Standard Chartered Report: Is Solana Falling into a "Meme Chain" Trap and Facing Growth Challenges?

TechFlow Selected TechFlow Selected

Standard Chartered Report: Is Solana Falling into a "Meme Chain" Trap and Facing Growth Challenges?

As Meme coin trading volume declines, Solana may struggle to maintain its momentum.

Author: Adrian Zmudzinski

Translation: Tim, PANews

According to a recent report from Standard Chartered, the Layer1 blockchain Solana may be evolving into a "single-purpose platform" focused primarily on the creation and trading of meme coins.

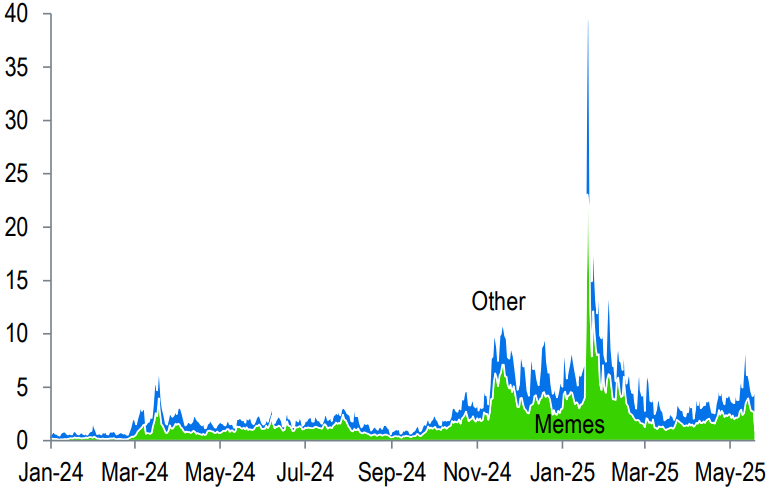

The May 27 research report states that Solana dominates the high-volume, low-cost public blockchain space, thanks to its architectural design enabling fast and inexpensive transaction confirmations. However, this technical advantage has led to an unintended consequence: so far, activity has been concentrated largely on meme coin trading, which accounts for the majority of Solana's on-chain activity (measured by "GDP," or application revenue).

Standard Chartered said the meme coin frenzy served as a stress test for Solana’s scalability, but the volatility and speculative nature of these assets also bring drawbacks. As meme coin trading volumes decline, the bank warned that Solana may struggle to maintain momentum.

Meme Frenzy Has Passed Its Peak

The report指出 that the Solana-based meme coin craze has passed its peak, and declining usage combined with "cheap" transactions is not an ideal combination. The bank recommends Solana expand into other areas requiring large-scale, low-cost, and rapid transaction processing—such as financial settlements, decentralized cloud computing, or real-time data exchange—emerging fields highly compatible with the blockchain's high-throughput characteristics.

Solana decentralized exchange trading volume. Source: Standard Chartered

According to the report, these areas could include high-throughput financial applications and traditional consumer-facing applications like social media. However, the bank noted that scaling such applications may take several years, which could have serious consequences for Solana—if progress falls short of expectations, its market competitiveness, developer ecosystem, and platform reputation could suffer significant damage, and its valuation may face substantial downward pressure.

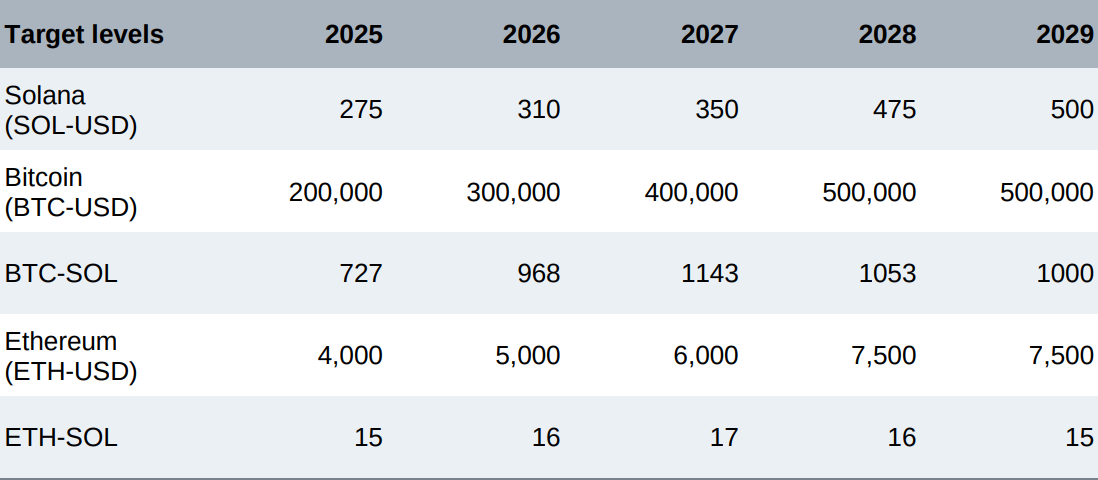

"Therefore, we expect Solana to underperform Ethereum over the next two to three years before catching up, at least in terms of actual value."

Standard Chartered's cryptocurrency target prices. Source: Standard Chartered

Solana's Advantages Are Gradually Fading

Solana has long positioned itself as a fast, low-cost, smart contract-enabled L1 public chain competing directly with Ethereum. However, this advantage may now be eroding.

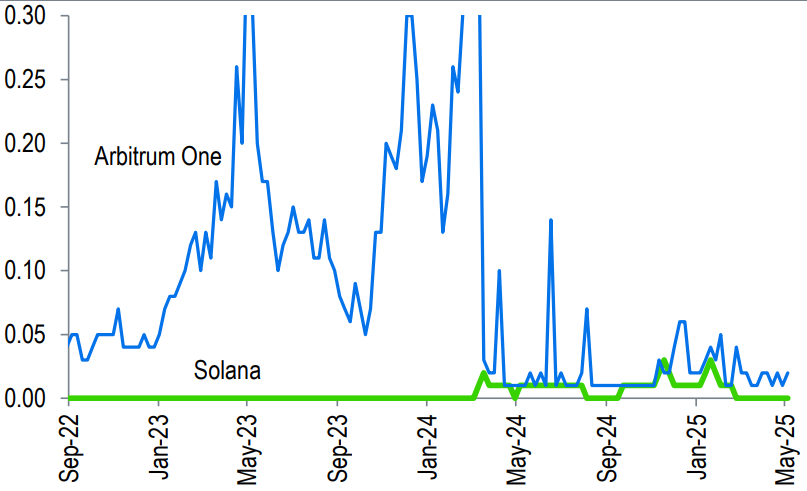

Average transaction fees on Solana and Arbitrum. Source: Standard Chartered

Since the Dencun network upgrade in March 2024, Ethereum's Layer 2 platforms have surpassed Solana in average transaction costs. This shift puts pressure on Solana's value proposition as the "cheapest high-throughput blockchain." Standard Chartered noted that Ethereum, through modular design, separates data availability, execution, and consensus layers, achieving more efficient scaling while maintaining decentralization: "Modular solutions allow Ethereum to scale transaction processing at low cost post-Dencun upgrade, while preserving the security benefits of a highly decentralized mainnet."

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News