Strategy's Bitcoin leverage game: Wall Street short-sellers target, major institutions bet on holdings

TechFlow Selected TechFlow Selected

Strategy's Bitcoin leverage game: Wall Street short-sellers target, major institutions bet on holdings

As Bitcoin's price returns to the $100,000 level and MSTR's stock continues to rise, market disagreements over Strategy's valuation are accelerating.

By: Nancy, PANews

As Bitcoin's price returns to the $100,000 high and MSTR stock continues to rise, market disagreement over Strategy’s (formerly MicroStrategy) valuation is widening rapidly. On one hand, several major global institutions are quietly increasing their holdings in MSTR stock, treating it as a key financial instrument for indirect Bitcoin exposure; on the other hand, its highly volatile and deeply leveraged asset structure has attracted short-sellers from Wall Street. As Strategy keeps expanding its Bitcoin exposure, it is becoming both a bellwether for Bitcoin’s price movement and a focal point for leveraged capital battles.

Outperforming Tech Giants, Drawing Attention from Wall Street Shorts

At the recent Sohn Investment Conference in New York, legendary Wall Street short-seller and former hedge fund manager Jim Chanos said he is shorting Strategy while simultaneously buying Bitcoin, calling it an "arbitrage opportunity—buy one dollar, sell two and a half."

He pointed out that Strategy holds over 500,000 Bitcoins through high leverage, and its current stock price carries a significant premium relative to its actual holdings. He criticized a growing number of companies mimicking Strategy’s model, selling the idea of accessing Bitcoin via corporate structures to retail investors and seeking inflated valuations, calling this logic "absurd."

Over the past year, MicroStrategy's stock has surged over 220%, while Bitcoin rose only about 70%. Chanos views this trade as a "barometer" for retail speculation.

Chanos is a highly influential investor on Wall Street. As founder of Kynikos Associates, a hedge fund focused on short-selling, he is known for deep fundamental analysis and a sharp eye in identifying corporate accounting frauds and flawed business models. His classic short positions include Enron, WorldCom, and Luckin Coffee. However, in recent years, he suffered heavy losses from shorting Tesla, leading some of his funds to shut down or adjust strategies.

Notably, this isn’t the first time Strategy has become a target for prominent short-sellers. In December last year, well-known shorting firm Citron Research announced a short position against Strategy. Although it remained bullish on Bitcoin overall, it argued that MSTR had severely deviated from Bitcoin’s fundamentals. The news briefly triggered a sharp drop in MSTR shares, but due to rising Bitcoin prices boosting market sentiment and increased visibility and liquidity from MSTR’s inclusion in the Nasdaq-100 Index, the short ultimately failed.

Recently, aside from external shorting pressure, Strategy executives have also been frequently selling shares. Disclosures show that Jarrod M. Patten, a board director for over 20 years, has sold approximately $5.2 million worth of stock since April and plans to sell another $300,000 worth this week.

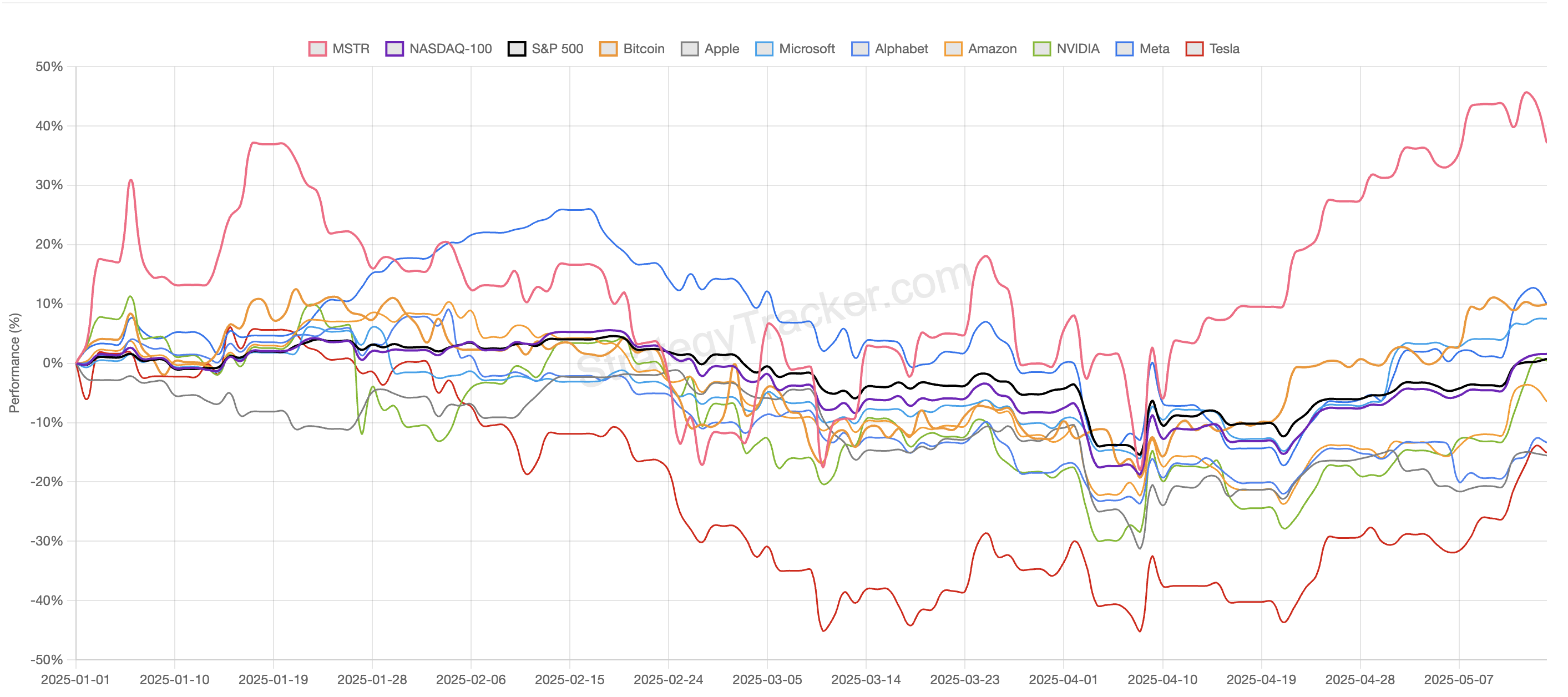

Despite this, MSTR’s stock performance has remained strong recently. According to MSTR-tracker data, Strategy’s total market cap now stands at $109.82 billion, ranking 183rd globally by asset value. So far this year, MSTR has risen around 37.1%, outperforming not only Bitcoin but also tech giants like Microsoft, Nvidia, Apple, and Amazon.

Q1 Earnings Report Shows Over $4 Billion Loss, Backed by Over 1,000 Institutional Holders

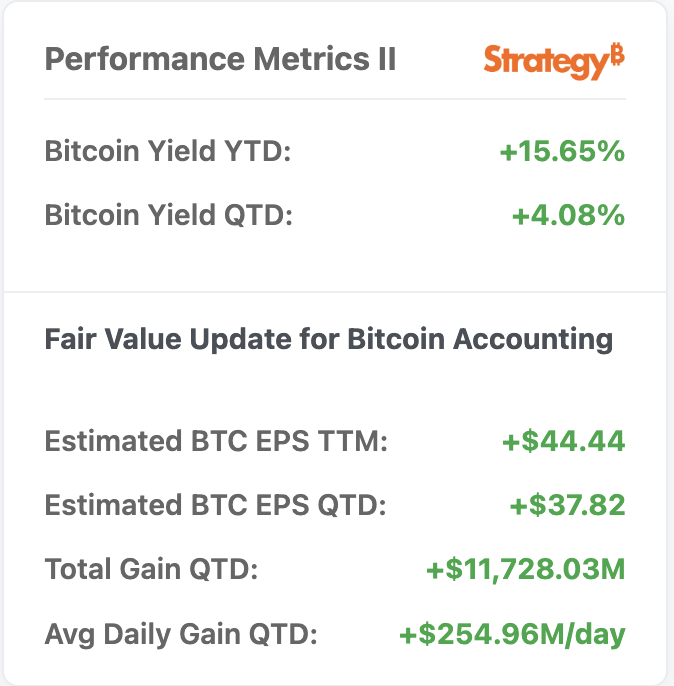

Data from MSTR-tracker shows that as of May 16, Strategy holds 568,840 BTC, with a year-to-date investment return on Bitcoin of 15.65%. Based on latest estimates, Bitcoin-related earnings per share (EPS) for the current quarter are expected to reach $37.82.

In contrast to these strong Bitcoin returns, Strategy’s latest quarterly financial results were pressured by Bitcoin’s price pullback in late Q1. Its recently released Q1 2025 earnings report showed revenue declined 3.6% year-over-year to $111.1 million, missing market expectations, while net loss reached $4.23 billion ($16.49 per share), far exceeding forecasts.

To ease financial pressure and further expand its Bitcoin holdings, Strategy is accelerating its capital operations strategy. Earlier this month, Strategy announced a new $21 billion at-the-market common stock offering program and raised its Bitcoin yield target from 15% to 25%, and its Bitcoin dollar profit target from $10 billion to $15 billion. Shortly after, Strategy further announced a new "42/42 Plan," aiming to raise $84 billion over two years to purchase Bitcoin. In response, Wall Street analysts expressed support, with Benchmark and TD Cowen reaffirming their buy ratings, viewing the company’s fundraising strategy as feasible.

Unlike most company stocks, which reflect product sales performance, Strategy’s stock is positioned as "intelligent leverage" on Bitcoin. Its founder Saylor elaborated on this narrative following the company’s rebranding to Strategy. There is typically a volatility gap of about 45% between traditional assets (such as SPDR S&P 500 ETF and Invesco QQQ Trust, with volatility levels between 15–20) and Bitcoin (volatility levels between 50–60). Strategy’s common stock targets even higher volatility than Bitcoin itself—between 80 and 90—while maintaining what Saylor calls "intelligent leverage" through a mix of equity issuance and convertible bonds.

While facing short attacks, many large institutional investors are backing Strategy’s strategy, bolstering market confidence. Fintel data shows that so far, 1,487 institutions hold Strategy stock, collectively owning 139 million shares with a current total value of approximately $55.175 billion.

Citadel Advisors

Citadel Advisors is one of the world’s largest hedge funds. 13F filings show that as of Q1 this year, Citadel Advisors holds over $6.69 billion worth of MSTR stock, around 23.22 million shares, making it one of Strategy’s largest shareholders.

Vanguard Group

As of Q1 2025, Vanguard Group, one of the world’s largest mutual fund managers, holds approximately 20.58 million MSTR shares valued at over $5.93 billion.

Susquehanna International Group

Susquehanna International Group is a globally renowned hedge fund. As of Q1 2025, the firm holds MSTR stock valued at over $5.73 billion, approximately 19.88 million shares.

Jane Street

13F filings show that as of Q1 2025, top-tier hedge fund Jane Street holds over 16 million MSTR shares, valued at nearly $4.63 billion.

Capital International

According to Capital International’s Q1 2025 13F filing, the firm holds nearly 14.68 million MSTR shares, valued at approximately $4.23 billion.

BlackRock

As of Q1 this year, BlackRock, one of the world’s largest asset management firms, holds about 14.42 million MSTR shares valued at over $4.15 billion.

CalPERS

CalPERS is the second-largest public pension fund in the U.S., managing over $300 billion in assets. As of Q1 2025, CalPERS holds 357,000 MSTR shares valued at approximately $102 million.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News