Coin Metrics: How WBTC and cbBTC Expand Bitcoin's Utility?

TechFlow Selected TechFlow Selected

Coin Metrics: How WBTC and cbBTC Expand Bitcoin's Utility?

Bitcoin should not be just a means of value storage.

By Tanay Ved

Translated by Luffy, Foresight News

Key Takeaways:

-

Wrapped bitcoins such as WBTC and cbBTC extend Bitcoin’s utility beyond its native network, enhancing cross-chain accessibility and interoperability.

-

Wrapped bitcoins feature different custodial models and governance structures, ranging from fully centralized issuers (e.g., Coinbase’s cbBTC) to decentralized, smart contract-based systems (e.g., Threshold tBTC).

-

WBTC has the largest supply (~129,000 BTC), but cbBTC's share is rapidly growing, with approximately 43,000 BTC issued on Base and Solana. Together, they represent over 172,000 wrapped bitcoins, used differently across blockchains.

-

Wrapped bitcoins are widely adopted in DeFi. WBTC dominates Ethereum DEXs (led by Uniswap v3), while cbBTC is more active on DEXs like Aerodrome. Over $7 billion in WBTC and cbBTC is locked in lending protocols such as Aave and Morpho, where users borrow against them as collateral.

Introduction

Bitcoin’s scarcity and predictable monetary policy make it an ideal "store of value," with ownership increasingly shifting toward long-term holders, ETFs, and public companies. But as BTC is heavily “hoarded,” the utility of its $2 trillion native token remains underutilized—what does this mean?

To address this, a growing number of products have emerged, all aiming to put Bitcoin to work. From Bitcoin-backed lending (such as Coinbase’s collaboration with Morpho or Cantor Fitzgerald’s Bitcoin credit tools via Maple Finance), to Layer 2 solutions designed to scale Bitcoin functionality, wrapped bitcoins for cross-chain interoperability, and corporate treasury tools like Strategy—all seek to make Bitcoin more productive.

In this article, we explore the evolving ecosystem of tokenized Bitcoin, focusing on Wrapped Bitcoin (WBTC) and Coinbase’s cbBTC, analyzing how they expand BTC’s utility across chains.

The State of Tokenized Bitcoin Products

Demand for using Bitcoin on smart contract platforms has led to a range of tokenized versions, also known as “Bitcoin derivatives.” Among these, wrapped Bitcoin is the largest category, representing BTC tokenized on other blockchains, typically issued through mint-and-burn mechanisms and backed 1:1 by custodied native Bitcoin.

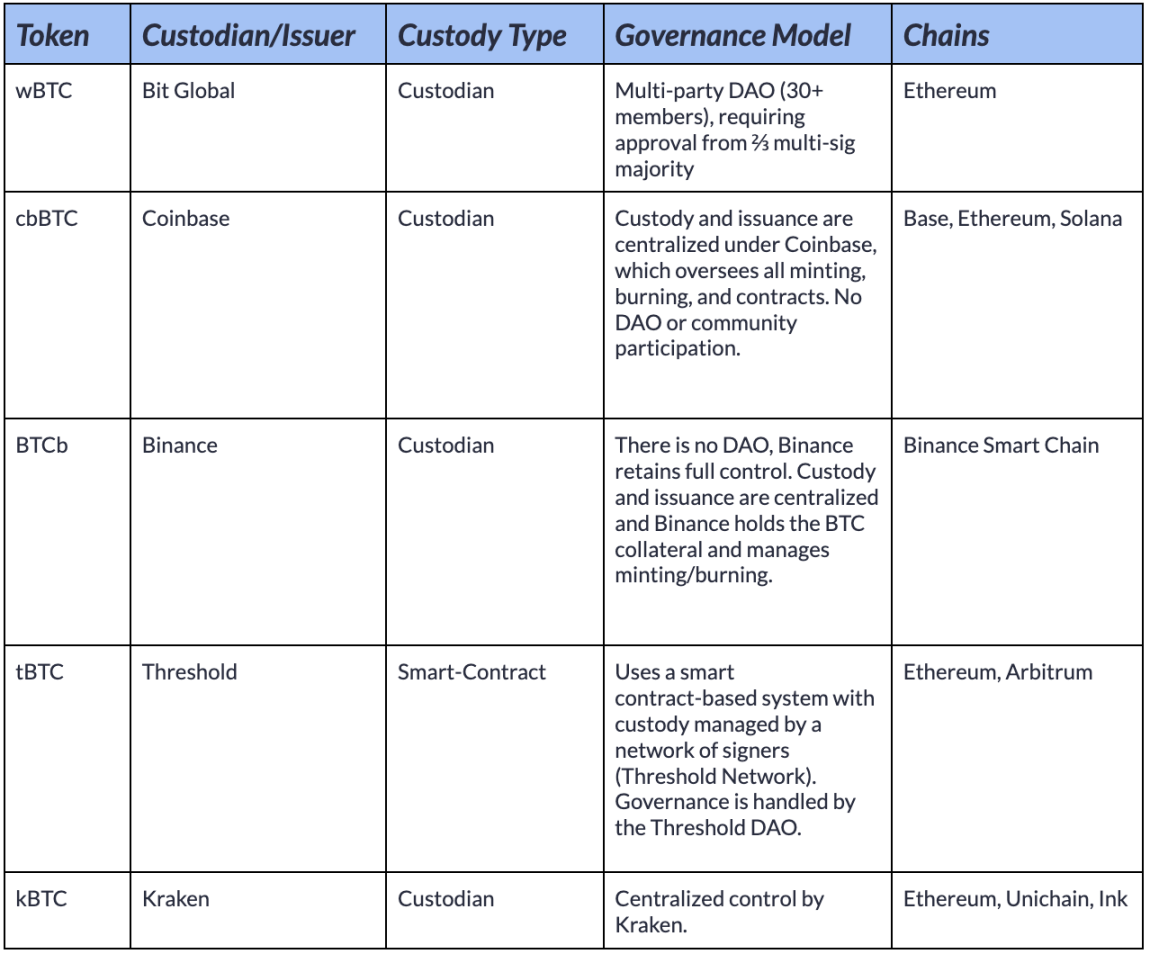

Wrapped Bitcoin tokens aim to enhance BTC’s accessibility and interoperability, offering programmability and low-cost execution not available with native Bitcoin. The table below outlines major wrapped Bitcoin tokens, comparing their custody models, issuing entities, governance structures, and supported blockchain networks:

While these tokens all aim to extend Bitcoin’s utility, their trust assumptions vary. Today’s solutions span the spectrum—from fully custodial models like Coinbase’s cbBTC, to DAO-based multisig systems like WBTC, to distributed smart contract-based systems like Threshold’s tBTC. In all cases, users entrust third parties with custody of Bitcoin in exchange for tokenized representations.

Beyond the main wrapped Bitcoin offerings, liquid staking Bitcoin derivatives are also emerging. For example, Lombard’s LBTC secures Proof-of-Stake (PoS) chains via Babylon Protocol, enabling BTC holders to earn staking yields.

WBTC and cbBTC

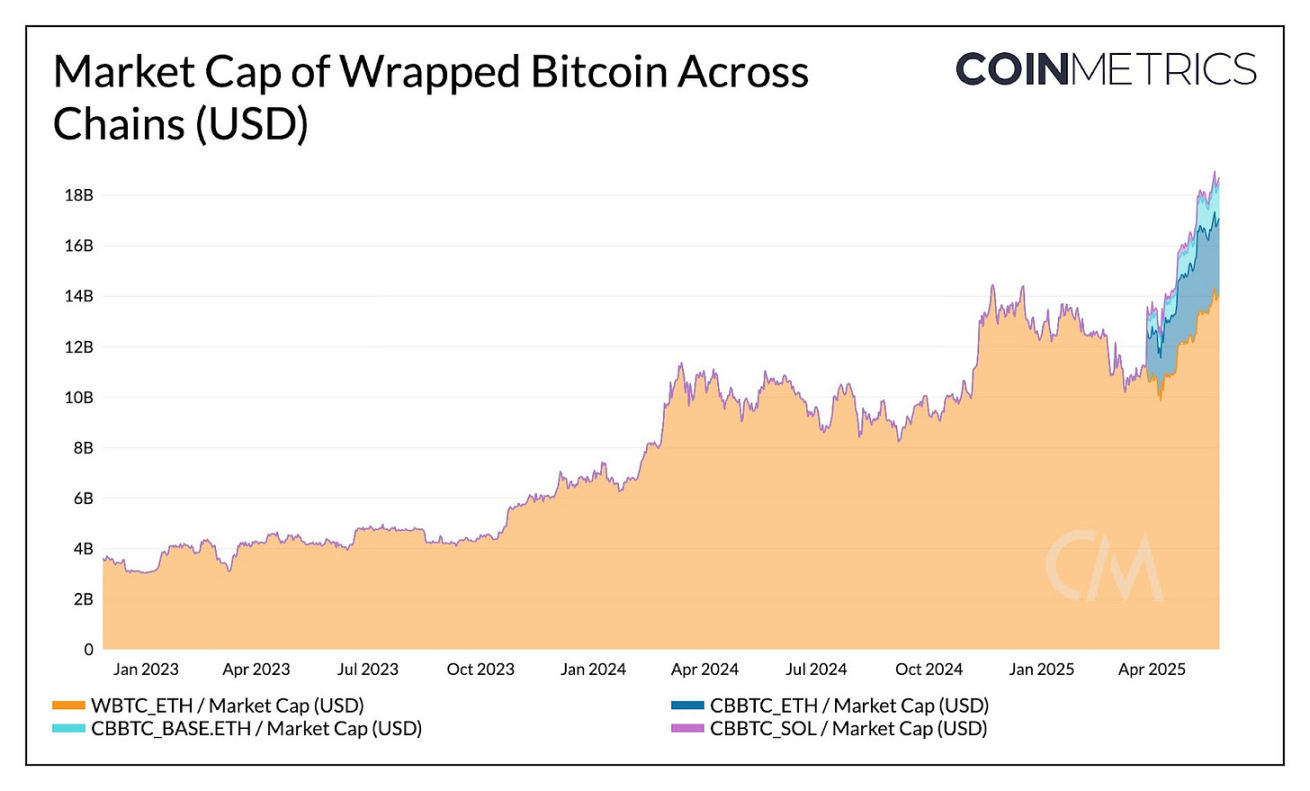

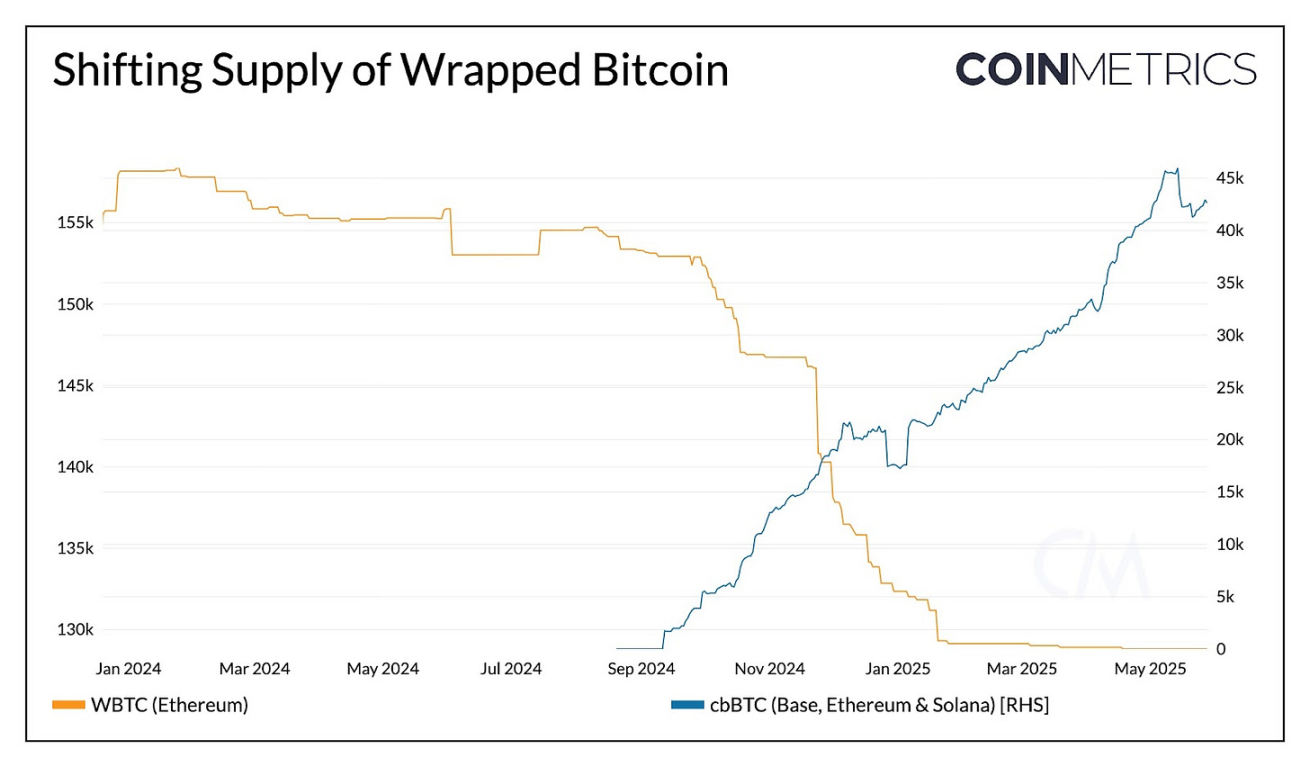

Since January 2023, driven by rising BTC prices and new cross-chain product launches, the market cap of wrapped Bitcoin has grown fivefold. The two largest tokens by market cap are WBTC and cbBTC, issued by Bit Global and Coinbase respectively, with a combined supply of 172,000 BTC.

As the first wrapped Bitcoin launched in 2019, WBTC has long dominated the market. However, since WBTC’s stewardship transferred to Bit Global in September 2024, demand appears to have softened. Meanwhile, Coinbase’s cbBTC, launched on Base, Ethereum, and Solana, has rapidly gained traction, offsetting WBTC’s decline.

As of June 1, 2025, WBTC holds 81% of the wrapped Bitcoin market, with a current supply of 128,800 BTC. In contrast, cbBTC accounts for the remaining 19%, with issuance on Ethereum, Base, and Solana at 27,600 BTC, 13,200 BTC, and 23,000 BTC respectively.

Cross-Chain Usage of Bitcoin

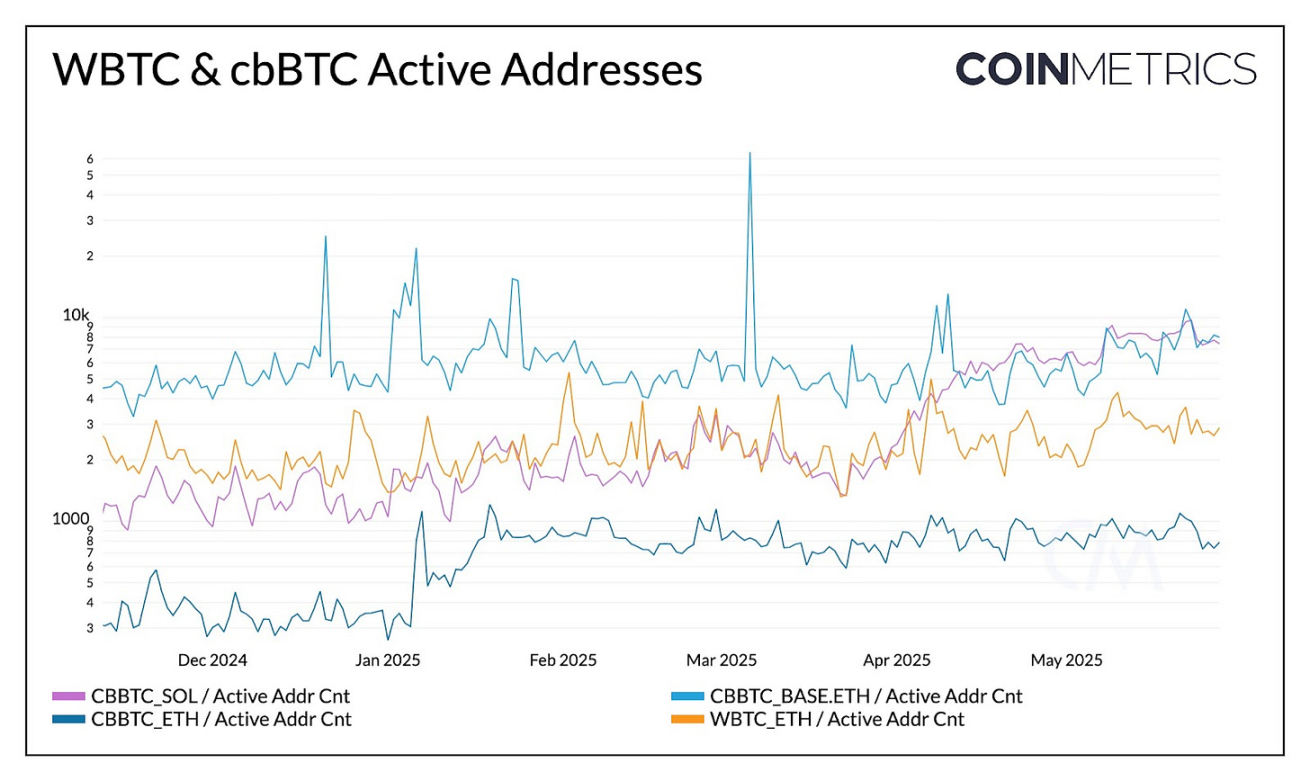

As Bitcoin surges across blockchains like Ethereum, Base, and Solana, on-chain activity offers deeper insights into its functional roles within these ecosystems. Active addresses help gauge the breadth of user engagement with cross-chain tokenized Bitcoin.

Leveraging Coinbase’s broad distribution and low transaction costs, cbBTC on Base leads in this metric, averaging around 7,000 daily active addresses. Solana follows closely, with active addresses steadily increasing since April, benefiting from its low-cost, high-throughput infrastructure. Ethereum participation appears limited to larger but less frequent transactions, suggesting that despite significant WBTC and cbBTC holdings on Ethereum, usage activity lags behind Base and Solana.

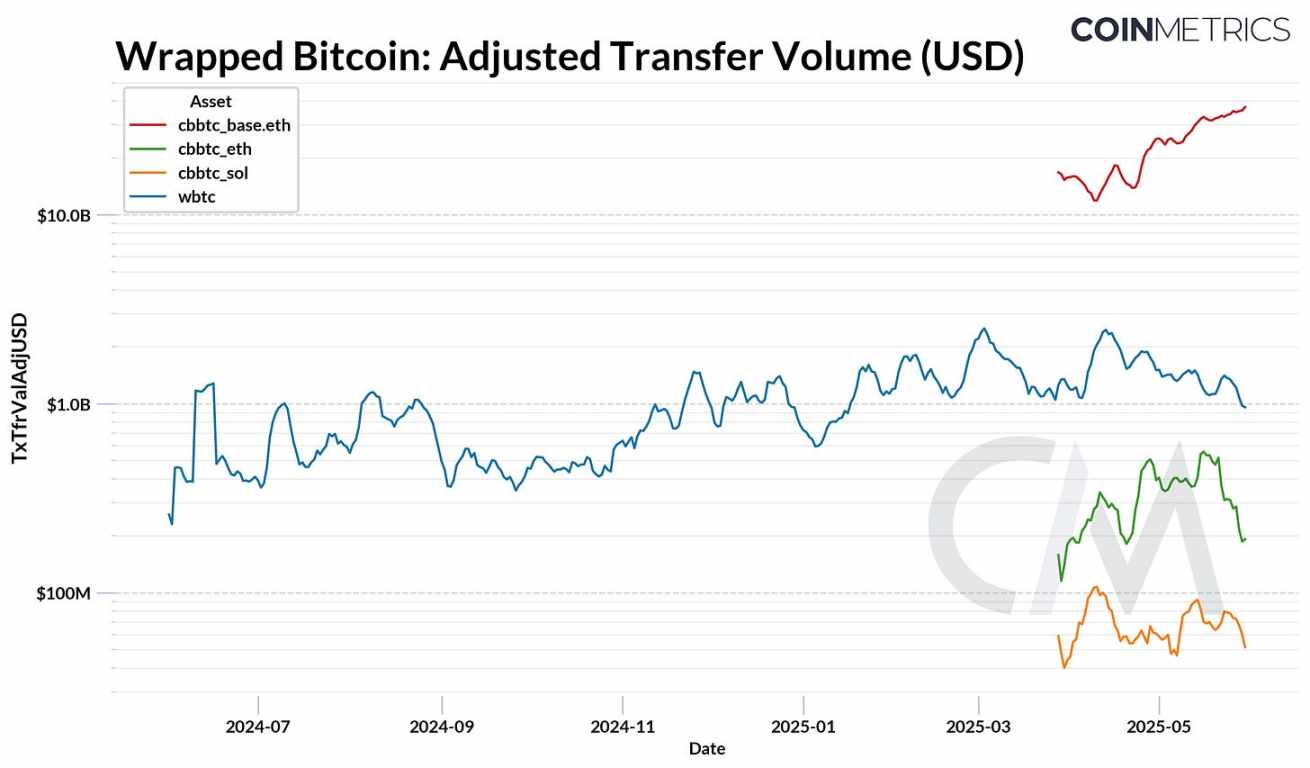

Transaction activity—measured by transaction count and volume of native token transfers—shows a similar pattern. The chart below illustrates adjusted transfer volumes for WBTC and cbBTC across chains. cbBTC on Base stands out, averaging ~$40 billion in weekly transfer volume—far exceeding WBTC on Ethereum, which sees around $1 billion.

Note: Adjusted cbBTC transfer volume spiked to $506 billion on April 22 and $787 billion on April 26. These outliers were excluded due to repetitive transactions between the “Impermax Exploiter” address and Morpho on Base, generating non-organic activity.

Circulation velocity further confirms this trend, measuring how frequently tokenized Bitcoin changes hands relative to its supply. cbBTC on Base has the highest turnover, followed by Solana and then Ethereum. All wrapped variants exhibit higher velocity than native Bitcoin, underscoring their role in driving active on-chain use of Bitcoin.

Wrapped Bitcoin in DeFi

The primary driver of wrapped Bitcoin demand is its ability to unlock financial services on-chain that are otherwise impossible with native Bitcoin. As key components of DeFi, WBTC and cbBTC allow users to trade, lend, and provide liquidity without selling their Bitcoin holdings.

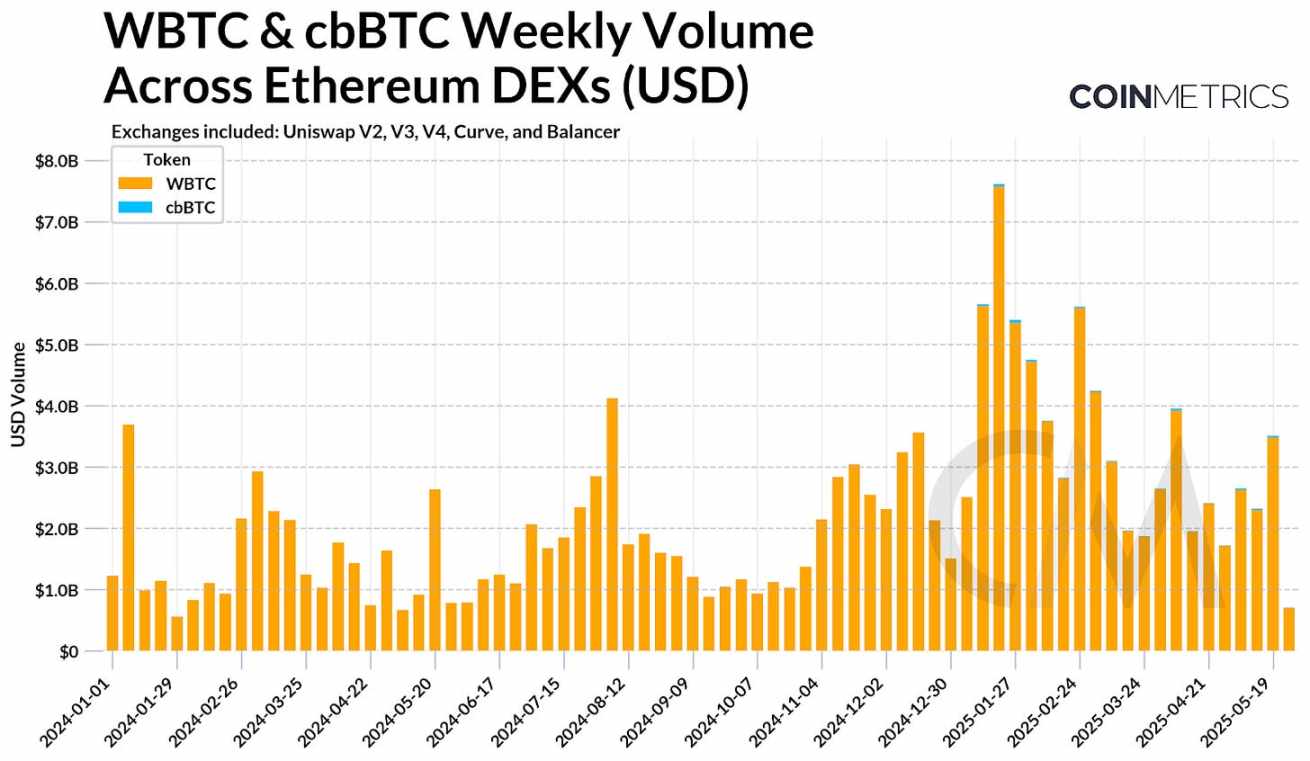

On Ethereum, WBTC remains the dominant wrapped Bitcoin in DEX markets, with Uniswap v3 accounting for most of its volume. While cbBTC also trades on Ethereum DEXs, its presence is relatively small. To access applications on Ethereum scaling solutions, WBTC is often bridged to L2s, whereas cbBTC is natively issued on Base and Solana, enabling broader cross-chain utility.

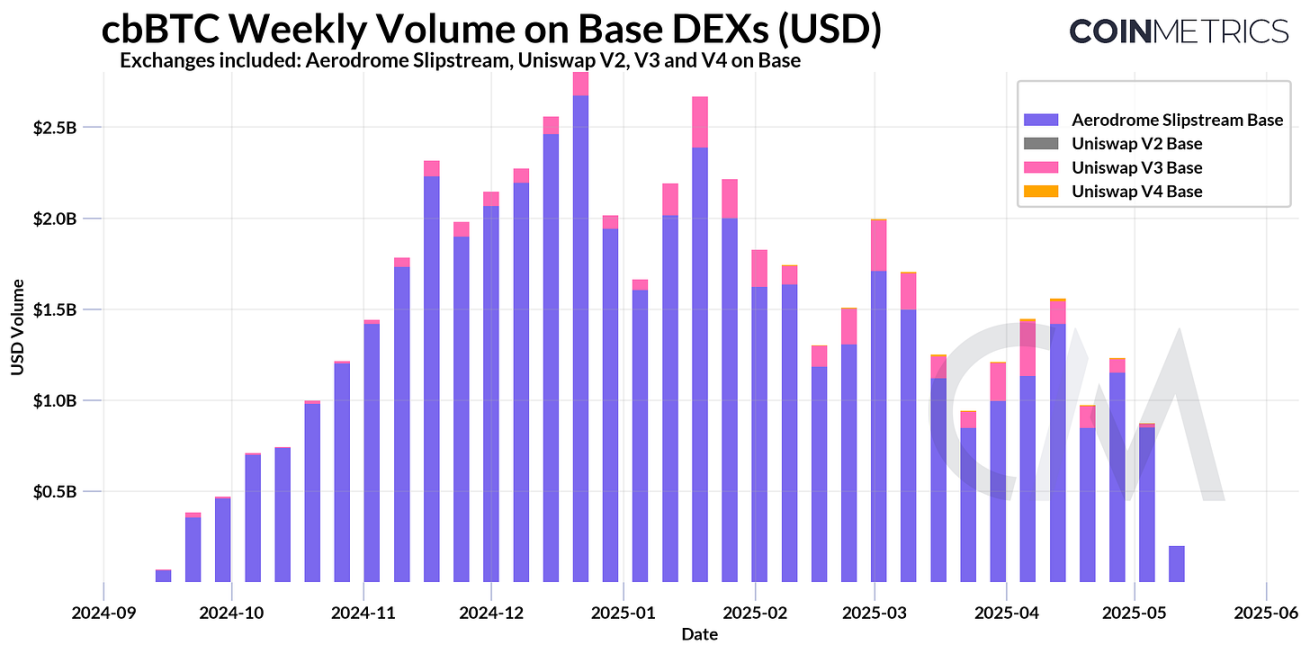

In contrast, cbBTC plays a more significant role in L2 ecosystems, particularly on Base, where it is the leading tokenized Bitcoin in DEX activity. Most trading occurs on Aerodrome, which peaked above $2.5 billion in volume in early 2025, followed by Uniswap v3 on Base.

Note: Uniswap v3 Base volume on April 26 and April 30 has been adjusted to exclude a series of repeated cbBTC transactions initiated by a single address.

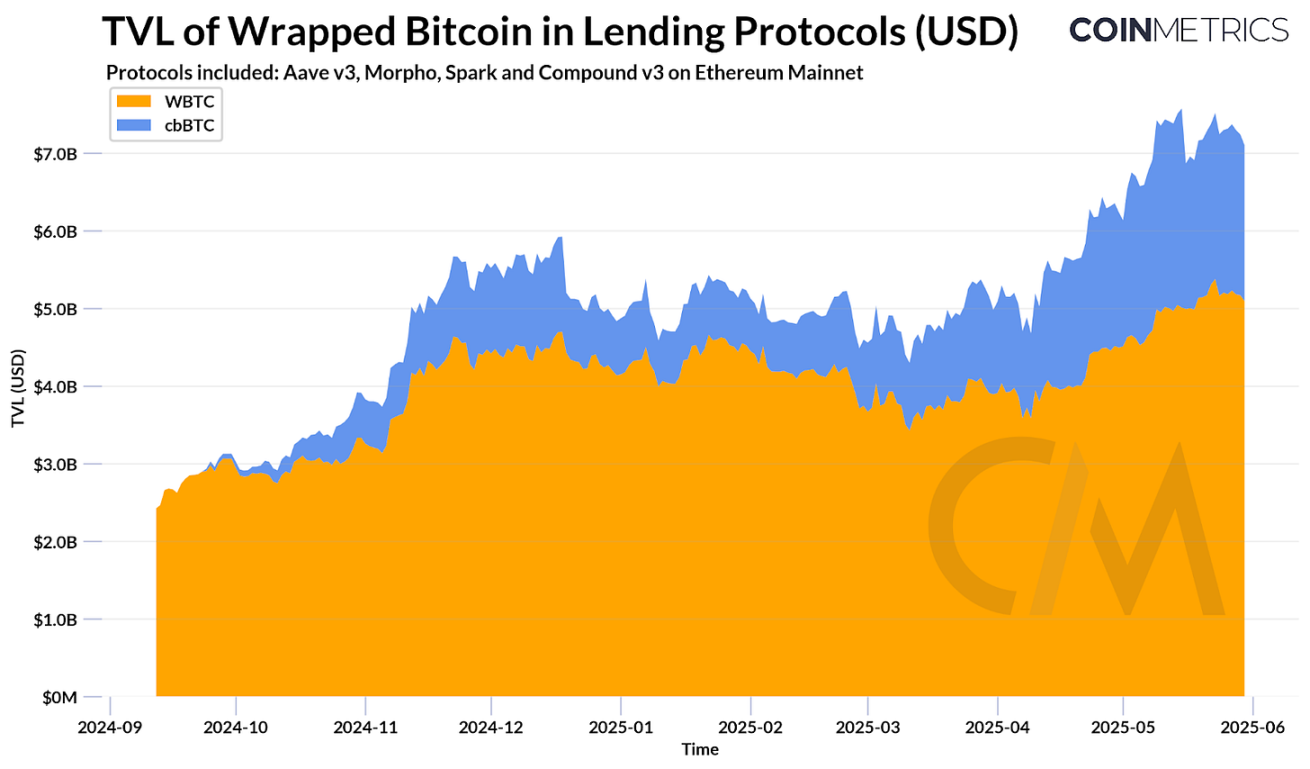

Beyond trading, wrapped BTC is also a crucial component of Ethereum’s lending markets. Both WBTC and cbBTC are widely used as collateral assets, with Aave v3, Morpho, and Spark being the largest holders of cbBTC. As of June 2025, over $7 billion in WBTC ($5B) and cbBTC ($2B) is locked across these protocols, reflecting growing integration and demand for Bitcoin-backed lending.

However, introducing different wrapped Bitcoin variants as collateral comes with trade-offs. Custodial models like cbBTC and WBTC carry centralization risks. Users must weigh these risks against the liquidity and utility provided by wrapped Bitcoin.

Conclusion

While Bitcoin’s role as a store of value remains firmly established, tokenized forms like WBTC and cbBTC are expanding its utility. Through these products, Bitcoin can now seamlessly move across chains, participate in on-chain finance, and integrate into new execution environments. Although these models introduce varying trust assumptions, their adoption reflects strong market demand for enhancing Bitcoin’s versatility. As parallel technologies like rollups and sidechains evolve, tokenized Bitcoin will likely remain a critical bridge connecting Bitcoin’s monetary reserve status with programmable economies built on other networks.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News