The Great Financial Reconciliation

TechFlow Selected TechFlow Selected

The Great Financial Reconciliation

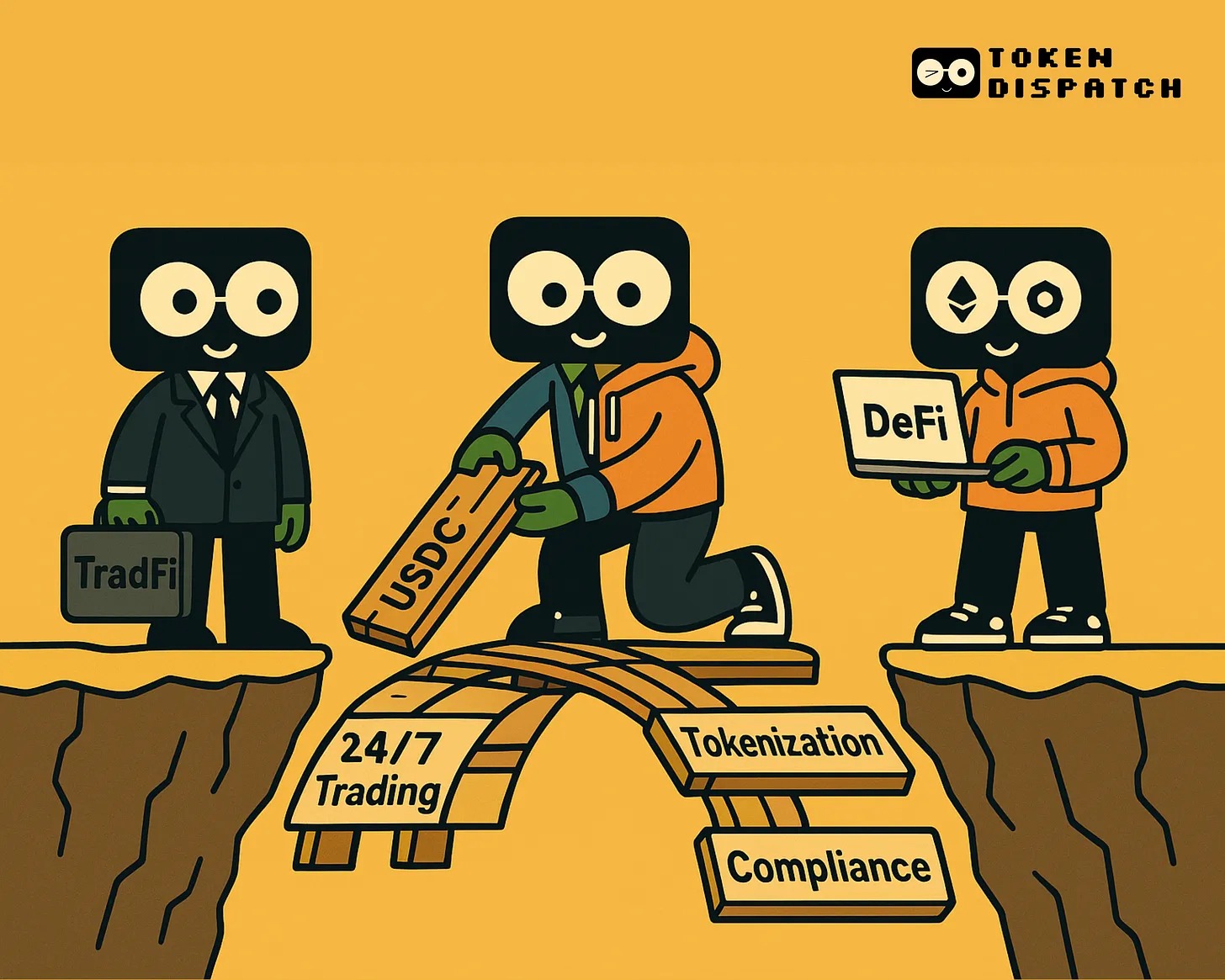

The great financial reconciliation of 2025 represents more than just technological convergence; it is a victory of pragmatism over ideology.

Author: Token Dispatch and Thejaswini M A

Translation: Block unicorn

Introduction

In every industry, there comes a moment when long-time rivals suddenly realize they've been fighting the wrong war.

In finance, that moment arrived quietly in 2025—not through grand announcements, but through a series of seemingly unrelated corporate moves signaling a profound shift: the end of the standoff between traditional finance (TradFi) and decentralized finance (DeFi).

For years, these two financial ecosystems operated like parallel universes. TradFi lived in a world of T+2 settlements, banking hours, and regulatory compliance.

DeFi existed in a realm of instant settlement, 24/7 operations, and permissionless innovation. They spoke different languages, followed different principles, and viewed each other with mutual suspicion.

We all remember the acquisition spree:

-

Ripple → Hidden Road: $1.25 billion (April 2025)

-

Stripe → Bridge: $1.1 billion (February 2025)

-

Robinhood → Bitstamp: $200 million (June 2024)

But something fundamental has changed. The rigid boundaries are melting away—not because either side won an ideological battle, but because both sides finally realized what they were missing.

The Shift

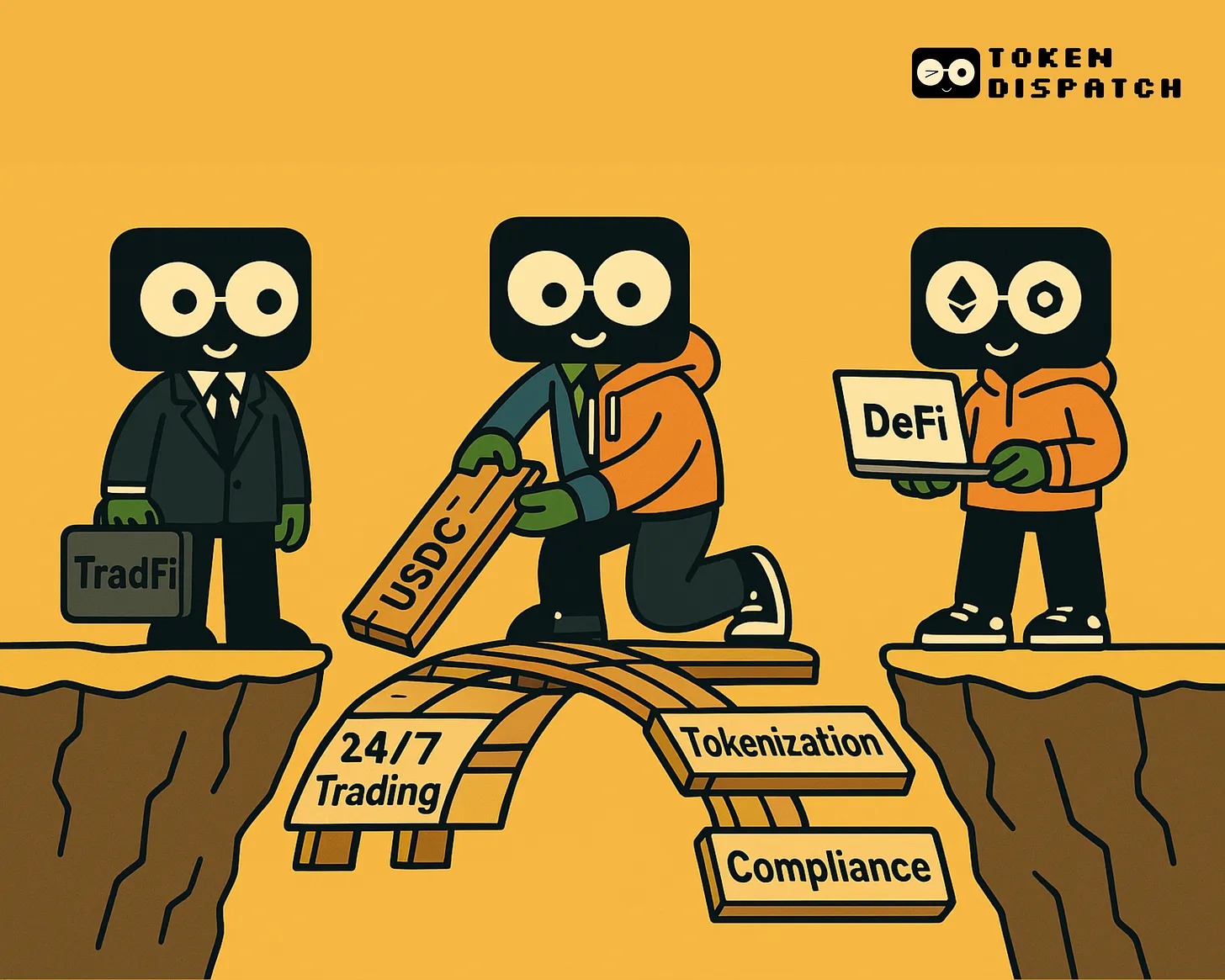

Kraken announced it will soon launch tokenized versions of Apple, Tesla, and Nvidia stocks—backed 1:1 by actual shares—and trade them around the clock on the Solana blockchain.

Not crypto derivatives. Not synthetic exposure. Real stocks—just freed from the constraints of traditional market hours.

This announcement sets the stage.

Think about it. Apple generates revenue every second—from App Store purchases in Tokyo, iCloud subscriptions in London, and iPhone sales in Sydney. Yet the ownership rights to this global, always-on company can only be traded during the narrow window when Manhattan is awake.

Kraken's xStocks—developed in partnership with Backed and issued as SPL tokens on Solana—don't solve this through clever financial engineering. They eliminate the problem entirely. Same stocks, same regulatory protections, same underlying ownership. Just programmable.

The implications go far beyond extended trading hours. These tokenized stocks can serve as collateral in DeFi protocols, combine with other assets in automated strategies, and transfer instantly across borders. Traditional brokerages require separate accounts, different compliance processes, and settlement delays. Blockchain infrastructure removes these friction points while preserving the core value proposition of equity ownership.

But here’s why it matters especially: Kraken isn’t targeting crypto enthusiasts who want to trade Tesla at 3 a.m. They’re aiming at institutional and retail investors outside the U.S., who face expensive, slow, and restricted access to American equities.

This is how the TradFi-DeFi bridge actually works. It’s not about crypto replacing traditional assets, but about blockchain infrastructure extending traditional assets beyond their conventional limits. And this is just the beginning.

From fierce competition, we’ve now arrived at banks uniting to create stablecoins:

This convergence is accelerating, going beyond individual company initiatives.

It marks a strategic shift compared to the past few years of tentative, isolated bank experiments in crypto. Instead of competing alone in unfamiliar territory, they’re pooling resources to build shared infrastructure, challenging existing stablecoin leaders.

The Infrastructure Revelation

Traditional finance has long struggled with a dirty secret: its infrastructure is collapsing under the pressure of global demand. Cross-border payments still take days. Settlement systems fail under market stress. Trading halts when people need it most. Meanwhile, DeFi protocols are already processing billions in transactions with millisecond settlement times, seamless cross-border functionality, and uninterrupted uptime.

The real revelation isn’t that DeFi is “better”—it’s that DeFi solved problems traditional finance didn’t even realize could be solved.

When Kraken announced it would offer 24/7 trading of tokenized U.S. stocks on Solana, they weren’t trying to replace stock exchanges. They simply asked a basic question: Why should Apple stock stop trading just because New York is asleep?

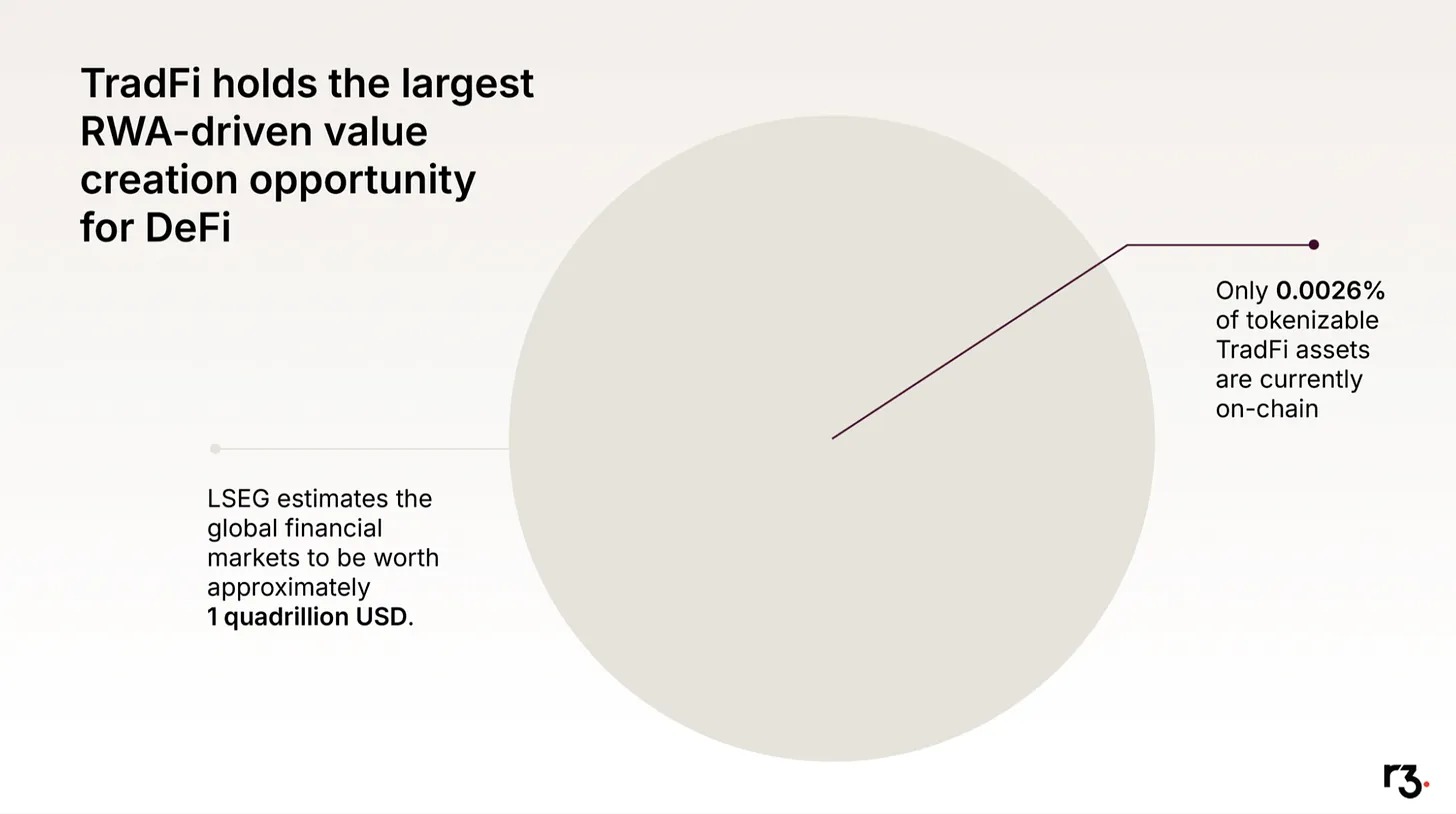

The same question drives R3’s collaboration with the Solana Foundation to bring $10 billion in traditional assets from institutions like HSBC and Bank of America onto public blockchains.

They’re not abandoning TradFi. They’re extending it beyond geography and time zones.

The Liquidity Epiphany

DeFi’s dirty secret is equally striking: despite its innovation, it severely lacks institutional capital. Retail traders and crypto natives can only provide limited liquidity.

Real money remains trapped behind regulatory barriers. The breakthrough came when neither side tried to change the other, but instead began building translation layers. Stablecoins became the Rosetta Stone.

Everything changed when institutions realized they could hold USDC without crypto volatility while earning DeFi yields.

And when DeFi protocols saw they could access traditional liquidity pools via regulated custodians, the walls started to fall. By 2025, stablecoin transaction volume is expected to exceed $3 trillion annually—not driven by speculation, but by institutions using them as bridges between old and new financial rails.

Composability Convergence

What’s happening is a fundamental reshaping of financial services. TradFi has always been fragmented.

Your bank account doesn’t talk to your brokerage. Your insurance policy can’t interact with your portfolio. Your retirement fund operates independently from daily spending. DeFi introduced something revolutionary: composability—the ability to seamlessly combine different financial primitives.

Provide liquidity, earn yield, use that yield as collateral, deploy borrowed funds into another strategy—all within a single transaction. Now, traditional institutions are starting to envy this composability.

Imagine a corporate treasury automatically optimizing between traditional money markets and DeFi yield strategies based on risk-adjusted returns.

Or a pension fund rebalancing tokenized stocks 24/7 while maintaining custody through regulated providers. These scenarios are no longer hypothetical. Today, forward-thinking companies understand the future belongs to hybrid systems and are building this infrastructure now.

At its core, the TradFi-DeFi convergence is driven by an efficiency arbitrage too powerful to ignore. TradFi excels at scale, regulatory compliance, and institutional trust—but it’s slow, expensive, and geographically constrained. DeFi thrives on speed, automation, and global accessibility—but lacks institutional adoption and regulatory clarity.

The winners in this convergence are those combining the best of both: institutional-grade compliance with blockchain efficiency, regulatory oversight with global reach, traditional scale with programmable automation.

When R3 moves $10 billion in traditional assets onto Solana, they’re not making an ideological statement.

They’re pursuing an efficiency arbitrage that benefits everyone: institutions gain faster settlement and global access, while blockchain networks gain the liquidity and legitimacy needed to scale.

Regulatory Reconciliation

The most important shift is happening at the regulatory level. The adversarial relationship between regulators and crypto is evolving into something more nuanced: cautious collaboration. The SEC’s approval of Bitcoin ETFs signaled that regulators are ready to work with crypto innovation, not suppress it.

The Financial Innovation and Technology for the 21st Century Act (FIT 21) and proposed stablecoin legislation provide institutions with the clarity needed to operate across both worlds. But the real change lies in how companies approach compliance.

The clearest signal of regulatory momentum came from David Sacks, White House Crypto Lead, who told CNBC the GENIUS Act stablecoin bill could unlock massive institutional demand:

“We already have over $200 billion in stablecoins—and they’re just unregulated. I think if we provide legal clarity and a legal framework, we could almost overnight create trillions in demand for our Treasuries. It would be very fast.”

Data supports Sacks’ optimism. Tether alone holds nearly $120 billion in U.S. Treasuries, making it the 19th largest holder globally—surpassing Germany. The GENIUS Act passed a key procedural vote 66 to 32 with bipartisan support, requiring stablecoins to be fully backed by U.S. Treasuries or dollar equivalents.

Instead of building crypto-native systems and hoping regulators adapt, platforms are now designing blockchain infrastructure with institutional compliance built in from day one.

This regulatory thaw explains why major banks are suddenly comfortable with tokenization projects. They’re embracing programmable infrastructure powered by blockchain technology—not just cryptocurrency.

User Experience Revolution

TradFi has conditioned people to accept limitations that blockchain has proven unnecessary. If blockchain transactions settle in seconds, why do international wire transfers take three business days?

When global demand operates 24/7, why do markets close?

Why does accessing different financial services require separate accounts, platforms, and compliance processes? The convergence of TradFi and DeFi isn’t just about institutional adoption or technological innovation—it’s about building financial infrastructure that truly serves user needs, rather than being constrained by legacy limitations.

When Kraken offers 24/7 trading of tokenized stocks, they’re not just adding a product feature. They’re showing how vast the possibilities become when artificial constraints are no longer accepted as permanent reality.

What makes this convergence particularly powerful is that it creates positive feedback loops.

As more traditional assets move onto blockchain rails, these networks become more valuable for everyone. As more institutions participate in DeFi protocols, those protocols become more stable and liquid.

These network effects explain why convergence is accelerating rather than slowly evolving. Early movers aren’t just gaining first-mover advantage—they’re helping establish standards and infrastructure that others will eventually adopt.

Tokenization of real-world assets is the most direct expression of this fusion. When Boston Consulting Group and Ripple predict the tokenized asset market could reach $18.9 trillion by 2033, they’re describing the infrastructure of a post-tribal financial system.

Our View

The great financial reconciliation of 2025 represents more than just technological convergence. It’s the triumph of pragmatism over ideology.

For years, the TradFi vs. DeFi debate was like watching two groups argue past each other.

TradFi focused on scale, compliance, and stability. DeFi prioritized innovation, accessibility, and efficiency. Both were right about what they valued—but incomplete. The breakthrough came when companies stopped trying to prove one approach superior and began building systems that combine the strengths of both.

Ripple’s acquisition of Hidden Road wasn’t about proving crypto superiority—they did it because hybrid infrastructure creates more value than any single approach. This pragmatic fusion is exactly what the financial industry needs. TradFi without innovation grows increasingly obsolete.

DeFi without institutional adoption remains a niche resource. But when intelligently combined, they create something neither could achieve alone: a financial infrastructure that is efficient, accessible, compliant, and globally scalable. The winners of this convergence will be those who build the best bridges.

They understand that the future doesn’t belong to TradFi or DeFi, but to those who can eliminate friction between people’s needs and the tools available to meet them.

This great financial reconciliation is about building a system where both sides bring out the best in each other—and where their limitations become irrelevant. Judging by the infrastructure being built today, this future is arriving faster than ideologues on either side ever expected.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News