When technology meets foreign exchange barriers: Why stablecoin growth struggles to break the "traditional deadlock"?

TechFlow Selected TechFlow Selected

When technology meets foreign exchange barriers: Why stablecoin growth struggles to break the "traditional deadlock"?

"In the cryptocurrency space, some believe that code and technology can solve everything. But in the foreign exchange market, such thinking is overly naive."

By Sidhartha Shukla, Bloomberg

Translated by Saoirse, Foresight News

Key Points

-

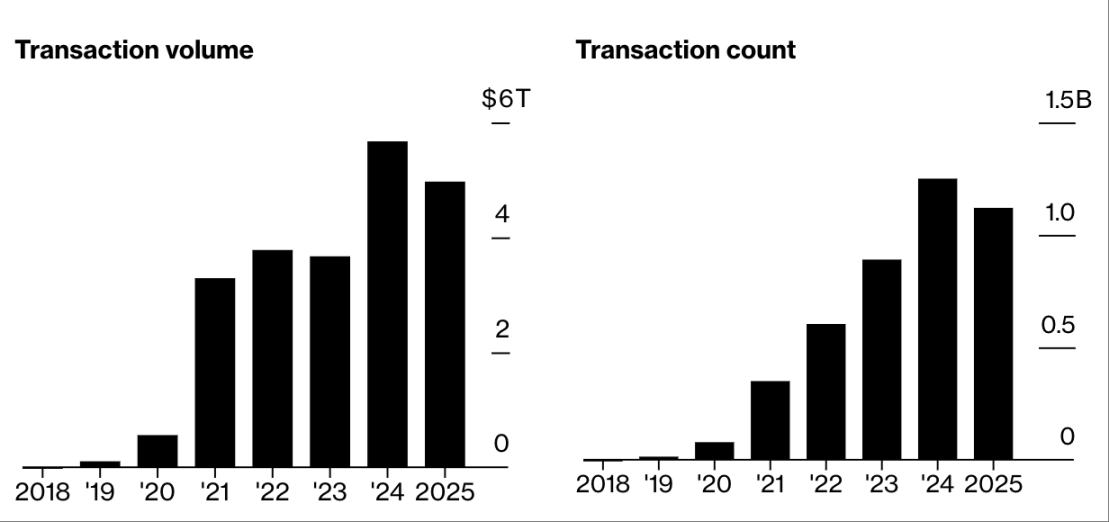

According to data from Visa and Allium, stablecoin transaction volume reached $5 trillion in 2025 year-to-date, involving one billion payments.

-

Converting stablecoins between different fiat currencies incurs costs similar to traditional foreign exchange, including bid-ask spreads, conversion fees, intermediary charges, and slippage.

-

Mike Robertson, CEO of foreign exchange infrastructure firm AbbeyCross, commented on the limitations of stablecoins as emerging payment tools: "In crypto, people think code and technology can solve everything. But in FX, that's overly naive."

Even as stablecoins enter what many expect to be their peak period, veterans in fintech still believe these tokens have limitations as emerging payment instruments.

Data from Visa and Allium show that stablecoin transaction volume hit $5 trillion in 2025 year-to-date, with one billion payments processed—approaching the full-year total of $5.7 trillion in 2024. Since Donald Trump’s U.S. presidential election victory in November 2024, the total market capitalization of these cryptocurrencies, designed to track established currencies like the U.S. dollar, has surged 47% to $255 billion.

The promise of stablecoins is a faster, lower-cost, and more efficient future for payments, especially cross-border transactions. The data suggest this potential is gradually materializing, but doubts remain about whether the technology can resolve long-standing challenges that have plagued foreign exchange operations for decades.

Converting stablecoins between different fiat currencies—for example, euros to Hong Kong dollars—incurs many of the same costs as traditional currency exchange.

"In crypto, some believe code and technology can solve all problems. But in foreign exchange, that thinking is too naive," said Mike Robertson, CEO of FX infrastructure company AbbeyCross. "Each currency has its own unique dynamics. And most banks and payment providers make their profits from FX spreads, not transaction fees."

Stablecoin Transaction Volume on Track to Double Last Year’s

Source: Visa, Allium

Note: 2025 data as of July

Foreign exchange costs typically include bid-ask spreads, conversion fees, intermediary charges, and slippage. These costs also exist in cross-border crypto transactions—and may be particularly pronounced during on- and off-ramps, challenging claims by stablecoin advocates of “low cost” transfers.

The growth in stablecoin payments is primarily driven by two use cases: simplifying cross-border transactions underserved by traditional financial institutions, and payment solutions in emerging markets.

BVNK, a startup focused on stablecoin payment infrastructure, pays little attention to payment corridors involving major currencies like the pound or dollar. Instead, according to Sagar Sarbhai, Managing Director for Asia-Pacific at BVNK, the company focuses on "alternative" corridors, such as remittances from Sri Lanka to Cambodia.

"These routes usually involve multiple intermediaries, making them costly and slow. Stablecoins simplify the process. While costs aren't necessarily low today, the speed and capital efficiency are much better," he said. BVNK now processes around $15 billion annually.

BVNK is not the only startup helping businesses adopt stablecoin operations.

After the crypto winter of 2022, Conduit pivoted into stablecoin payments. The startup began using stablecoins to let users send money via local systems like Brazil’s Pix and receive funds through SEPA (the Single Euro Payments Area, a standardized payment system across the EU and parts of Europe). According to CEO Kirill Gertman, the company now handles $10 billion in annual volume.

Singapore-based Thunes and Canada’s Aquanow are also partnering with stablecoin issuers and enterprises to streamline payments.

"The rise of stablecoins presents a business opportunity," said Floris de Kort, CEO of Thunes, which raised $150 million in April. "The infrastructure may change, but people will always need local currencies and wallets to complete the 'last mile' of payment delivery."

Risk Investors Renew Interest in Stablecoins

Source: CB Insights

Note: 2025 data as of July 23

Compared to the scale of mature payment operators, these figures may seem modest. Visa’s latest annual report shows the company alone processed $13.2 trillion in payments in 2024—more than double the total stablecoin transaction volume during the same period.

But rapid market growth has put payment giants on high alert. They are exploring so-called 'stablecoin sandwich' models: inserting stablecoins between two fiat currencies to bypass traditional banking networks like SWIFT (Society for Worldwide Interbank Financial Telecommunication), enabling settlement within minutes, with a focus on markets suffering from dollar liquidity shortages and inefficient legacy systems.

In October 2024, Visa launched a platform allowing banks to mint, burn, and transfer fiat-backed tokens, including tokenized deposits and stablecoins.

Recent passage of the GENIUS Act in the U.S. has provided a clear regulatory framework for the world’s largest stablecoin market, giving banks and payment firms greater confidence to enter the space. This has in turn triggered a global regulatory race, with authorities worldwide developing similar rules for stablecoin issuers.

"We’re only just beginning to see signs of exponential growth," said BVNK’s Sarbhai. "The foundation built over the past five years could explode in the next 12 months."

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News