Can Bitcoin's dominance, as the leading asset, be sustained in the long term?

TechFlow Selected TechFlow Selected

Can Bitcoin's dominance, as the leading asset, be sustained in the long term?

The core factor behind Bitcoin's dominant market share leadership in the blockchain space is: brand.

Author: Huang Shiliang

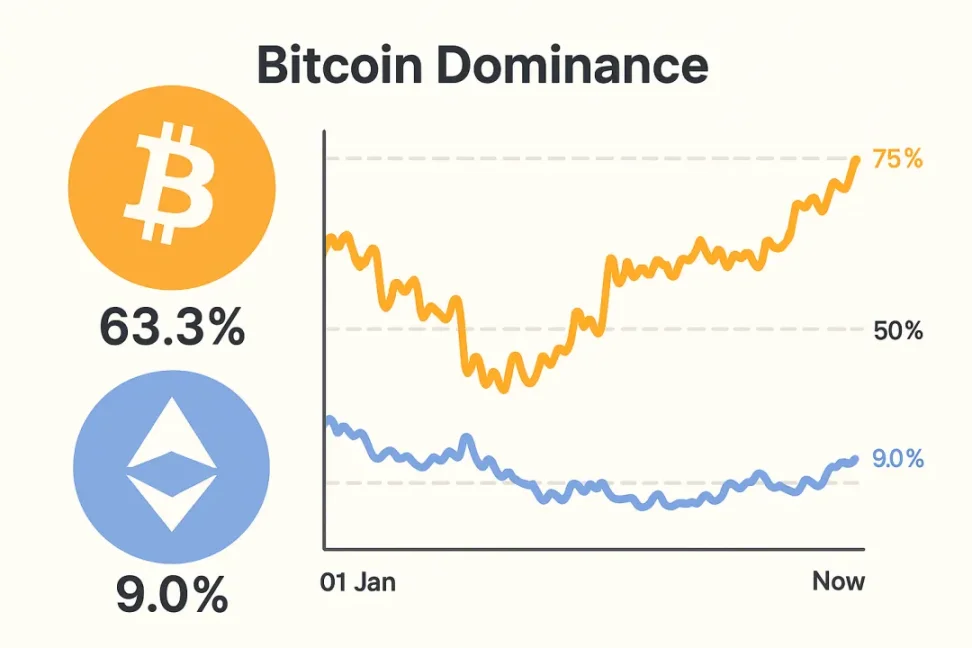

Over the past year, Bitcoin's market capitalization dominance within the cryptocurrency space has continuously expanded, now reaching a five-year high exceeding 63%.

This figure may be more devastating to ETH investors than ETH's price itself—at least it hit me hard enough to want to crawl under the covers and cry. If only I had just held and done nothing five years ago, I wouldn't be in this mess today.

Ever since the ETH/BTC exchange rate dropped below 4%, I've been constantly asking myself: will this thing keep falling? What should I do? Damn it, I was so angry I kept questioning until it fell below 2%, leaving me completely speechless.

We need to seriously consider this question: will Bitcoin’s market cap lead remain dominant over the long term? Should investing in cryptocurrencies simply mean holding BTC and calling it a day, abandoning any further research into other projects?

I’d like to compare this situation with other industries—do leading companies in other sectors maintain long-term dominance?

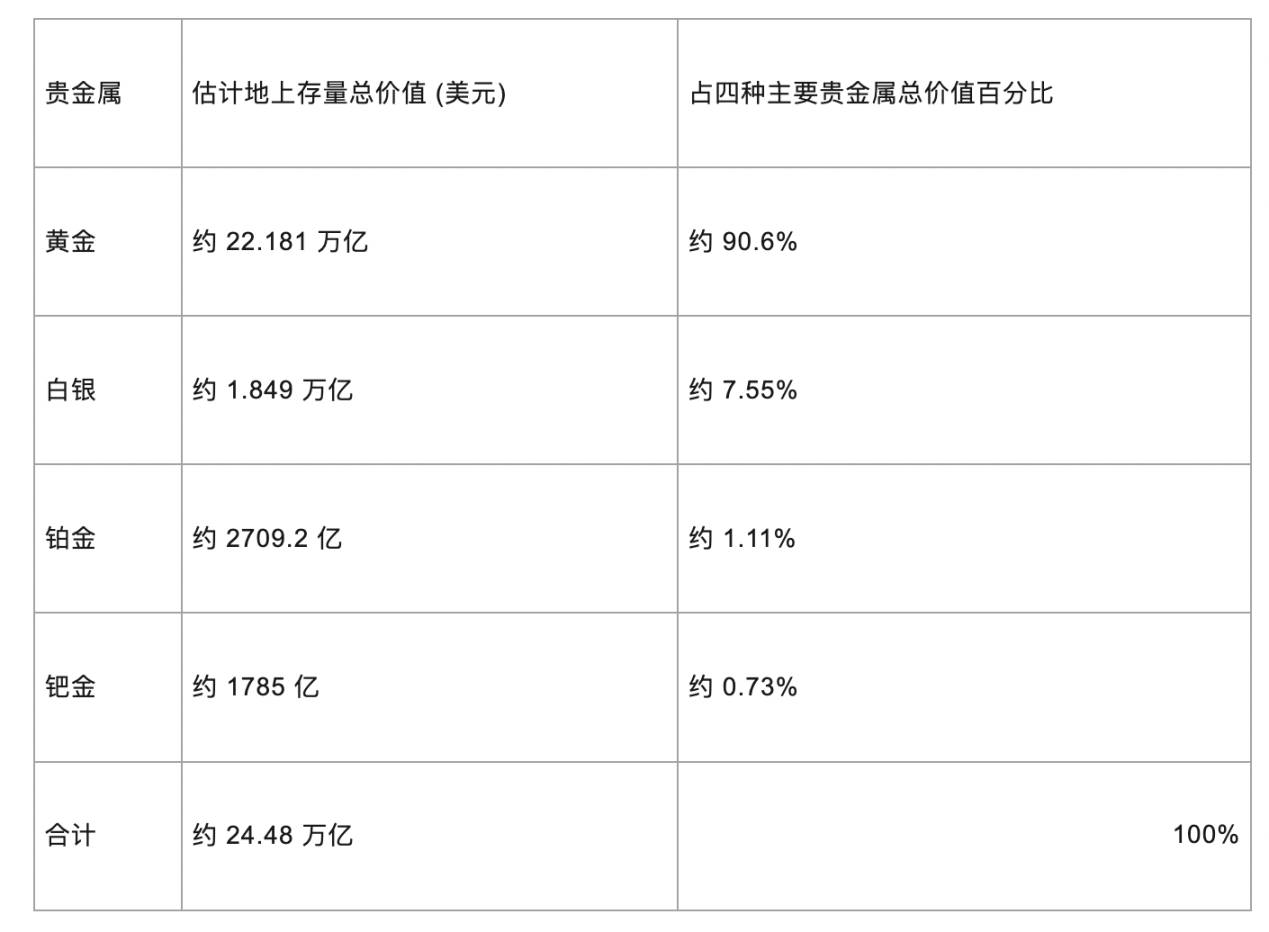

The most obvious comparison is gold. I asked both ChatGPT and Gemini to analyze the market cap distribution of precious metals, as shown in the table below:

Table 1: Market Cap Share Distribution of Precious Metals

Gold’s market dominance primarily stems from its brand—built over millennia as a currency and store of value. Such brand recognition creates deeply ingrained perceptions in human minds, forming an extremely high barrier to entry.

In this sense, Bitcoin seems quite similar.

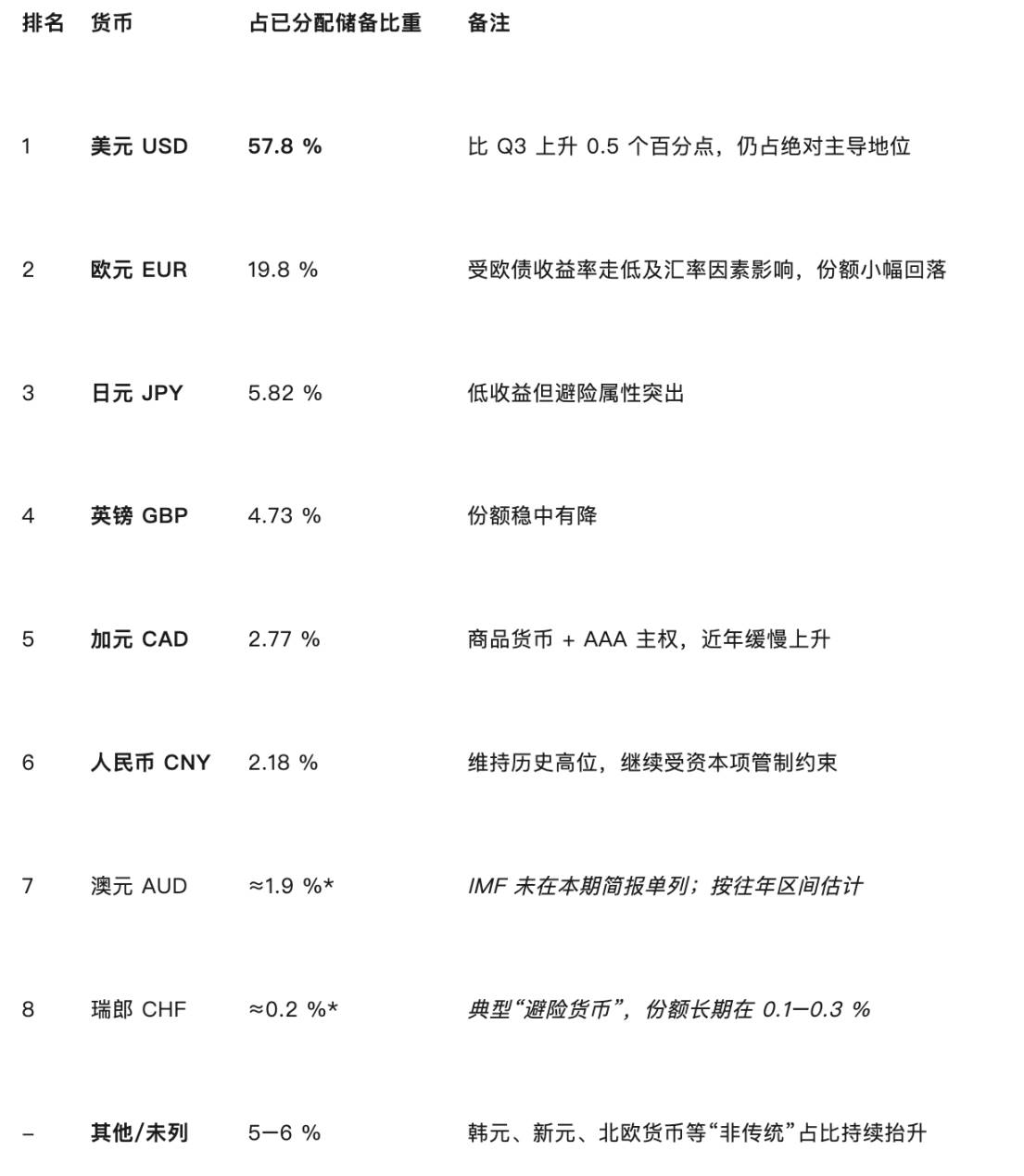

A second comparable case is the share of national fiat currencies in global foreign exchange reserves. Once again, I turned to ChatGPT and Gemini for data.

Table 2: Global Foreign Exchange Reserve Currency Composition, Q4 2024

The US dollar holds absolute monopoly power, primarily because the United States is the world’s largest economy, the depth of the US Treasury market is unmatched, and most major international trade—especially oil—is priced in dollars. Additional supporting factors include the strength of US politics, culture, and the Federal Reserve.

However, current trends suggest the dollar’s dominance may decline, mainly challenged by the RMB.

Compared to Bitcoin’s market cap share in the crypto space, Bitcoin lacks advantages equivalent to those of the dollar. Bitcoin hasn’t created the most useful things in the blockchain world. On the contrary, Ethereum, the second-largest player, resembles the dollar in providing much of the industry’s infrastructure and use cases.

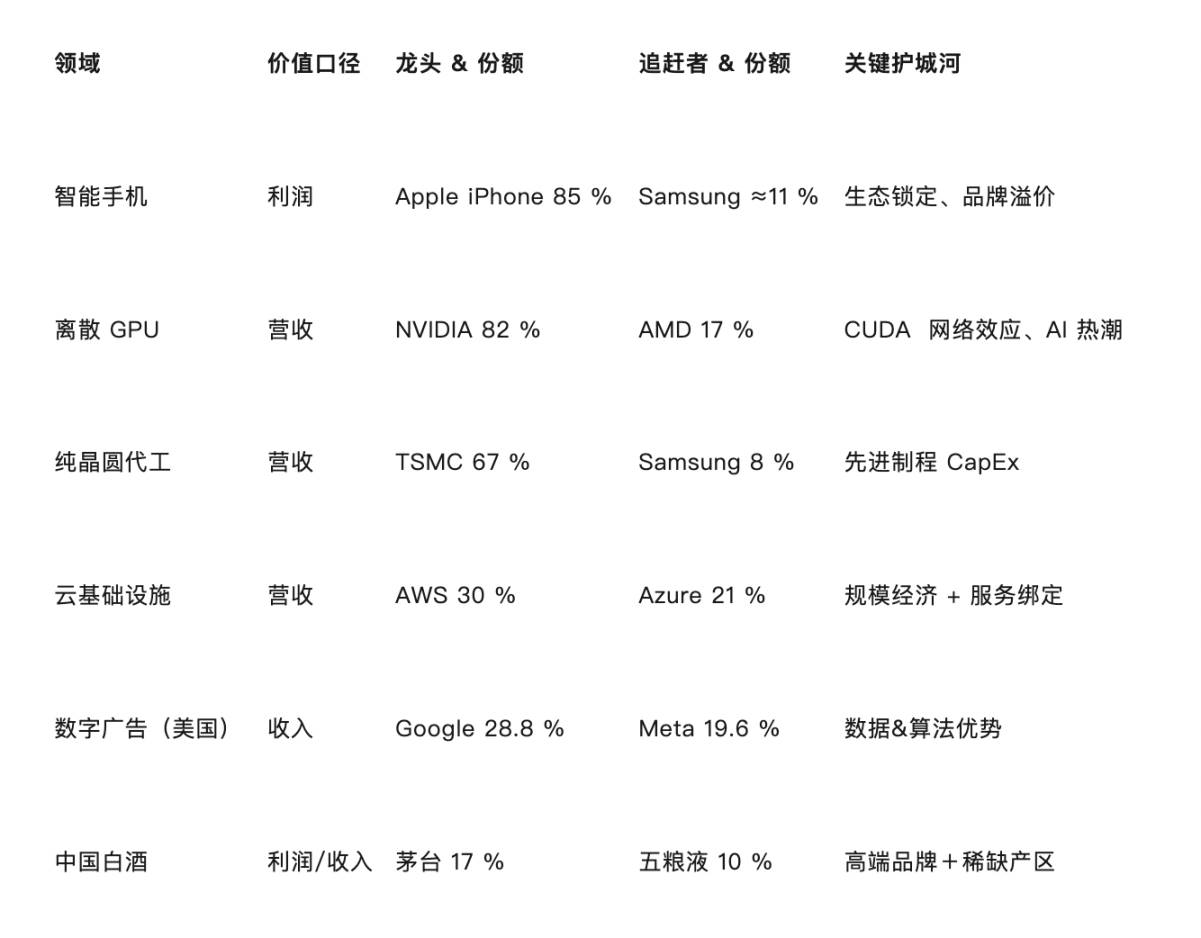

Now let’s look at several well-known companies.

Note: For effective comparison, I use “value capture” share—that is, metrics directly related to profitability—rather than market share (such as user count) or stock market cap distribution.

Table 3: Profitability Share of Well-Known Companies Within Their Industries

From these three categories of examples, we can summarize several key mechanisms of value capture:

Brand and premium pricing: iPhone, Moutai, gold, and undoubtedly BTC as well

Technological/capital barriers: NVIDIA, TSMC

Network effects: AWS, Google

Resource scarcity or sovereign backing: gold, the US dollar (Bitcoin may relate to this category)

Economies of scale: Amazon Cloud Computing, TSMC wafer fabrication, NVIDIA GPUs

I believe the core reason Bitcoin holds such an overwhelmingly dominant market cap position in blockchain is: brand.

Brands have strong capabilities in capturing value within their industries—iPhone captures 85%, gold captures 90%.

If competition among cryptocurrencies ultimately comes down to brand, then Bitcoin’s current 63% market cap share isn’t even that high.

If that’s the case, ETH holders are truly in for tears.

But can we really believe brand is the absolute, ultimate core factor for coins and blockchains?

Shouldn’t it be decentralization, network effects, user base, real-world adoption, and applications?

I don’t have a final answer yet.

But never underestimate the power of brand.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News