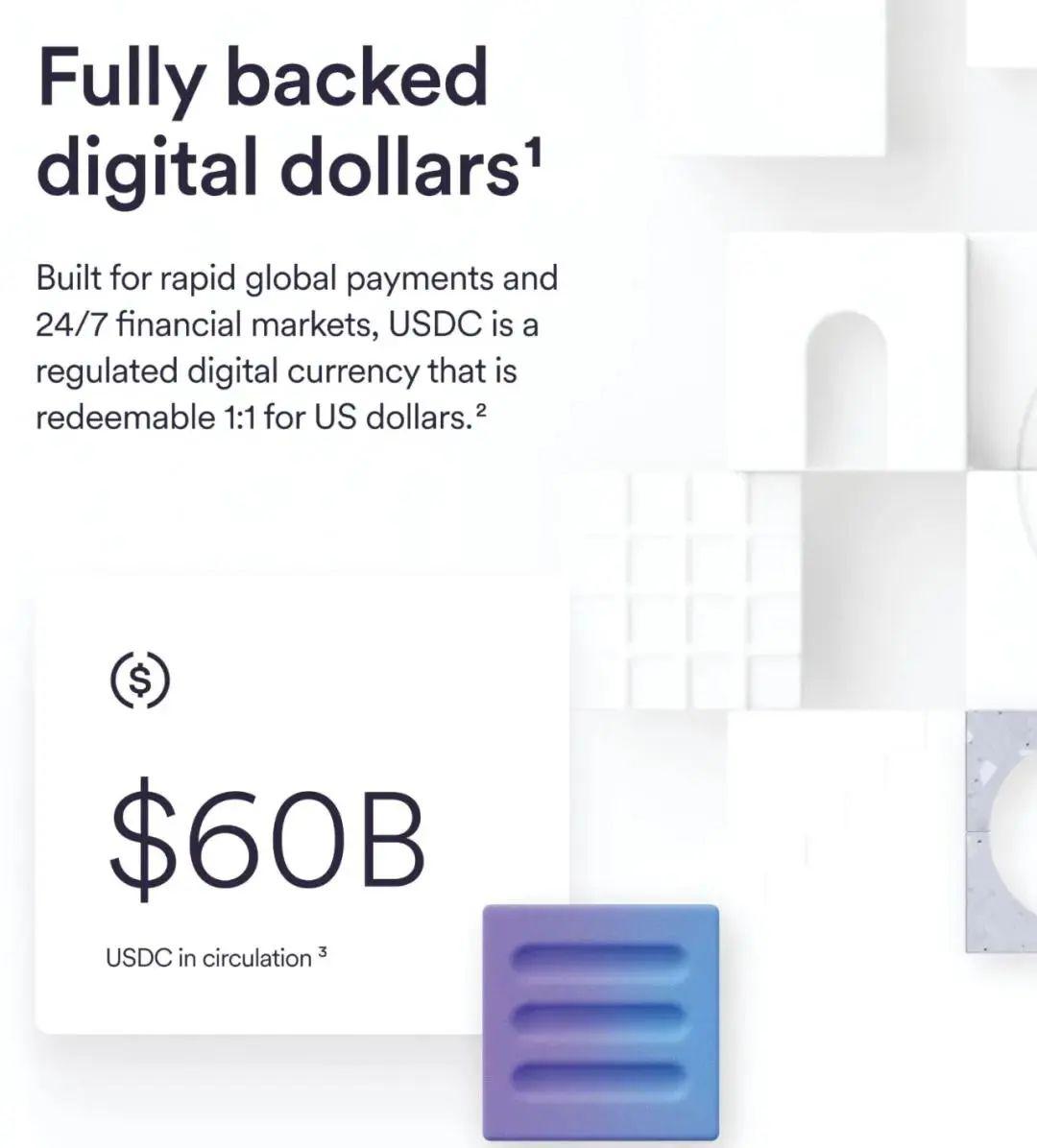

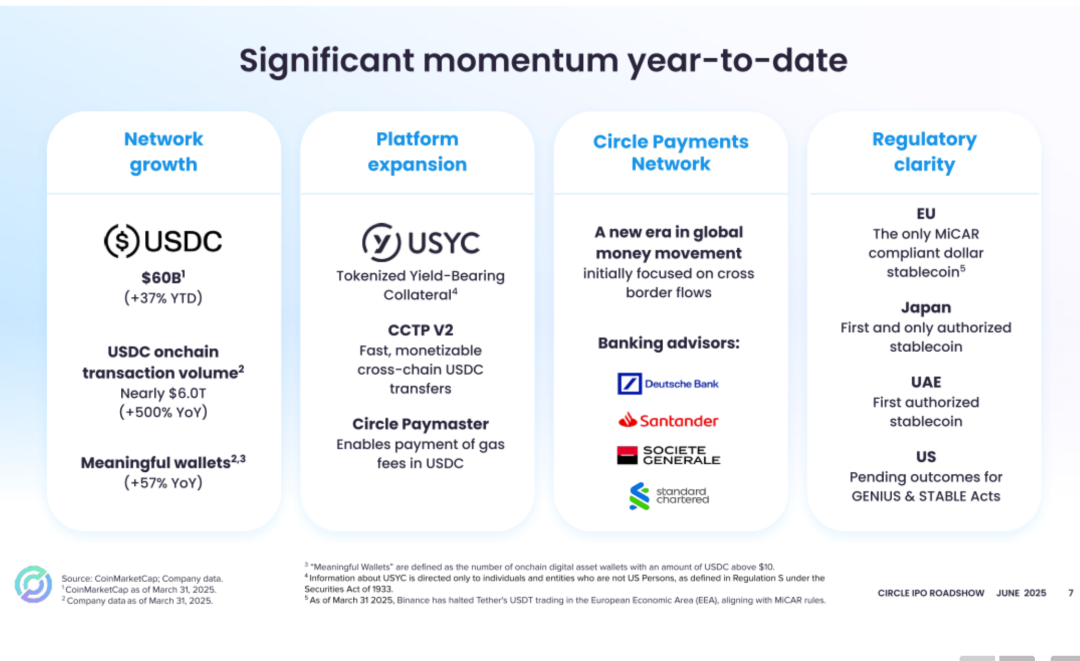

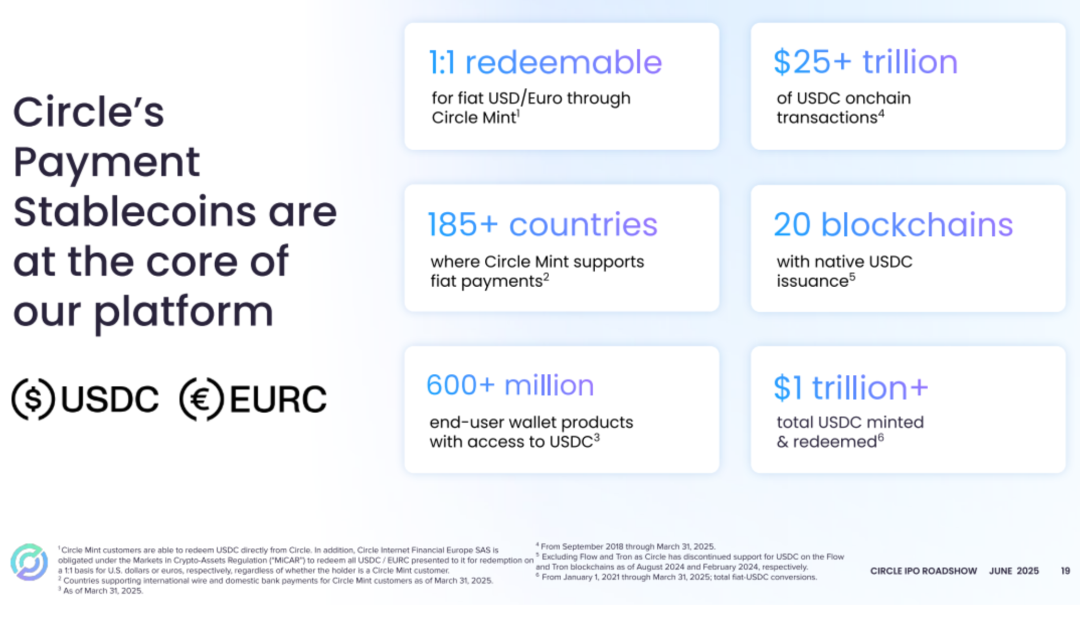

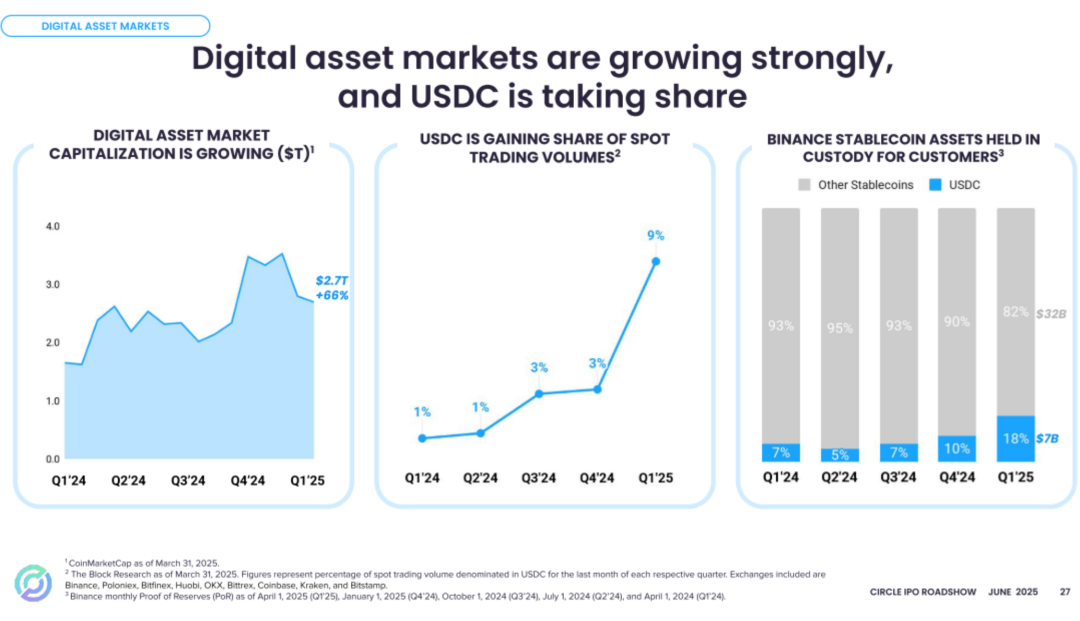

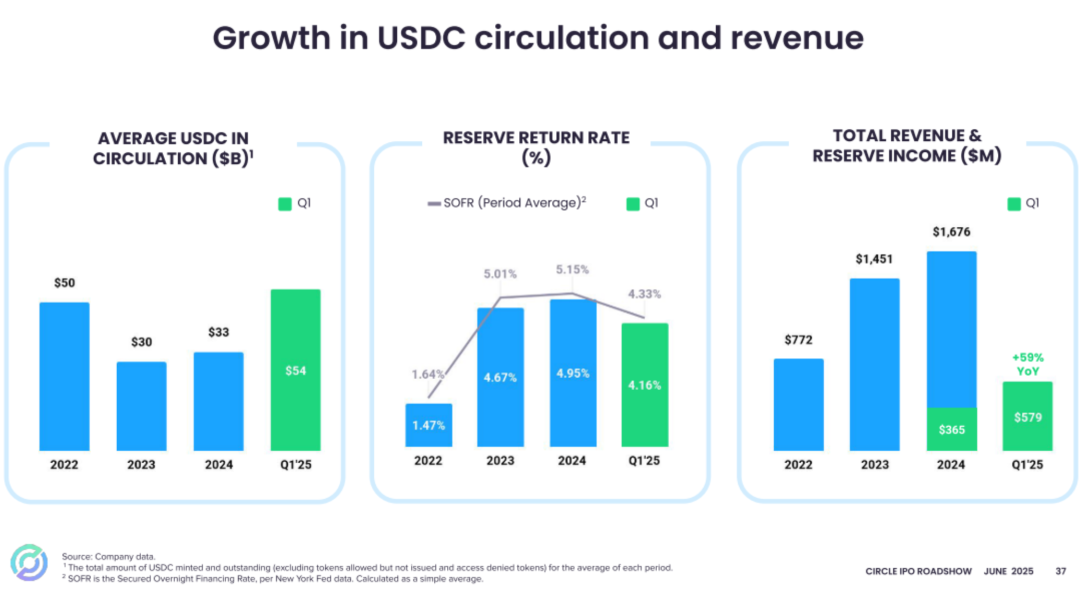

As of March 31, 2025, Circle held USDC reserves valued at $59.976 billion, with an average USDC value of $54.136 billion.

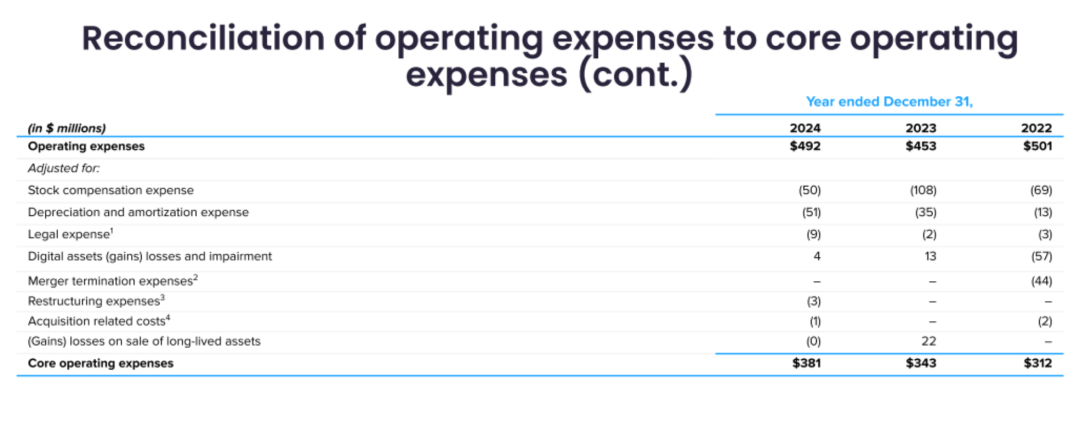

The prospectus shows that Circle generated revenues of $772 million, $1.45 billion, and $1.676 billion in 2022, 2023, and 2024, respectively. Operating profits were -$38.12 million, $269 million, and $167 million during those years.

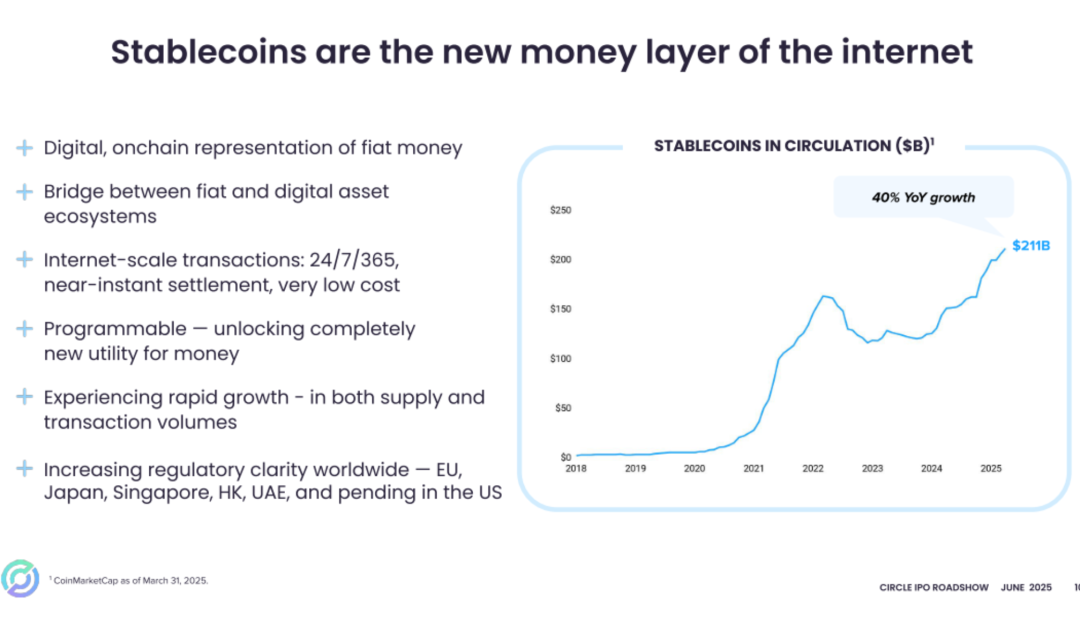

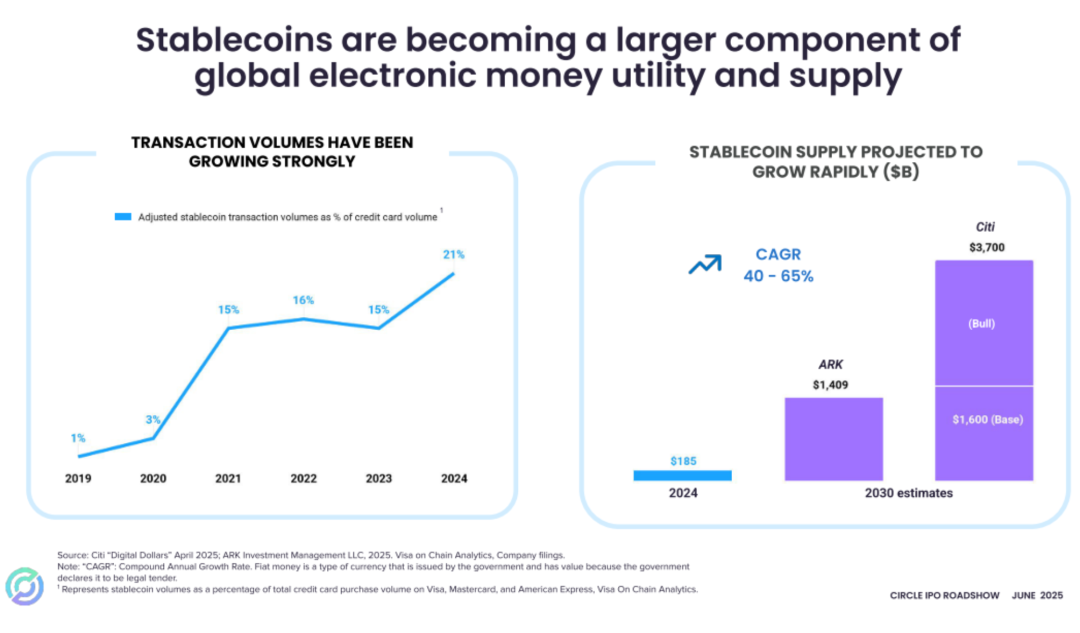

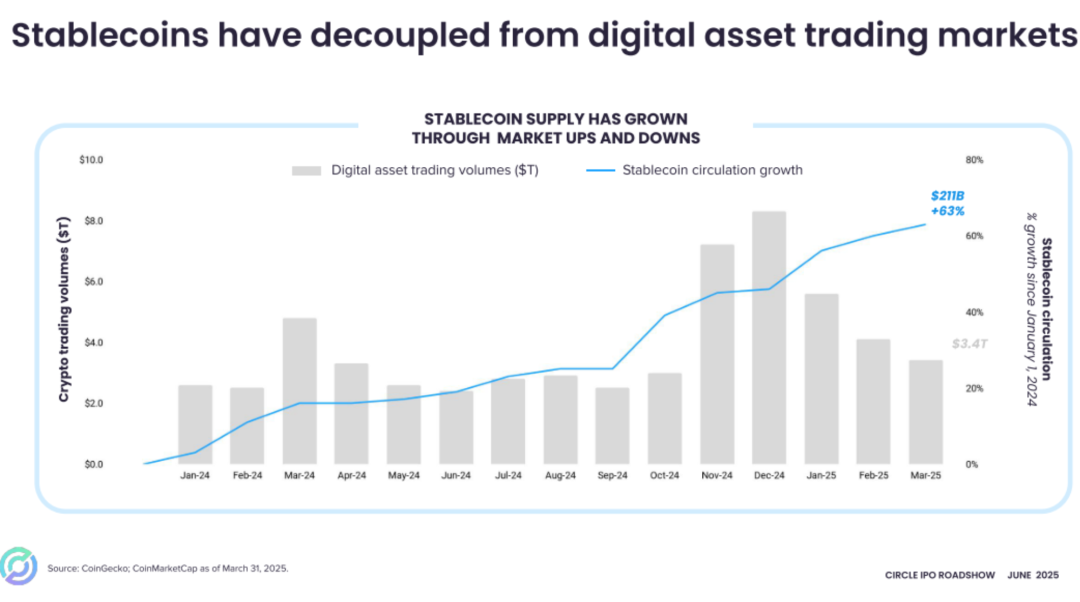

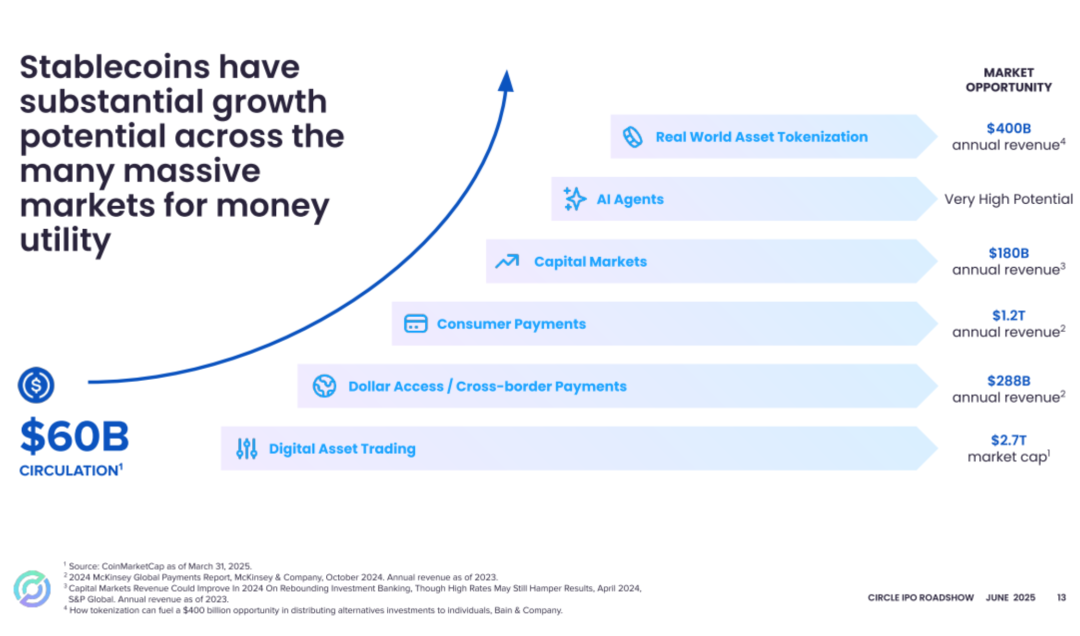

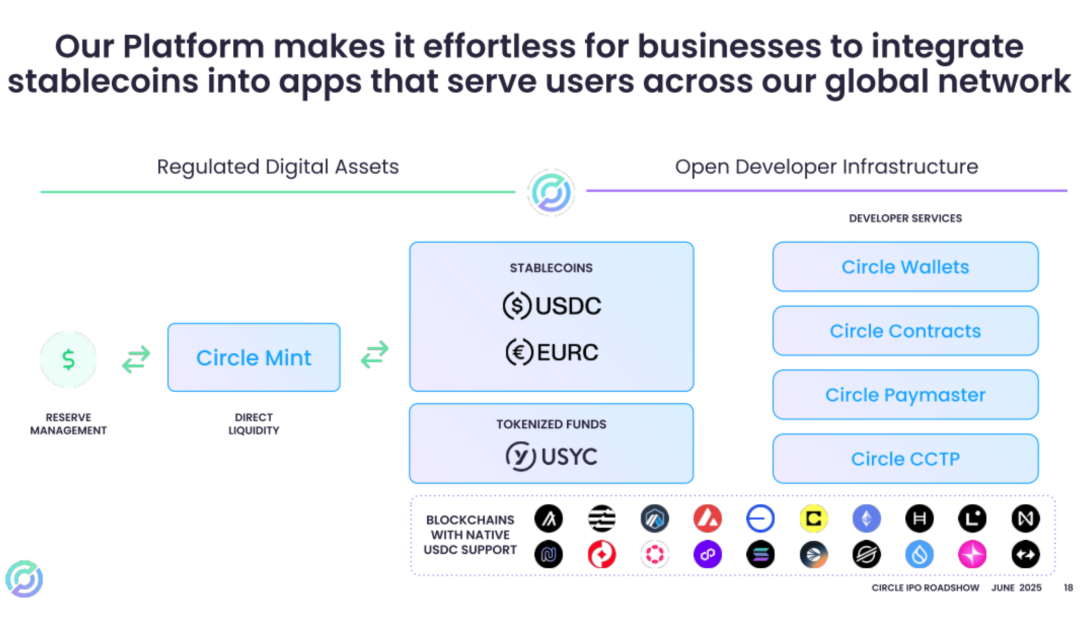

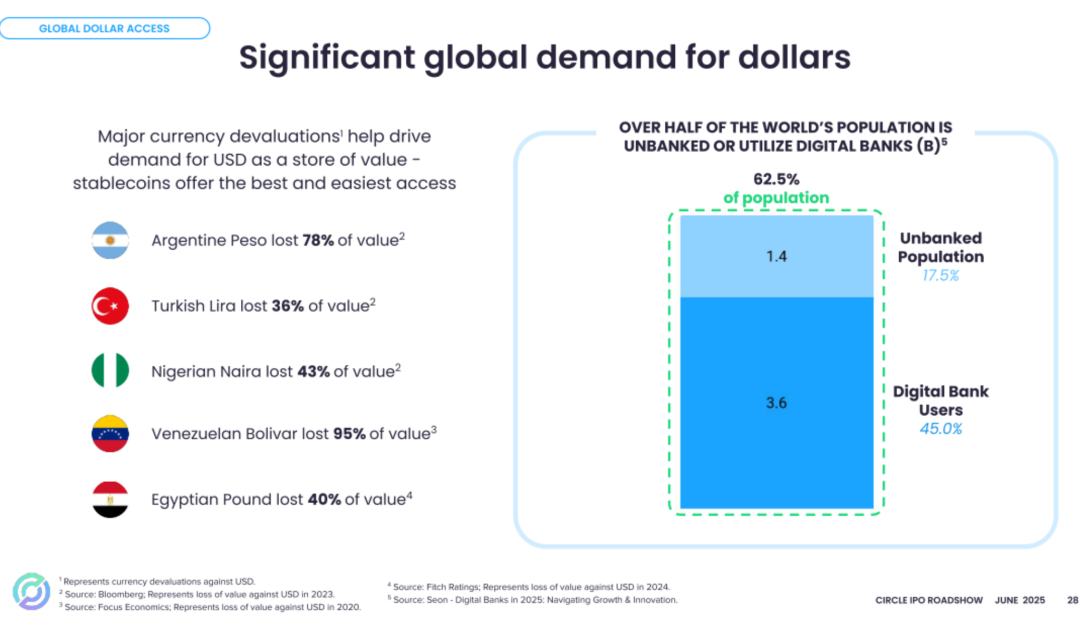

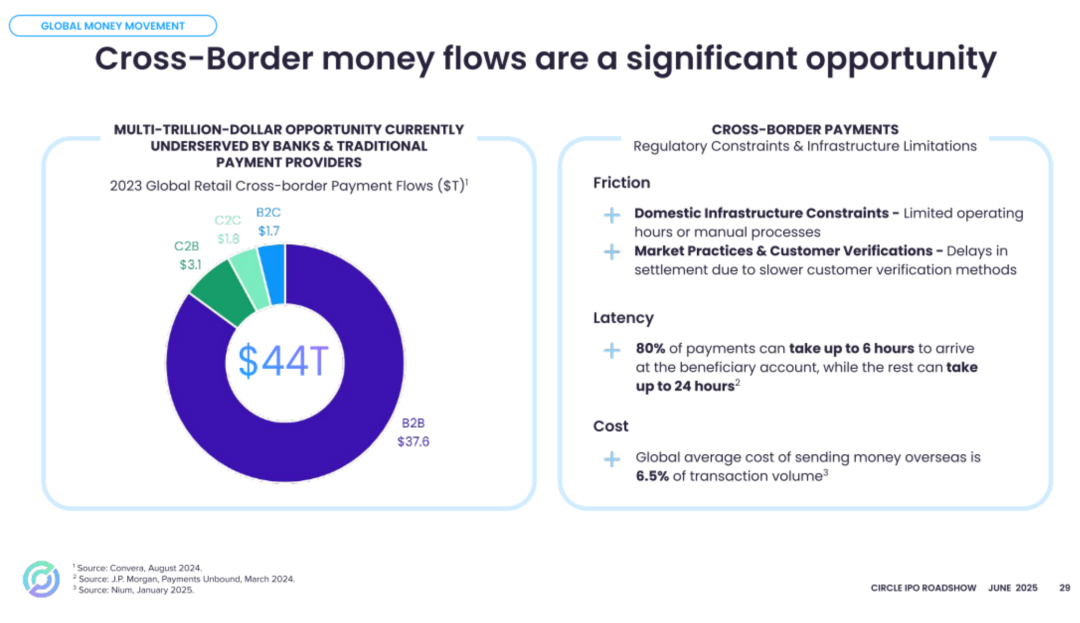

Circle’s business model is straightforward: it issues the USDC stablecoin, which is pegged 1:1 to the U.S. dollar, and invests users’ deposited funds—approximately $60 billion—into short-term U.S. Treasury securities to earn risk-free interest income.

Circle primarily invests in U.S. Treasuries and cash equivalents, generating approximately $1.6 billion in interest income ("reserve income") in 2024, accounting for 99% of its total revenue.

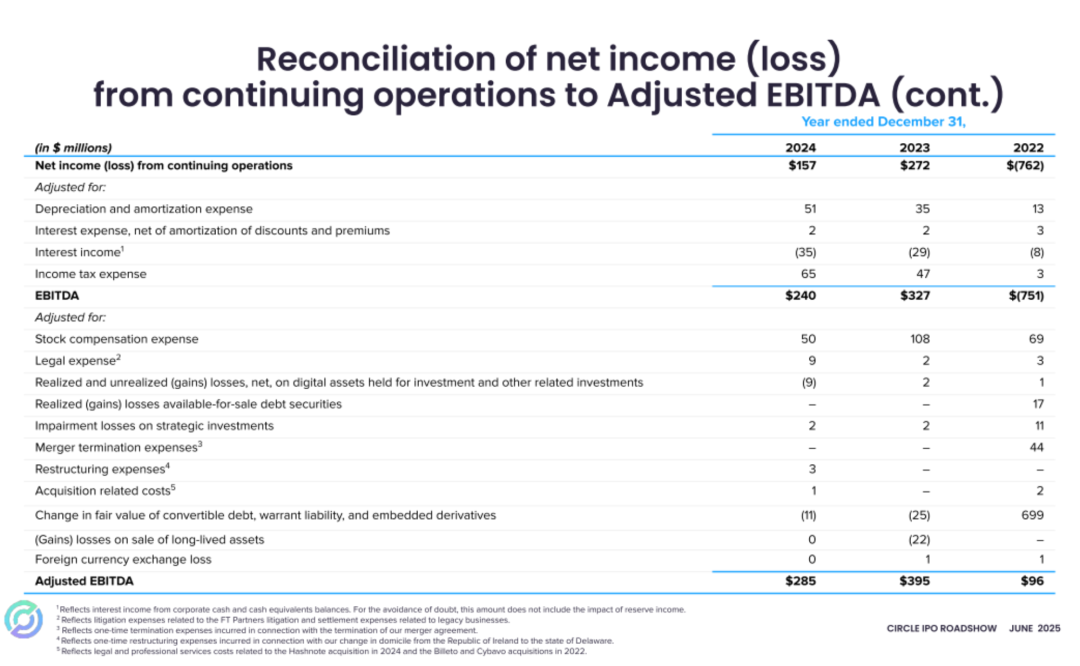

Net income from continuing operations was -$760 million, $271 million, and $157 million in 2022, 2023, and 2024, respectively.

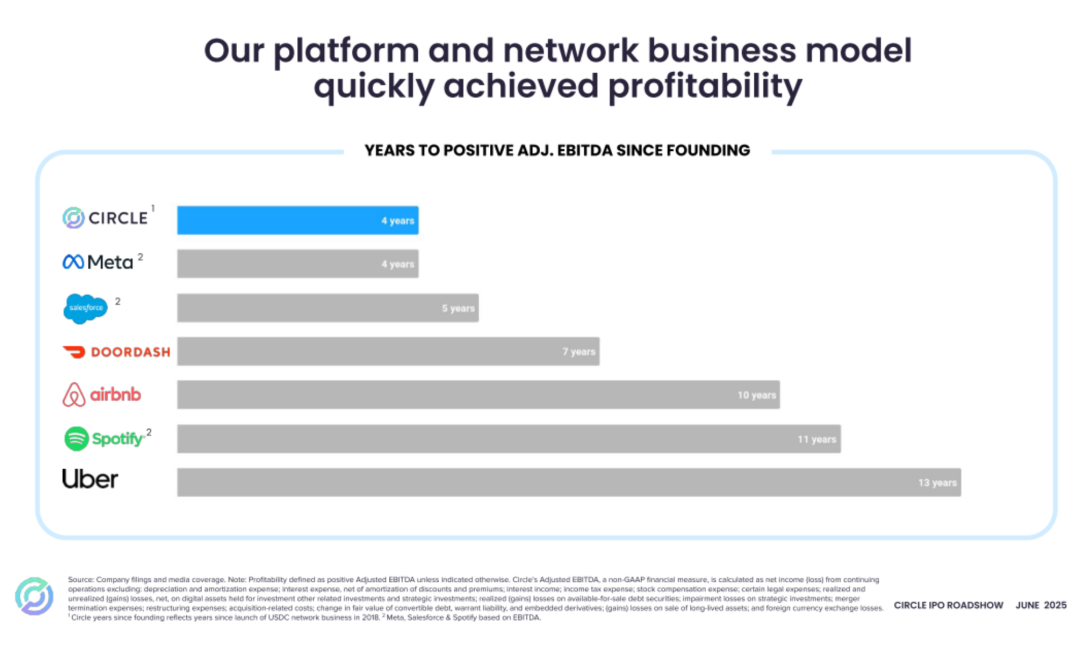

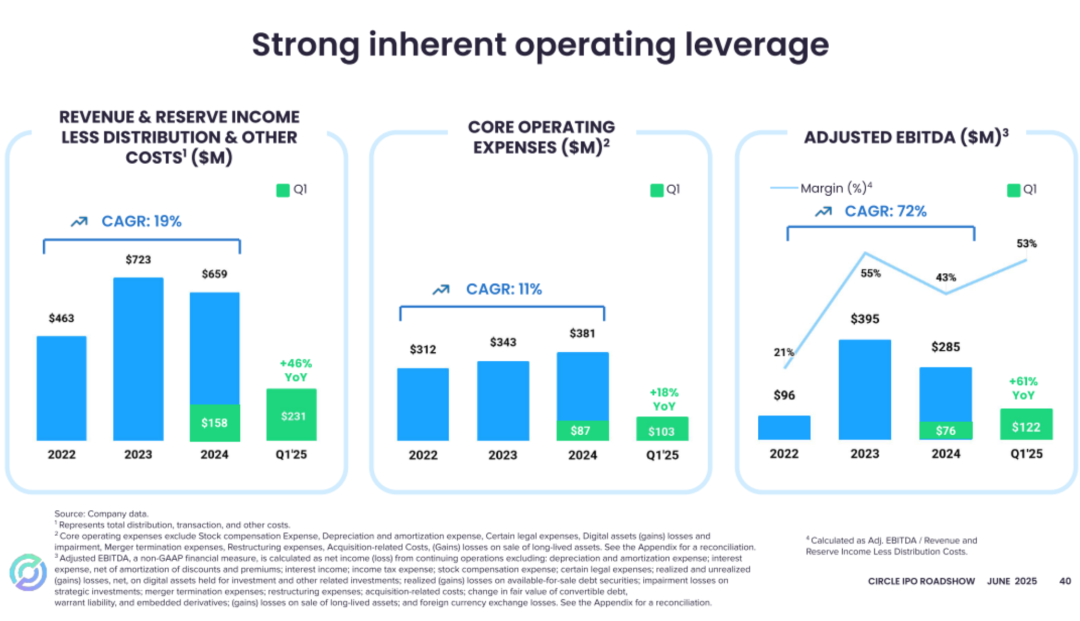

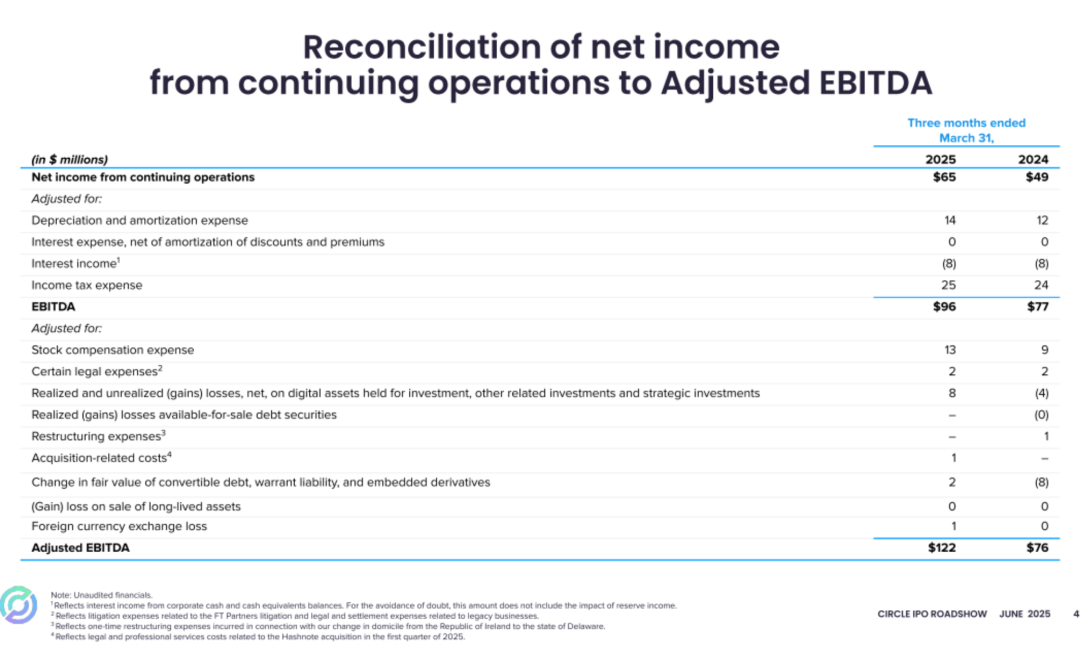

Adjusted EBITDA for Circle was $96 million, $395 million, and $285 million in 2022, 2023, and 2024, respectively.

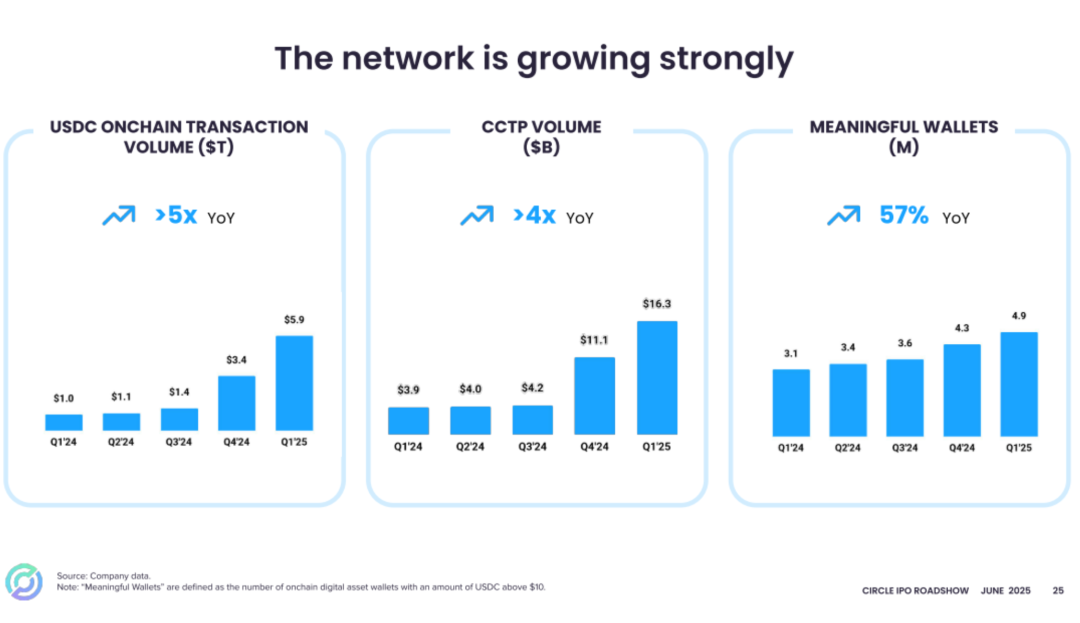

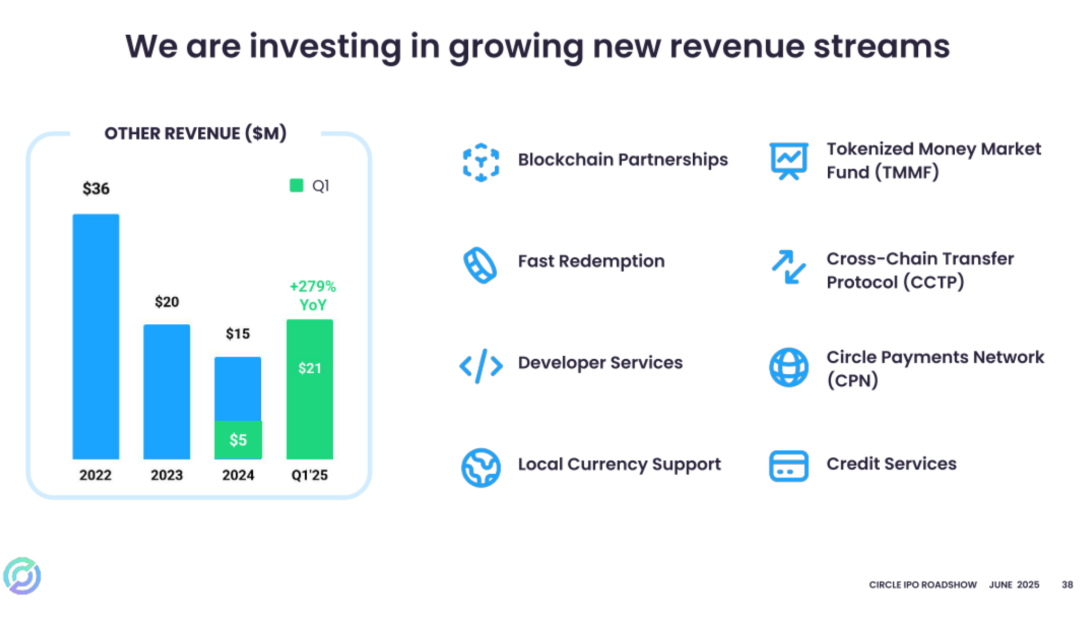

In the first quarter of 2025, Circle reported revenue of $579 million, a 58.6% increase compared to $365 million in the same period last year.

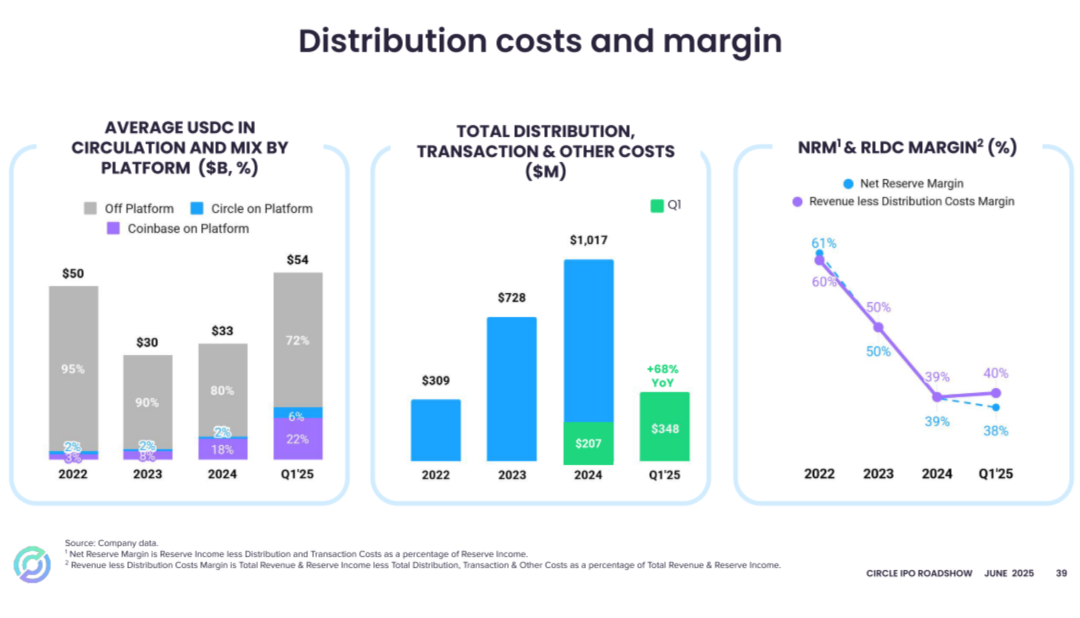

Distribution and transaction costs in Q1 2025 increased by $144.6 million, or 71.3%, year-over-year, primarily due to a $101.8 million increase in distribution costs paid to Coinbase—attributable to higher reserve income and platform balances—as well as an additional $42.5 million in distribution costs related to new strategic distribution partnerships.

Operating profit from continuing operations in Q1 2025 was $92.94 million, up 77.6% from $52.32 million in the prior-year period. Net income from continuing operations was $64.79 million, up 33.2% from $48.63 million in the same period last year.

Adjusted EBITDA in Q1 2025 was $122 million, compared to $76.26 million in the same period last year. Adjusted EBITDA figures for 2022, 2023, and 2024 were $96.28 million, $395 million, and $285 million, respectively.

IDG Capital and Accel Are Shareholders

The board of directors of Circle is chaired by CEO Jeremy Allaire, with Jeremy Fox-Geen serving as CFO and Heath Tarbert as President.

Prior to IPO, Jeremy Allaire held 77.1% of Class B shares, representing 23.1% of voting power; Nikhil Chandhok held 1% of Class A shares; Accel held 6.9% of Class A shares, with 4.8% voting power; Breyer held 9% of Class A shares, with 6.3% voting power;

General Catalyst held 12.8% of Class A shares, with 8.9% voting power; P. Sean Neville held 22.9% of Class B shares, with 6.9% voting power.

IDG Capital held 12.6% of Class A shares, with 8.8% voting power; Oak Investment held 7.5% of Class A shares, with 5.3% voting power; FMR held 7.2% of Class A shares, with 5.1% voting power; Elisabeth Carpenter held 2.8% of Class A shares, with 2.0% voting power.

After the IPO, Jeremy Allaire will hold 78.9% of Class B shares, retaining 23.7% of voting power; P. Sean Neville will hold 21.1% of Class B shares, with 6.3% voting power.

Accel will hold 5.4% of Class A shares, with 3.8% voting power; Breyer will hold 6.7% of Class A shares, with 4.7% voting power; General Catalyst will hold 10% of Class A shares, with 7% voting power.

IDG Capital will hold 10.4% of Class A shares, with 7.3% voting power; Oak Investment will hold 5.9% of Class A shares, with 4.1% voting power; FMR will hold 6.7% of Class A shares, with 4.7% voting power; Elisabeth Carpenter will hold 2.1% of Class A shares, with 1.5% voting power.

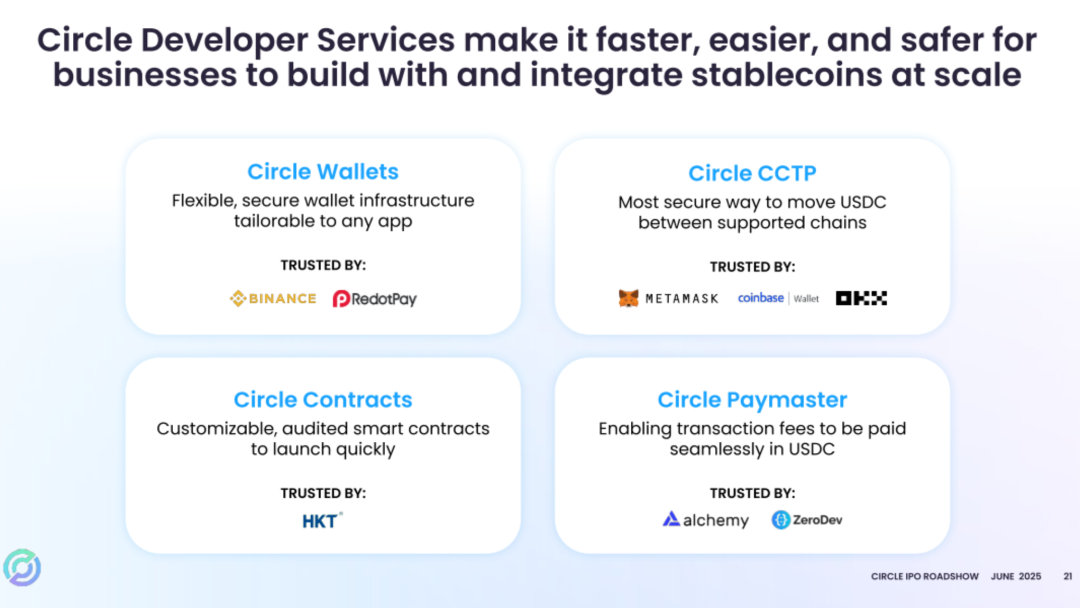

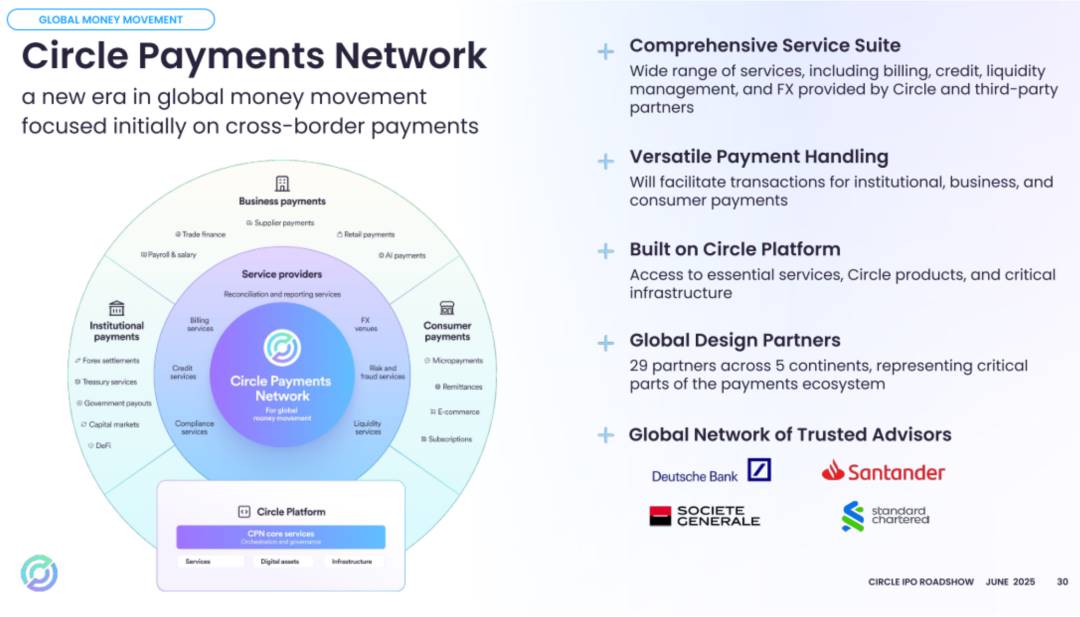

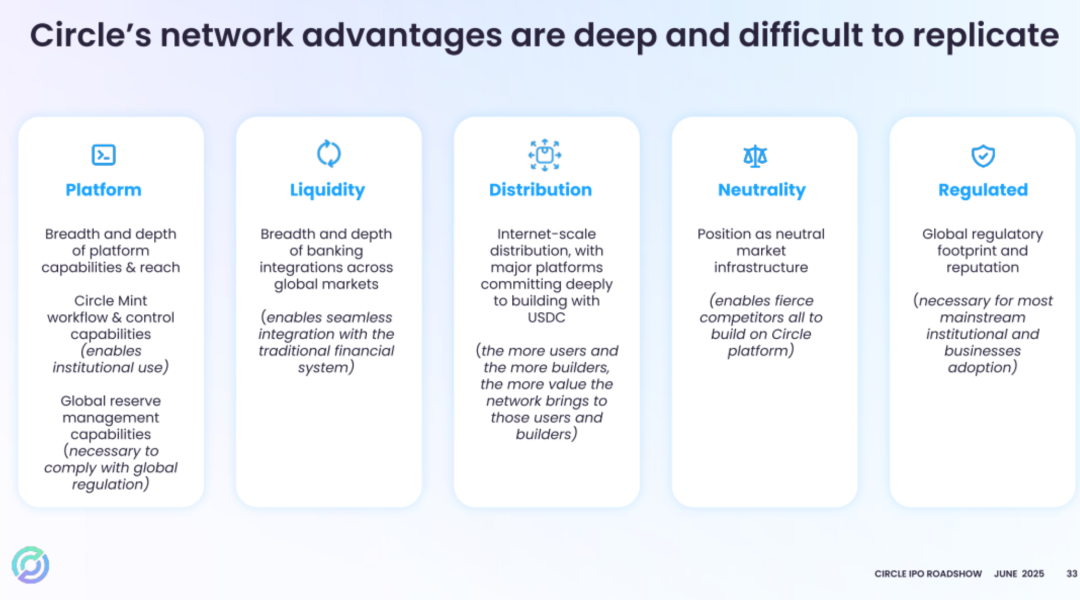

Below are slides from Circle's roadshow presentation:

Content from Circle's roadshow presentation

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News